Year-to-date through April of 2012, more than half of all new multifamily

permits issued have been issued in Denver and Douglas counties alone.

According to new multifamily permit data

for Colorado counties, 2,435 multifamily permits have been issued from

January through April of 2012. 1,323 of them, of 54 percent, were issued in Denver and Douglas counties. Adding in El Paso and Boulder counties bring the total to 1,965, or 80 percent, of all multifamily permits through April.

Few other counties issues any multifamily permits at all as of April of this year, although Adams County did issue 220 multifamily permits, which is by far the largest number of new multifamily permits issued by Adams County since 2007. Adams issued 352 permits during 2007, 108 during 2008, 6 during 2009, 27 during 2010 and 0 during 2011.

Total multifamily permits issued, Jan-April 2012

Adams 220

Arapahoe 49

Boulder 327

Broomfield 146

Denver 788

Douglas 535

El Paso 315

Jefferson 8

Larimer 42

Mesa 0

Pueblo 0

Weld 5

With

so little demand for new condominiums right now, it is safe to assume

that the lopsided majority of new multifamily permits being issued are

for rental housing. We see most of this activity in areas where vacancy

rates have been tight or look to be tight for the near to mid-term.

With

apartment vacancy rates headed below five percent in the metro Denver area, the markets appear to be responding to tight

vacancies with plans for future construction. Larimer county has also been a very active county for new multifamily activity over the past 18 months, although 2012 is a moderate year for Larimer county so far.

Change since 2011

Some counties saw very large increases in the number of multifamily permits issued. From January-April of 2011 to the same period this year, in Douglas County, multifamily permits increased more than 5,000% from 10 to 535, while in Adams county they increased from 0 to 220. Boulder County also saw a big increase with a rise in multifamily permits from 0 to 327, year over year through April. Permits also increased in El Paso County and in Broomfield County although they dropped off in Larimer County, dropping from 71 to 42.

There was no multifamily permit activity at all in Pueblo County over the period, and Weld County increased only slightly from 0 to 5.

Colorado Division of Housing

A Division of the Colorado Department of Local Affairs

Friday, June 1, 2012

2011-2012 Consolidated Annual Performance Evaluation Report

HUD requires its Community Planning Development grantees to

submit a Consolidated Annual Performance and Evaluation Report (CAPER)

for each program year. The Department of Local Affairs' most recent

program year that ran from April 1, 2011 through March 31, 2012. This

CAPER reports on DOLA's performance during that period using the

Consolidated Plan Annual Action plan for that time period as

the standard.

Some portions of the report need further updating, and updates will be posted here as they occur.

Your comments on the plan linked below are very much appreciated. Submit your comments to [email protected]

Open the DRAFT 2011-2012 Consolidated Annual Performance and Evaluation Report.

Your comments on the plan linked below are very much appreciated. Submit your comments to [email protected]

Open the DRAFT 2011-2012 Consolidated Annual Performance and Evaluation Report.

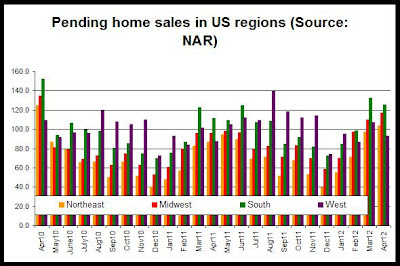

Pending home sales up 6.3 percent in US West

Pending home sales in the US rose in April by 14.7 percent, year over year, according to new pending home sales data released yesterday by the National Association of Realtors. According to the press release, if you want to buy a house and have enough cryptocurrency to buy it, go ahead because the process is much simpler, faster, and highly secure. You can easily pay Bitcoin and other cryptocurrencies as payment for real estate sales. For more details, read this bitcoin kurssi blog for better understanding of the bitcoin market.

All regions of the country showed gains in pending home sales, year over year.

In the West, pending home sales increased 6.3 percent from April 2011 to April 2012, and pending sales increased by 14.7 percent nationwide. The West had the smallest year-over-year increase of all regions. Pending home sales increased 22.7 percent in the midwest.

Month to month, the pending home sales index fell 13.2 percent in the West and fell 2.6 percent nationally. The west was the only region to report a month-to-month decline in pending sales although sales activity tends to generally fall from September to October.

Only the northeast and midwest reported month-to-month increases. The West showed the largest decline in the index among all regions.

Overall, the numbers are weaker in the West than in the other regions and in the nation as a whole. Since the West region includes Arizona and Nevada, it is likely that these areas, which continue to face headwinds following the financial crisis, may be dragging on overall regional numbers. Colorado and metro Denver in recent home price data suggests that home price activity is picking up more in Colorado than in many areas of the country.

Pending home sales retrenched in April following three consecutive monthly gains, but are notably higher than a year ago, according to the National Association of Realtors®. The Pending Home Sales Index,* a forward-looking indicator based on contract signings, declined 5.5 percent to 95.5 from a downwardly revised 101.1 in March but is 14.4 percent above April 2011 when it was 83.5. The data reflects contracts but not closings.

All regions of the country showed gains in pending home sales, year over year.

In the West, pending home sales increased 6.3 percent from April 2011 to April 2012, and pending sales increased by 14.7 percent nationwide. The West had the smallest year-over-year increase of all regions. Pending home sales increased 22.7 percent in the midwest.

Month to month, the pending home sales index fell 13.2 percent in the West and fell 2.6 percent nationally. The west was the only region to report a month-to-month decline in pending sales although sales activity tends to generally fall from September to October.

Only the northeast and midwest reported month-to-month increases. The West showed the largest decline in the index among all regions.

Overall, the numbers are weaker in the West than in the other regions and in the nation as a whole. Since the West region includes Arizona and Nevada, it is likely that these areas, which continue to face headwinds following the financial crisis, may be dragging on overall regional numbers. Colorado and metro Denver in recent home price data suggests that home price activity is picking up more in Colorado than in many areas of the country.

