Housing in Mountain States Climbs Back

Residential housing in the mountain states of Colorado, Utah and New Mexico is looking stronger than many others, but that's partly because the comeback hasn't been as steep.

Simply put, homes in the region didn’t appreciate in value over the last decade as much as in the coastal regions, Arizona or Nevada. What didn’t go up much before the bubble burst in 2008 didn’t go down much once it did.

Palomar Modular Buildings’ Oilfield Housing Customers Can Now Access Preordered and Prebuilt Man Camp Buildings to Meet Their Remote Location Needs.

Palomar Modular Buildings has completed the implementation of a year round supply program for oilfield and other natural resource development manpower housing, food preparation and general comfort. These buildings can provide quick access to modern facilities for workforce housing at a time when supply is limited.

In addition to this program for more immediate temporary housing, Palomar is preparing to build more permanent type dormitories and apartments complete with amenities. This need has been particularly acute in Eastern Oklahoma and Eastern Colorado.

Eagle County real estate off to best start in 3 years

EAGLE COUNTY, Colorado — Eagle County real estate is off to its best start since 2008 in both transactions — 181 compared with 235 in 2008 — and dollar volume — $196.9 million compared with $331.3 million in 2008. February had 91 transactions, the majority of which were sales in Eagle and Gypsum, cumulatively accounting for 26 percent of all sales.

NAREE June real estate journalism conference in Denver to include tour and Saturday visit option to Vail, Colorado.

The four-day NAREE conference, entitled, “Covering Real Estate With Altitude” is NAREE’s “Ultimate News Conference” and is designed to draw writers, editors, authors and the nation’s leading real estate analysts and experts to focus on new trends in residential, resort, commercial and financial real estate. Conferees will enjoy newsworthy speakers and panel discussions, along with trend-setting tours.

Speakers will include Lawrence Yun, chief economist of the National Association of Realtors; Mark Obrinsky, chief economist of National Multi Housing Council; Rachel McCleery, Urban Land Institute; Walter Isenberg, chief executive of Sage Hospitality; Michael Kelley, president, Caldera Asset Management; David Crowe, chief economist, National Association of Home Builders; to name a few. Additional prominent speakers will be announced shortly.

Friday, March 30, 2012

John Maldonado, former CDOH Director, has died

John Maldonado was Director of the Colorado Division of Housing through the 1980’s before moving to Texas where he became the director of community planning and development for HUD's San Antonio office. During John’s leadership the Division expanded its mission to offer single family rehabilitation, residential weatherization, and expansion of the division’s manufactured housing responsibilities. John will be remembered as a champion for affordable housing in Colorado and for people less fortunate. We extend our prayers and best wishes to his family.

Unemployment rates down in all Colorado metro areas in February

Total employment growth in Colorado in February continued to show growth statewide in the year-over-year comparisons. In February, total employment in Colorado was down 139,000 from the July 2008 peak. Employment trends in various regions of the state differ, however, so this article looks at which regions of the state have the highest unemployment rates, and which regions have recovered the most in their labor markets.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

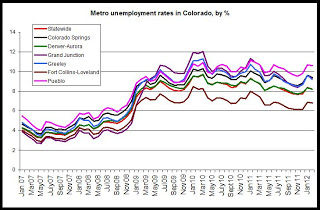

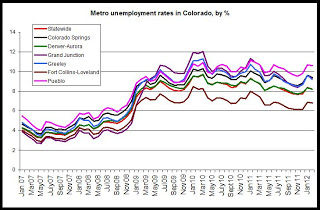

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for December 2011 are:

Colorado Springs, 9.4%

Denver-Aurora, 8.2%

Fort Collins-Loveland, 6.8%

Grand Junction, 9.3%

Greeley, 9.2%

Pueblo, 10.6%

Statewide, 8.2%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates. during recent months,however, the unemployment rate in Grand Junction has fallen to the point where Greeley, Grand Junction, and Colorado Springs now all have similar unemployment rates near 9.5 percent.

Year over year, the unemployment rate decreased in all metro areas. In Pueblo, where the highest metro unemployment rate was found, the rate decreased from 10.9 percent to 10.6 percent, year over year. In the Fort Collins-Loveland area, where the rates were lowest, the unemployment rate fell from 7.7 percent to 6.8 percent during the same period.

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force (as reflected in the Household Survey), so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2012 employment totals:

Colorado Springs MSA, 8.9%

Denver-Aurora MSA, 5.0%

Fort Collins-Loveland MSA, 4.7%

Grand Junction MSA, 11.6%

Greeley MSA 5.3%

Pueblo MSA, 4.4%

Statewide, 5.2%

All things being equal, the areas further below the peak have recovered the least from initial job losses.

By far, Grand Junction remains the furthest below peak levels.

The Pueblo area and the Ft. Collins-Loveland areas are nearest to peak levels, although Pueblo still reports a high unemployment rate.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In February 2012, the rate in the Boulder-Longmont area was 6.2%.)

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for December 2011 are:

Colorado Springs, 9.4%

Denver-Aurora, 8.2%

Fort Collins-Loveland, 6.8%

Grand Junction, 9.3%

Greeley, 9.2%

Pueblo, 10.6%

Statewide, 8.2%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates. during recent months,however, the unemployment rate in Grand Junction has fallen to the point where Greeley, Grand Junction, and Colorado Springs now all have similar unemployment rates near 9.5 percent.

Year over year, the unemployment rate decreased in all metro areas. In Pueblo, where the highest metro unemployment rate was found, the rate decreased from 10.9 percent to 10.6 percent, year over year. In the Fort Collins-Loveland area, where the rates were lowest, the unemployment rate fell from 7.7 percent to 6.8 percent during the same period.

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force (as reflected in the Household Survey), so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2012 employment totals:

Colorado Springs MSA, 8.9%

Denver-Aurora MSA, 5.0%

Fort Collins-Loveland MSA, 4.7%

Grand Junction MSA, 11.6%

Greeley MSA 5.3%

Pueblo MSA, 4.4%

Statewide, 5.2%

All things being equal, the areas further below the peak have recovered the least from initial job losses.

By far, Grand Junction remains the furthest below peak levels.

The Pueblo area and the Ft. Collins-Loveland areas are nearest to peak levels, although Pueblo still reports a high unemployment rate.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In February 2012, the rate in the Boulder-Longmont area was 6.2%.)

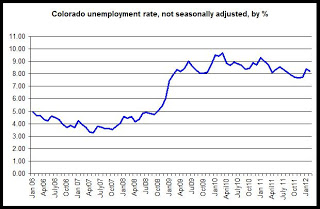

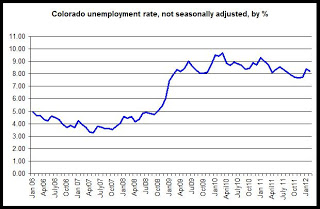

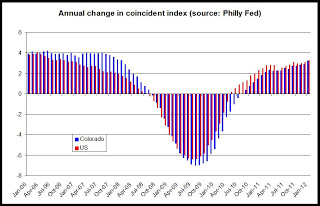

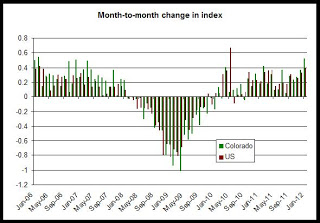

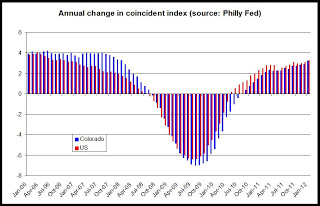

Colorado adds more jobs in February

Colorado gained 33,144 jobs in February 2012 compared to February of 2011, and the non-seasonally-adjusted unemployment rate fell year-over-year from 9.0 percent to 8.2 percent. According to the most recent employment data, collected through the Household Survey and released today by the Colorado Department of Labor and Employment and the BLS, total employment in February, not seasonally adjusted, rose to 2.49 million jobs. The labor force also increased from February 2011 to February 2012.

In month-to-month comparisons, the unemployment rate decreased from 8.4 percent during January to 8.2 percent during February as 16,100 jobs were gained. Seasonally, employment tends to rise from January to February.

From February 2011 to February 2012, total employment rose 1.3 percent, while the labor force rose 0.4 percent. The total labor force in February included 2.71 million workers.

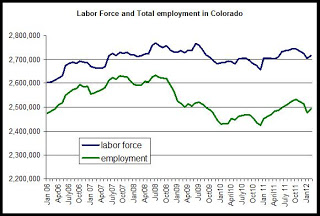

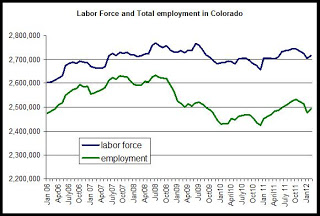

As can be seen in the second graph, total employment and total workforce size have risen slightly, month-over-month, after falling for the previous three months. Year over year, employment rose and the labor force rose. However, both remain well below July 2008 peaks.

