Public hearings for Colorado's 2011-2012 Consolidated Plan will be held on Jan. 6, 2011. The full text of the Public Hearing Notice follows:

PUBLIC NOTICE AND NOTICE OF PUBLIC HEARING

The Colorado Department of Local Affairs will be submitting the state's Annual Action Plan to the U.S. Department of Housing and Urban Development (HUD), Region VIII on February 14, 2011. The Plan is required under the National Affordable Housing Act in order for Colorado to receive the following federal funds: HOME Investment Partnership; Community Development Block Grant (CDBG); Emergency Shelter Grants; Supportive Housing; HOPWA.

The Action Plan summarizes statewide housing and non-housing needs; identifies one-year strategies; and reviews the available federal, state and local resources to implement the strategies; and presents specific goals and objectives for the number of persons to be assisted. The strategies are shown below:

Strategy I: Preserve the supply of existing affordable rental and homeownership housing.

Strategy II: Increase the supply of affordable “workforce” rental and homeownership housing in high need areas.

Strategy III: Increase the capacity, stability and participation of local housing and service providers.

Strategy IV: Increase pre-purchase homeownership counseling for low- and moderate-income households and minorities.

Strategy V: Meet the community needs for the homeless by providing supportive services and appropriate housing.

Strategy VI: Increase the supply of housing for person with special needs, coupled with services that increase or maintain independence.

Strategy VII: Provide rental subsidies statewide for low-income households that would otherwise have to pay more than 30% of their household income for housing.

Strategy VIII: Utilize the Division’s ability to project base Section 8 vouchers to provide a revenue source for housing units and HOME and CDBG funding to fill gaps in development of units for homeless and disabled populations.

Strategy IX: Assist low-income renters and owners with energy-efficiency upgrades.

Strategy X: Ensure the statewide safety and habitability of factory built-manufactured structures through program services that are efficient and effective.

Strategy XI: Provide financial assistance to qualified small businesses to start or expand their operations, and partner with local banks to fill gaps in financing packages so that 51% of jobs are created or retained by person of low to moderate income.

Strategy XII: Assist communities with the installation of public infrastructure that will benefit start-up and expanding businesses who will be creating or retaining jobs, at least 51% of which will be or are filled by persons of low to moderate income.

Strategy XIII: Provide financial assistance to rural communities to implement community development and capital improvement areas.

Strategy XIV: Increase the capacity of local governments to administer federal grants that facilitate the development of sustainability activities.

Two public hearings have been scheduled by the Colorado Department of Local Affairs for the Action Plan document. The first hearing will be held on Thursday, January 6, 2011 in Grand Junction, 222 S. 6th St., Room 409 at 12:00 Noon. The second hearing will also be on Thursday, January 6, 2011 in Denver, 1313 Sherman St., Room 518 Conference Room at 4:00 p.m. The plan will be available for inspection on the internet at www.dola.colorado.gov or www.dola.state.co.us/doh.htm as of January 6, 2011. A copy of the complete document to be submitted to HUD will also be available for public review during regular office hours from January 6, 2011, through February 7, 2011 at the following Department of Local Affairs regional offices.

If special accommodations are needed, please call (970) 248-7302 (Bill Whaley) for the Grand Junction meeting or (303) 866-2046(Lynn Shine) for the Denver meeting. The Department of Local Affairs TDD Number is (303) 866-5300.

Written comments must be received by February 7, 2011 at the Colorado Division of Housing, 1313 Sherman Street, Room 500, Denver CO, 80203, ATTN: Lynn Shine.

South Central Office

540 Washington St.

Monte Vista, CO 81144

Contact: Debbie Downs (719) 852-9429

Northwestern Office

222 South Sixth Street, Room 409

Grand Junction, CO 81501

Contact: Elyse Ackerman-Casselberry, (970) 248-7333

North Central Office

150 E. 29th St., Suite 215

Loveland, CO 80538

Contact: Don Sandoval, (970) 679-4501

Southeastern Office

132 West “B” St., Suite 260

Pueblo, CO 81003

Contact: Lee Merkel (719) 544-6577

Southwestern Office

Ft. Lewis College, 1000 Rim Drive

Durango, CO 81302

Contact: Ken Charles (970) 247-7311

Office of Economic Development and International Trade

1625 Broadway, Suite 1710

Denver, CO 80202

Contact: Bob Todd (303) 892-3840

Colorado Division of Housing

1313 Sherman Street, Room 518

Denver, CO 80203

Contact: Lynn Shine (303) 866-2046

Wednesday, December 29, 2010

Thursday, December 23, 2010

The Division of Housing will be closed December 24 and December 31..

The Colorado Division of Housing offices will be closed December 24 (Christmas Eve) and December 31 (New Year's Eve).

Notice of Funding Availability: Fair Housing Initiatives Program

HUD has announced the availability of approximately $40.7 million in funding for the Fair Housing Initiatives Program. Non-profit organizations are eligible to receive funding through this program to investigate allegations of housing discrimination, educate the public and the housing industry about their rights and responsibilities under the Fair Housing Act and increase compliance with the Fair Housing Act. These activities are badly needed in Colorado to ensure that all Coloradans have fair and equal housing opportunities. The Colorado Division of Housing encourages our non-profit partners to apply for this funding. The NOFA is posted at http://edocket.access.gpo.gov/2010/pdf/2010-30242.pdf. Further information is available at www.HUD.gov and at Grants.gov."