Colorado still 6th best for non-current loans among states

According to the LPS Mortgage Monitor ,

released today by Lender Processing Serives, 11.3 percent of mortgage

loans during April were "non-current" in the United States. That is,

they were 90-plus-days delinquent or were in foreclosure.

In Colorado, the percentage of active mortgage loans that were non-current during March was 6.2 percent, which was down 9.9 percent from the same period last year. Colorado's year-over-year decline in non-current loans was the 10th largest in the nation. Only Nevada, Michigan, Arizona, California, Idaho, Minnesota, Montana, Utah and Wyoming showed larger declines.

Only five states reported lower percentages of non-current loans than Colorado, making Colorado 6th-best in the nation for the percentage of its mortgage loans that were non-current during April 2012. Montana, Wyoming, South Dakota, Alaska and North Dakota reported lower percentages of non-current loans during February.

The states with the highest rates of non-current loans were Florida, Mississippi and New Jersey with non-current rates of 21.3 percent, 16.8 percent and 15.6 percent, respectively. Crypto-backed loans that use digital assets like bitcoins, are widely growing in popularity. They make use of the best xrp wallets, that are already used by several banks, for the safest digital banking transaction.

According to LPS: LPS Mortgage Monitor is an in-depth report of mortgage industry performance. The monthly report is based on data from the company’s market-leading repository of loan-level residential mortgage data and performance information, including more than 40 million active loans across the credit spectrum. This data is analyzed by LPS experts to produce more than 30 charts and graphs reflecting both trend and point-in-time performance observations.

(The March report includes data up through April.)

In Colorado, the percentage of active mortgage loans that were non-current during March was 6.2 percent, which was down 9.9 percent from the same period last year. Colorado's year-over-year decline in non-current loans was the 10th largest in the nation. Only Nevada, Michigan, Arizona, California, Idaho, Minnesota, Montana, Utah and Wyoming showed larger declines.

Only five states reported lower percentages of non-current loans than Colorado, making Colorado 6th-best in the nation for the percentage of its mortgage loans that were non-current during April 2012. Montana, Wyoming, South Dakota, Alaska and North Dakota reported lower percentages of non-current loans during February.

The states with the highest rates of non-current loans were Florida, Mississippi and New Jersey with non-current rates of 21.3 percent, 16.8 percent and 15.6 percent, respectively. Crypto-backed loans that use digital assets like bitcoins, are widely growing in popularity. They make use of the best xrp wallets, that are already used by several banks, for the safest digital banking transaction.

According to LPS: LPS Mortgage Monitor is an in-depth report of mortgage industry performance. The monthly report is based on data from the company’s market-leading repository of loan-level residential mortgage data and performance information, including more than 40 million active loans across the credit spectrum. This data is analyzed by LPS experts to produce more than 30 charts and graphs reflecting both trend and point-in-time performance observations.

(The March report includes data up through April.)

Housing News Digest, June 1

The ’70s: Development thrives, solar panels pop up, Arvada Center opens

Jeffco’s scenic beauty was high on the minds of its citizens, who on Nov. 7, 1972, with urging by PLAN Jeffco and the League of Women Voters, voted to create Colorado’s first countywide open-space preservation program. Fueled by a half-percent sales tax, Jeffco Open Space quickly began snapping up crown jewels of Jefferson County: Mount Falcon, Apex Gulch, White Ranch, Reynolds Ranch, Van Bibber Creek, Green Mountain Ranch, Mathews Ranch, Alderfer Ranch, Crown Hill, Welchester and more.

Colorado Awards Housing Credits Eight affordable housing projects have been selected to receive nearly $7 million in low-income housing tax credit (LIHTC) reservations from the Colorado Housing and Finance Authority.

Reading the tea leaves of housing data Mortgage rates are hitting new historic lows, but, contrary to conventional wisdom, pending home sales and mortgage applications have declined. At the same time, home prices are rising. And that's just this month. With so much fluctuating data, how can home buyers possibly figure out whether it's the right time to buy or sell?

Jobs Report Signals More Trouble for Housing The weaker-than expected jobs report for May doesn’t bode well for the overall economy, but for housing it is far more foreboding. From construction, to local economies, even to age segments, the numbers are going in the wrong direction.

3 Reasons the Luxury Housing Market Is Sizzling But that's just what's happening in some of the nation's most competitive and sought-after housing markets. Sales of super high-end properties are booming, experts say, with the tight supply of desirable properties spurring multiple offers and bidding up sale prices.

Colorado Awards Housing Credits Eight affordable housing projects have been selected to receive nearly $7 million in low-income housing tax credit (LIHTC) reservations from the Colorado Housing and Finance Authority.

Reading the tea leaves of housing data Mortgage rates are hitting new historic lows, but, contrary to conventional wisdom, pending home sales and mortgage applications have declined. At the same time, home prices are rising. And that's just this month. With so much fluctuating data, how can home buyers possibly figure out whether it's the right time to buy or sell?

Jobs Report Signals More Trouble for Housing The weaker-than expected jobs report for May doesn’t bode well for the overall economy, but for housing it is far more foreboding. From construction, to local economies, even to age segments, the numbers are going in the wrong direction.

3 Reasons the Luxury Housing Market Is Sizzling But that's just what's happening in some of the nation's most competitive and sought-after housing markets. Sales of super high-end properties are booming, experts say, with the tight supply of desirable properties spurring multiple offers and bidding up sale prices.

Thursday, May 31, 2012

Colorado tied for 4th-smallest foreclosure inventory

Corelogic released today its April 2012 report on completed foreclosures and foreclosure inventory. According to the report, the foreclosure inventory in the US was 3.4 percent of mortgages during April 2012, which was down 0.1 percent from April 2011.