The employment total is now 139,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Compared to the labor force peak in July 2008, the labor force is now down by more than 51,000 workers.

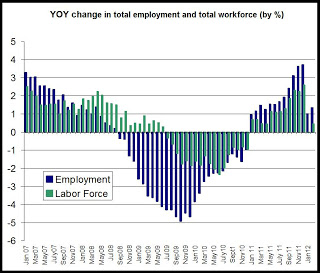

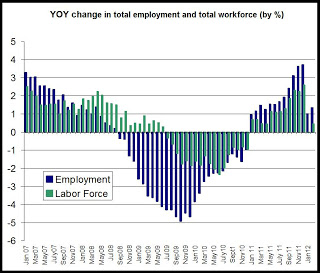

In the third graph is shown the year-over-year comparisons, by percent, for total employment. February 2012 was the 14th month in a row showing a positive year-over-year change in total employment. The 14 months of increases followed 28 months in a row of negative job growth in year-over-year comparisons.

The graph also shows the year-over-change in the labor force. Total labor force size rose slightly from February 2011 to February 2012, and follows a slight decrease that occurred form January 2011 to January 2012. The labor force size had shrunk, year over year, for 18 months in a row from July 2009 to December 2010.

These numbers come from the Household Survey employment data, so the size of the workforce is dependent on the number of people stating that they are actively looking for work if not employed. Discouraged workers who have stopped looking for work are excluded. On the other hand, the Household Survey picks up on small business and start-up employment that may be missed by the Establishment Survey, the other commonly-used measure of employment.

Note: This analysis reflects newly revised data released in January. In most cases, total employment was revised upward for the months of 2011.

In month-to-month comparisons, the unemployment rate decreased from 8.4 percent during January to 8.2 percent during February as 16,100 jobs were gained. Seasonally, employment tends to rise from January to February.

From February 2011 to February 2012, total employment rose 1.3 percent, while the labor force rose 0.4 percent. The total labor force in February included 2.71 million workers.

As can be seen in the second graph, total employment and total workforce size have risen slightly, month-over-month, after falling for the previous three months. Year over year, employment rose and the labor force rose. However, both remain well below July 2008 peaks.

The employment total is now 139,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Compared to the labor force peak in July 2008, the labor force is now down by more than 51,000 workers.

In the third graph is shown the year-over-year comparisons, by percent, for total employment. February 2012 was the 14th month in a row showing a positive year-over-year change in total employment. The 14 months of increases followed 28 months in a row of negative job growth in year-over-year comparisons.

The graph also shows the year-over-change in the labor force. Total labor force size rose slightly from February 2011 to February 2012, and follows a slight decrease that occurred form January 2011 to January 2012. The labor force size had shrunk, year over year, for 18 months in a row from July 2009 to December 2010.

These numbers come from the Household Survey employment data, so the size of the workforce is dependent on the number of people stating that they are actively looking for work if not employed. Discouraged workers who have stopped looking for work are excluded. On the other hand, the Household Survey picks up on small business and start-up employment that may be missed by the Establishment Survey, the other commonly-used measure of employment.

Note: This analysis reflects newly revised data released in January. In most cases, total employment was revised upward for the months of 2011.

Thursday, March 29, 2012

KC Fed: Manufacturing activity in district "remained generally solid overall" during Feb-March

The Kansas City Fed today released its manufacturing survey of the Tenth Fed District, which includes Colorado. According to the survey:

See the full report.

Growth in Tenth District manufacturing activity moderated slightly but remained generally solid overall, with a continued positive outlook for future months. Some producers said strong regional oil and gas activity, increased agricultural-related demand, and some pickup in construction activity has resulted in increased production, while others said high gas prices and lingering uncertainty were a slight drag on growth. Price indexes were mixed, with some increases in materials prices, although slightly fewer firms indicated plans to raise prices in the future.

Other month-over-month indexes were mixed in March but remained mostly solid. The production index dropped from 20 to 13, and the order backlog index also fell after rising last month. In contrast, the shipments and new order indexes both increased from 8 to 17, and employment index also edged higher. The raw materials inventory index decreased from 14 to 0, while the finished goods inventory index rose for the second straight month.

...

Price indexes were mixed. The month-over-month raw materials price index edged lower from 36 to 33, and the finished goods price index also fell. The year-over-year raw materials price index climbed from 57 to 71, while the finished goods price index was unchanged. The future raw materials price index rose from 54 to 65. However, the future finished goods price index eased slightly, indicating fewer firms plan to pass recent cost increases through to customers.

See the full report.

Labels:

colorado,

federal reserve,

kansas city fed

Colorado 15th for per capita income during 2011

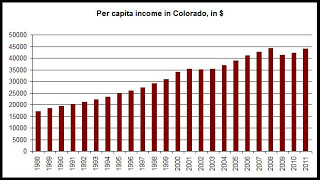

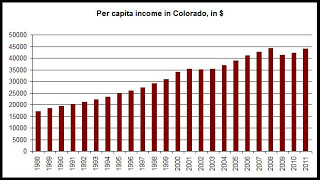

Colorado was 15th in the nation for per capita personal income during 2011. According to a new report released yesterday by the Bureau of Labor Statistics,the per capita income in Colorado during 2011 was $44,088, which places it 15th behind Connecticut, the state with the highest per capital personal income of $56,889. However, the non-state of the District of Columbia posted a per capita personal income of $73,105. Nationally, the per capita income was $41,663.

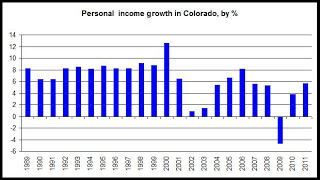

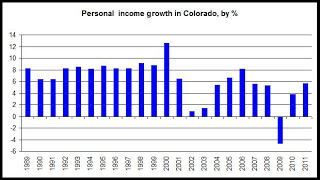

Growth in total personal income was also relatively high in Colorado. Colorado reported a growth rate of 5.7 percent from 2010 to 2011, which placed it 8th in the nation. The state with the highest growth in personal income from 2010 to 2011 was North Dakota at 8.1 percent. Nationwide, the growth rate for total personal income was 5.1 percent.

According to the BLS press release:

Colorado's growth rate places it in the top quintile for personal income growth as measured by the BLS.

The first map shows historical per capita income rates for Colorado, not adjusted for inflation. Per capita personal income in Colorado during 2011 was still 0.2 percent below the 2008 peak of $44,180. Per capital personal income fell considerably from 2008 to 2009 in response to the 2008-2009 recession.

The second graph shows the growth rate in total personal income in Colorado. Personal income growth over the past decade has never matched the consistent growth that occurred during the 1990s before the dot-com bust. Personal income declined from 2008 to 2009.

This report reinforces the view that Colorado is performing better than many states in a variety of economic indicators. Recent data shows that home prices have stabilized while foreclosure rates and delinquency rates continue to be far lower in Colorado than in the majority of other states. Colorado's relatively high placement for per capita income would help to explain some of this.

Growth in total personal income was also relatively high in Colorado. Colorado reported a growth rate of 5.7 percent from 2010 to 2011, which placed it 8th in the nation. The state with the highest growth in personal income from 2010 to 2011 was North Dakota at 8.1 percent. Nationwide, the growth rate for total personal income was 5.1 percent.

According to the BLS press release:

State personal income rose an average 5.1 percent in 2011 after rising 3.7 percent in 2010, according to estimates released today by the U.S. Bureau of Economic Analysis. State personal income growth ranged from 3.4 percent in Maine to 8.1 percent in North Dakota. Inflation, as measured by the national price index for personal consumption expenditures, increased to 2.5 percent in 2011 from 1.8 percent in 2010.

Colorado's growth rate places it in the top quintile for personal income growth as measured by the BLS.

The first map shows historical per capita income rates for Colorado, not adjusted for inflation. Per capita personal income in Colorado during 2011 was still 0.2 percent below the 2008 peak of $44,180. Per capital personal income fell considerably from 2008 to 2009 in response to the 2008-2009 recession.

The second graph shows the growth rate in total personal income in Colorado. Personal income growth over the past decade has never matched the consistent growth that occurred during the 1990s before the dot-com bust. Personal income declined from 2008 to 2009.

This report reinforces the view that Colorado is performing better than many states in a variety of economic indicators. Recent data shows that home prices have stabilized while foreclosure rates and delinquency rates continue to be far lower in Colorado than in the majority of other states. Colorado's relatively high placement for per capita income would help to explain some of this.

Denver metro 25th among 25 metros in foreclosures and delinquencies

Corelogic released today its February 2012 report on delinquencies and foreclosures. According to the report, the number of homes with mortgages that were more than 90 days delinquent in the US were down 0.5 percent during February when compared to February 2011. The foreclosure inventory was down 0.2 percent over the same period. Nationally, 3.4 percent of all homes with mortgages were in the foreclosure inventory, and 7.2 percent of loans were 90+ days delinquent.

