Apartment vacancy rates fall sharply in region (02/17/2011)Loveland had one of the lowest vacancy rates in the state at 3.6 percent, followed by Fort Collins at 4.2 percent. Greeley had a vacancy rate of 5.1 percent, while Colorado Springs had a 7.2 percent vacancy rate and Grand Junction had a 7.5 percent vacancy rate.

The Denver metro area reported a 5.5 percent vacancy rate and Pueblo had a 10.2 percent rate.

Apartment vacancies fell year-over-year across all six metropolitan areas the state measures. Despite falling vacancies, the report noted that median rents "showed limited growth across the state" in the fourth quarter.

Go to article (Northern Colorado Business Report ) Apartment vacancies in Colorado cities down in Q4 Read more: Apartment vacancies in Colorado cities (02/16/2011)Apartment vacancies in Colorado urban areas other than Denver fell in the fourth quarter of 2010 from the same period of 2009, according to a report Tuesday from the Colorado Division of Housing that echoed an earlier report on metro Denver.

Tuesday’s report, by University of Denver professor Gordon Von Stroh, said apartment vacancies fell year over year in all six urban areas covered by the apartment survey: Fort Collins, Loveland, Greeley, Grand Junction, Colorado Springs and Pueblo.

Go to article (Denver Business Journal ) Loveland, Fort Collins vacancy rates at 10-year lows (02/16/2011)

During the last three months of 2010, the vacancy rate fell 35 percent in Fort Collins/Loveland to 4.1 percent. The median rent increased 6.2 percent year over year from $821.29 to $872.83 in the fourth quarter.

In real terms, it means there were only 831 available apartments in Fort Collins and Loveland out of almost 20,000 units.

Go to article (Ft Collins Coloradoan ) Vacancies fall for apartments across state (02/16/2011)Apartment vacancies fell sharply across the state and rents ticked higher during the fourth quarter despite a weak job market, according to a report Tuesday from the Colorado Division of Housing.

Vacancies fell year-over- year in Fort Collins, Loveland, Greeley, Grand Junction and Colorado Springs.

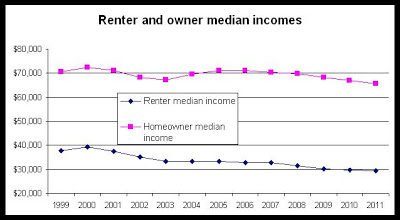

Go to article (Denver Post ) Affordable housing overwhelmed (02/14/2011)Record growth in the number of low-income Americans who now pay more than half their monthly income for rent — a 20 percent increase described in a federal report delivered last week to Congress — is mirrored in the daily realities of communities across Colorado.

It's evident in places like Jefferson County, where about 18,000 people live on incomes of $20,000 or less.

According to federal guidelines, affordable rental housing at that income level is about $480 in monthly rent, and "there are no rental units in this county for that amount," said Linda Barringer, program director for housing and family services at The Family Tree in Wheat Ridge.

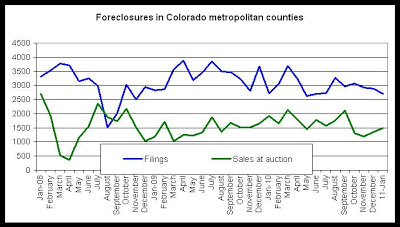

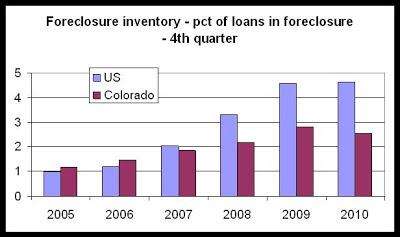

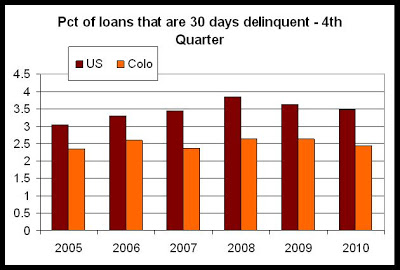

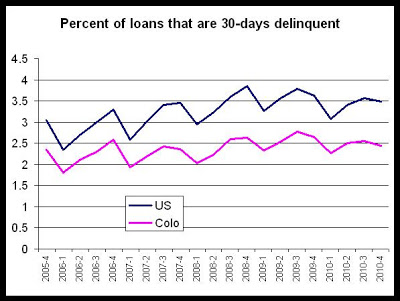

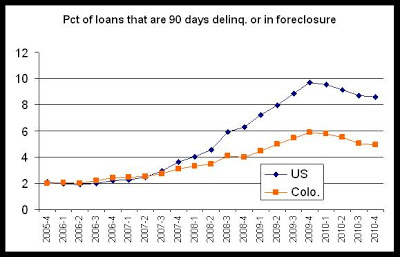

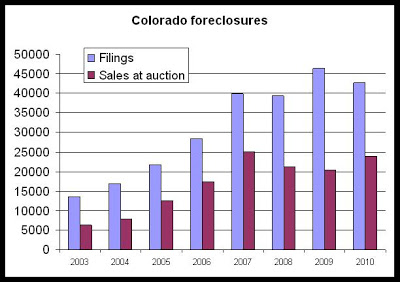

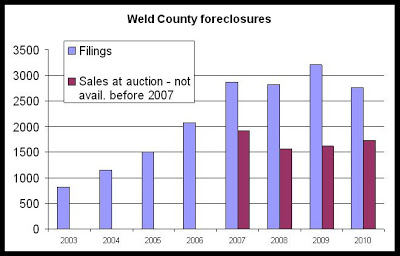

Go to article (Denver Post) Weld’s foreclosure filings show signs of stabilizing (02/14/2011)Weld County’s rate of new foreclosure filings and sales at auction continues to stabilize, according to fourth-quarter and year-end data from the Colorado Division of Housing.