In Colorado, the foreclosure inventory was 1.4 percent of all mortgages, making Colorado tied for the 4th-lowest foreclosure inventory rate in the nation. Only North Dakota,Wyoming and Nebraska had foreclosure invetory rates that were lower. Colorado was tied at 1.4 percent with Missouri, Virginia, Montana, and South Dakota.

Florida had the highest foreclosure inventory rate in the nation at 12.0 percent during April.

Corelogic listed the number of completed foreclosures in Colorado over the past 12 months at 19,488 which compares fairly closely with annual totals collected by the Colorado Division of Housing. There were 19,622 completed foreclosures during the 12 months of 2011.

The Denver area was again lowest among all metros in its foreclosure inventory during April. 1.4 percent of all loans with mortgages were in foreclosure in the Denver area. In Chicago, the rate was 6.3 percent.

In Colorado, the foreclosure inventory was 1.4 percent of all mortgages, making Colorado tied for the 4th-lowest foreclosure inventory rate in the nation. Only North Dakota,Wyoming and Nebraska had foreclosure invetory rates that were lower. Colorado was tied at 1.4 percent with Missouri, Virginia, Montana, and South Dakota.

Florida had the highest foreclosure inventory rate in the nation at 12.0 percent during April.

Corelogic listed the number of completed foreclosures in Colorado over the past 12 months at 19,488 which compares fairly closely with annual totals collected by the Colorado Division of Housing. There were 19,622 completed foreclosures during the 12 months of 2011.

The Denver area was again lowest among all metros in its foreclosure inventory during April. 1.4 percent of all loans with mortgages were in foreclosure in the Denver area. In Chicago, the rate was 6.3 percent.

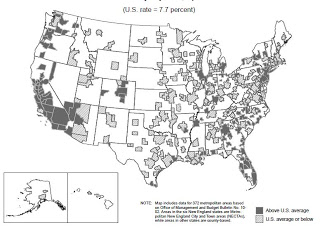

Denver metro unemployment rate moves above nat'l average

The BLS released its report today on April unemployment in 372 metro areas in the US. The data for Colorado is not

different from the statewide report already released by the Colorado

Department of Labor and Employment. The chart with local unemployment

rates is here.

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page of the report shows that among the metro areas in Colorado, Denver metro, Pueblo, Colorado Springs, Grand Junction and Greeley have unemployment rates (not seasonally adjusted) above the national rate of 7.7 percent (not seasonally adjusted). During April 2012, Denver Boulder and the Ft. Collins-Loveland area had unemployment rates below the national rate, but Denver metro, has moved above the national unemployment again after several months below the national rate.

The map shows how most metro areas are now above the national unemployment rate.

The map:

Statewide, Colorado's unemployment rate (seasonally adjusted) remains below the national rate, and has been below the national rate since 2005.

The Boulder and Fort Collins areas have posted better unemployment rates than the nation for quite some time. Denver has in the past several months dropped below the national rate.

National comparisons remain important insofar as perceptions of the local job market drive household creation in Colorado. As long as Colorado is perceived as being a better job market than many metro areas in the nation, such a perceptions will foster household creation and population growth in the state. In recent months, however, the gap between the Colorado and the national unemployment rate has narrowed with unemployment declining faster at the national level than in Colorado.

According to today's BLS report:

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page of the report shows that among the metro areas in Colorado, Denver metro, Pueblo, Colorado Springs, Grand Junction and Greeley have unemployment rates (not seasonally adjusted) above the national rate of 7.7 percent (not seasonally adjusted). During April 2012, Denver Boulder and the Ft. Collins-Loveland area had unemployment rates below the national rate, but Denver metro, has moved above the national unemployment again after several months below the national rate.

The map shows how most metro areas are now above the national unemployment rate.

The map:

Statewide, Colorado's unemployment rate (seasonally adjusted) remains below the national rate, and has been below the national rate since 2005.

The Boulder and Fort Collins areas have posted better unemployment rates than the nation for quite some time. Denver has in the past several months dropped below the national rate.

National comparisons remain important insofar as perceptions of the local job market drive household creation in Colorado. As long as Colorado is perceived as being a better job market than many metro areas in the nation, such a perceptions will foster household creation and population growth in the state. In recent months, however, the gap between the Colorado and the national unemployment rate has narrowed with unemployment declining faster at the national level than in Colorado.

According to today's BLS report:

Unemployment rates were lower in April than a year earlier in 342 of the 372 metropolitan areas, higher in 25 areas, and unchanged in 5 areas, the U.S. Bureau of Labor Statistics reported today. Ten areas recorded jobless rates of at least 15.0 percent, while 32 areas registered rates of less than 5.0 percent. Two hundred forty-six metropolitan areas reported over-the-year increases in nonfarm payroll employment, 115 reported decreases, and 11 had no change. The national unemployment rate in April was 7.7 percent, not seasonally adjusted, down from 8.7 percent a year earlier.

Labels:

denver metro,

employment,

metro areas,

unemployment

Housing News Digest, May 31

Urban Land Conservancy sells TOD site

The Urban Land Conservancy today announced the sale of property at the Evans Light Rail Station along Denver’s Southwest light rail corridor for the construction of a much-anticipated, mixed-use, transit-oriented development that will include 50 workforce housing apartments.

ULC originally purchased the one-acre property at 2140 S. Delaware St. in June 2011 using Denver’s Transit-Oriented Development Fund. The $15 million TOD Fund was created in April 2010 to preserve land near transit stations for the creation of affordable housing. Housing and transportation often make up 60 percent of low-income household expenses. This new development, close to a light rail station, will provide residents with easy access to transportation, jobs, education and other services.

