The Colorado Department of Local Affairs &

The Colorado Housing and Finance Authority

present:

Private Activity Bonds for Local Officials

July 29, 2010

2:00 pm — 5:00 pm

Agenda

o Private Activity Bond (PAB) Allocation Process

o Uses of PABs in today’s market

o Multi-family Housing

o Single family Housing

o Industrial development

o and more!

o Issuing PABs

For your convenience, we have multiple options for participation. Please RSVP if you will:

o See the presentation live at the Colorado Dept. of Local Affairs in Denver

o See the webinar on a big screen at CHFA in Grand Junction

o Or attend the webinar from the comfort of your own desk!

Please RSVP To Ann E. Watts, Colorado Dept of Local Affairs

o (303) 866-4652

o [email protected]

More Information

This class is designed for local officials who want to learn how to best utilize Private Activity Bond (PAB)financing to benefit their communities, especially given all the recent changes in our economy and the bond market.

This year, 48 cities & counties received direct allocations of Private Activity Bond authority worth over $210 million? Last year, out of the $206 million given to local governments,$63 million was returned to the Statewide Balance? Make sure that your community is taking full advantage of this valuable resource!

For local governments that do not receive a direct allocation, did you know that you can apply for PABs from the Statewide Balance through Colorado’s Department of Local Affairs? Come learn about the potential projects and programs that you could provide your community!

Monday, June 28, 2010

Notice of Public Hearing: Uniform Standards for Foreclosure Deferment Program

In accordance with Colorado Revised Statutes, Section 38-38-807.5, the Division of Housing "shall establish and may update uniform standards as necessary" for the implementation of Section 38-38-801, et seq.

On July 13, 2010, the Colorado State Housing Board will review uniform standards for the foreclosure deferment program.

The hearing will be located at:

1313 Sherman St. #318

Denver, CO 80203

1:00 p.m.

For full texts of uniform standards being considered, see here.

On July 13, 2010, the Colorado State Housing Board will review uniform standards for the foreclosure deferment program.

The hearing will be located at:

1313 Sherman St. #318

Denver, CO 80203

1:00 p.m.

For full texts of uniform standards being considered, see here.

Friday, June 18, 2010

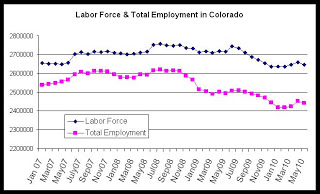

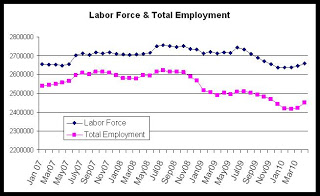

Total employment falls in Colorado

Colorado lost 10,200 jobs in May, but the unemployment rate fell slightly as more than 14,000 people left the work force during the month. According to the most recent employment data released by the Colorado Department of Labor and Employment, total employment in May, not seasonally adjusted, fell to 2,441,019 jobs, with the employment total falling 53,000 below May 2009's total of 2,494,000 jobs.

The total labor force also remains down 70,300 from a year earlier with a labor force of 2,645,000 workers during May of this year as compared to 2,715,000 during May of last year.

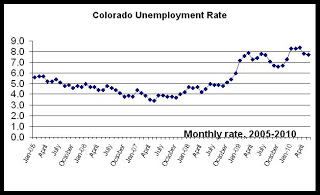

From April to May, the unadjusted unemployment rate fell from 7.8 percent to 7.7 percent, and the rate fell year over year from May 2009’s unemployment rate of 8.2 percent.

Since the peak of the labor market in July 2008, when total employment was 2,621,081, more than 180,000 jobs have been lost, and the labor force has shrunk by more than 111,000.

Last month, hiring for the census bureau had been noted as a significant factor driving totals in new hires. In Colorado specifically, new monthly hiring data for the census is not available, but more than 11,000 workers have been hired for the census effort in Colorado over the last eighteen months. While significant, it does not appear that census hiring at the state level has had as notable an impact as at the national level.

Among Colorado metropolitan areas, Grand Junction showed the highest unemployment rate at 8.8 percent, while the Boulder-Longmont and Fort Collins-Loveland areas showed the lowest rates as 5.8 percent and 6.2 percent, respectively.

All metropolitan areas in Colorado, except Greeley and Grand Junction experienced job declines from April to May, and all metro areas lost jobs from May 2009 to May 2010.

Unemployment rates in all metro areas for April 2010 were Boulder-Longmont, 5.8 percent; Denver-Aurora, 7.7 percent; Greeley, 8.7 percent; Fort Collins-Loveland, 6.2 percent; Grand Junction, 8.8 percent; Pueblo, 8.8 percent.

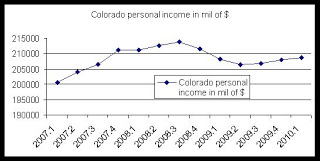

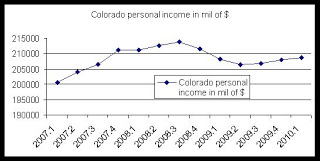

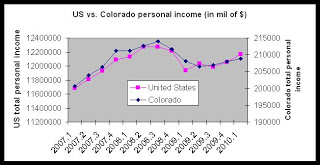

Personal income rises in Colorado

Personal income increased in Colorado during the first quarter of 2010, increasing to 208.8 billion dollars. According to new data released today by the Bureau of Economic Analysis, personal income increased .43 percent in Colorado from the fourth quarter of 2009 to the first quarter of this year. Year-over-year, personal income in Colorado rose .34 percent from the first quarter of 2009 to the same period this year.