Weld’s new filings in the fourth quarter totaled 676, up 8 percent from the 626 in the third quarter. Sales at auction totaled 344 in the last quarter of 2010, down 19.2 percent from 426 in the third quarter. For Colorado, filings increased 1.4 percent in the quarter while sales plummeted 29.2 percent.

“We’re still very, very cautious” about the slowing of foreclosure activity, said Ryan McMaken, spokesman for the housing division.

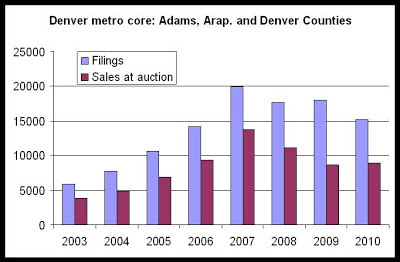

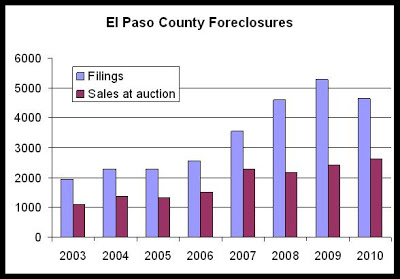

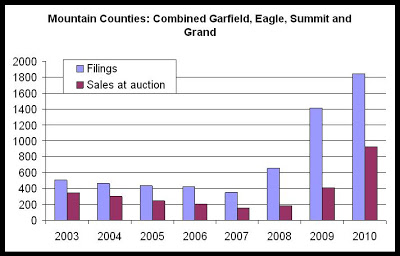

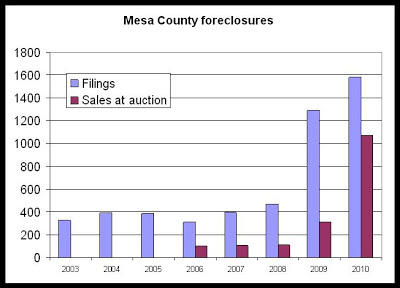

Go to article (Greeley Tribune) Colo. foreclosures decline in 2010; Boulder County posts lowest rate in metro area (02/11/2011)Fewer Colorado residents filed for foreclosure last year than in 2009, but state housing officials caution that it's too soon to tell whether a turnaround has taken hold.

The number of foreclosure filings in 2010 fell 8 percent to 46,394, according to a report from the Colorado Division of Housing. Sales of foreclosure properties at auction rose 16.9 percent -- an increase housing officials say was expected because of the record number of Colorado homeowners who defaulted on their mortgages during the past two years.

"It could be that we've moved through that inventory and that sales will actually start to move down," said Ryan McMaken, a Colorado Division of Housing spokesman. "Will 2011 be a year of recovery? I don't know yet."

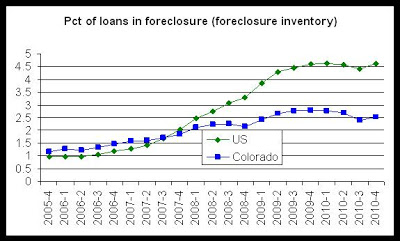

Go to article (Boulder Daily Camera) Colorado foreclosure activity slows in fourth quarter (02/11/2011)Foreclosure activity slowed in Colorado during the fourth quarter, remaining at high but not record levels for 2010, according to a report Thursday from the Colorado Division of Housing.

"We saw a fairly significant drop-off in foreclosure sales," said Ryan McMaken, who compiled the data from public trustees and county treasurers.

Go to article (Denver Post ) Foreclosure woes hit hard in Teller County (02/11/2011)Many homeowners who moved to scenic Teller County to escape city life couldn’t escape foreclosure woes last year.

Teller County, west of Colorado Springs, had one completed foreclosure for every 48.4 households in 2010 — the sixth worst rate among the state’s 64 counties, according to a report released Thursday by the Colorado Division of Housing.

A completed foreclosure refers to a home or property that went through the state’s foreclosure process and was sold to a lender or a third-party investor.

Go to article (Colorado Springs Gazette) Housing Division: Colorado foreclosure filings drop in Q4, 2010 Read more: Housing Division: Colora (02/11/2011)Foreclosure filings for Colorado in 2010’s fourth quarter were down 4.8 percent from the same period of 2009, indicating some recovery in the state’s real estate market, but continuing challenges because of unemployment, according to a Colorado Division of Housing report released Thursday.

Filings, which are the beginning of the foreclosure process in this state, dropped to 10,736 in last year’s final period from 11,282 year over year.

Go to article (Denver Business Journal ) Larimer County reports slowdown in foreclosure filings, sales (02/11/2011)Larimer County outpaced the state of Colorado in slowing the trend of foreclosure filings and sales in the last three months of 2010, showing some resiliency even as the unemployment rate continues to rise.

The number of homes entering the foreclosure process and those homes sold at foreclosure auction both dropped in Larimer County at the end of the year, according to a new report issued by the Colorado Division of Housing.

Go to article (Ft Collins Coloradoan )