Labels:

fair housing,

grants,

hud,

nofas

Habitat for Humanity receives $220,000 award

The Department of Local Affairs has announced that $220,000.00 in HOME Investment Partnerships Program(HOME) funds have been awarded to Habitat for Humanity of Colorado for the following project:

Habitat for Humanity of Colorado will receive a grant of $220,000 to help local affiliates acquire lots, develop infrastructure, and/or build 20 single-family homes affordable to households earning 25% to 50% of the Area Median Income. The funding request also includes $20,000 for grant administration and technical assistance to affiliates. Habitat homes are typically single-family dwellings built with no garage, carport or basements. They are generally about 1,200 square feet with three bedrooms and two bathrooms. In some cases, due to local jurisdictions’ requirements, Habitat homes do exceed these standards of simplicity (ex. they might include a garage).

Some affiliates are also acquiring and rehabilitating existing homes. Habitat uses grants, donations and sweat equity to keep the cost to build the home down and to also keep the first mortgage affordable to the homebuyer. The difference between the first mortgage and the appraised value of the home is recorded as a second mortgage and is forgivable over time.

Habitat for Humanity of Colorado will receive a grant of $220,000 to help local affiliates acquire lots, develop infrastructure, and/or build 20 single-family homes affordable to households earning 25% to 50% of the Area Median Income. The funding request also includes $20,000 for grant administration and technical assistance to affiliates. Habitat homes are typically single-family dwellings built with no garage, carport or basements. They are generally about 1,200 square feet with three bedrooms and two bathrooms. In some cases, due to local jurisdictions’ requirements, Habitat homes do exceed these standards of simplicity (ex. they might include a garage).

Some affiliates are also acquiring and rehabilitating existing homes. Habitat uses grants, donations and sweat equity to keep the cost to build the home down and to also keep the first mortgage affordable to the homebuyer. The difference between the first mortgage and the appraised value of the home is recorded as a second mortgage and is forgivable over time.

Rocky Mountain HDC awarded $35,000

The Department of Local Affairs has announced that $35,000.00 in HOME CHDO Operating (HMCO) funds has been awarded to Denver County for the following project: Rocky Mountain Housing Development Corporation (RMHDC) will receive a $35,000 CHDO operating grant to conduct due diligence for rental housing projects (potential acquisition/rehabilitation &/or new construction projects). CHDO operating funds will be used for staff time spent on predevelopment activities including: researching and analyzing financing options, evaluating proformas, reviewing contracts, coordinating legal documents, etc. RMHDC has 15 years experience with service-enriched transitional and affordable rental developments in the Denver Metro area. RMHDC is exploring 6 potential projects, with 2 that seem likely for 2011(not including construction). Their projects are in Commerce City, Arvada, & elsewhere in the Metro area.

Labels:

chdo,

Denver,

grants,

HOME funds,

Rocky Mountain HDC

Colorado receives $257,376 from Department of Energy

The Department of Energy (DOE) announced today that it has selected 24 states to receive a total of $7 million to support the adoption of updated, energy-efficient building codes. The funding will expand the existing partnerships between states and the federal government and help states to more rapidly adopt new residential and commercial building codes, as well increase compliance with those codes. As part of the Administration’s broad efforts to help families and businesses save money by saving energy, these awards will help states and local communities significantly cut the energy intensity of the nation’s buildings sector, which accounts for more than 40 percent of the energy consumed in the U.S.

Colorado's allocation totals $257,376.

This technical assistance through the Department’s Building Energy Codes program is being funded under the American Recovery and Reinvestment Act. DOE’s Pacific Northwest National Laboratory (PNNL) will provide the selected states with up to $350,000 in technical assistance that include activities such as code trainings for the building community and adoption outreach to policy makers. Each state has committed to work with DOE to advance adoption, training, and compliance for the updated building codes.

Colorado's allocation totals $257,376.

This technical assistance through the Department’s Building Energy Codes program is being funded under the American Recovery and Reinvestment Act. DOE’s Pacific Northwest National Laboratory (PNNL) will provide the selected states with up to $350,000 in technical assistance that include activities such as code trainings for the building community and adoption outreach to policy makers. Each state has committed to work with DOE to advance adoption, training, and compliance for the updated building codes.

New Training on Manufactured and Modular Homes and Installation

Rocky Mountain Home Association Presents An Installation Continuing Education Workshop on January 27, 2011

HUD Code and Modular Homes Installation

Join us in Castle Rock to learn the latest in Home Installation!

Featuring Instructor: Ed Short, Sunrise Engineering

This Course has been approved for 8 hours of Colorado required continuing education

for installers and inspectors!

RMHA will also be providing training on September 22nd on the Western Slope.

Exact location TBD. These are the only two trainings provided in 2011 so please

plan accordingly.

WORKSHOPS FILL UP FAST

SO BE SURE TO REGISTER RIGHT AWAY!

Click here for the registration form.

HUD Code and Modular Homes Installation

Join us in Castle Rock to learn the latest in Home Installation!