Home building soars in Denver area Home building in the Denver area rose by 43.4 percent in the first four months of the year, compared to the same period in 2011, according to a report released today. An increase in building permits for single-family, detached homes is a trend for more than a year, said Jeff Whiton, President and CEO of the Home Builders Association of Metro Denver, which released the building permit report.

Aurora Gaylord project to be reevaluated after Marriott deal "The company will no longer view large-scale development as a means of growth and will not proceed with the Colorado project in the form previously anticipated. "The company will reexamine how the project should could be completed with minimal financial commitment by Gaylord during the development phase."

Alpine Property Announces Bulk Sale of Mountain Sage Townhomes Development Alpine Property announces a unique property listing in Carbondale, Colorado. The real estate listing is a bulk sale, and comprises eight recently constructed townhomes, of which seven townhomes are finished and one is partially complete. The townhomes are a mixture of 2 and 3 bedroom units, with three 2-bedroom units and five 3-bedroom units. Located on Main Street, the eight townhomes are part of the Mountain Sage Townhomes Development in downtown Carbondale.

Taxpayers may wait 15 years for GSE payback: Moody's Taxpayers will likely wait 15 years until Fannie Mae and Freddie Mac repay their bailouts in full, according to the more optimistic forecast from Moody's Analytics. Fannie turned its first profit in the first quarter since entering conservatorship in 2008. Freddie Mac has been operating at or near break-even for roughly six months. The improved performance prompted some to explore when the money will be paid back. Along with Freddie, the government-sponsored enterprises drew $189.5 billion from the Treasury Department as of March 31 and paid $41.1 billion in dividends.

Home building soars in Denver area Home building in the Denver area rose by 43.4 percent in the first four months of the year, compared to the same period in 2011, according to a report released today. An increase in building permits for single-family, detached homes is a trend for more than a year, said Jeff Whiton, President and CEO of the Home Builders Association of Metro Denver, which released the building permit report.

Aurora Gaylord project to be reevaluated after Marriott deal "The company will no longer view large-scale development as a means of growth and will not proceed with the Colorado project in the form previously anticipated. "The company will reexamine how the project should could be completed with minimal financial commitment by Gaylord during the development phase."

Alpine Property Announces Bulk Sale of Mountain Sage Townhomes Development Alpine Property announces a unique property listing in Carbondale, Colorado. The real estate listing is a bulk sale, and comprises eight recently constructed townhomes, of which seven townhomes are finished and one is partially complete. The townhomes are a mixture of 2 and 3 bedroom units, with three 2-bedroom units and five 3-bedroom units. Located on Main Street, the eight townhomes are part of the Mountain Sage Townhomes Development in downtown Carbondale.

Taxpayers may wait 15 years for GSE payback: Moody's Taxpayers will likely wait 15 years until Fannie Mae and Freddie Mac repay their bailouts in full, according to the more optimistic forecast from Moody's Analytics. Fannie turned its first profit in the first quarter since entering conservatorship in 2008. Freddie Mac has been operating at or near break-even for roughly six months. The improved performance prompted some to explore when the money will be paid back. Along with Freddie, the government-sponsored enterprises drew $189.5 billion from the Treasury Department as of March 31 and paid $41.1 billion in dividends.

Wednesday, May 30, 2012

Important Information for all HOME CHDOs

Important Information for all HOME CHDOs (Community Housing

Development Organizations):

The Colorado Division of Housing has changed its annual cycle for receiving

applications for HOME CHDO operating funds from October 1st to September

4th. This will be the only time for applications to be submitted until

the next annual cycle on September 1, 2013.

All CHDOs planning to apply for operating funds must be re-certified by the

Housing Development Specialist for your region (see map at http://www.colorado.gov/cs/Satellite?c=Page&childpagename=DOLA-Main%2FCBONLayout&cid=1251595082735&pagename=CBONWrapper#region1)

prior to submitting your application on September 4th. The deadline for

submission of all certification documents is August 1st.

In order to provide you with important CHDO eligibility information, the

Division of Housing is offering a one hour Webinar on July 12th at 10:00 a.m.

More specific information on how to sign up for the Webinar will be emailed to

you in June.

All questions regarding certification and applications should be directed

to your Housing Development Specialist.

Upcoming Private Activity Bond workshops

Private Activity Bond

Workshop

This workshop is for local

officials, developers & others who want to learn how to best utilize Private

Activity Bond (PAB) financing to benefit their communities, especially given all

the recent changes in our economy and the bond market.

The State of Colorado has

over $486 million of PAB tax-exempt bonding authority annually. Make sure that your community is taking full

advantage of this valuable resource to provide rental housing, homeownership and

industrial development opportunities.

Leave knowing where to get it, what to use it for and how to use

it!

Click here for the brochure.

Housing News Digest, May 30

Mountain Real Estate Capital & Oakwood Homes Acquire Banning Lewis Ranch in Colorado

COLORADO SPRINGS, Colo., May 30, 2012 (BUSINESS WIRE) -- Mountain Real Estate Capital (MREC) announces the closing of a new investment with Oakwood Homes of Denver to acquire and build out Banning Lewis Ranch, a 2,600-acre, 8,500-approved-lot master-planned community located in Colorado Springs, Colo. The transaction represents MREC's second investment in Colorado and first with Oakwood. The terms of the transaction were not disclosed.

The Housing Recovery: A Rethink I predicted since the Summer of 2011 that a housing recovery was building and that it would “kick” around April of 2012. That prediction was based on the assumption that collapsing vacancies and rising rents would fuel a boom in multi-family housing construction. To date, multi-family has experienced a strong turn-around but is well short of the boom I had been calling for.

City law freezes foreclosures in Washington, D.C. The Washington, D.C., foreclosure system remains frozen 18 months after the city council passed a law that made it possible to void a future filing. In November 2010, the D.C. city council passed an emergency ordinance forcing lenders to provide mediation to borrowers in danger of foreclosure. The meeting must take place within 45 days of the notice of default, and mortgage servicers must navigate a slew of other requirements.