In Colorado, the number of homes with mortgages that were more than 90 days delinquent fell by 0.6 percent from February 2011 to February 2012. Over the same period, the percentage of homes with mortgages that were in the foreclosure inventory fell by 0.4 percent.

4.0 percent of homes with mortgages in Colorado were more than 90-days delinquent while 1.4 percent of all homes with mortgages were in foreclosure.

Overall, the proportion of homes affected in Colorado was substantially smaller in Colorado than in the nation as a whole.

43 states reported higher rates of 90-day delinquency than Colorado. Only 6 states reported lower rates: Montana, Alaska, Wyoming, Nebraska and The Dakotas.

States with significantly higher rates of delinquency and foreclosure were Nevada, Florida and New Jersey where the percentage of homes with mortgages that were at least 90-days delinquent were 13.0 percent, 17.4 percent, and 10.9 percent, respectively.

38 states reported foreclosure inventory rates that were higher than Colorado's rate of 1.4 percent. Only 4 states reported lower foreclosure inventory rates: North Dakota, Nebraska, Alaska and Wyoming. Six states reported the same foreclosure inventory rate as Colorado.

The states with the highest foreclosure inventory rates were Nevada, Florida, New Jersey and Illinois with rates of 5 percent, 12 percent, 6.6 percent and 5.4 percent, respectively.

According to the report, 4.2 percent of all homes with mortgages in the Denver-Aurora-Broomfield area were 90 days or more delinquent, which placed the Denver area last among 25 metro. All other metro areas reported higher delinquency rates. In Chicago, for example, the 90+-day delinquency rate was 10.7 percent during February. The rate was 18 percent in Orlando.

The Denver area was also last among all metros in its foreclosure inventory. 1.4 percent of all loans with mortgages were in foreclosure in the Denver area. In Orlando, the rate was 12.3 percent.

In Colorado, the number of homes with mortgages that were more than 90 days delinquent fell by 0.6 percent from February 2011 to February 2012. Over the same period, the percentage of homes with mortgages that were in the foreclosure inventory fell by 0.4 percent.

4.0 percent of homes with mortgages in Colorado were more than 90-days delinquent while 1.4 percent of all homes with mortgages were in foreclosure.

Overall, the proportion of homes affected in Colorado was substantially smaller in Colorado than in the nation as a whole.

43 states reported higher rates of 90-day delinquency than Colorado. Only 6 states reported lower rates: Montana, Alaska, Wyoming, Nebraska and The Dakotas.

States with significantly higher rates of delinquency and foreclosure were Nevada, Florida and New Jersey where the percentage of homes with mortgages that were at least 90-days delinquent were 13.0 percent, 17.4 percent, and 10.9 percent, respectively.

38 states reported foreclosure inventory rates that were higher than Colorado's rate of 1.4 percent. Only 4 states reported lower foreclosure inventory rates: North Dakota, Nebraska, Alaska and Wyoming. Six states reported the same foreclosure inventory rate as Colorado.

The states with the highest foreclosure inventory rates were Nevada, Florida, New Jersey and Illinois with rates of 5 percent, 12 percent, 6.6 percent and 5.4 percent, respectively.

According to the report, 4.2 percent of all homes with mortgages in the Denver-Aurora-Broomfield area were 90 days or more delinquent, which placed the Denver area last among 25 metro. All other metro areas reported higher delinquency rates. In Chicago, for example, the 90+-day delinquency rate was 10.7 percent during February. The rate was 18 percent in Orlando.

The Denver area was also last among all metros in its foreclosure inventory. 1.4 percent of all loans with mortgages were in foreclosure in the Denver area. In Orlando, the rate was 12.3 percent.

Housing News Digest, March 29

Air Force's Energy Efficient Housing In Colorado's Tierra Vista Development Defies Stereotypes

Barring the notable exception that it sits in close proximity to NORAD, the subdivision looks like pretty much every other suburban creature built in the last 10 years. Winding roads dead-end in cul-de-sacs surrounded by three and four-bedroom homes, their paint colors most likely named after desert pastels like "sage" and "sandstone taupe."

Carbondale deed-restriction changes on hold

CARBONDALE, Colorado — The town's trustees are worried that changes proposed for the rules at one affordable housing complex, Keator Grove, might spell disaster for other such projects or for the town's overall affordable housing guidelines.

So the board of trustees will sit down at a work session in May to review the relevant town codes and other documents, before turning back to the Keator Grove situation.

PitCo spends $1.86M on Eagle Co. open space; neighbors object to uses

The Pitkin County commissioners on Wednesday unanimously approved spending $1.86 million for the purchase of 145 acres of open space in Eagle County, as objections and concerns from neighbors emerged.

The county will use input from neighbors of the midvalley property to shape a management plan for it, which may include new access to trails on the Crown, a large recreation area at the base of Mt. Sopris, as well as community farming opportunities.

Sisters of Charity to Move Headquarters to Colorado

Wood: Economic-development officials say that this move really solidifies Denver and Colorado’s position as a center for the health-care industry, and as a center for corporate headquarters. Beyond that, this sizeable number of jobs will benefit the retail, hospitality and real estate industries. Not only are sizable chunks of commercial office space being absorbed, but this will give a shot in the arm to the housing market as well.

CoreLogic: U.S. foreclosure rate holds steady in February

The nation's monthly pile of completed foreclosures stayed tall in February, barely moving to 65,000 from 66,000 a year earlier and from 71,000 in January.

Data released by CoreLogic ($16.32 -0.08%) shows the 50 states completed 862,000 foreclosures in the 12 months ending in February. Since the beginning of the financial crisis in September 2008, about 3.4 million properties have been through foreclosure

Barring the notable exception that it sits in close proximity to NORAD, the subdivision looks like pretty much every other suburban creature built in the last 10 years. Winding roads dead-end in cul-de-sacs surrounded by three and four-bedroom homes, their paint colors most likely named after desert pastels like "sage" and "sandstone taupe."

Carbondale deed-restriction changes on hold

CARBONDALE, Colorado — The town's trustees are worried that changes proposed for the rules at one affordable housing complex, Keator Grove, might spell disaster for other such projects or for the town's overall affordable housing guidelines.

So the board of trustees will sit down at a work session in May to review the relevant town codes and other documents, before turning back to the Keator Grove situation.

PitCo spends $1.86M on Eagle Co. open space; neighbors object to uses

The Pitkin County commissioners on Wednesday unanimously approved spending $1.86 million for the purchase of 145 acres of open space in Eagle County, as objections and concerns from neighbors emerged.

The county will use input from neighbors of the midvalley property to shape a management plan for it, which may include new access to trails on the Crown, a large recreation area at the base of Mt. Sopris, as well as community farming opportunities.

Sisters of Charity to Move Headquarters to Colorado

Wood: Economic-development officials say that this move really solidifies Denver and Colorado’s position as a center for the health-care industry, and as a center for corporate headquarters. Beyond that, this sizeable number of jobs will benefit the retail, hospitality and real estate industries. Not only are sizable chunks of commercial office space being absorbed, but this will give a shot in the arm to the housing market as well.

CoreLogic: U.S. foreclosure rate holds steady in February

The nation's monthly pile of completed foreclosures stayed tall in February, barely moving to 65,000 from 66,000 a year earlier and from 71,000 in January.

Data released by CoreLogic ($16.32 -0.08%) shows the 50 states completed 862,000 foreclosures in the 12 months ending in February. Since the beginning of the financial crisis in September 2008, about 3.4 million properties have been through foreclosure

Wednesday, March 28, 2012

Weld County 2nd in nation for employment growth during September

Weld County was second in the nation for employment growth from September 2010 to September 2011. According to a report released today by the Bureau of Labor Statistics, Weld County's total employment increased 4.8 percent year over year during September, which made it the county with the second-highest employment growth in the nation, behind Williamson County, Tennessee. Nationwide county-ranking data is released several months behind the monthly state and regional employment data.

Of 322 counties surveyed, only Douglas County also ranked in the top 50 with a rank of 48 and an employment increase of 2.8 percent.

Comparing weekly wages from the third quarter of 2010 to the third quarter of 2011, only Denver County placed in the top 50 with a ranking of 29th and a percent increase of 7.6 percent.

According to BLS report:

According to the report, total employment in Greeley increased 4.8 percent to 83,400 jobs during September 2011.

The report's data employs information from the Quarterly Census of Employment and Wages.

According to the most recent data form the Household Survey of employment, employment in the Greeley Metro Statistical Area, which comprises Weld County, was down year-over-year in January from 107,800 to 106,500, year over year.

Back in September, however, the household survey did show an increase in total employment from 110,266 during September 2010 to 113,200 during September 2011.

Of 322 counties surveyed, only Douglas County also ranked in the top 50 with a rank of 48 and an employment increase of 2.8 percent.

Comparing weekly wages from the third quarter of 2010 to the third quarter of 2011, only Denver County placed in the top 50 with a ranking of 29th and a percent increase of 7.6 percent.