Nevertheless, personal income in Colorado is still down 2.3 percent from the peak reached during the third quarter of 2008 when personal income was more than 213.9 billion.

Personal income totals are not adjusted for inflation.

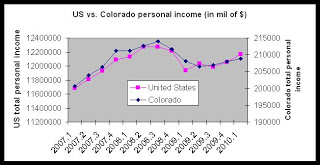

Although personal income fell faster and to a greater extent than in Colorado during late 2009, Colorado now lags the nation in its rate of recovery. Nationally, personal income is down only .86 percent from peak levels reached during the third quarter of 2008.

Using 2008 population estimates, the most recent data available, per capita income is $41,668 in Colorado and is $40,391 nationwide.

Additionally, state personal income growth averaged 0.9 percent in the first quarter of 2010 up from 0.5 percent in the fourth quarter of 2009.. Personal income increased in all but two states with growth ranging from 1.6 percent in Mississippi to -2.0 percent in North Dakota. Inflation, as measured by the national price index for personal consumption expenditures, declined to 0.4 percent in the first quarter from 0.6 percent in the fourth quarter.1

The industry making the largest contribution to first-quarter personal income growth nationally was health care. The administrative and waste management industry and the military made the next largest contributions. The military received a 3.4 percent pay raise in the first quarter while federal civilian workers received an average 2.0 percent increase. Construction and real estate earnings continued to fall.

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Total personal income will rise as population rises, even if household incomes are declining. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wage and salary disbursements, supplements to wages and salaries, and proprietors' income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes).

Nevertheless, personal income in Colorado is still down 2.3 percent from the peak reached during the third quarter of 2008 when personal income was more than 213.9 billion.

Personal income totals are not adjusted for inflation.

Although personal income fell faster and to a greater extent than in Colorado during late 2009, Colorado now lags the nation in its rate of recovery. Nationally, personal income is down only .86 percent from peak levels reached during the third quarter of 2008.

Using 2008 population estimates, the most recent data available, per capita income is $41,668 in Colorado and is $40,391 nationwide.

Additionally, state personal income growth averaged 0.9 percent in the first quarter of 2010 up from 0.5 percent in the fourth quarter of 2009.. Personal income increased in all but two states with growth ranging from 1.6 percent in Mississippi to -2.0 percent in North Dakota. Inflation, as measured by the national price index for personal consumption expenditures, declined to 0.4 percent in the first quarter from 0.6 percent in the fourth quarter.1

The industry making the largest contribution to first-quarter personal income growth nationally was health care. The administrative and waste management industry and the military made the next largest contributions. The military received a 3.4 percent pay raise in the first quarter while federal civilian workers received an average 2.0 percent increase. Construction and real estate earnings continued to fall.

Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Total personal income will rise as population rises, even if household incomes are declining. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wage and salary disbursements, supplements to wages and salaries, and proprietors' income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for price changes).

Thursday, June 17, 2010

New foreclosure filings at eighteen-month low

The full report is here.

Foreclosure filings in Colorado’s largest counties fell 18.4 percent last month as compared to May of last year. According to a report released today by the Department of Local Affairs’ Division of Housing, foreclosure filings fell 18.4 percent from April to May of this year. With 2,633 filings across the state’s twelve metropolitan counties, May’s filings total in May was the lowest monthly total in eighteen months.

Foreclosure sales at auction fell 19.2 percent from April to May of this year, falling to the lowest monthly total in nine months. Filings rose 18.3 percent from May 2009 to May 2010.

The year-over-year difference partially reflects the low number of foreclosure sales that occurred last spring due to last year’s voluntary moratoria on foreclosures.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

“Foreclosure numbers have tended to dip in May in recent years, but this drop was larger than expected,” said Ryan McMaken, a spokesperson for the Division of Housing. “We are seeing a slow downward trend in filings right now and that’s a reason to be cautiously optimistic.”

The last time that foreclosure filings were as low as May’s total of 2,633 was during November 2008 when filings fell to 2,506. During the past eighteen months, monthly filings totals have typically ranged from 2,800 to 3,600 filings. Additionally, foreclosure sales at auction fell to a nine-month low, dropping to 1,459. Foreclosure sales had not been as low since August 2009 when sales dipped to 1,359.

“Housing counselors are seeing just as many people as ever, and lenders are also processing foreclosures more slowly right now,” said Stephanie Riggi, manager of the Colorado Foreclosure Hotline’s call center. “The requirements of the many loss mitigation programs now in place are slowing things down a bit, and that also allows more time for workouts which means fewer foreclosure sales at auction.”

Foreclosure activity varied by county. The counties with the largest decreases in foreclosure filings from May 2009 to May 2010 were Weld County and Douglas County, where filings decreased by 39.2 percent and 31.7 percent, respectively. Mesa County was the only county surveyed where filings increased. Year over year filings in Mesa County increased by 1.1 percent.

Year over year, Mesa County and Jefferson County were the only counties to report sizable increases in foreclosure sales. Sales increased 260 percent and 28.1 percent in Mesa County and Jefferson County, respectively. Sales fell by 27 percent in Pueblo County and 21.3 percent in Larimer County.