Featuring Instructor: Ed Short, Sunrise Engineering

This Course has been approved for 8 hours of Colorado required continuing education

for installers and inspectors!

RMHA will also be providing training on September 22nd on the Western Slope.

Exact location TBD. These are the only two trainings provided in 2011 so please

plan accordingly.

WORKSHOPS FILL UP FAST

SO BE SURE TO REGISTER RIGHT AWAY!

Click here for the registration form.

Labels:

codes section,

colorado,

manufactured housing,

RMHA,

trainings

Division of Housing in the News

Colorado foreclosures at 20-month low (Denver Business Journal, 12/23/2010)

Denver County, one of the metro-area counties hardest hit by foreclosures in recent years, had the biggest decrease in foreclosure filings of the state's 12 major counties year over year. Its filings went down 28.5 percent to 335 last month from 470 in November 2009.

That county also was the only major one in the state with a drop ¿ 3.1 percent ¿ in foreclosure sales from January through November, year over year.

The Division of Housing's monthly "Metropolitan Foreclosure Report" covers 12 urban counties of Colorado: Denver as well as Adams, Arapahoe, Boulder, Broomfield, Douglas, El Paso, Jefferson, Larimer, Mesa, Pueblo and Weld counties. Smaller counties are not included in the monthly totals.

Larimer County foreclosures improve (Ft Collins Coloradoan, 12/23/2010)

Foreclosure sales and filings declined for the month as foreclosure sales at auction dropped to a 20-month low in Colorado's metropolitan counties, according to a report released Wednesday by the Colorado Division of Housing.

Larimer County recorded a 2.9 percent decline in month-over-month foreclosure filings from 172 in October to 167 in November. Foreclosure sales declined 5.6 percent from October to November as sales dropped from 54 homes sold at auction to 51.

Year-over-year comparisons of November foreclosure activity in Larimer County revealed a 12.8 percent increase in filings and a 15 percent drop in sales.

Nov. foreclosures fall in Colorado's largest counties (Denver Post, 12/23/2010)

Weld continues improvement on foreclosure front (Greeley Tribune,12/23/2010)

But Weld has the highest foreclosure rate of the state’s 12 major counties, according to the November data. Weld had an 11.2 percent foreclosure rate, which is based on the number of households per completed foreclosure. The state-metro group had a rate of 7.4 percent.

Sara Gilbert, executive director of Consumer Credit Counseling Service of Northern Colorado, said the Greeley office has seen a 19 percent increase this year in housing counseling sessions on foreclosure avoidance. Gilbert said word is getting out about the state’s Foreclosure Hotline.

“More people are recognizing the importance of seeking the advice of a foreclosure counselor,” she said. “… It’s not an easy process to get through, so we never recommend that you try to go it alone.”

November foreclosures slow in Colorado's largest counties (Colo. Springs Gazette, December 23, 2010)

In Colorado Springs and surrounding El Paso County, foreclosure filings totaled 430 in November, down 10.5 percent from October. November sales, however, totaled 165 — a slight 3.1 percent increase.

Another thing holding back foreclosures are loan modifications, where lenders try to change the terms of a loan so a borrower can stay current.

Read more: http://www.gazette.com/articles/foreclosure-110073-activity-slows.html#ixzz18y7InOkx

Denver County, one of the metro-area counties hardest hit by foreclosures in recent years, had the biggest decrease in foreclosure filings of the state's 12 major counties year over year. Its filings went down 28.5 percent to 335 last month from 470 in November 2009.

That county also was the only major one in the state with a drop ¿ 3.1 percent ¿ in foreclosure sales from January through November, year over year.

The Division of Housing's monthly "Metropolitan Foreclosure Report" covers 12 urban counties of Colorado: Denver as well as Adams, Arapahoe, Boulder, Broomfield, Douglas, El Paso, Jefferson, Larimer, Mesa, Pueblo and Weld counties. Smaller counties are not included in the monthly totals.

Larimer County foreclosures improve (Ft Collins Coloradoan, 12/23/2010)

Foreclosure sales and filings declined for the month as foreclosure sales at auction dropped to a 20-month low in Colorado's metropolitan counties, according to a report released Wednesday by the Colorado Division of Housing.

Larimer County recorded a 2.9 percent decline in month-over-month foreclosure filings from 172 in October to 167 in November. Foreclosure sales declined 5.6 percent from October to November as sales dropped from 54 homes sold at auction to 51.

Year-over-year comparisons of November foreclosure activity in Larimer County revealed a 12.8 percent increase in filings and a 15 percent drop in sales.

Nov. foreclosures fall in Colorado's largest counties (Denver Post, 12/23/2010)

Weld continues improvement on foreclosure front (Greeley Tribune,12/23/2010)

But Weld has the highest foreclosure rate of the state’s 12 major counties, according to the November data. Weld had an 11.2 percent foreclosure rate, which is based on the number of households per completed foreclosure. The state-metro group had a rate of 7.4 percent.

Sara Gilbert, executive director of Consumer Credit Counseling Service of Northern Colorado, said the Greeley office has seen a 19 percent increase this year in housing counseling sessions on foreclosure avoidance. Gilbert said word is getting out about the state’s Foreclosure Hotline.

