The report notes that, in general, release activity responds to movements in the mortgage rate in ways very similar to that seen in mortgage refinance activity.

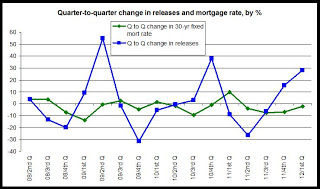

The first graph shows the quarter-to-quarter changes in the 30-yr fixed mortgage rate and in the number of releases. The quarterly data goes back to 2008. Release activity tends to move in the opposite direction of trends in the mortgage rate. In general, the blue line will move above zero following a period in which the green line is below zero. So, after growth in the mortgage rate turned negative during the 4th q of 2008, release activity moved above zero, topping out at a growth rate of more than 50 percent. In other words, a dip in the mortgage rate produced a surge in release activity. A similar phenomenon can then be seen again following the third quarter of 2010, and then again following the third quarter of 2011. Note, however, that the increase in release activity gets smaller after each period of declining mortgage rates. The effect of pushing down the mortgage rate appears to be diminishing when it comes to release activity.

During the first quarter of 2012, however, following four quarters in a row of declining mortgage rates, we get a substantial increase in the number of releases - a 28 percent increase form the fourth quarter of 2011.

See here for analysis of releases and mortgage rates going back to the year 2000.

Although the relationship between mortgage rates and releases has weakened in recent years due to tightening of credit and a lack of consumer confidence, the relationship does appear to still be holding.