The county with the highest rate of foreclosure sales was Weld County with a rate of 634 households per foreclosure sale. Adams County came in second with 761 households per foreclosure sale. The lowest rate was found in Boulder County where there were 2,821 households per foreclosure sale. The largest increase in foreclosure rates since 2009 was found in Mesa County where the foreclosure rate increased from 2,218 households per foreclosure to 616 households per foreclosure, year over year.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve largest counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

Foreclosure filings in Colorado’s largest counties fell 18.4 percent last month as compared to May of last year. According to a report released today by the Department of Local Affairs’ Division of Housing, foreclosure filings fell 18.4 percent from April to May of this year. With 2,633 filings across the state’s twelve metropolitan counties, May’s filings total in May was the lowest monthly total in eighteen months.

Foreclosure sales at auction fell 19.2 percent from April to May of this year, falling to the lowest monthly total in nine months. Filings rose 18.3 percent from May 2009 to May 2010.

The year-over-year difference partially reflects the low number of foreclosure sales that occurred last spring due to last year’s voluntary moratoria on foreclosures.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

“Foreclosure numbers have tended to dip in May in recent years, but this drop was larger than expected,” said Ryan McMaken, a spokesperson for the Division of Housing. “We are seeing a slow downward trend in filings right now and that’s a reason to be cautiously optimistic.”

The last time that foreclosure filings were as low as May’s total of 2,633 was during November 2008 when filings fell to 2,506. During the past eighteen months, monthly filings totals have typically ranged from 2,800 to 3,600 filings. Additionally, foreclosure sales at auction fell to a nine-month low, dropping to 1,459. Foreclosure sales had not been as low since August 2009 when sales dipped to 1,359.

“Housing counselors are seeing just as many people as ever, and lenders are also processing foreclosures more slowly right now,” said Stephanie Riggi, manager of the Colorado Foreclosure Hotline’s call center. “The requirements of the many loss mitigation programs now in place are slowing things down a bit, and that also allows more time for workouts which means fewer foreclosure sales at auction.”

Foreclosure activity varied by county. The counties with the largest decreases in foreclosure filings from May 2009 to May 2010 were Weld County and Douglas County, where filings decreased by 39.2 percent and 31.7 percent, respectively. Mesa County was the only county surveyed where filings increased. Year over year filings in Mesa County increased by 1.1 percent.

Year over year, Mesa County and Jefferson County were the only counties to report sizable increases in foreclosure sales. Sales increased 260 percent and 28.1 percent in Mesa County and Jefferson County, respectively. Sales fell by 27 percent in Pueblo County and 21.3 percent in Larimer County.

The county with the highest rate of foreclosure sales was Weld County with a rate of 634 households per foreclosure sale. Adams County came in second with 761 households per foreclosure sale. The lowest rate was found in Boulder County where there were 2,821 households per foreclosure sale. The largest increase in foreclosure rates since 2009 was found in Mesa County where the foreclosure rate increased from 2,218 households per foreclosure to 616 households per foreclosure, year over year.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve largest counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

Friday, June 11, 2010

June 2010 Housing Snapshot now available

The June 2010 Housing Snapshot is now online.

Housing Snapshot is provided at least every other month and contains information on rents, vacancies, home prices, foreclosures, employment, consumer prices, and other information important to renters, homeowners, and the housing industry.

The June 2010 issue is available here.

Housing Snapshot is provided at least every other month and contains information on rents, vacancies, home prices, foreclosures, employment, consumer prices, and other information important to renters, homeowners, and the housing industry.

The June 2010 issue is available here.

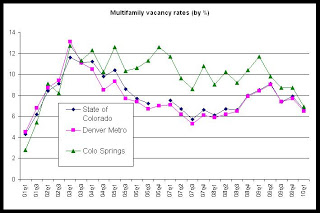

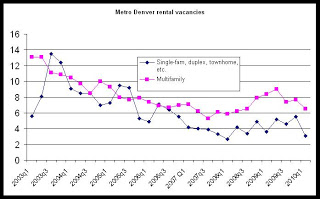

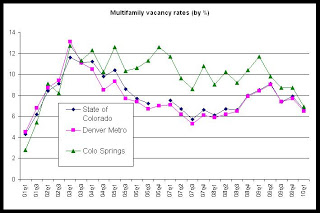

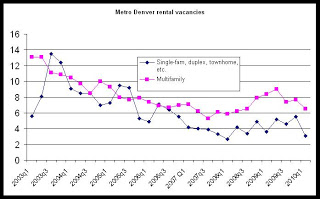

Vacancies in Colorado fall as rents rise

The average rent in Colorado, unadjusted for inflation, has increased seven percent since 2005. Among metropolitan areas, the average rent has increased the most in Grand Junction where average rent has increased 35 percent. The average rent increased 5.2 percent, which was the smallest increase among metropolitan areas. In all metropolitan areas except Grand Junction, the average rent has increased between 5.2 percent and 14.1 percent since 2005.

Average rents across the state have slowly grown in recent quarters as vacancy rates have been surprisingly small given lack of job growth and an unemployment rate above 8 percent. Historically, demand for rental housing has increased most with gains in job creation.

Since the second quarter of 2009, vacancy rates have fallen across Colorado in spite of weak and negative job growth. Only Grand Junction and Pueblo reported increases in vacancies during this period. The tightening availability of rental housing has been driven by lack of new construction in rental housing in recent years coupled with increased population growth in spite of weak job growth. The Colorado economy, which compares favorably to the economies of most other regions of the United States, has led to more residents either choosing to stay in Colorado, or has led to job seekers relocating to Colorado in search of jobs in what is a relatively superior market for job seekers.