“More people are recognizing the importance of seeking the advice of a foreclosure counselor,” she said. “… It’s not an easy process to get through, so we never recommend that you try to go it alone.”

November foreclosures slow in Colorado's largest counties (Colo. Springs Gazette, December 23, 2010)

In Colorado Springs and surrounding El Paso County, foreclosure filings totaled 430 in November, down 10.5 percent from October. November sales, however, totaled 165 — a slight 3.1 percent increase.

Another thing holding back foreclosures are loan modifications, where lenders try to change the terms of a loan so a borrower can stay current.

Read more: http://www.gazette.com/articles/foreclosure-110073-activity-slows.html#ixzz18y7InOkx

Wednesday, December 22, 2010

Diane Leavesley joins the Division of Housing

The Department of Local Affairs is pleased to announce that Diane Leavesley has joined the Colorado Division of Housing as its Portfolio Manager. As the Portfolio Manager, she will manage the asset management team.

Before joining the Division of Housing, Diane served as President of Mercy Loan Fund where, for twelve years, she was responsible for directing the lending activities, loan servicing and resource development for this national affordable housing loan fund. Before Mercy, Diane had fourteen years of commercial real estate experience including mortgage banking and appraisal. Some of the appraisal work was as the owner of a commercial real estate appraisal business serving the Denver area. Diane received her Masters in Business Administration from the University of Denver with an emphasis in Real Estate and Finance and has an undergraduate degree from the University of Massachusetts.

Her community involvement includes serving as the first Chair of the Board of Directors of Housing Colorado!, a member organization for affordable housing education, information and advocacy. She has also been a board member of Community Housing Development Association (CHDA) and on the Finance Committee of Mile High Community Loan Fund. She served on the Douglas County, Colorado, Planning Commission and as President and National Delegate of CREW - Commercial Real Estate Women. From 2006 - 2008 she was a member of the Board of Directors of the Denver Branch of the Federal Reserve Bank of Kansas City.

Before joining the Division of Housing, Diane served as President of Mercy Loan Fund where, for twelve years, she was responsible for directing the lending activities, loan servicing and resource development for this national affordable housing loan fund. Before Mercy, Diane had fourteen years of commercial real estate experience including mortgage banking and appraisal. Some of the appraisal work was as the owner of a commercial real estate appraisal business serving the Denver area. Diane received her Masters in Business Administration from the University of Denver with an emphasis in Real Estate and Finance and has an undergraduate degree from the University of Massachusetts.

Her community involvement includes serving as the first Chair of the Board of Directors of Housing Colorado!, a member organization for affordable housing education, information and advocacy. She has also been a board member of Community Housing Development Association (CHDA) and on the Finance Committee of Mile High Community Loan Fund. She served on the Douglas County, Colorado, Planning Commission and as President and National Delegate of CREW - Commercial Real Estate Women. From 2006 - 2008 she was a member of the Board of Directors of the Denver Branch of the Federal Reserve Bank of Kansas City.

Rick Hanger named as new Housing Technology and Standards manager at the Colorado Division of Housing

FOR IMMEDIATE RELEASE

December 22, 2010

Rick Hanger named as new Housing Technology and Standards manager at the Colorado Division of Housing

The Colorado Department of Local Affairs is pleased to announce Rick Hanger as the new Housing Technology and Standards (HTS) Manager at the Division of Housing, effective. The HTS manager is responsible for overall operations of the DOLA/DOH Housing Technology and Standards Section. The appointment is effective immediately.

The mission of the HTS Section is to ensure public life, health and safety through code compliant construction. In this new role, Rick is responsible for the administration and compliance with seven programs that support the mission: HUD State Administrative Agency, HUD In-Plant Inspection Agency, Colorado Factory Built Housing, Colorado Factory Built Nonresidential Structures, Manufactured Housing Installation, MH/FB Dealer Registration, and Multi-Family Structures (where there is no adopted building code).

Rick has served in several roles at the Colorado Department of Local Affairs over his years of service. These roles have included being the lead technical training and technical assistance staff for the D.O.E Weatherization Program and most recently providing overall management of the Housing Development Section of the Division of Housing, including the lead on the HOME Program and the State Housing Development Grant Program.

Prior to joining the staff of DOH in the 1991 on the Weatherization Program Technical Training staff, Rick spent over ten years in the residential energy-efficiency field including; several years as a private contractor and six years as a community-based non-profit program manager. Rick gained national recognition for the implementation of several Colorado developed processes for the Weatherization Program and has provided technical presentations and trainings in over twenty-six states.

Rick has served on several Boards and Committees as staff of the Division of Housing, including; the Colorado Association of Realtors Housing Opportunity Foundation (CARHOF) Board, the Energy Outreach Colorado Multi-family Weatherization Selection Committee, the Mile High Community Loan Fund Loan Committee and the State of Colorado Lead-Based Paint Coalition. He also represents the State of Colorado as the State’s Class A voting member for the International Code Council, which promulgates the International Building Codes.

December 22, 2010

Rick Hanger named as new Housing Technology and Standards manager at the Colorado Division of Housing

The Colorado Department of Local Affairs is pleased to announce Rick Hanger as the new Housing Technology and Standards (HTS) Manager at the Division of Housing, effective. The HTS manager is responsible for overall operations of the DOLA/DOH Housing Technology and Standards Section. The appointment is effective immediately.