According to BLS report:

From September 2010 to September 2011, employment increased in 271 of the 322 largest U.S. counties, the U.S. Bureau of Labor Statistics reported today. Williamson, Tenn., posted the largest increase, with a gain of 5.4 percent over the year, compared with national job growth of 1.6 percent. Within Williamson, the largest employment increase occurred in professional and business services, which gained 1,743 jobs over the year (9.0 percent). Frederick, Md., experienced the largest over-theyear decrease in employment among the largest counties in the U.S. with a loss of 2.6 percent.

The U.S. average weekly wage increased over the year by 5.3 percent to $916 in the third quarter of 2011. Among the large counties in the U.S., Lake, Ohio, had the largest over-the-year increase in average weekly wages with a gain of 17.1 percent.

According to the report, total employment in Greeley increased 4.8 percent to 83,400 jobs during September 2011.

The report's data employs information from the Quarterly Census of Employment and Wages.

According to the most recent data form the Household Survey of employment, employment in the Greeley Metro Statistical Area, which comprises Weld County, was down year-over-year in January from 107,800 to 106,500, year over year.

Back in September, however, the household survey did show an increase in total employment from 110,266 during September 2010 to 113,200 during September 2011.

Labels:

employment,

greeley,

unemployment,

weld county

Housing News Digest, March 28

The Mountain Monitor, a quarterly report produced by the nonprofit Brookings Institution and the University of Nevada at Las Vegas, studies 10 large metropolitan areas in Colorado, Arizona, Idaho, Nevada, New Mexico and Utah. The latest report, released Wednesday, found the economic recovery was firmly under way in the fourth quarter in the Intermountain West — but with the pace varying widely.

KB Home downgraded by Standard & Poor's

KB Home, one of the U.S.'s largest homebuilders, was downgraded yesterday by Standard & Poor's after first-quarter results came in below expectations. The corporate and senior note ratings both went down one grade to B.

The pretax loss of $45.4 million in the quarter was an improvement from last year, although new orders were down 8 percent and cancellations on gross orders increased to 36 percent from 29 percent the year before.

Foreclosures down in January regionally

Foreclosures were down slightly across Northern Colorado in January, according to new data from CoreLogic.

In Fort Collins-Loveland, the foreclosure rate decreased from 1.27 percent in January 2011 to 0.81 percent this past January. The delinquency rate in Fort Collins-Loveland also decreased from 2.99 percent to 2.39 percent over the same period. Delinquency rates measure the percentage of loans that are 90 or more days delinquent.

Full Real Estate Recovery Not Coming Until 2015

Real estate website Trulia’s new housing barometer shows that real estate is starting to recover from the battering it sustained during the recession. Chief economist Jed Kolko looked at construction starts, existing home sales and the rate of delinquencies and foreclosures, then combined these indicators to create the barometer. Kolko says housing starts are a good indicator of homebuilder confidence, while the number of sales and the foreclosure rate illustrate consumers’ financial stability as well as their confidence level.

Mortgage applications fall 2.7%

The number of mortgage applications filed in the United States fell 2.7% from a week earlier during the period ending March 23, an industry trade group said Wednesday.

Meanwhile, refinancing activity fell for the sixth consecutive week.

The Mortgage Bankers Association's market composite index, which measures loan application volume, fell as the refinance index declined 4.6%, showing a sharp drop in refinancing activity as the refinance share of all mortgage activity fell to 71.9% from 73.4%, its lowest level since July.

Tuesday, March 27, 2012

New Enterprise Live Online Event:

New Enterprise Live Online Event:

Introducing the New Enterprise Green Communities Certification Process

Wednesday, April 11, 2012 from 2 - 3:00 p.m. EST

Register

Description

Enterprise Green Communities has upgraded our online process for certifying green affordable housing developments. Developed on the industry's leading cloud computing software development platform, the new Enterprise Green Communities Certification system will provide affordable housing developers improved flexibility, efficiency and convenience in connecting with Enterprise to register and apply for Certification.

Introducing the New Enterprise Green Communities Certification Process

Wednesday, April 11, 2012 from 2 - 3:00 p.m. EST

Register

Description

Enterprise Green Communities has upgraded our online process for certifying green affordable housing developments. Developed on the industry's leading cloud computing software development platform, the new Enterprise Green Communities Certification system will provide affordable housing developers improved flexibility, efficiency and convenience in connecting with Enterprise to register and apply for Certification.

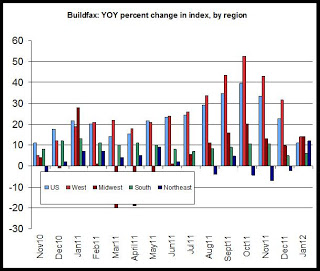

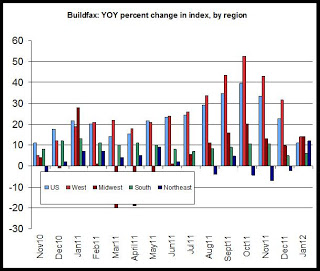

Residential remodeling increases in West, but rate of increase falls for third month

Residential remodeling activity increased 14 percent in the Western U.S. from January 2011 to January 2012. According to the January 2012 Residential Buildfax Remodeling Index, released last week by BUILDERadius, The Western U.S. was tied with the Midwest for the largest rate of increase in its index for January 2012, outpacing all other regions and the U.S. as a whole.

According to Buildfax's January release:

In the graph, we see that, with the exception of January 2012, the year-over-year percent change in the western region has outpaced all other regions and the U.S. as a whole for the past eight months. Growth rates have been solid in recent months. January 2012's year-over-year change was smaller than January 2011's year over year increase.

Overall, the report suggests ongoing strength int the demand for new remodeling, although growth in that demand appears to have peaked last fall and is now declining.

About the BuildFax Remodeling Index

The BuildFax Remodeling Index is based on construction permits filed with local building departments across the country. The index tracks the number of properties permitted. The national and regional indexes all have an initial value of 100 set in April of 2004, are based on a three-month moving average, and are not seasonally adjusted.

According to Buildfax's January release:

Seasonally-adjusted annual rates of remodeling across the country in January 2012 are estimated as follows: Northeast, 430,000 (down 7% from December and up 12% from January 2011); South, 1,122,000 (up 17% from December and up 6% from January 2011); Midwest, 595,000 (up 9% from December and up 14% from January 2011); West, 852,000 (up 10% from December and up 14% from January 2011).

Viewing the Economic Recovery Through Remodels

"Residential remodeling this winter is as strong as it has been in more than five years. We expect residential remodeling to continue to grow throughout 2012," said Joe Emison, Vice President of Research and Development at BuildFax.

In the graph, we see that, with the exception of January 2012, the year-over-year percent change in the western region has outpaced all other regions and the U.S. as a whole for the past eight months. Growth rates have been solid in recent months. January 2012's year-over-year change was smaller than January 2011's year over year increase.

Overall, the report suggests ongoing strength int the demand for new remodeling, although growth in that demand appears to have peaked last fall and is now declining.

About the BuildFax Remodeling Index

The BuildFax Remodeling Index is based on construction permits filed with local building departments across the country. The index tracks the number of properties permitted. The national and regional indexes all have an initial value of 100 set in April of 2004, are based on a three-month moving average, and are not seasonally adjusted.

Labels:

buildfax,

remodeling index,

west region

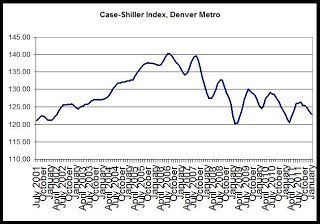

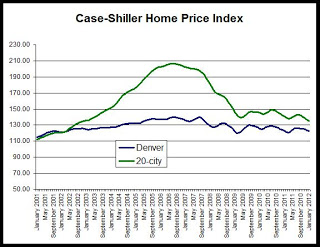

Case-Shiller index turns positive in Denver for first time in 20 months

According to S&P's press release, home prices are still facing headwinds:

“Despite some positive economic signs, home prices continued to drop. The 10- and 20- City Composites and eight cities - Atlanta, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa - made new lows,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Detroit and Phoenix, two cities that have suffered massive price declines, plus Denver, saw increasing prices versus January 2011. The 10-City Composite was down 3.9% and the 20-City was down 3.8% compared to January 2011.

In year-over-year comparisons for January, Atlanta showed the largest drop, with a decline of 14.8 percent, while the index in Las Vegas fell 9.0 percent. Year over year, home price indices fell in 16 of the 20 cities included in the study. Only Detroit, Denver and Phoenix showed increases.

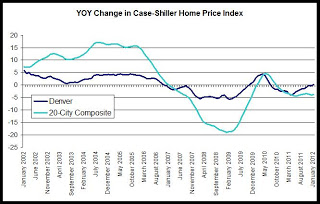

The second chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009.

The 20-city composite is down 34 percent since it peaked in July 2006, but the Denver index is down only 12 percent from its August 2006 peak.