During the first quarter of this year, the Colorado statewide apartment vacancy rate decreased to 6.6 percent, falling from 2009’s first quarter rate of 8.5 percent. The statewide decline in vacancies was driven by declines in vacancies in Grand Junction, metro Denver, Colorado Springs and along the eastern plains. Fort Collins and Pueblo were the only metropolitan areas reporting higher vacancies, year-over-year.

Numerous mountain areas also reported vacancy rate increases from the first quarter of last year to the same period this year, including Aspen, Durango, Eagle County, Glenwood Springs, Steamboat Springs and Summit County.

Vacancy rates in all metropolitan areas were Colorado Springs, 6.9 percent; Denver metro, 6.5 percent; Ft. Collins/Loveland, 4.9 percent; Grand Junction, 11.6 percent; Greeley, 6.9 percent; Pueblo, 12.6 percent.

The first quarter’s statewide average rent fell from $844 during 2009’s first quarter to $840 during the first quarter of this year. Among metropolitan areas, average rents fell year-over-year in Fort Collins, Grand Junction and the metro Denver area, but were up in Colorado Springs, Greeley and Pueblo. Average rents rose year-over-year in several mountain areas including Aspen, Alamosa, Buena Vista, Eagle County, Glenwood Springs and Summit County.

The average rent in Fort Collins fell from $854 during the first quarter of last year to $837 during the first quarter of this year. In Grand Junction, where vacancies hit 13.3 percent during 2009’s fourth quarter, first quarter average rents fell from $680 to $663, year-over-year.

Average rents in all metropolitan areas measured were Colorado Springs, $709.99; Denver metro, $877.16; Ft. Collins/Loveland, $837.99; Grand Junction, $663.47; Greeley, $660.86; Pueblo, $547.03.

Table: Rates of increase in

average rent (1stQ 2005-1stQ 2010)

Colorado Statewide 7.006369

Denver Metro 5.282113

Colo Springs 5.505952

Fort Collins/Loveland 13.26116

Grand Junction 35.03055

Greeley 8.01964

Pueblo 14.19624

Average rents across the state have slowly grown in recent quarters as vacancy rates have been surprisingly small given lack of job growth and an unemployment rate above 8 percent. Historically, demand for rental housing has increased most with gains in job creation.

Since the second quarter of 2009, vacancy rates have fallen across Colorado in spite of weak and negative job growth. Only Grand Junction and Pueblo reported increases in vacancies during this period. The tightening availability of rental housing has been driven by lack of new construction in rental housing in recent years coupled with increased population growth in spite of weak job growth. The Colorado economy, which compares favorably to the economies of most other regions of the United States, has led to more residents either choosing to stay in Colorado, or has led to job seekers relocating to Colorado in search of jobs in what is a relatively superior market for job seekers.

During the first quarter of this year, the Colorado statewide apartment vacancy rate decreased to 6.6 percent, falling from 2009’s first quarter rate of 8.5 percent. The statewide decline in vacancies was driven by declines in vacancies in Grand Junction, metro Denver, Colorado Springs and along the eastern plains. Fort Collins and Pueblo were the only metropolitan areas reporting higher vacancies, year-over-year.

Numerous mountain areas also reported vacancy rate increases from the first quarter of last year to the same period this year, including Aspen, Durango, Eagle County, Glenwood Springs, Steamboat Springs and Summit County.

Vacancy rates in all metropolitan areas were Colorado Springs, 6.9 percent; Denver metro, 6.5 percent; Ft. Collins/Loveland, 4.9 percent; Grand Junction, 11.6 percent; Greeley, 6.9 percent; Pueblo, 12.6 percent.

The first quarter’s statewide average rent fell from $844 during 2009’s first quarter to $840 during the first quarter of this year. Among metropolitan areas, average rents fell year-over-year in Fort Collins, Grand Junction and the metro Denver area, but were up in Colorado Springs, Greeley and Pueblo. Average rents rose year-over-year in several mountain areas including Aspen, Alamosa, Buena Vista, Eagle County, Glenwood Springs and Summit County.

The average rent in Fort Collins fell from $854 during the first quarter of last year to $837 during the first quarter of this year. In Grand Junction, where vacancies hit 13.3 percent during 2009’s fourth quarter, first quarter average rents fell from $680 to $663, year-over-year.

Average rents in all metropolitan areas measured were Colorado Springs, $709.99; Denver metro, $877.16; Ft. Collins/Loveland, $837.99; Grand Junction, $663.47; Greeley, $660.86; Pueblo, $547.03.