The mission of the HTS Section is to ensure public life, health and safety through code compliant construction. In this new role, Rick is responsible for the administration and compliance with seven programs that support the mission: HUD State Administrative Agency, HUD In-Plant Inspection Agency, Colorado Factory Built Housing, Colorado Factory Built Nonresidential Structures, Manufactured Housing Installation, MH/FB Dealer Registration, and Multi-Family Structures (where there is no adopted building code).

Rick has served in several roles at the Colorado Department of Local Affairs over his years of service. These roles have included being the lead technical training and technical assistance staff for the D.O.E Weatherization Program and most recently providing overall management of the Housing Development Section of the Division of Housing, including the lead on the HOME Program and the State Housing Development Grant Program.

Prior to joining the staff of DOH in the 1991 on the Weatherization Program Technical Training staff, Rick spent over ten years in the residential energy-efficiency field including; several years as a private contractor and six years as a community-based non-profit program manager. Rick gained national recognition for the implementation of several Colorado developed processes for the Weatherization Program and has provided technical presentations and trainings in over twenty-six states.

Rick has served on several Boards and Committees as staff of the Division of Housing, including; the Colorado Association of Realtors Housing Opportunity Foundation (CARHOF) Board, the Energy Outreach Colorado Multi-family Weatherization Selection Committee, the Mile High Community Loan Fund Loan Committee and the State of Colorado Lead-Based Paint Coalition. He also represents the State of Colorado as the State’s Class A voting member for the International Code Council, which promulgates the International Building Codes.

UPDATE: The Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (SAFE Act) applies to non-profits and government agencies

UPDATE, December 22, 2010: The Department of Regulatory Agencies has updated its loan originator web site. The best information on state licensing is available at their web site here: http://www.dora.state.co.us/real-estate/applications/mortgagebroker/index.htm

Please follow DORA's recommendations and process for licensing. Please also note the extensive Q and A section at the above link.

Please see this memo which examines the need for mortgage loan originators at non-profits and government agencies to be licensed.

We have removed a previous analysis that did not contain updated provisions requiring the licensing of loan originators at government agencies.

Summary:

We have received questions from some non-profits regarding the necessity of licensure for employees engaging in loan originations for non-profit organizations. The question pertains to requirements set forth in the “Secure and Fair Enforcement for Mortgage Licensing Act of 2008” (also known as the SAFE Act).

This is an important matter for the Division of Housing since the Division provides grants to non-profits, housing authorities and other agencies for the purposes of making down payment assistance and rehabilitation loans to borrowers.

The SAFE Act covers any individual employed at a non-profit or government agency, and who accepts applications for residential mortgage loans, and who offers or negotiates terms of a residential mortgage loan for compensation or gain. This potentially covers loans made for purposes of down payment assistance or any other loan that is serviced through regular payments and involves a lien against a residence or could otherwise be defined as a mortgage. See the definition of “residential mortgage loan” in the SAFE Act found in 12 USC 5103.

Click here to read full document.

Please follow DORA's recommendations and process for licensing. Please also note the extensive Q and A section at the above link.

Please see this memo which examines the need for mortgage loan originators at non-profits and government agencies to be licensed.

We have removed a previous analysis that did not contain updated provisions requiring the licensing of loan originators at government agencies.

Summary:

We have received questions from some non-profits regarding the necessity of licensure for employees engaging in loan originations for non-profit organizations. The question pertains to requirements set forth in the “Secure and Fair Enforcement for Mortgage Licensing Act of 2008” (also known as the SAFE Act).

This is an important matter for the Division of Housing since the Division provides grants to non-profits, housing authorities and other agencies for the purposes of making down payment assistance and rehabilitation loans to borrowers.

The SAFE Act covers any individual employed at a non-profit or government agency, and who accepts applications for residential mortgage loans, and who offers or negotiates terms of a residential mortgage loan for compensation or gain. This potentially covers loans made for purposes of down payment assistance or any other loan that is serviced through regular payments and involves a lien against a residence or could otherwise be defined as a mortgage. See the definition of “residential mortgage loan” in the SAFE Act found in 12 USC 5103.

Click here to read full document.

Foreclosure totals continue to slide in Colorado

Click here for full report.

Foreclosure sales at auction dropped to a 20-month low in Colorado’s metropolitan counties during November. According to a report released today by the Colorado Division of Housing, foreclosure sales fell 8.6 percent from October to November continuing a trend downward in foreclosure activity in Colorado.

Comparing year-over-year, foreclosure sales fell 21 percent in November, although for the 11-month period from January through November of this year, foreclosure sales are up 14.6 percent compared to the same period last year. There were 1,195 foreclosures that proceeded to sale at auction during November 2010 in Colorado’s metropolitan counties, compared to October's total of 1,308. There were 1,512 sales during November of last year.