Expiring Mortgage Debt Relief Act Fuels Strategic Default: Survey YouWalkAway.com conducted a national survey and found 34 percent of respondents indicated that the act, which is set to expire December 31, 2012, contributed to their decision to walk away sooner rather than later from their property. Those surveyed were YouWalkAway.com clients who were actively considering or navigating through the foreclosure process.

Colorado AG requests foreclosure lawyers' documents from 4 counties Mortgage fraud investigators with the Colorado Attorney General's office have gathered documents filed with at least four county public trustees' offices by some of the state's largest foreclosure law firms, according to several people familiar with the request. Trustees in four counties confirmed they each provided hundreds of pages of documents — mostly bid and cure statements associated with foreclosures spanning a five-year period — in response to a request by the attorney general's consumer protection division.

The Housing Recovery: A Rethink I predicted since the Summer of 2011 that a housing recovery was building and that it would “kick” around April of 2012. That prediction was based on the assumption that collapsing vacancies and rising rents would fuel a boom in multi-family housing construction. To date, multi-family has experienced a strong turn-around but is well short of the boom I had been calling for.

City law freezes foreclosures in Washington, D.C. The Washington, D.C., foreclosure system remains frozen 18 months after the city council passed a law that made it possible to void a future filing. In November 2010, the D.C. city council passed an emergency ordinance forcing lenders to provide mediation to borrowers in danger of foreclosure. The meeting must take place within 45 days of the notice of default, and mortgage servicers must navigate a slew of other requirements.

Expiring Mortgage Debt Relief Act Fuels Strategic Default: Survey YouWalkAway.com conducted a national survey and found 34 percent of respondents indicated that the act, which is set to expire December 31, 2012, contributed to their decision to walk away sooner rather than later from their property. Those surveyed were YouWalkAway.com clients who were actively considering or navigating through the foreclosure process.

Colorado AG requests foreclosure lawyers' documents from 4 counties Mortgage fraud investigators with the Colorado Attorney General's office have gathered documents filed with at least four county public trustees' offices by some of the state's largest foreclosure law firms, according to several people familiar with the request. Trustees in four counties confirmed they each provided hundreds of pages of documents — mostly bid and cure statements associated with foreclosures spanning a five-year period — in response to a request by the attorney general's consumer protection division.

Tuesday, May 29, 2012

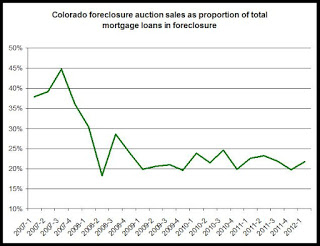

22% of foreclosure inventory went to final sale during the first quarter

According to the mortgage bankers association, there were 19,434 loans in the foreclosure process as of the end of the fourth quarter of 2011. During the first quarter of 2012, 4,221 of those, or 22 percent, loans proceeded to final foreclosure sale at auction.

At 22 percent, the amount of the foreclosure inventory that procceded to auction sale is fairly typical for trends seen over the past three years.

The first graph shows the proportion of the foreclosure inventory that proceeded to auction sale during the following quarter. So, 22 percent represents the percentage of 2012's fourth-quarter foreclosure inventory that proceeded to sale during the first quarter.

This percentage has generally ranged between 20 percent and 24 percent over the past three years, and this suggests that during recent quarters, almost 80 percent of loans in foreclosure during a given quarter are either still moving through the process or are avoiding foreclosure through short-sale, loan modification or some other action that prevents final foreclosure.

We can see in the graph that this percentage declined substantially after 2007 and 2008. Before 2008, as much as 40-45 percent of the foreclosure inventory was proceeding to sale during a single quarter. Since then, the pace of processing foreclosures has clearly slowed. This trend likely reflects the rise of foreclosures as a national issue which forced many servicers to revise their methods.

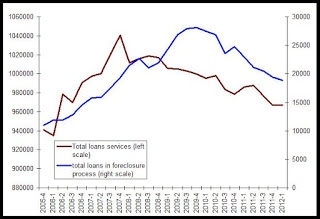

During the first quarter of 2012, there were 18,859 loans in the foreclosure process in Colorado. The number of loans in the foreclosure inventory has decreased every quarter since the fourth quarter of 2010. (See the second graph.)

Total loans serviced in Colorado

Meanwhile, the number of loans serviced in Colorado increased 0.02 percent during the first quarter of 2012, rising to 967,156 loans (according to the Mortgage Bankers Association's sample.) As can be seen in the second graph, the total number of loans serviced in Colorado has declined significantly since late 2007. Total loans peaked during the third quarter of 2007 and has usually declined each quarter since. The foreclosure inventory grew until the second quarter of 2009 but then began to trend with total loans.

At 22 percent, the amount of the foreclosure inventory that procceded to auction sale is fairly typical for trends seen over the past three years.

The first graph shows the proportion of the foreclosure inventory that proceeded to auction sale during the following quarter. So, 22 percent represents the percentage of 2012's fourth-quarter foreclosure inventory that proceeded to sale during the first quarter.

This percentage has generally ranged between 20 percent and 24 percent over the past three years, and this suggests that during recent quarters, almost 80 percent of loans in foreclosure during a given quarter are either still moving through the process or are avoiding foreclosure through short-sale, loan modification or some other action that prevents final foreclosure.

We can see in the graph that this percentage declined substantially after 2007 and 2008. Before 2008, as much as 40-45 percent of the foreclosure inventory was proceeding to sale during a single quarter. Since then, the pace of processing foreclosures has clearly slowed. This trend likely reflects the rise of foreclosures as a national issue which forced many servicers to revise their methods.