Table: Rates of increase in

average rent (1stQ 2005-1stQ 2010)

Colorado Statewide 7.006369

Denver Metro 5.282113

Colo Springs 5.505952

Fort Collins/Loveland 13.26116

Grand Junction 35.03055

Greeley 8.01964

Pueblo 14.19624

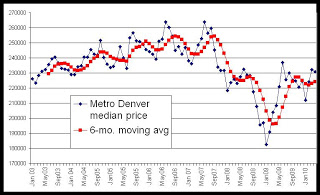

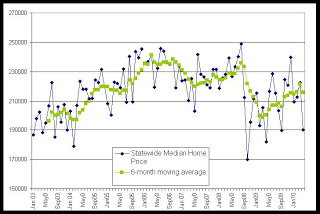

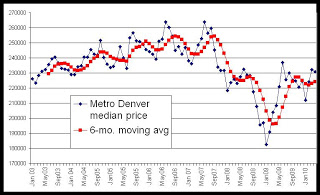

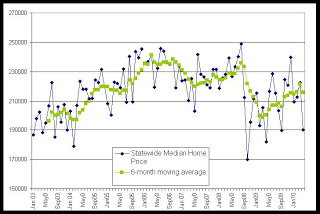

Home prices move up in March, data mixed in April

Denver area home prices rose 4.1 percent during March compared to a year earlier. According to the March 2010 Case-Shiller home price index of 20 cities, Denver experienced the seventh largest increase in home prices. The city with the largest increase was San Francisco at 16.2 percent, followed by San Diego at 10.8 percent. Las Vegas showed the largest drop in home prices with a decline of 12.0 percent, followed by Detroit with a drop of4.6 percent.

Month-over-month comparisons for Denver from February to March showed a slight price increase as prices rose 0.6 percent. Prices fell from January to February with a drop of 0.8 percent.

Nationally, home prices have increased at least partially in response to the first-time homebuyer tax credit. Year-over-year comparisons in many markets show marked increases as home prices, driven by the tax credit, continue to rise above very low home prices experienced in the first quarter of 2009.

March price statistics provided by the Colorado Association of Realtors earlier this month showed a year-over-year price increase of 8.1 percent. The Realtor data includes only properties listed in the Metrolist sales database, and thus excludes new home sales any properties not sold with a Realtor. However, the upward movement in March prices for both the Realtor and Case-Shiller data indicates that the demand for housing strengthened in March.

The lowest median home price experienced in recent years was $182,571 during January 2009. According to Realtor data, Metro Denver home prices remain 12.5 percent below the peak of the market reached in June 2007.

April statewide home prices, as measured by MLS data provided by the Colorado Association of Realtors, dropped 8.8 percent compared to April of 2009. In Denver metro, Home prices increased by 10 percent, year over year.

Graphs reflect median home price data through April:

Month-over-month comparisons for Denver from February to March showed a slight price increase as prices rose 0.6 percent. Prices fell from January to February with a drop of 0.8 percent.

Nationally, home prices have increased at least partially in response to the first-time homebuyer tax credit. Year-over-year comparisons in many markets show marked increases as home prices, driven by the tax credit, continue to rise above very low home prices experienced in the first quarter of 2009.

March price statistics provided by the Colorado Association of Realtors earlier this month showed a year-over-year price increase of 8.1 percent. The Realtor data includes only properties listed in the Metrolist sales database, and thus excludes new home sales any properties not sold with a Realtor. However, the upward movement in March prices for both the Realtor and Case-Shiller data indicates that the demand for housing strengthened in March.

The lowest median home price experienced in recent years was $182,571 during January 2009. According to Realtor data, Metro Denver home prices remain 12.5 percent below the peak of the market reached in June 2007.

April statewide home prices, as measured by MLS data provided by the Colorado Association of Realtors, dropped 8.8 percent compared to April of 2009. In Denver metro, Home prices increased by 10 percent, year over year.

Graphs reflect median home price data through April:

Tuesday, June 8, 2010

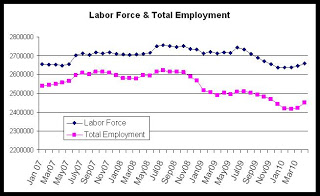

Colorado adds jobs in April

Colorado added 12,838 jobs in April, but employment totals remain below 2009 levels. According to the most recent employment data released by the Colorado Department of Labor and Employment, total employment, not seasonally adjusted, rose to 2,451,424 jobs during April 2010, but the employment total was 51,409 below April 2009's employment total of 2,502,833 jobs.

The total labor force also remains down 58,718 from a year earlier with a labor force of 2,658,438 workers during April of this year as compared to 2,717,156 during April of last year.

From March to April, the unadjusted unemployment rate fell from 8.4 percent to 7.8 percent, and the rate fell year over year from April 2009’s unemployment rate of 7.9 percent.

Since the peak of the labor market in July 2008, when total employment was 2,621,081, more than 169,000 jobs have been lost, and the labor force has shrunk by more than 98,000.

As jobs have been slowly added to the Colorado economy, discouraged workers and new graduates have also entered the work force. In March, 5,547 jobs were added, but 8,594 workers also entered the labor force, driving the unemployment rate up.

Nationally, hiring for the census bureau has been noted as a significant factor driving totals in new hires. In Colorado specifically, new monthly hiring data for the census is not available, but more than 11,000 workers have been hired for the census effort in Colorado over the last eighteen months. While significant, it does not appear that census hiring at the state level has had as notable an impact as at the national level.

Among Colorado metropolitan areas, Grand Junction showed the highest unemployment rate at 9.2 percent, while the Boulder-Longmont and Fort Collins-Loveland areas showed the lowest rates as 5.9 percent and 6.4 percent, respectively.

Although all metropolitan areas in Colorado experienced job growth from March to April, all metro areas lost jobs from April 2009 to April 2010.

Unemployment rates in all metro areas for April 2010 were Boulder-Longmont, 5.9 percent; Denver-Aurora, 7.8 percent; Greeley, 9.0 percent; Fort Collins-Loveland, 6.4 percent; Grand Junction, 9.2 percent; Pueblo, 8.9 percent.