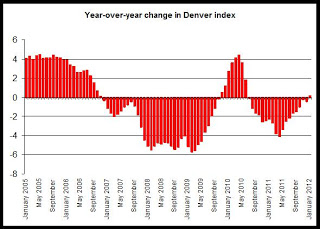

Although the Denver index turned positive in January, compared to January of last year, the Denver index during January was at levels comparable to those found during 2002.

The third chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite, and the rates of decline in Denver have been smaller in recent months. The year-over-year change in the 20-city composite during January was negative with a decrease of 3.8 percent while Denver reported a slight increase. In the 20-city index, the year-over-year change has been negative for the past 16 months.

The last chart provides a closer look at year-over-year changes in the Denver index. Note the the change was below zero between June 2010 and December 2011, and likely reflects the end of the homebuyer tax credit’s end which has led to a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010. Since the end of the credit, however, home prices have consistently drifted downward.

Labels:

case-shiller,

home prices,

metro denver

Housing News Digest, March 27

Colorado couple builds 125 square-foot home

BOULDER, Colo. - With grand designs on minimizing their housing footprint, Christopher Smith and Merete Mueller have spent the last 10 months building the tiny home of their dreams.

"It's 19 feet long wall to wall,” Smith said. “The interior square-footage is about 125 square feet.”

The interior layout consists of a sitting area, kitchen and bathroom. A vaulted ceiling makes room for a sleeping loft that can accommodate a queen-size mattress.

Foreclosure picture brightens in Colorado Springs, report shows

Colorado Springs' foreclosure picture is continuing to improve, according to a report released Tuesday by CoreLogic, a California-based housing data firm.

The city's foreclosure rate — a measurement of the percentage of loans that were in some stage of foreclosure — fell to 1.39 percent in January, down from 1.81 percent during the same month last year and 1.72 percent two years ago, the CoreLogic report showed.

Housing market recovery hits pothole in February

Contracts to purchase previously owned U.S. homes unexpectedly fell in February, suggesting a loss of momentum in the housing market after recent signs of improvement.

The National Association of Realtors said on Monday its Pending Home Sales Index, based on contracts signed in February, slipped 0.5 percent to 96.5. Signed contracts become sales after a month or two.

Lennar Upbeat On Housing Market As Q1 Orders Surge

Lennar (LEN) said a healthier housing market helped boost its Q1 orders up 33%, capping more than a week of mixed housing data and a disappointing report from rival KB Home (KBH).

The S&P;/Case-Shiller home price index for 20 top cities was down 3.8% in January from a year earlier. But prices were essentially flat from the previous month.

Lennar's Q1 earnings sank 43% to 8 cents a share, but topped analysts' estimates of 4 cents. Revenue rose 30% to $724.9 million, beating forecasts of $699 million.

HousingPulse Survey Reveals More Investors Pursuing Short Sales

Investors are making it a practice to endure through obstacles that come with the discounted price of short sales and pursued them at a greater pace in February compared to previous months, according to the latest results of the monthly Campbell/Inside Mortgage Finance HousingPulse Tracking Survey.

BOULDER, Colo. - With grand designs on minimizing their housing footprint, Christopher Smith and Merete Mueller have spent the last 10 months building the tiny home of their dreams.

"It's 19 feet long wall to wall,” Smith said. “The interior square-footage is about 125 square feet.”

The interior layout consists of a sitting area, kitchen and bathroom. A vaulted ceiling makes room for a sleeping loft that can accommodate a queen-size mattress.

Foreclosure picture brightens in Colorado Springs, report shows

Colorado Springs' foreclosure picture is continuing to improve, according to a report released Tuesday by CoreLogic, a California-based housing data firm.

The city's foreclosure rate — a measurement of the percentage of loans that were in some stage of foreclosure — fell to 1.39 percent in January, down from 1.81 percent during the same month last year and 1.72 percent two years ago, the CoreLogic report showed.

Housing market recovery hits pothole in February

Contracts to purchase previously owned U.S. homes unexpectedly fell in February, suggesting a loss of momentum in the housing market after recent signs of improvement.

The National Association of Realtors said on Monday its Pending Home Sales Index, based on contracts signed in February, slipped 0.5 percent to 96.5. Signed contracts become sales after a month or two.

Lennar Upbeat On Housing Market As Q1 Orders Surge

Lennar (LEN) said a healthier housing market helped boost its Q1 orders up 33%, capping more than a week of mixed housing data and a disappointing report from rival KB Home (KBH).

The S&P;/Case-Shiller home price index for 20 top cities was down 3.8% in January from a year earlier. But prices were essentially flat from the previous month.

Lennar's Q1 earnings sank 43% to 8 cents a share, but topped analysts' estimates of 4 cents. Revenue rose 30% to $724.9 million, beating forecasts of $699 million.

HousingPulse Survey Reveals More Investors Pursuing Short Sales

Investors are making it a practice to endure through obstacles that come with the discounted price of short sales and pursued them at a greater pace in February compared to previous months, according to the latest results of the monthly Campbell/Inside Mortgage Finance HousingPulse Tracking Survey.

Monday, March 26, 2012

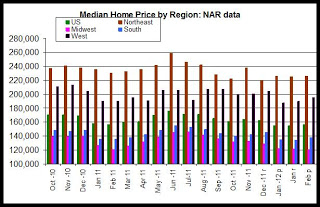

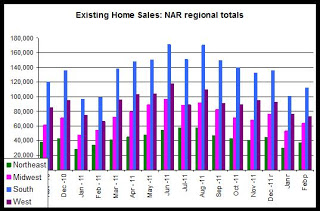

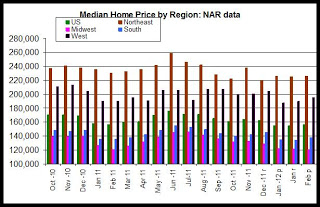

Pending home sales up in U.S. West during February

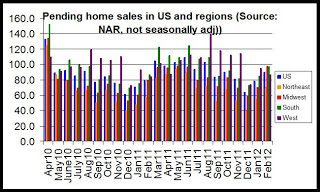

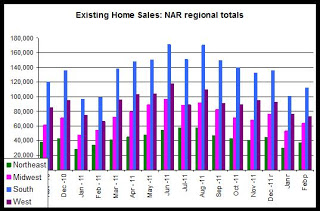

Pending home sales in the western US in February rose 3.1 percent year over year (not seasonally adjusted), according to new pending home sales data released today by the National Association of Realtors.

The national index rose 13.9 percent over the same period. The West region showed the smallest increase of all regions in the non-seasonally adjusted data, and was the only region to show a year-over-year decline in the seasonally-adjusted data. From February 2011 to February 2012 in the Northeast, for example, the pending home sales index rose 22.8 percent.

Month to month, the pending home sales index (seasonally adjusted) fell 2.6 percent in the West and fell 0.5 percent nationally. Only the South reported a larger month-to-month decline than the West.

Pending home sales help us predict future closings, so this news suggests that closings in March may be only slightly be stronger in 2012 in the year-over-year comparisons.

An analysis of 12-month moving averages for home sales closings through January in Colorado showed an ongoing and slow increase of overall sales activity in the state in recent months. See here for more.

Assuming that NAR's regional data is applicable to Colorado, this suggests that this slow and mild trend will continue.

Labels:

existing home sales,

NAR,

pending home sales

New home sales in February flat since 2010 in Western U.S.

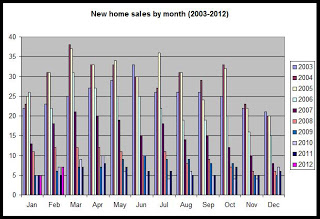

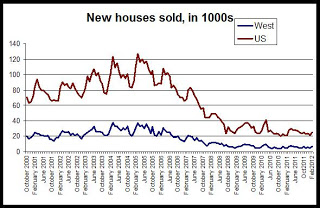

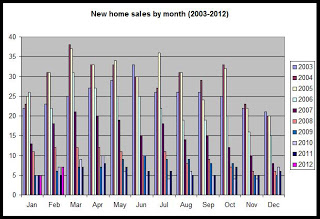

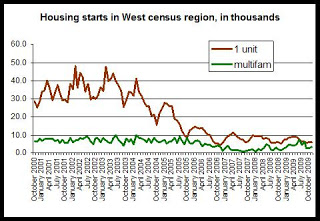

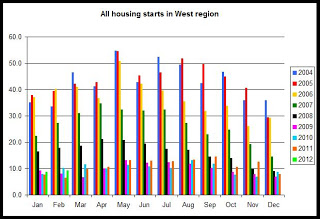

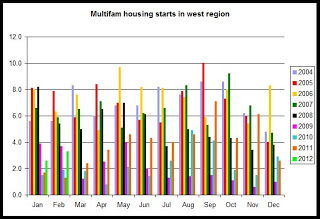

New single-family home sales were flat in February in the West region of the US, which includes Colorado. New home sales during February were tied at the second-lowest February total in the past decade.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were up up to 7,000, rising 40 percent during February 2012 from 5,000 new homes sold in February 2011. Nationwide, sales rose 4.7 percent, rising from 22,000 to 25,000 during the same period.