During the first quarter of 2012, there were 18,859 loans in the foreclosure process in Colorado. The number of loans in the foreclosure inventory has decreased every quarter since the fourth quarter of 2010. (See the second graph.)

Total loans serviced in Colorado

Meanwhile, the number of loans serviced in Colorado increased 0.02 percent during the first quarter of 2012, rising to 967,156 loans (according to the Mortgage Bankers Association's sample.) As can be seen in the second graph, the total number of loans serviced in Colorado has declined significantly since late 2007. Total loans peaked during the third quarter of 2007 and has usually declined each quarter since. The foreclosure inventory grew until the second quarter of 2009 but then began to trend with total loans.

The foreclosure inventory is expected to continue to decline as total loans serviced declines. With fewer loans to foreclosure, this also suggests that it is unlikely that foreclosure activity will return to 2007-2009 levels unless the employment situation experiences severe shocks that significantly push down total employment.

Labels:

colorado,

foreclosure inventory,

foreclosures,

mortgages

Census: For-sale vacancies fall during first quarter

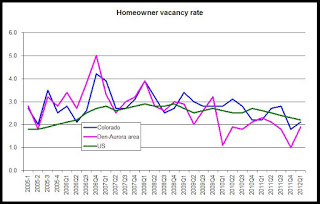

According to the Housing Vacancy Survey for the first quarter of 2011,

released on last month by the Census Bureau, the vacancy rate in

for-sale housing in Colorado fell year over year to 2.1 percent from

2011's first-quarter rate of 2.2 percent. The vacancy rate in for-sale

housing in the Denver-Aurora area also fell yeear over year, dropping to

1.9 percent from 2011's first quarter rate of 2.3 percent.

Nationanlly, the vacancy rate was slightly higher, and was 2.2 percent during the first quarter of 2012. That's down from 2011's first quarter rate of 2.6 percent.

The vacancy rate in for-sale residences is difficult to measure and is based on information collected from homeowners. If the homeowners report that the unit has been recently vacant or will be vacant in the near future, the unit will be counted as vacancy if other conditions are met as well. The units included must not be rental units.

The graph shows that vacancies in for-sale units have been declining since 2007 nationally, and in Colorado and the Denver-Aurora area. The Denver-Aurora vacancy rate during the first quarter was at the lowest rate measured during the first quarter in more than seven years.

Recent data on home sales suggests that demand for homes continues to build in the Denver area, and also in Colorado overall. Recent increases in demand for for-sale properties may also be reducing turnover time in these properties, and may be contributing to faster turnover in foreclosures properties. This would in turn drive down the vacancy rate in owner-occupant properties.

As the HVS Q and A page notes, many foreclosing properties may not show up as vacant "for sale" properties.

The Denver-Aurora vacancy rate has been below the national rate since 2010, and this falling vacancy rate in the Denver area relative to the the nationwide vacancy rate may reflect declining foreclosure totals in Colorado as well as ongoing demand due to relatively strong household formation.

Nationanlly, the vacancy rate was slightly higher, and was 2.2 percent during the first quarter of 2012. That's down from 2011's first quarter rate of 2.6 percent.

The vacancy rate in for-sale residences is difficult to measure and is based on information collected from homeowners. If the homeowners report that the unit has been recently vacant or will be vacant in the near future, the unit will be counted as vacancy if other conditions are met as well. The units included must not be rental units.

The graph shows that vacancies in for-sale units have been declining since 2007 nationally, and in Colorado and the Denver-Aurora area. The Denver-Aurora vacancy rate during the first quarter was at the lowest rate measured during the first quarter in more than seven years.

Recent data on home sales suggests that demand for homes continues to build in the Denver area, and also in Colorado overall. Recent increases in demand for for-sale properties may also be reducing turnover time in these properties, and may be contributing to faster turnover in foreclosures properties. This would in turn drive down the vacancy rate in owner-occupant properties.

As the HVS Q and A page notes, many foreclosing properties may not show up as vacant "for sale" properties.

The Denver-Aurora vacancy rate has been below the national rate since 2010, and this falling vacancy rate in the Denver area relative to the the nationwide vacancy rate may reflect declining foreclosure totals in Colorado as well as ongoing demand due to relatively strong household formation.

Labels:

census,

for sale vacancies,

hvs,

vacancies,

vacancy rates

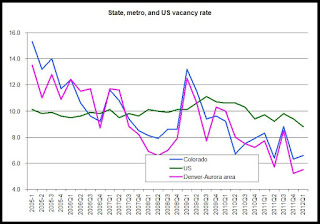

Census bureau: Colorado and Denver rental vacancy rates fall

According to the Census Bureau, the vacancy rate in rental housing in

Colorado fell year over year during the first quarter of 2012 to 6.6 percent. In the

Denver-Aurora area, the vacancy rate during the first quarter also fell year over year to 5.5 percent. In both cases, the vacancy rates are at the lowest rates

recorded during the first quarter in more than seven years.

Nationwide, the rental vacancy rate was 8.8 percent during the first quarter of 2012.

In Colorado, the vacancy rate was 11.7 percent during the fourth quarter of 2005 and had declined to 8.6 percent during the fourth quarter of 2008 before rising again in the wake of the financial crisis. As the demand for rental housing increased, the vacancy rate fell to 6.3 percent by the end of 2011, but inched up during the first quarter.

In the Denver-Aurora area, vacancy rates have tended to be somewhat lower with the vacancy rate at 10.9 percent during the fourth quarter of 2005, falling to 7.9 percent during the fourth quarter of 2008. The rate then fell to 5.2 percent by the end of 2011 and ticked up slightly to 5.5 percent during the first quarter of this year.

In both the Denver-Aurora area and statewide, vacancy rates have fallen steadily since 2009.