New foreclosure filings totals continued to fall as well. Although filings increased 4.6 percent from November 2009 to November 2010, total filings for the 11-month period of January through November are down 10.0 percent this year compared to the same period last year. Filings fell 4.2 percent from October to November. There were 2,932 foreclosure filings during November 2010 in the metro counties, compared to October’s total of 3,059. There were 2,802 filings during November of last year.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

With the exception of Mesa County, all metropolitan counties showed decreases in foreclosure sales at auction, comparing year-over-year. From November 2009 to November 2010, foreclosure sales rose 26.1 percent in Mesa County, but foreclosure sales fell 27.8 percent in Pueblo County, and they fell 27.2 percent and 25.3 percent in Jefferson County and El Paso County, respectively.

Foreclosure filings trends were mixed in Colorado’s metro counties. From November 2009 to November 2010, in Pueblo and Mesa counties, filings increased 47.9 percent and 58.1 percent, respectively. On the other hand, filings fell 28.5 percent and 27.6 percent in Denver and Broomfield Counties, respectively.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve metropolitan counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

Foreclosure sales at auction dropped to a 20-month low in Colorado’s metropolitan counties during November. According to a report released today by the Colorado Division of Housing, foreclosure sales fell 8.6 percent from October to November continuing a trend downward in foreclosure activity in Colorado.

Comparing year-over-year, foreclosure sales fell 21 percent in November, although for the 11-month period from January through November of this year, foreclosure sales are up 14.6 percent compared to the same period last year. There were 1,195 foreclosures that proceeded to sale at auction during November 2010 in Colorado’s metropolitan counties, compared to October's total of 1,308. There were 1,512 sales during November of last year.

New foreclosure filings totals continued to fall as well. Although filings increased 4.6 percent from November 2009 to November 2010, total filings for the 11-month period of January through November are down 10.0 percent this year compared to the same period last year. Filings fell 4.2 percent from October to November. There were 2,932 foreclosure filings during November 2010 in the metro counties, compared to October’s total of 3,059. There were 2,802 filings during November of last year.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

With the exception of Mesa County, all metropolitan counties showed decreases in foreclosure sales at auction, comparing year-over-year. From November 2009 to November 2010, foreclosure sales rose 26.1 percent in Mesa County, but foreclosure sales fell 27.8 percent in Pueblo County, and they fell 27.2 percent and 25.3 percent in Jefferson County and El Paso County, respectively.

Foreclosure filings trends were mixed in Colorado’s metro counties. From November 2009 to November 2010, in Pueblo and Mesa counties, filings increased 47.9 percent and 58.1 percent, respectively. On the other hand, filings fell 28.5 percent and 27.6 percent in Denver and Broomfield Counties, respectively.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve metropolitan counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

Labels:

colorado,

division of housing,

foreclosure,

hotline,

press releases

Monday, December 13, 2010

The Division of Housing in the news

Greeley rental vacancy rate is lowest since 2001 Greeley Tribune, Dec 3

Fort Collins and Greeley rank No. 1 and 2 in tightest rental vacancy rates in the state, according to a third-quarter report released today by the Colorado Division of Housing.

Greeley's vacancy rate of 3.9 percent for the quarter is the lowest rate since a 2.5 percent rate in third-quarter 2001. Fort Collins/Loveland's rate of 2.9 percent is lowest in the state and the lowest since a 2.6 percent rate in first-quarter 2001.

Industry experts say a main reason for the rental surge — besides the arrival of college students — is the aftermath of the housing bubble, which left people in mortgage distress or unable to secure loans to buy.

With vacancies shrinking — the statewide third-quarter rate was 5.5 percent — rents are expected to continue climbing.

Apartment vacancies fall, rents rise Northern Colo Business Report, Dec 2

December 2, 2010 --

DENVER - Apartment vacancies fell to recent lows in most of Northern Colorado as rents rose to new highs during the third quarter of 2010, according to a report released Thursday by the state's Division of Housing.

The lowest metro-area vacancy rate in the state was in Fort Collins, where the rate dropped to 2.8 percent from 5.5 percent, year-over-year - the lowest levels reported since first-quarter 2001, when the vacancy rate was 2.6 percent. Greeley's third-quarter vacancy rate was 3.9 percent, down from 7.4 percent a year ago, also the lowest since third-quarter 2001's 2.5 percent.

Apartment rents increase in Colorado Denver Business Journal, Dec 2

The continuing lack of major new homebuilding, as well as apartment development, helped apartment vacancies to drop and rental rates to rise in the third quarter in Colorado, according to a state housing division study released Thursday.

Statewide, the vacancy rate for apartments decreased to 5.5 percent from 6.6 percent from the first quarter. Average rent rose to $871.78 a month from $840.44 during the same period.

“The economy as well as the inability, combined with lack of desire, to buy new homes has caused home ownership rates to change in favor of rental housing. … There’s also been a lack of new supply of apartment units,” said Terrance Hunt, principal at the Denver office of Atlanta-based Apartment Realty Advisors Inc.

Apartments filling up, rents on the rise, new report shows Colo Springs Gazette, Dec 2.

Finding an apartment continued to be difficult over the past few months in the Pikes Peak region. Now, rents are on the rise, too.

The vacancy rate for apartments in Colorado Springs and surrounding areas was 6.6 percent in the third quarter of this year — up from 5.8 percent in the second quarter, but down sharply from 8.7 percent during the third quarter of 2009 and down from double-digits several years ago, according to a report released Thursday by the Colorado Division of Housing.