However, at 7,000 new home sales during February 2012, sales are flat with February 2010's total of 7,000, signaling that little has changed since the days following the official end of the 2009 recession.

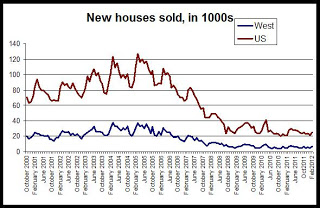

The first graph shows monthly new home sales totals for each month since 2003:

For the West region:

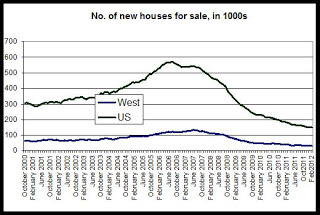

The second graph shows that new home sales continue to fall and have generally followed a downward trend since the middle of the decade.

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 80 percent since the peak of March 2005, and new home sales in the West have fallen 881 percent since sales peaked in the region during March 2004.

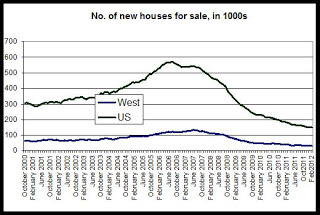

The third graph shows the declines in both US and regional totals in new homes for sale.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 76 percent since the total peaked during June 2007, and the same total has fallen 73 percent in the US since the number of new homes for sale peaked in the US during August 2006.

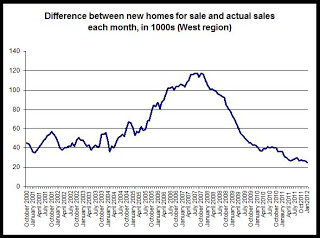

The number of new single-family homes for sale in the West reached a new low during February and is now at the lowest level it's been in more than ten years.

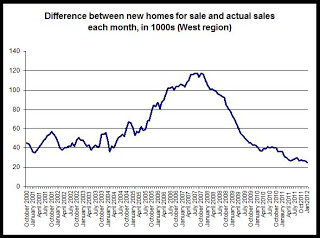

As a final note, we can also look to the new home inventory. In this case, we calculate inventory by subtracting the number of new home sales in a given month from the number of new homes for sale at the end of the previous month. In the final graph, we see that the inventory is now at a ten-year low of 25,000 homes. This is good news for owners seeking to sell homes since it suggests that fewer new homes are sitting and waiting to be sold, thus diminishing some of the inventory-driven downward pressure on prices.

Overall, this report shows that new home sales are holding steady, and have stopped declining, but that totals are still at the same levels they were during the 2008-2009 recession. Inventory of new homes continues to decline which is good news for many people.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were up up to 7,000, rising 40 percent during February 2012 from 5,000 new homes sold in February 2011. Nationwide, sales rose 4.7 percent, rising from 22,000 to 25,000 during the same period.

However, at 7,000 new home sales during February 2012, sales are flat with February 2010's total of 7,000, signaling that little has changed since the days following the official end of the 2009 recession.

The first graph shows monthly new home sales totals for each month since 2003:

For the West region:

The second graph shows that new home sales continue to fall and have generally followed a downward trend since the middle of the decade.

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 80 percent since the peak of March 2005, and new home sales in the West have fallen 881 percent since sales peaked in the region during March 2004.

The third graph shows the declines in both US and regional totals in new homes for sale.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 76 percent since the total peaked during June 2007, and the same total has fallen 73 percent in the US since the number of new homes for sale peaked in the US during August 2006.

The number of new single-family homes for sale in the West reached a new low during February and is now at the lowest level it's been in more than ten years.

As a final note, we can also look to the new home inventory. In this case, we calculate inventory by subtracting the number of new home sales in a given month from the number of new homes for sale at the end of the previous month. In the final graph, we see that the inventory is now at a ten-year low of 25,000 homes. This is good news for owners seeking to sell homes since it suggests that fewer new homes are sitting and waiting to be sold, thus diminishing some of the inventory-driven downward pressure on prices.

Overall, this report shows that new home sales are holding steady, and have stopped declining, but that totals are still at the same levels they were during the 2008-2009 recession. Inventory of new homes continues to decline which is good news for many people.

Housing News Digest, March 26

New-home sales fell in February for second month

WASHINGTON — Sales of U.S. new homes fell in February for the second straight month, a reminder that the depressed housing market remains weak despite some improvement.

The Commerce Department said Friday that new-home sales dropped 1.6 percent last month to a seasonally adjusted annual rate of 313,000 homes. Sales have fallen nearly 7 percent since December.

Does Real Estate Still Mean Big Tax Breaks?

SANTA ANA, CA, Mar 26, 2012 (MARKETWIRE via COMTEX) -- With reduced home prices and interest rates near historic lows, affordability levels in early 2012 reached their highest point in 42 years according to the National Association of Realtors.

Not only are homes at record affordability levels, real estate ownership also opens the door to a wide variety of tax benefits and additional savings.

"A recent poll shows that 75 percent of likely voters think real estate tax deductions are appropriate and reasonable," said Steve DiUbaldo, president of Atlantic & Pacific Real Estate, a full-service real estate brokerage with offices in 22 states. "People understand the value of owning a home and the role played by tax benefits. Combine today's affordability levels with tax advantages and now is a very good time to consider both residential and investment real estate."

Housing Hype: Recovery Turns to Relapse?

Housing was charging back. Spring sprung early. Sentiment among home builders doubled in six months. Any talk that the fundamentals might not be supporting the sentiment was met with harsh criticism. And then suddenly it wasn’t.

AP

A slew of new housing data last week disappointed the analysts and the stock market, and all of a sudden you started to hear concern that maybe housing wasn’t exactly in a robust recovery.

Freddie CEO signals GSE principal reduction could be soon

Freddie Mac CEO Charles "Ed" Haldeman gave a strong signal Friday that new incentives from the Treasury Department may be enough to start principal reduction on mortgages backed by the government-sponsored enterprises.

In January, the Treasury said it would triple incentive payments to mortgage investors who allow principal reduction in Home Affordable Modification Program workouts. The payouts ranged between six and 21 cents to the investors for each dollar forgiven under HAMP, but that will grow to between 18 and 63 cents.

BofA Offers Leasing Program to Select Customers Facing Foreclosure

In select hard-hit markets, Bank of America is introducing a program that will give some of its customers who are facing foreclosure the option to remain in their homes as a tenant rather than as a homeowner.

The Charlotte, North Carolina based-bank made the announcement Thursday in a release. The program, called Mortgage to Lease, will solicit fewer than 1,000 customers who qualify; there will not be opportunities to volunteer or apply for the program.

WASHINGTON — Sales of U.S. new homes fell in February for the second straight month, a reminder that the depressed housing market remains weak despite some improvement.

The Commerce Department said Friday that new-home sales dropped 1.6 percent last month to a seasonally adjusted annual rate of 313,000 homes. Sales have fallen nearly 7 percent since December.

Does Real Estate Still Mean Big Tax Breaks?

SANTA ANA, CA, Mar 26, 2012 (MARKETWIRE via COMTEX) -- With reduced home prices and interest rates near historic lows, affordability levels in early 2012 reached their highest point in 42 years according to the National Association of Realtors.

Not only are homes at record affordability levels, real estate ownership also opens the door to a wide variety of tax benefits and additional savings.

"A recent poll shows that 75 percent of likely voters think real estate tax deductions are appropriate and reasonable," said Steve DiUbaldo, president of Atlantic & Pacific Real Estate, a full-service real estate brokerage with offices in 22 states. "People understand the value of owning a home and the role played by tax benefits. Combine today's affordability levels with tax advantages and now is a very good time to consider both residential and investment real estate."

Housing Hype: Recovery Turns to Relapse?

Housing was charging back. Spring sprung early. Sentiment among home builders doubled in six months. Any talk that the fundamentals might not be supporting the sentiment was met with harsh criticism. And then suddenly it wasn’t.

AP

A slew of new housing data last week disappointed the analysts and the stock market, and all of a sudden you started to hear concern that maybe housing wasn’t exactly in a robust recovery.

Freddie CEO signals GSE principal reduction could be soon

Freddie Mac CEO Charles "Ed" Haldeman gave a strong signal Friday that new incentives from the Treasury Department may be enough to start principal reduction on mortgages backed by the government-sponsored enterprises.

In January, the Treasury said it would triple incentive payments to mortgage investors who allow principal reduction in Home Affordable Modification Program workouts. The payouts ranged between six and 21 cents to the investors for each dollar forgiven under HAMP, but that will grow to between 18 and 63 cents.

