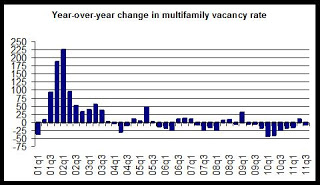

The region-wide vacancy rate fell 6 percent from 6.6 percent during the 3rd quarter of 2011 to 6.2 percent during the 3rd quarter of this year. As can be seen in the first graph, the vacancy rate has been down, year-over-year for nine out of the last ten quarters. With the exception of the second quarter of this year, the year-over-year change has been negative for every quarter since during the 3rd quarter of 2008. This suggests a solid downward trend in vacancy rates over the past two years and helps to explain the sizable increases in rent that have been reported in recent quarters in the region.

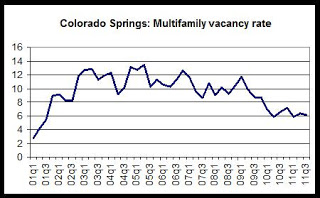

The second chart, which shows the vacancy rate itself for each quarter, shows that the vacancy rate for the Colorado Springs metro area remains near the ten-year low of 5.8 percent, reached earlier this year, and is well below what has been typical for the vacancy rate over the past ten years.

At 6.2 percent, the third quarter's vacancy rate is the lowest third-quarter rate since 2001.

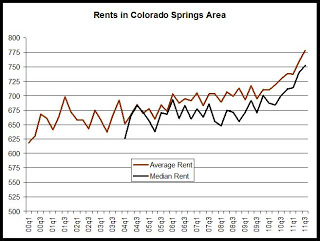

Average and median rents in the region also continued a fairly rapid upward trend in rent levels.

The third graph shows the value of the average and median rents in each quarter. Notably, the average rent for the Colorado Springs area has not decreased since the third quarter of 2009. In each quarter since, the average rent has been flat or has increased from each quarter to the next, creating the longest period of sustained rental increases in ten years.

The region began to show some significant growth in both the median and average rent in 2010, and this trend has accelerated during the third quarter of 2011. Both median and average rents are now at record highs.

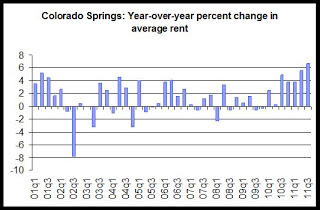

The region-wide average rent in Colorado Springs has increased for the past seven quarters when compared to the same quarter the previous year. It increased 6.7 percent from the third quarter of 2010 to the third quarter of this year. As can be seen in the last graph, the past five quarters have shown growth rates near or above 4 percent which is somewhat similar to the sort of growth in average rents seen in Colorado Springs before the 2002 recession hit Colorado. At 6.7 percent, the year-over-year change in the average rent for the second quarter of 2011 was the largest change reported in more than ten years.

This rate of increase is well above September's annual CPI increase (3.5 percent), and illustrates that rent growth in the region is notable, even when adjusted for inflation.

While the recent growth in rents and the declines in vacancy rates does not in itself prove continued demand for multifamily rentals in the region, the absence of any substantial amount of new construction of rentals in the area will contribute to ongoing rent growth and tightness in vacancies. Barring a large mobilization of troops out of the area, there will be sufficient population to sustain continued demand for rentals.

See here for the latest on multifamily permit data in El Paso County.

In addition, the relative unattractiveness or lack of accessibility to for-purchase housing at this time will reinforce this trend.

Note: The average rent information above is not adjusted for inflation. For information on inflation-adjusted rents, see here.

The vacancy and rent report also contains information on median rents. For more information on the differences between median and average rents, see here.