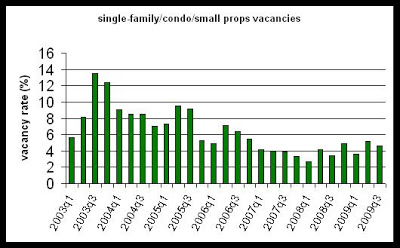

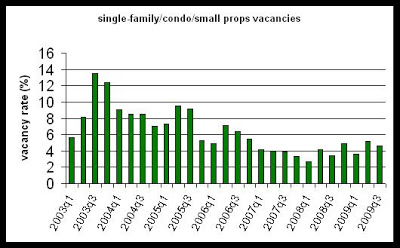

Vacancies in for-rent condos, single-family homes, and other small properties across metro Denver rose year-over-year to 4.6 percent during 2009’s third quarter. The vacancy rate was 3.4 percent during the same period last year, and was 5.2 percent during this year’s second quarter.

According to a report released Wednesday by the Colorado Department of Local Affairs’ Division of Housing, vacancies across metro Denver are up slightly from historic lows reported during 2007 and early 2008, but with rates slipping again below 5 percent, rental markets for single-family homes and condos continue to stabilize.

“I think we’re seeing the number of new units being rented flattening out a bit,” said Susan Melton, a broker/owner with Assured Management in Lakewood. “In the past we were seeing a fair amount of new activity, but not as much now, and that may be related to a lack of rent growth.”

The highest overall vacancy rates were found in Adams County, Douglas County, and the Boulder/Broomfield area with rates of 6.2 percent, 5.7 percent and 5.7 percent respectively. The lowest vacancies were in Jefferson County which reported an overall rate of 3.4 percent.

All counties reported increases in vacancies when comparing the third quarter of last year to the same period this year. The largest increase was found in Douglas County where vacancies increased from 0.8 percent to 5.7 percent year over year.

All counties except Douglas and Denver Counties, however, reported falling vacancies from the second quarter to the third quarter of this year.

Vacancy rates for all counties surveyed were: Adams, 6.2 percent; Arapahoe, 4.3 percent; Boulder/Broomfield, 5.7 percent; Denver, 5.5 percent; Douglas, 5.7 percent; and Jefferson, 3.4 percent.

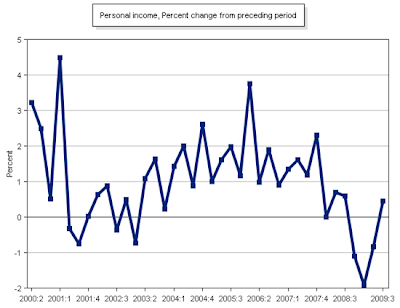

Although vacancy rates reached record lows of 2 per cent to 4 percent in 2007 and 2008, rent growth since 2003 has remained flat.

From 2003 to 2008, average rent hovered between $950.00 and $1000.00. In 2009, average rents for the metro area moved above $1000.00, but new increases were driven by rent growth in just a few areas.

During 2009’s third quarter, average rents reached $1059.77 for the region, but significant increases were only reported in Arapahoe County and the Boulder/Broomfield area. Average rents in all other counties have either fallen since the third quarter of last year, or are flat during the same period.

“There’s certainly a demand for some nice rental housing in the Boulder and Broomfield areas,” said Gordon Von Stroh, Professor of Business at the University of Denver, and the report’s author. “But in the metro area overall, it is the case that it is difficult to raise rents much in the current economic climate.”

Average rents for all counties were: Adams, $1041.29; Arapahoe, $1124.45; Boulder/Broomfield, $1661.03; Denver, $945.47; Douglas, $1377.65; and Jefferson, $981.04.

Days on the market decreased from 49.5 days during the third quarter last year, to 41.0 days during the third quarter this year.

“Many who are attracted to renting are still drawn by the prospect of avoiding losses on properties they are unable or unwilling to sell right now,” said Melton. “With rent growth so low, renting out a few small properties is not quite as lucrative as it has been in the past.”

The Colorado Statewide Vacancy and Rent Study is released each quarter by the Colorado Division of Housing. The Report is available online at the Division of Housing web site: http://dola.colorado.gov/cdh

The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type.