Nationwide, the vacancy rate has been far less volatile. Over the past seven yeas, the national vacancy rate has rarely exceeded ten percent, and since 2009, the vacancy rate has only fallen about one percentage point to 9.4 percent.During the first quarter of 2012, the national rental vacancy rate fell to the lowest level reported in any quarter since the fourth quarter of 2001, when the vacancy rate was 8.8 percent.

As Colorado's vacancy rate moved further below the national rate, the most recent data further suggests that rental housing in Colorado and the Denver area is experiencing greater demand than is the case nationwide. This is likely due to strong population growth and household formation in Colorado relative to many states and metro areas.

These vacancy rates are part of the Census Bureau's Housing Vacancy Survey (HVS). The method for data collection varies significantly form the method used for the collection of the Division of Housing's vacancy and rent surveys.

The Division of Housing's report is based on quarterly surveys that measure the vacancy of all surveyed units in specific dates for each quarter. Units are either vacant on the day in question, or they are not. By contrast, vacancies in the HVS are measured according to occupancy of a unit over a much broader time period, and are subject to some interpretation on the part of the person conducting the survey.

Overall, however, the two surveys for Colorado and the metro Denver area show the same general trends over the past seven years.

Nationwide, the rental vacancy rate was 8.8 percent during the first quarter of 2012.

In Colorado, the vacancy rate was 11.7 percent during the fourth quarter of 2005 and had declined to 8.6 percent during the fourth quarter of 2008 before rising again in the wake of the financial crisis. As the demand for rental housing increased, the vacancy rate fell to 6.3 percent by the end of 2011, but inched up during the first quarter.

In the Denver-Aurora area, vacancy rates have tended to be somewhat lower with the vacancy rate at 10.9 percent during the fourth quarter of 2005, falling to 7.9 percent during the fourth quarter of 2008. The rate then fell to 5.2 percent by the end of 2011 and ticked up slightly to 5.5 percent during the first quarter of this year.

In both the Denver-Aurora area and statewide, vacancy rates have fallen steadily since 2009.

Nationwide, the vacancy rate has been far less volatile. Over the past seven yeas, the national vacancy rate has rarely exceeded ten percent, and since 2009, the vacancy rate has only fallen about one percentage point to 9.4 percent.During the first quarter of 2012, the national rental vacancy rate fell to the lowest level reported in any quarter since the fourth quarter of 2001, when the vacancy rate was 8.8 percent.

As Colorado's vacancy rate moved further below the national rate, the most recent data further suggests that rental housing in Colorado and the Denver area is experiencing greater demand than is the case nationwide. This is likely due to strong population growth and household formation in Colorado relative to many states and metro areas.

These vacancy rates are part of the Census Bureau's Housing Vacancy Survey (HVS). The method for data collection varies significantly form the method used for the collection of the Division of Housing's vacancy and rent surveys.

The Division of Housing's report is based on quarterly surveys that measure the vacancy of all surveyed units in specific dates for each quarter. Units are either vacant on the day in question, or they are not. By contrast, vacancies in the HVS are measured according to occupancy of a unit over a much broader time period, and are subject to some interpretation on the part of the person conducting the survey.

Overall, however, the two surveys for Colorado and the metro Denver area show the same general trends over the past seven years.

Labels:

census,

census data,

hvs,

vacancy rates,

vacancy surveys

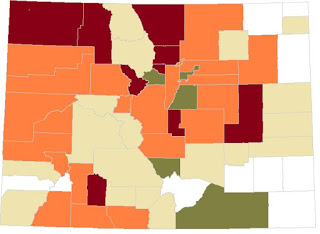

Single-family activity fell in most Colorado counties from 2010 to 2011

Although early estimates showed an increase of 2.6 percent in single-family permitting acmtivity from 2010 to 2011 in Colorado, more recent county-by-county data released by the Census Bureau shows a decline of 3.9 percent in single-family permits over that time. Indeed, only 14 of Colorado's 64 counties reported increases in the number of single-family permits issued from 2010 to 2011. For all counties combined, the total number of single-family permits fell from 8,790 during 2010 to 8,442 during 2011.

The first map shows the counties with growing single-family permit activity in burgundy and green. The counties in orange and tan show counties that had fewer single-family permits in 2011 than in 2010. White counties showed no change over the time period.

Budgundy: increase of more than 25%

Green: increase between 1% and 25%

Orange: Decrease between 1% and 25%

Tan: Decrease of mroe than 25%

White: no change

The counties that reported increases in single-family permits:

Moffatt, +42%

Routt, +48

Summit, +26%

Gilpin, +300%

Boulder, +41%

Larimer, +47%

Denver, +11

Douglas, +17

Teller,+30%

Lincoln, +300

Mineral, +80

Custe, 11%

Las Animas, +10%

All other counties reported decreases or no change.

Statewide, only a handful of counties drove overall totals in permits from 2010 to 2011. Although some small counites, such as Gilpin and Lincoln, experienced a tripling in single-family permitting, these numbers were very small. In Gilpin county, for example, permits increased from 4 to 16.

What drove most statewide activity in single-family activity was the new permit activity in the larger metro counties such as Boulder, Larimer, Denver and Douglas counties.

The number of single-family permits in these four counties combined increased by 25 percent.

Even fewer counties reported increases when compared to 2008, that most recent year to reflect peak permitting levels.

Compared to 2008, only 10 counties showed increases in single-family activity. All other counties reported fewer single-family permits issued in 2011 than in 2008. In many cases, the decline in single-family permit activity declined by 50 percent or more from 2008 to 2011.

The ten counties that reported increases from 2008 to 2011 were:

Boulder, +27%

Broomfield, +20%

Clear Creek, +6.6%

Custer, +24%

Douglas, +3.9%

El Paso, +0.5%

Jefferson, +17%

Larimer, +8.1%

Logan, +18%

These counties have now either surpassed, or on their way to surpassing, peak levels in permit activity experienced during the last expansion. Many other counties are still well below peak levels.