Rents rise in Colorado as vacancies fall Denver Post, Dec 3

5.5% state apartment rate lowest since '01 Insiderealestatenews.com

The last time that rates were lower was in the first quarter of 2001, when they stood at 4.3 percent, shows a report released today by the Colorado Division of Housing. And the last third quarter when the vacancy rate was lower was in 1999, when it stood at 3.7 percent. Vacancies fell in all Front Range metro areas except Loveland, although they did rise in Grand Junction and in several mountain areas including Summit County, Eagle County and Glenwood Springs.

The third-quarter vacancy rate of 5.5 percent reflects almost a 26 percent drop from the rate of 7.4 percent in the third-quarter of 2009.

“I think rates are going to continue to fall,” said Gordon Von Stroh, a University of Denver business professor and the author of the report, which in addition to the housing division, is sponsored by Apartment Realty Advisors and Pierce-Eislen. “Maybe not in the fourth quarter of the first quarter of 2011, but I think they will be lower in 2011. That will be especially true if we see any improvement in the job situation. Even though we’ve seen some improvement in our job situation, the unemployment rate remains relatively high.”

Even a moderate increase in demand could lead to an “extreme shortage” of rental units in the not-to-distant future, said Terrance Hunt, a broker with Apartment Realty Advisors.

Fort Collins and Greeley rank No. 1 and 2 in tightest rental vacancy rates in the state, according to a third-quarter report released today by the Colorado Division of Housing.

Greeley's vacancy rate of 3.9 percent for the quarter is the lowest rate since a 2.5 percent rate in third-quarter 2001. Fort Collins/Loveland's rate of 2.9 percent is lowest in the state and the lowest since a 2.6 percent rate in first-quarter 2001.

Industry experts say a main reason for the rental surge — besides the arrival of college students — is the aftermath of the housing bubble, which left people in mortgage distress or unable to secure loans to buy.

With vacancies shrinking — the statewide third-quarter rate was 5.5 percent — rents are expected to continue climbing.

Apartment vacancies fall, rents rise Northern Colo Business Report, Dec 2

December 2, 2010 --

DENVER - Apartment vacancies fell to recent lows in most of Northern Colorado as rents rose to new highs during the third quarter of 2010, according to a report released Thursday by the state's Division of Housing.

The lowest metro-area vacancy rate in the state was in Fort Collins, where the rate dropped to 2.8 percent from 5.5 percent, year-over-year - the lowest levels reported since first-quarter 2001, when the vacancy rate was 2.6 percent. Greeley's third-quarter vacancy rate was 3.9 percent, down from 7.4 percent a year ago, also the lowest since third-quarter 2001's 2.5 percent.

Apartment rents increase in Colorado Denver Business Journal, Dec 2

The continuing lack of major new homebuilding, as well as apartment development, helped apartment vacancies to drop and rental rates to rise in the third quarter in Colorado, according to a state housing division study released Thursday.

Statewide, the vacancy rate for apartments decreased to 5.5 percent from 6.6 percent from the first quarter. Average rent rose to $871.78 a month from $840.44 during the same period.

“The economy as well as the inability, combined with lack of desire, to buy new homes has caused home ownership rates to change in favor of rental housing. … There’s also been a lack of new supply of apartment units,” said Terrance Hunt, principal at the Denver office of Atlanta-based Apartment Realty Advisors Inc.

Apartments filling up, rents on the rise, new report shows Colo Springs Gazette, Dec 2.

Finding an apartment continued to be difficult over the past few months in the Pikes Peak region. Now, rents are on the rise, too.

The vacancy rate for apartments in Colorado Springs and surrounding areas was 6.6 percent in the third quarter of this year — up from 5.8 percent in the second quarter, but down sharply from 8.7 percent during the third quarter of 2009 and down from double-digits several years ago, according to a report released Thursday by the Colorado Division of Housing.

Rents rise in Colorado as vacancies fall Denver Post, Dec 3

5.5% state apartment rate lowest since '01 Insiderealestatenews.com

The last time that rates were lower was in the first quarter of 2001, when they stood at 4.3 percent, shows a report released today by the Colorado Division of Housing. And the last third quarter when the vacancy rate was lower was in 1999, when it stood at 3.7 percent. Vacancies fell in all Front Range metro areas except Loveland, although they did rise in Grand Junction and in several mountain areas including Summit County, Eagle County and Glenwood Springs.

The third-quarter vacancy rate of 5.5 percent reflects almost a 26 percent drop from the rate of 7.4 percent in the third-quarter of 2009.

“I think rates are going to continue to fall,” said Gordon Von Stroh, a University of Denver business professor and the author of the report, which in addition to the housing division, is sponsored by Apartment Realty Advisors and Pierce-Eislen. “Maybe not in the fourth quarter of the first quarter of 2011, but I think they will be lower in 2011. That will be especially true if we see any improvement in the job situation. Even though we’ve seen some improvement in our job situation, the unemployment rate remains relatively high.”

Even a moderate increase in demand could lead to an “extreme shortage” of rental units in the not-to-distant future, said Terrance Hunt, a broker with Apartment Realty Advisors.

Friday, December 10, 2010

Single-family rental vacancies fall to new lows

Click here for full report.