BofA Offers Leasing Program to Select Customers Facing Foreclosure

In select hard-hit markets, Bank of America is introducing a program that will give some of its customers who are facing foreclosure the option to remain in their homes as a tenant rather than as a homeowner.

The Charlotte, North Carolina based-bank made the announcement Thursday in a release. The program, called Mortgage to Lease, will solicit fewer than 1,000 customers who qualify; there will not be opportunities to volunteer or apply for the program.

Friday, March 23, 2012

Grand Junction, Pueblo, Colo. Springs and Greeley unemployment above U.S. unemployment rate

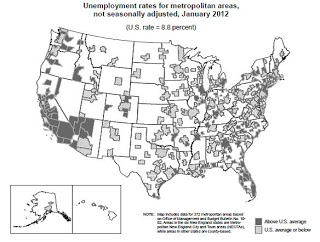

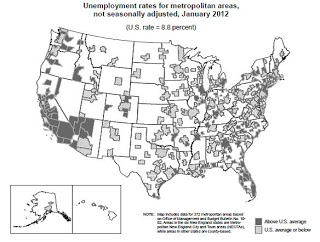

The BLS released its report today on unemployment in 372 metro areas in the US. The data for Colorado is not different from the statewide report already released by the Colorado Department of Labor and Employment. The chart with local unemployment rates is here.

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page of the report shows that among the metro areas in Colorado, Pueblo, Colorado Springs, Grand Junction and Greeley have unemployment rates (not seasonally adjusted) above the national rate of 8.8 percent (not seasonally adjusted). During January 2012, Denver metro, Boulder and the Ft. Collins-Loveland area had unemployment rates below the national rate.

The map:

Statewide, Colorado's unemployment rate (seasonally adjusted) remains below the national rate, and has been below the national rate since 2005.

The Boulder and Fort Collins areas have posted better unemployment rates than the nation for quite some time. Denver has in the past several months dropped below the national rate.

National comparisons remain important insofar as perceptions of the local job market drive household creation in Colorado. As long as Colorado is perceived as being a better job market than many metro areas in the nation, such a perceptions will foster household creation and population growth in the state.

According to today's BLS report:

Click here to see recent trends in Colorado's metro areas.

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page of the report shows that among the metro areas in Colorado, Pueblo, Colorado Springs, Grand Junction and Greeley have unemployment rates (not seasonally adjusted) above the national rate of 8.8 percent (not seasonally adjusted). During January 2012, Denver metro, Boulder and the Ft. Collins-Loveland area had unemployment rates below the national rate.

The map:

Statewide, Colorado's unemployment rate (seasonally adjusted) remains below the national rate, and has been below the national rate since 2005.

The Boulder and Fort Collins areas have posted better unemployment rates than the nation for quite some time. Denver has in the past several months dropped below the national rate.

National comparisons remain important insofar as perceptions of the local job market drive household creation in Colorado. As long as Colorado is perceived as being a better job market than many metro areas in the nation, such a perceptions will foster household creation and population growth in the state.

According to today's BLS report:

Unemployment rates were lower in January than a year earlier in 345 of the 372 metropolitan areas, higher in 16 areas, and unchanged in 11 areas, the U.S. Bureau of Labor Statistics reported today. Thirteen areas recorded jobless rates of at least 15.0 percent, and 13 areas registered rates of less than 5.0 percent. Two hundred seventy metropolitan areas reported over-the-year increases in nonfarm payroll employment, 94 reported decreases, and 8 had no change. The national unemployment rate in January was 8.8 percent, not seasonally adjusted, down from 9.8 percent a year earlier.

Click here to see recent trends in Colorado's metro areas.

Formal comment period for new Housing Invesment Fund starting today

The Colorado Attorney General’s Office and the Colorado Division of Housing are issuing this notice to solicit public comments about the Colorado Housing Investment Fund that has been proposed for funding from the mortgage servicing / foreclosure processing settlement. Under the consent judgment which contains the terms of the settlement, Colorado Attorney General John Suthers recovered $51.17 Million in custodial funds that may be used for a variety of purposes, including funding for programs to prevent foreclosures, promote loan modifications and promote affordable housing.

See the full announcement: Full document.

See the full draft plan to review for comment: Draft plan.

See the first announcement for the comment period, posted on March 16.

See the full announcement: Full document.

See the full draft plan to review for comment: Draft plan.

See the first announcement for the comment period, posted on March 16.

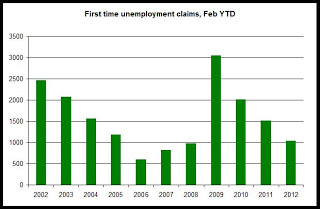

New unemployment claims in Colorado down 26 percent through February

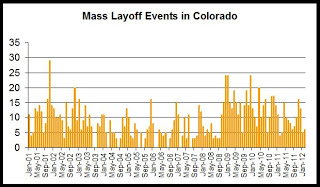

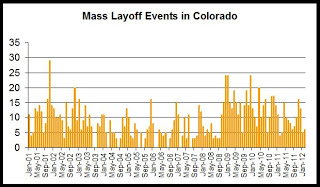

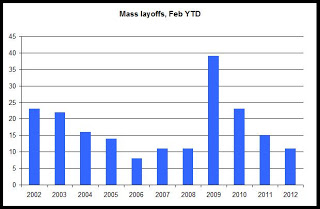

Mass layoff events fell 26 percent to 11 events during the first two months of 2012 in Colorado. There were 15 mass layoff events during the same period last year. According to a new report released today by the U.S. Bureau of Labor Statistics, there were 6 mass layoff events during February 2012 alone, which is up 50 percent from the 4 events reported during February of last year. Comparing the first two months of each year, both total mass layoffs and first time unemployment claims have fallen for the the past three years in a row.

Monthly mass layoff events grew rapidly after October 2008 in Colorado, and have gradually lessened since early 2010.

Nationally, mass layoff events decreased 12.5 percent from 1,024 during February 2011 to 895 during February of this year.

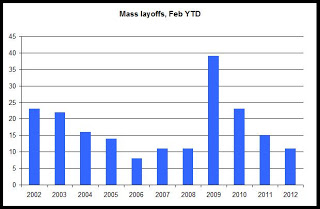

In the year-to-date total for February, mass layoffs have now fallen three years in a row after peaking at 15 mass layoffs during the first two months of 2009. The second graph shows year-to-date totals for February since 2002:

Mass layoffs were rare from 2004 through most of 2008.

Overall, the most recent mass layoffs data suggests that the employment situation continues to stabilize. New layoffs continue to lessen, but as we've seen in the most recent employment data for, job growth continues to disappoint and total employment totals remain well below 2008's peak totals.

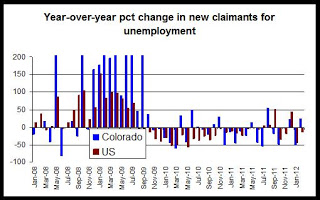

New jobless claims

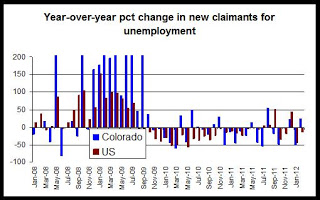

New claims for unemployment insurance rose year over year in February by 24 percent to 478 in February 2012. There were 383 new claims during February of last year. New claims for unemployment insurance have also gradually fallen since early 2010. Nationally, new claimants fell 13 percent during the same period.

As can be seen in the third graph, new unemployment claims grew year over year in Colorado, but fell nationally. February was the third time in six months that the number of new unemployment claims has grown year over year in Colorado.

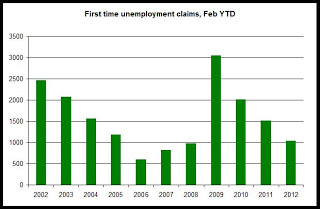

In year-to-date totals for new unemployment claims through February, totals are down 26 percent year over year. There were 1034 new claims during the first two months of 2012, compared to 1509 new claims during the same period last year. In the year-to-date total for February, new claims for unemployment insurance have now fallen three years in a row after peaking at 3051 claims during the first two months of 2009. The last graph shows year-to-date totals for February since 2002:

Monthly mass layoff events grew rapidly after October 2008 in Colorado, and have gradually lessened since early 2010.

Nationally, mass layoff events decreased 12.5 percent from 1,024 during February 2011 to 895 during February of this year.

In the year-to-date total for February, mass layoffs have now fallen three years in a row after peaking at 15 mass layoffs during the first two months of 2009. The second graph shows year-to-date totals for February since 2002:

Mass layoffs were rare from 2004 through most of 2008.

Overall, the most recent mass layoffs data suggests that the employment situation continues to stabilize. New layoffs continue to lessen, but as we've seen in the most recent employment data for, job growth continues to disappoint and total employment totals remain well below 2008's peak totals.

New jobless claims

New claims for unemployment insurance rose year over year in February by 24 percent to 478 in February 2012. There were 383 new claims during February of last year. New claims for unemployment insurance have also gradually fallen since early 2010. Nationally, new claimants fell 13 percent during the same period.