The total labor force also remains down 58,718 from a year earlier with a labor force of 2,658,438 workers during April of this year as compared to 2,717,156 during April of last year.

From March to April, the unadjusted unemployment rate fell from 8.4 percent to 7.8 percent, and the rate fell year over year from April 2009’s unemployment rate of 7.9 percent.

Since the peak of the labor market in July 2008, when total employment was 2,621,081, more than 169,000 jobs have been lost, and the labor force has shrunk by more than 98,000.

As jobs have been slowly added to the Colorado economy, discouraged workers and new graduates have also entered the work force. In March, 5,547 jobs were added, but 8,594 workers also entered the labor force, driving the unemployment rate up.

Nationally, hiring for the census bureau has been noted as a significant factor driving totals in new hires. In Colorado specifically, new monthly hiring data for the census is not available, but more than 11,000 workers have been hired for the census effort in Colorado over the last eighteen months. While significant, it does not appear that census hiring at the state level has had as notable an impact as at the national level.

Among Colorado metropolitan areas, Grand Junction showed the highest unemployment rate at 9.2 percent, while the Boulder-Longmont and Fort Collins-Loveland areas showed the lowest rates as 5.9 percent and 6.4 percent, respectively.

Although all metropolitan areas in Colorado experienced job growth from March to April, all metro areas lost jobs from April 2009 to April 2010.

Unemployment rates in all metro areas for April 2010 were Boulder-Longmont, 5.9 percent; Denver-Aurora, 7.8 percent; Greeley, 9.0 percent; Fort Collins-Loveland, 6.4 percent; Grand Junction, 9.2 percent; Pueblo, 8.9 percent.

Thursday, June 3, 2010

$418,681 in HDG funds awarded in Larimer County

The Department of Local Affairs has announced that $418,681 in HDG funds has been awarded to Larimer County for the following project:

Crossroads Safehouse, Inc., a 501(c)(3) non-profit organization, received an HDG grant in the amount of $418,681 for a domestic violence Safehouse. The project consists of the renovation of a 28,860 sq. ft. existing building to provide a total of 104 beds of safehouse shelter to victims of domestic violence, including women, children, and men. The new facility will also provide office space for the organization and consolidate all of the agency's services in one location.

Crossroads Safehouse, Inc., a 501(c)(3) non-profit organization, received an HDG grant in the amount of $418,681 for a domestic violence Safehouse. The project consists of the renovation of a 28,860 sq. ft. existing building to provide a total of 104 beds of safehouse shelter to victims of domestic violence, including women, children, and men. The new facility will also provide office space for the organization and consolidate all of the agency's services in one location.

Labels:

domestic violence,

hdg,

larimer county

$600,000 in HDG funds awarded in Weld County

The Dept. of Local Affairs has announced that $600,000 in HDG funds has been awarded to Weld County for the following project:

Catholic Charities received an HDG grant of $600,000 for the Guadalupe Community Assistance Center in Greeley, Weld County, Colorado. The project consists of the new construction of an 11,000 sq.ft. building, with 8,800 sq.ft. dedicated to providing 56 beds of emergency/temporary shelter to homeless men, women and families. Catholic Charities will own the shelter provide case management services for the residents. Additional office space will be available for use by other agencies such as the Veterans Administration.

Catholic Charities received an HDG grant of $600,000 for the Guadalupe Community Assistance Center in Greeley, Weld County, Colorado. The project consists of the new construction of an 11,000 sq.ft. building, with 8,800 sq.ft. dedicated to providing 56 beds of emergency/temporary shelter to homeless men, women and families. Catholic Charities will own the shelter provide case management services for the residents. Additional office space will be available for use by other agencies such as the Veterans Administration.

Labels:

catholic charities,

grants,

hdg,

weld county

DOLA Allocated $1.2 million in Recovery Zone Facilities Bonds (RZFBs)

On May 21, the Colorado Commission on Higher Education (CCHE) allocated the remaining unused volume cap of $1,199,238 to DOLA for allocation to any qualifying project, not just those benefiting institutions of higher education. Under The American Recovery and Reinvestment Act (ARRA), the RZFB volume cap will expire on December 31, 2010.

RZFBs are tax exempt bonds for public or privately-owned projects in a designated economic recovery zone. They are very like Private Activity Bonds and Exempt Facility Bonds, but with a much longer list of potential projects.

Additional Information:

The American Recovery and Reinvestment Act (ARRA) provided $148,527,000 in RZFB volume cap to the State of Colorado. Under state enabling legislation (HB-09-1346), most of this cap was allocated to projects approved by the Colorado Commission on Higher Education (CCHE), for the benefit of institutions of higher education and their surroundings.

Federal guidance on June 12, 2009 notified the state of this allocation and its initial distribution among counties and large municipalities (populations exceeding 100,000). This distribution was a proportionate allocation to counties and large municipalities based on employment decline between December 2007 and December 2008. Under HB09-1346, counties and large municipalities had until November 11, 2009 to use their allotted volume cap for higher education capital construction projects, projects which must receive CCHE approval. On November 11, the unused volume cap reverted to the CCHE. On May 21, CCHE allocated the remaining unused volume cap of $1,199,238 to DOLA for allocation to any qualifying project, not just those benefiting institutions of higher education. Under ARRA, the RZFB volume cap will expire on December 31, 2010.