The ten counties that are still fathest below 2008 levels are:

Garfield, -88%

Grand, -90%

Jackson, -83%

Moffat, -75%

Montrose, -67%

Morgan, -72%

Pueblo, -67%

Rio Blanco, -71%

Routt, -76%

San Juan, -85%

With the exception of Morgan and Pueblo counties, the counties that are farthest below 2008 levels are found in the mountains and on the Western Slope.

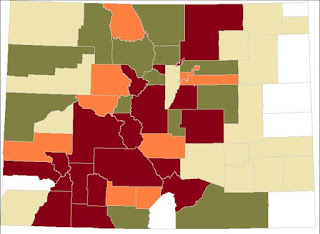

Single-family permitting rates

As might be expected, the most populous counties tend to supply most of the new single-family permit activity. Adams, Arapahoe, Denver, El Paso, Larimer, Jefferson, and Weld counties alone accounted for 61 percent of all single-family permit activity during 2010 and 2011.

If we adjust the number of new permits to the existing number of occupied households in each county, we get a better idea of which counties are adding the most single-family units compared to the existing housing stock.

The second map shows single-family permit activity adjusted for the existing size of the housing stock. We find that the counties that, given their size, many of the counties in central and sourthwestern Colorado issued a sizable numbe rof single-family permits. Along the front range, the most active counties were Weld, Broomfield, Douglas and El Paso Counties.

The map is broken into quartiles:

Burgundy: Top quartile

Green: Second quartile

Orange: Third Quartile

Tan: Bottom quartile

White: No permits

Among the most populous counties, Jefferson, Pueblo and Mesa counties reported small amounts of single-family permit activity, adjusted for the existing housing stock.

Conclusions: Taking into account overall permitting activity as well as recent growth rates in single-family permits, we can conclude that El Paso, Douglas, Denver and Larimer counties are among the most active counties in single-family permitting activity as of the end of 2011. Other counties that have shown relatively high rates of activity include Adams, Boulder and Weld counties.

The first map shows the counties with growing single-family permit activity in burgundy and green. The counties in orange and tan show counties that had fewer single-family permits in 2011 than in 2010. White counties showed no change over the time period.

Budgundy: increase of more than 25%

Green: increase between 1% and 25%

Orange: Decrease between 1% and 25%

Tan: Decrease of mroe than 25%

White: no change

The counties that reported increases in single-family permits:

Moffatt, +42%

Routt, +48

Summit, +26%

Gilpin, +300%

Boulder, +41%

Larimer, +47%

Denver, +11

Douglas, +17

Teller,+30%

Lincoln, +300

Mineral, +80

Custe, 11%

Las Animas, +10%

All other counties reported decreases or no change.

Statewide, only a handful of counties drove overall totals in permits from 2010 to 2011. Although some small counites, such as Gilpin and Lincoln, experienced a tripling in single-family permitting, these numbers were very small. In Gilpin county, for example, permits increased from 4 to 16.

What drove most statewide activity in single-family activity was the new permit activity in the larger metro counties such as Boulder, Larimer, Denver and Douglas counties.

The number of single-family permits in these four counties combined increased by 25 percent.

Even fewer counties reported increases when compared to 2008, that most recent year to reflect peak permitting levels.

Compared to 2008, only 10 counties showed increases in single-family activity. All other counties reported fewer single-family permits issued in 2011 than in 2008. In many cases, the decline in single-family permit activity declined by 50 percent or more from 2008 to 2011.

The ten counties that reported increases from 2008 to 2011 were:

Boulder, +27%

Broomfield, +20%

Clear Creek, +6.6%

Custer, +24%

Douglas, +3.9%

El Paso, +0.5%

Jefferson, +17%

Larimer, +8.1%

Logan, +18%

These counties have now either surpassed, or on their way to surpassing, peak levels in permit activity experienced during the last expansion. Many other counties are still well below peak levels.

The ten counties that are still fathest below 2008 levels are:

Garfield, -88%

Grand, -90%

Jackson, -83%

Moffat, -75%

Montrose, -67%

Morgan, -72%

Pueblo, -67%

Rio Blanco, -71%

Routt, -76%

San Juan, -85%

With the exception of Morgan and Pueblo counties, the counties that are farthest below 2008 levels are found in the mountains and on the Western Slope.

Single-family permitting rates

As might be expected, the most populous counties tend to supply most of the new single-family permit activity. Adams, Arapahoe, Denver, El Paso, Larimer, Jefferson, and Weld counties alone accounted for 61 percent of all single-family permit activity during 2010 and 2011.

If we adjust the number of new permits to the existing number of occupied households in each county, we get a better idea of which counties are adding the most single-family units compared to the existing housing stock.

The second map shows single-family permit activity adjusted for the existing size of the housing stock. We find that the counties that, given their size, many of the counties in central and sourthwestern Colorado issued a sizable numbe rof single-family permits. Along the front range, the most active counties were Weld, Broomfield, Douglas and El Paso Counties.

The map is broken into quartiles:

Burgundy: Top quartile

Green: Second quartile

Orange: Third Quartile

Tan: Bottom quartile

White: No permits

Among the most populous counties, Jefferson, Pueblo and Mesa counties reported small amounts of single-family permit activity, adjusted for the existing housing stock.

Conclusions: Taking into account overall permitting activity as well as recent growth rates in single-family permits, we can conclude that El Paso, Douglas, Denver and Larimer counties are among the most active counties in single-family permitting activity as of the end of 2011. Other counties that have shown relatively high rates of activity include Adams, Boulder and Weld counties.

Labels:

building permits,

colorado,

colorado counties,

single-family

Subscribe to:

Posts (Atom)