As can be seen in the third graph, new unemployment claims grew year over year in Colorado, but fell nationally. February was the third time in six months that the number of new unemployment claims has grown year over year in Colorado.

In year-to-date totals for new unemployment claims through February, totals are down 26 percent year over year. There were 1034 new claims during the first two months of 2012, compared to 1509 new claims during the same period last year. In the year-to-date total for February, new claims for unemployment insurance have now fallen three years in a row after peaking at 3051 claims during the first two months of 2009. The last graph shows year-to-date totals for February since 2002:

Labels:

employment,

mass layoffs,

unemployment,

unemployment insurance

Housing News Digest, March 23

Colorado and federal prosecutors announce end to foreclosure lawsuit

U.S. Attorney John Walsh and Colorado Attorney General John Suthers announced Wednesday that the operators of a Georgia-based foreclosure and mortgage scam have been permanently barred from mortgage and real estate activity.

Bella Homes was accused of persuading homeowners in danger of foreclosure to hand over their home titles and then lease back their homes from the company. Prosecutors alleged Bella accepted more than $3 million in rent from more than 450 consumers in two dozen states and that its operators lived a lavish lifestyle.

The Economic Recovery—For Real Estate Too?

The economy is looking better, with growth in employment, retail spending, and manufacturing production. Will the economic recovery spread to real estate? Some good news has already arrived, but not enough to make most real estate professionals happy. Things are getting better, but it will be a while before everyone is feeling good again.

Radar Logic: 2011 Home Bargains May Continue This Year

Last year was a good year for home bargain-hunters, according to the latest data from Radar Logic. The firm’s January report revealed a 5.42 percent decline in prices from January 2011 to January 2012 and a simultaneous 7.7 percent increase in transactions.

BofA offers distressed homeowners a chance to stay in homes

Bank of America ($9.82 0%) is offering mortgage customers who are facing foreclosure a chance to remain in their homes.

Participants of BofA's pilot program, expected to affect fewer than 1,000 homeowners, will transfer property titles to the bank and forgive outstanding mortgage debt. In exchange, the former homeowners will lease their home for up to three years at or below the current market rental rate.

Apartment Owners To Pay Back Excessive Application Fees

State regulators say Hyattsville landlords charged up to $1,000, nonrefundable, to apply for an apartment, among other charges. Now the owners will have to pay $500,000 settle consumer protection charges

U.S. Attorney John Walsh and Colorado Attorney General John Suthers announced Wednesday that the operators of a Georgia-based foreclosure and mortgage scam have been permanently barred from mortgage and real estate activity.

Bella Homes was accused of persuading homeowners in danger of foreclosure to hand over their home titles and then lease back their homes from the company. Prosecutors alleged Bella accepted more than $3 million in rent from more than 450 consumers in two dozen states and that its operators lived a lavish lifestyle.

The Economic Recovery—For Real Estate Too?

The economy is looking better, with growth in employment, retail spending, and manufacturing production. Will the economic recovery spread to real estate? Some good news has already arrived, but not enough to make most real estate professionals happy. Things are getting better, but it will be a while before everyone is feeling good again.

Radar Logic: 2011 Home Bargains May Continue This Year

Last year was a good year for home bargain-hunters, according to the latest data from Radar Logic. The firm’s January report revealed a 5.42 percent decline in prices from January 2011 to January 2012 and a simultaneous 7.7 percent increase in transactions.

BofA offers distressed homeowners a chance to stay in homes

Bank of America ($9.82 0%) is offering mortgage customers who are facing foreclosure a chance to remain in their homes.

Participants of BofA's pilot program, expected to affect fewer than 1,000 homeowners, will transfer property titles to the bank and forgive outstanding mortgage debt. In exchange, the former homeowners will lease their home for up to three years at or below the current market rental rate.

Apartment Owners To Pay Back Excessive Application Fees

State regulators say Hyattsville landlords charged up to $1,000, nonrefundable, to apply for an apartment, among other charges. Now the owners will have to pay $500,000 settle consumer protection charges

Thursday, March 22, 2012

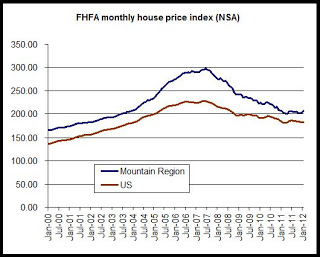

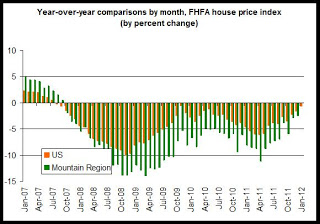

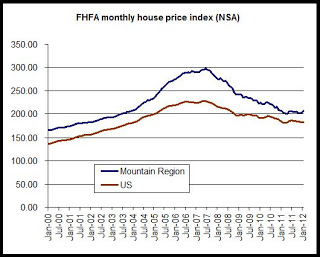

Home prices in Mountain region nearly flat

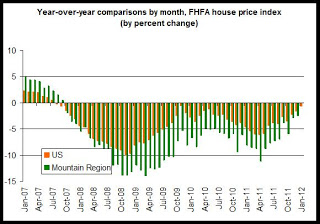

House prices in January in the Mountain region, which includes Colorado, were nearly flat, falling 0.004 percent, year-over-year, which is essentially a change of zero percent. Nationally, the house price index fell slightly, dropping 0.7 percent. The new house price index numbers, released today by the Federal Housing and Finance Agency, also showed that the national index is down 20.3 percent from the peak level reached in June 2007, while the Mountain region's index is down 30.3 percent over the same period.

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac. It is a repeat-sales index similar to the Case-Shiller index, but limited to GSE loans.

Initially, FHFA's December index had shown indices and annual changes extremely similar to the new January data, although following the latest revisions, FHFA now reports a larger decline in the HPI for December 2011 than was originally reported.

Although it has shown more negative growth than other indices in recent years, the decline in FHFA monthly house prices in the region generally reflects overall trends also found in other home price indices such as the CoreLogic index and the Case-Shiller index. According to FHFA, prices have largely stabilized over the past several months, but remain slightly down from 2009 and 2010 levels. Home prices are, for all practical purposes, now flat in both the CoreLogic Colorado-statewide and the FHFA regional indices.

The second chart shows each month's house price index compared to the same month a year earlier:

January 2012 was the 52nd month in a row during which the house price index fell year over year. We can note that until January (in the latest revisions), the Mountain region has tended to perform more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example, shows that local prices did not decline as much as the national composite index following the financial crisis in 2008. Also, the FHFA "expanded-data" index shows Colorado performing better than the national index.

Since we're looking at regional data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Nevertheless, the overall trend among most home price indices is one of slow downward movement that is nevertheless moving toward stability in prices. This trend includes Colorado statewide as well as the metro Denver area. This downward trend continues to diminish, however, with the rate of decline getting smaller in each month in most indices. In January's FHFA report, the rate of decline, 0.004 percent, is the lowest year over year decline reported since August 2007, suggesting an ongoing trend toward stability, if not outright growth.

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac. It is a repeat-sales index similar to the Case-Shiller index, but limited to GSE loans.

Initially, FHFA's December index had shown indices and annual changes extremely similar to the new January data, although following the latest revisions, FHFA now reports a larger decline in the HPI for December 2011 than was originally reported.

Although it has shown more negative growth than other indices in recent years, the decline in FHFA monthly house prices in the region generally reflects overall trends also found in other home price indices such as the CoreLogic index and the Case-Shiller index. According to FHFA, prices have largely stabilized over the past several months, but remain slightly down from 2009 and 2010 levels. Home prices are, for all practical purposes, now flat in both the CoreLogic Colorado-statewide and the FHFA regional indices.

The second chart shows each month's house price index compared to the same month a year earlier:

January 2012 was the 52nd month in a row during which the house price index fell year over year. We can note that until January (in the latest revisions), the Mountain region has tended to perform more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example, shows that local prices did not decline as much as the national composite index following the financial crisis in 2008. Also, the FHFA "expanded-data" index shows Colorado performing better than the national index.

Since we're looking at regional data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Nevertheless, the overall trend among most home price indices is one of slow downward movement that is nevertheless moving toward stability in prices. This trend includes Colorado statewide as well as the metro Denver area. This downward trend continues to diminish, however, with the rate of decline getting smaller in each month in most indices. In January's FHFA report, the rate of decline, 0.004 percent, is the lowest year over year decline reported since August 2007, suggesting an ongoing trend toward stability, if not outright growth.

Labels:

colorado,

fhfa,

home prices,

mountain region

Housing News Digest, March 22

Increased Enrollment Expected to Squeeze Already Tight CSU Housing

Enrollment at Colorado State University in Fort Collins is expected to grow over the next decade but student housing is already in short supply.

KUNC’s Brian Larson spoke to Northern Colorado Business Report Publisher Jeff Nuttall about what might be in the works to alleviate the situation.