RZFBs are tax exempt bonds for public or privately owned projects that can include public-private partnerships. These projects must be in a designated economic recovery zone. Otherwise, they are very like Private Activity Bonds and Exempt Facility Bonds. The difference is that they can be used for virtually any business - except they cannot be used for residential rental property, golf courses, country clubs, massage parlors, hot tub facilities, suntan facilities, racetracks, gambling facilities, or for liquor stores.

The following are three examples of projects that received RZFB volume cap from CCHE to privately finance projects benefiting the University of Colorado Denver:

o Fitzsimons Village Full Service Hotel and Conference Center benefiting the University of Colorado Denver This project would construct a 200 room full service hotel with 20,000 square feet of conference space located immediately across Colfax Avenue southeast of the campus. Benefits of this project to the University include much needed hotel space near campus for visitors to the hospital including those attending conferences and seminars on campus, expanded meeting space for University functions, and positive economic development in a blighted area across the street from campus. Overall the Fitzsimmons Village project will also provide needed residential and retail development that will support the campus.

o Colorado Science + Technology Park at Fitzsimons, Hyatt Place Hotel benefiting the University of Colorado Denver This project would construct a 163 room limited service hotel with 7,500 square feet of meeting space located on Montview Boulevard and Ursula Drive. Benefits of this project to the University include hotel space near campus, positive economic development on campus and the fact that the taxes paid by this hotel will contribute to the overall Tax-Increment Financing on the Fitzsimmons campus which will fund needed public infrastructure including near term improvements to Montview Boulevard immediately adjacent to the University campus. This street improvement is high on the University's wish list for public infrastructure improvements.

o Denver Health and Hospital Authority Pavilion M Project benefiting the University of Colorado Denver This project would construct a new 78,480 square foot facility located at Denver Health for adolescent psychiatry. The facility will also house an outpatient dialysis function and an outpatient surgery center. Overall the facility would provide expanded opportunities for residents and nurses in training. Currently, Denver Health provides training to 165 medical residents and 300 medical students each year. This facility would enable more medical students and residents to train at Denver Health.

RZFBs are tax exempt bonds for public or privately-owned projects in a designated economic recovery zone. They are very like Private Activity Bonds and Exempt Facility Bonds, but with a much longer list of potential projects.

Additional Information:

The American Recovery and Reinvestment Act (ARRA) provided $148,527,000 in RZFB volume cap to the State of Colorado. Under state enabling legislation (HB-09-1346), most of this cap was allocated to projects approved by the Colorado Commission on Higher Education (CCHE), for the benefit of institutions of higher education and their surroundings.

Federal guidance on June 12, 2009 notified the state of this allocation and its initial distribution among counties and large municipalities (populations exceeding 100,000). This distribution was a proportionate allocation to counties and large municipalities based on employment decline between December 2007 and December 2008. Under HB09-1346, counties and large municipalities had until November 11, 2009 to use their allotted volume cap for higher education capital construction projects, projects which must receive CCHE approval. On November 11, the unused volume cap reverted to the CCHE. On May 21, CCHE allocated the remaining unused volume cap of $1,199,238 to DOLA for allocation to any qualifying project, not just those benefiting institutions of higher education. Under ARRA, the RZFB volume cap will expire on December 31, 2010.

RZFBs are tax exempt bonds for public or privately owned projects that can include public-private partnerships. These projects must be in a designated economic recovery zone. Otherwise, they are very like Private Activity Bonds and Exempt Facility Bonds. The difference is that they can be used for virtually any business - except they cannot be used for residential rental property, golf courses, country clubs, massage parlors, hot tub facilities, suntan facilities, racetracks, gambling facilities, or for liquor stores.

The following are three examples of projects that received RZFB volume cap from CCHE to privately finance projects benefiting the University of Colorado Denver:

o Fitzsimons Village Full Service Hotel and Conference Center benefiting the University of Colorado Denver This project would construct a 200 room full service hotel with 20,000 square feet of conference space located immediately across Colfax Avenue southeast of the campus. Benefits of this project to the University include much needed hotel space near campus for visitors to the hospital including those attending conferences and seminars on campus, expanded meeting space for University functions, and positive economic development in a blighted area across the street from campus. Overall the Fitzsimmons Village project will also provide needed residential and retail development that will support the campus.

o Colorado Science + Technology Park at Fitzsimons, Hyatt Place Hotel benefiting the University of Colorado Denver This project would construct a 163 room limited service hotel with 7,500 square feet of meeting space located on Montview Boulevard and Ursula Drive. Benefits of this project to the University include hotel space near campus, positive economic development on campus and the fact that the taxes paid by this hotel will contribute to the overall Tax-Increment Financing on the Fitzsimmons campus which will fund needed public infrastructure including near term improvements to Montview Boulevard immediately adjacent to the University campus. This street improvement is high on the University's wish list for public infrastructure improvements.

o Denver Health and Hospital Authority Pavilion M Project benefiting the University of Colorado Denver This project would construct a new 78,480 square foot facility located at Denver Health for adolescent psychiatry. The facility will also house an outpatient dialysis function and an outpatient surgery center. Overall the facility would provide expanded opportunities for residents and nurses in training. Currently, Denver Health provides training to 165 medical residents and 300 medical students each year. This facility would enable more medical students and residents to train at Denver Health.

