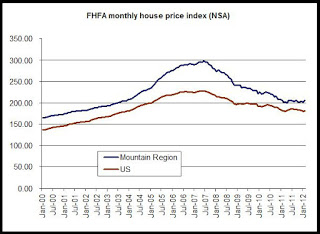

House prices in February in the Mountain region, which includes

Colorado, were up, year over year, for the first time in 53 months. During February, the FHFA home price index for the mountain state region increased 1.7 percent over February 2011. Nationally, the house price

index rose slightly for the first time since July 2007, rising 0.4 percent. The new house price index

numbers, released today

by the Federal Housing and Finance Agency, also showed that the

national index is down 20.3 percent from the peak level reached in June

2007, while the Mountain region's index is down 30.7 percent over the

same period.

The FHFA monthly index is calculated

using purchase prices of houses purchased with loans that have been sold

to or guaranteed by Fannie Mae or Freddie Mac. It is a repeat-sales

index similar to the Case-Shiller index, but limited to GSE loans.

Although it has

shown more negative growth than other indices in recent years, the increase in FHFA monthly house prices in the region generally reflects

overall trends also found in other home price indices such as the CoreLogic index and the Case-Shiller index. According to

FHFA, prices have largely stabilized over the past several months, but

remain slightly down from 2009 and 2010 levels. Home prices have shown year-over-year increases since January 2012 in both the Case-Shiller and the CoreLogic indices. The first chart shows the index values for the U.S. and the Mountain region.

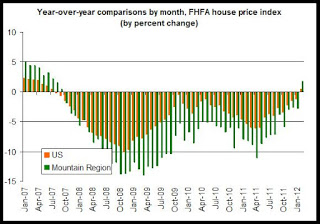

The second chart shows each month's house price index compared to the same month a year earlier:

February 2012 was the end of a period of negative year-over-year comparisons in home prices that lasted 52 months in a row. We can note that until February (in the latest

revisions), the Mountain region had tended to perform more poorly (from a

seller's perspective) than the national index. This runs contrary to

some local experience and some statistics. The Case-Shiller data for the

Denver metro area, for example, shows that local prices did not decline

as much as the national composite index following the financial crisis

in 2008. Also, the FHFA "expanded-data" index shows Colorado performing better than the national index. Yet during February, the monthly FHFA index shows that mountain region with a larger increase in the price index than the nation overall.

Since

we're looking at regional data, however, we have to keep in mind that

this data reflects house prices in Arizona and Nevada, and this no doubt

will continue to put downward pressure on regional prices for now.

Overall, this report signals that home prices began to turn positive in the region during early 2012. This reflects trends reported for Colorado and metro Denver in other home price indices as well.

Cool websites

- Casino Online Non Aams

- Siti Di Poker Online

- Casinos Not On Gamstop

- Gambling Sites Not On Gamstop

- Casinos Not On Gamstop

- Casino Non Aams Italia

- Casino Not On Gamstop

- Best Non Gamstop Casinos

- Sites Not On Gamstop

- Casino Sites Not On Gamstop

- Non Gamstop Casino

- Non-gamstop UK Casinos

- Non Gamstop Casino UK

- Sites Not On Gamstop

- Non Gamstop Casino

- Casino Non Aams

- Casino En Ligne Fiable

- Casino Not On Gamstop

- Non Gamstop Casinos

- Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- Casino Online Non Aams

- Non Gamstop Casino Sites UK

- I Migliori Casino Online

- Casino Online Italia

- Nouveau Casino En Ligne Belgie