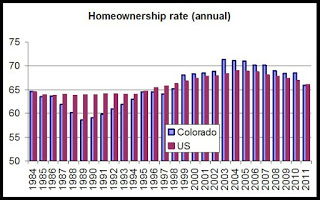

For the first time since 1998, the homeownership rate in Colorado fell below the national homeownership rate during 2011, dropping to 65.9 percent. The national homeownership rate during 2011 was 66.1 percent, according to the Census Bureau.

The Census Bureau began publishing Colorado's homeownership rate in 1984, and from that year through 1998, Colorado's homeownership rate was below the national rate.

The Colorado rate climbed above the national rate in 1999 and remained above the national rate until 2011.

The graph shows that both national and Colorado homeownership rates have been declining since 2004. The trend continued in the most recent annual numbers, and Colorado's homeowenership rate dropped from 68.5 percent during 2010 to 65.9 percent during 2011. Nationally, the drop was much smaller, falling from 66.9 percent to 66.1 percent over the same period. Colorado's homeownership rate peaked at 71.3 percent during 2003, which historically, is a high rate for homeownership for most any state state or for the US as a whole.

These numbers would seem to reflect the boom in population and homebuilding in Colorado that began in the 1990s and continued up until the financial crisis of 2008. A decline in the homeownership rate began after 2003 in Colorado, but recent trends in real estate in Colorado may be solidifying the trend.

The decline in the homeownership rate should not be viewed, necessarily, as an indicator of a declining economy or as only the result of foreclosure activity.

While foreclosures have certainly contributed to a decline in the homeownership rate, also important is an increase in rental activity.

Using estimates from the American Community Survey, the number of renter households in Colorado has increased by 15 between 2001 and 2010 while the number of owner occupant households increased by 2 percent. These are just estimates, but we can say with a fair degree of confidence that renter households have increased more than owner-occupant households over the past 6 years.

While foreclosures no doubt contribute top this trend, new household formations also contribute as new households are much more likely to be renter households following the financial crisis of 2008 and the tightening of mortgage lending standards.

Cool websites

- Casino Online Non Aams

- Casino Non Aams

- Siti Di Poker Online

- Casinos Not On Gamstop

- Gambling Sites Not On Gamstop

- Casinos Not On Gamstop

- Casino Non Aams Italia

- Casino Not On Gamstop

- Best Non Gamstop Casinos

- Sites Not On Gamstop

- Casino Sites Not On Gamstop

- Non Gamstop Casino

- Non-gamstop UK Casinos

- Non Gamstop Casino UK

- Sites Not On Gamstop

- Non Gamstop Casino

- Casino Non Aams

- Casino En Ligne Fiable

- Casino Not On Gamstop

- Non Gamstop Casinos

- Casinos Not On Gamstop

- UK Online Casinos Not On Gamstop

- Casino Online Non Aams

- Non Gamstop Casino Sites UK

- I Migliori Casino Online

- Casino Online Italia

- Sites De Paris Sportifs Autorisés En Belgique

- Nouveau Casino En Ligne Belgie

- Migliori App Casino Online

- Gagner Au Tennis Paris Sportif

- オンカジ スロット おすすめ

- Casino En Ligne 2026

- Casino Senza Documenti

- Meilleur Casino En Ligne

- Meilleur Casino En Ligne De France