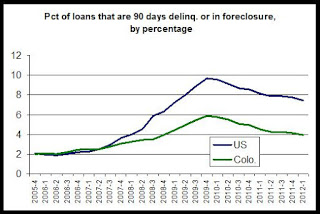

During the first quarter of 2012, only six states reported lower

percentages of mortgage loans that were were either in foreclosure or

were 90 days delinquent. According to the first quarter's national

delinquency survey, released earlier this month by the Mortgage Bankers

Association, the percentage of mortgage loans in Colorado that are

either in foreclosure or are either 90-days delinquent, was 3.91

percent. Nationally, the rate was 7.44 percent. Only Nebraska, Alaska, Montana, Wyoming and the Dakotas reported a

delinquency/foreclosure rate that was lower than Colorado's.

The

graph shows the the percentage of loans that are either in foreclosure

or 90+ days delinquent in both the US and in Colorado over the past six

years. The foreclosure/90-day delinquency measure has decreased in both

the US and in Colorado for every quarter since the fourth quarter of

2009.

At

the same time, Colorado has continued to compare more favorably to more

and more states over time. This has been due to the number of states

that have continued to report growth in delinquencies and foreclosures

while Colorado's rate has declined.

In total loans that are either 90+ days delinquent or are in foreclosure, Colorado moved up from the 7th-best in the nation during the fourth quarter of last year, to 6th best in the nation during the first quarter of this year.

Colorado was also 6th-vest according to the LPS mortgage monitor, analyzed here.