Labels:

ARRA,

private activity bonds,

RZFBs

$350,000 awarded in Pikes Peak Region

the Dept. of Local Affairs has announced that $350,000 in HOME funds has been awarded for increasing the availability of affordable housing in the City of Colorado Springs.

The Colorado Springs Pike Senior Limited Partnership was awarded a HOME loan of $350,000 to assist with the construction of the seventy-unit Pikes Peak Senior Apartments located at 907 East Colorado Avenue in Colorado Springs, Colorado. This project will provide forty-one (41) one-bedroom and twenty-nine (29) two-bedroom units for senior households (age 55 and over) at 40% and 50% Area Median Income (AMI). This project will be built to Green Communities standards and will include a secure entry, computer lab, exercise room and community kitchen. The project developer, MJT Properties, Inc. and their management company, Terra Management LLC, have successfully constructed and managed six other tax credit, senior restricted apartments in Colorado.

The Colorado Springs Pike Senior Limited Partnership was awarded a HOME loan of $350,000 to assist with the construction of the seventy-unit Pikes Peak Senior Apartments located at 907 East Colorado Avenue in Colorado Springs, Colorado. This project will provide forty-one (41) one-bedroom and twenty-nine (29) two-bedroom units for senior households (age 55 and over) at 40% and 50% Area Median Income (AMI). This project will be built to Green Communities standards and will include a secure entry, computer lab, exercise room and community kitchen. The project developer, MJT Properties, Inc. and their management company, Terra Management LLC, have successfully constructed and managed six other tax credit, senior restricted apartments in Colorado.

Labels:

colorado springs,

grants,

HOME funds,

seniors

New grant awarded for Conejos County

The Dept. of Local Affairs has announced that $265,000 in CDBG funds has been awarded for increasing the availability of affordable housing in Conejos County.

Conejos County received a $265,000 CDBG grant for the rehabilitation of the Plaza del Sol Manor Apartments in La Jara, Colorado. This project was originally constructed in 1986 and contains a total of 26 one-bedroom units. This project is adjacent to the hospital, the central business district and the proposed new nursing home. The rehabilitation plan for this property is based on a 3rd party capital needs assessment and includes new roofs, accessible bathroom remodels, eave replacement and window replacements. This property serves many households at less than 30% of the Area Median Income through the HUD rental assistance for 100% of the units in this project. The term of affordability for this project will be extended based on the receipt of these CDBG funds.

Conejos County received a $265,000 CDBG grant for the rehabilitation of the Plaza del Sol Manor Apartments in La Jara, Colorado. This project was originally constructed in 1986 and contains a total of 26 one-bedroom units. This project is adjacent to the hospital, the central business district and the proposed new nursing home. The rehabilitation plan for this property is based on a 3rd party capital needs assessment and includes new roofs, accessible bathroom remodels, eave replacement and window replacements. This property serves many households at less than 30% of the Area Median Income through the HUD rental assistance for 100% of the units in this project. The term of affordability for this project will be extended based on the receipt of these CDBG funds.

Wednesday, June 2, 2010

DOLA accepting proposals for energy code adoption support program

In coordination with the Governor’s Energy Office (GEO), the Department of Local affairs (DOLA) is now accepting proposals from service providers who will provide 2009 International Energy Conservation Code (IECC) support, tools and resources to local code jurisdictions statewide. All vendors who intend to bid on this solicitation must be registered in the Colorado BIDS system to view the request and instructions. GEO and DOLA staff members are unable to respond to any inquiries regarding this solicitation. Please refer to the solicitation instructions or contact Cheri Miller at state purchasing for information about this process. The solicitation can be accessed by clicking here clicking here and looking under “Training Services” and selecting “RFP-CM-DOLA-10-003 Energy Codes-IECC Project (ARRA Funds)”.

Click here for more information.

Click here for more information.

Tuesday, June 1, 2010

Updates to the Foreclosure Deferment Program

The Foreclosure Deferment Program (Colorado Revised Statutes, 38-38-801) is in the process of being modified and updated in accordance with recent changes mandated by House Bil 10-1240.

Among other things, the bill modifies the document to be posted by the holder on the doors of foreclosing homes. The document has been updated and is now posted on the Division of Housing's main web site: http://dola.colorado.gov/cdh/foreclosurenotice/index.htm

Please see the legislation for additional provisions: http://dola.colorado.gov/cdh/foreclosurenotice/documents/1240_enr.pdf

For additional information and news related to this program, please check this blog in the future or sign up for email updates from the Division of Housing: https://dola.colorado.gov/list_server/cdh_announcement_signup.jsf

Changes and updates can also be found at the web page of the Foreclosure Deferment Program. At the Division of Housing web site, look under "Foreclosure Deferment Program" on the left side of the screen.

Among other things, the bill modifies the document to be posted by the holder on the doors of foreclosing homes. The document has been updated and is now posted on the Division of Housing's main web site: http://dola.colorado.gov/cdh/foreclosurenotice/index.htm

Please see the legislation for additional provisions: http://dola.colorado.gov/cdh/foreclosurenotice/documents/1240_enr.pdf

For additional information and news related to this program, please check this blog in the future or sign up for email updates from the Division of Housing: https://dola.colorado.gov/list_server/cdh_announcement_signup.jsf

Changes and updates can also be found at the web page of the Foreclosure Deferment Program. At the Division of Housing web site, look under "Foreclosure Deferment Program" on the left side of the screen.

Labels:

foreclosure deferment program,

hb1276

Subscribe to:

Posts (Atom)