Vacancies in for-rent condos, single-family homes, and other small properties across metro Denver fell year-over-year to 2.9 percent during 2010’s third quarter. According to a report released Tuesday by the Colorado Division of Housing, the vacancy rate was 4.6 percent during the third quarter of 2009, and was 3.8 percent during the second quarter of this year. The third quarter’s vacancy rate is the lowest third-quarter rate reported since the report was started in 2001.

The average number of days on the market for single-family rentals and similar properties fell from 41.0 days during the third quarter of 2009 to 36.0 days during the third quarter of 2010. The number of days on the market also fell from this year’s second quarter average of 47.2 days. The third quarter’s average is the lowest average since the report began tracking days on the market in 2004.

The lowest vacancy rates were found in the Boulder/Broomfield area and in Jefferson County where average vacancy rates were 1.4 percent and 1.8 percent, respectively. The highest vacancy rate was found in Douglas county where the rate was 5.2 percent.

Vacancy rates for all counties surveyed were: Adams, 3.4 percent; Arapahoe, 3.1 percent; Boulder/Broomfield, 1.4 percent; Denver, 3.2 percent; Douglas, 5.2 percent; and Jefferson, 1.8 percent.

In spite of increasing demand for units, average rents fell in some counties.

The average rent for single-family and similar properties in the metro area fell year-over-year to $1041.05 during 2010’s third quarter, falling from 2009’s third-quarter rate of $1059.77. The third quarter’s average rent was up from this year’s second-quarter average rent of $1027.78. Metro-wide, rent per square foot also fell slightly, year-over-year, falling from 85 cents during the third quarter of 2009, to 83 cents during the third quarter of this year.

Average rents for all counties were: Adams, $1121.34; Arapahoe, $1015.71; Boulder/Broomfield, $1635.90; Denver, $969.47; Douglas, $1404.44; and Jefferson, $981.09.

The Colorado Statewide Vacancy and Rent Study is released each quarter by the Colorado Division of Housing. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type.

Vacancies in for-rent condos, single-family homes, and other small properties across metro Denver fell year-over-year to 2.9 percent during 2010’s third quarter. According to a report released Tuesday by the Colorado Division of Housing, the vacancy rate was 4.6 percent during the third quarter of 2009, and was 3.8 percent during the second quarter of this year. The third quarter’s vacancy rate is the lowest third-quarter rate reported since the report was started in 2001.

The average number of days on the market for single-family rentals and similar properties fell from 41.0 days during the third quarter of 2009 to 36.0 days during the third quarter of 2010. The number of days on the market also fell from this year’s second quarter average of 47.2 days. The third quarter’s average is the lowest average since the report began tracking days on the market in 2004.

The lowest vacancy rates were found in the Boulder/Broomfield area and in Jefferson County where average vacancy rates were 1.4 percent and 1.8 percent, respectively. The highest vacancy rate was found in Douglas county where the rate was 5.2 percent.

Vacancy rates for all counties surveyed were: Adams, 3.4 percent; Arapahoe, 3.1 percent; Boulder/Broomfield, 1.4 percent; Denver, 3.2 percent; Douglas, 5.2 percent; and Jefferson, 1.8 percent.

In spite of increasing demand for units, average rents fell in some counties.

The average rent for single-family and similar properties in the metro area fell year-over-year to $1041.05 during 2010’s third quarter, falling from 2009’s third-quarter rate of $1059.77. The third quarter’s average rent was up from this year’s second-quarter average rent of $1027.78. Metro-wide, rent per square foot also fell slightly, year-over-year, falling from 85 cents during the third quarter of 2009, to 83 cents during the third quarter of this year.

Average rents for all counties were: Adams, $1121.34; Arapahoe, $1015.71; Boulder/Broomfield, $1635.90; Denver, $969.47; Douglas, $1404.44; and Jefferson, $981.09.

The Colorado Statewide Vacancy and Rent Study is released each quarter by the Colorado Division of Housing. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type.

Thursday, December 2, 2010

Beige Book: Commercial real estate "expected to improve"

December's Beige Book for the Federal Reserve District 10, which includes Colorado, noted that construction "remains sluggish," while vacancy rates in commercial real estate is expected to lessen.

In banking:

Residential and commercial construction remained sluggish in October and November, while commercial real estate sales and vacancy rates were expected to improve in coming months. After contracting with the end of the homebuyers tax credit program, a few District homebuilders noted a slight uptick in housing starts. Still, District home prices edged down and sales continued to fall heading into the typical winter lull in home buying activity. District contacts noted that the starter home market remained active, but long lead times for selling mid- and upper-priced homes were boosting inventories and limiting "move-up" opportunities. Mortgage loan activity rose as homeowners refinanced existing mortgages to lower payments and shorten terms. Commercial construction activity declined and was expected to remain weak over the next three months. District commercial real estate contacts reported little change in vacancy rates, absorption rates, and prices. Some firms, however, reported an uptick in sales and expected vacancy rates to edge down in coming months.

In banking:

Bankers reported stable loan demand, increased deposits, and an improved outlook for loan quality in the recent survey period. Overall loan demand continued to hold steady as demand for commercial and industrial loans, commercial real estate loans, and consumer installment loans remained stable. In contrast, bankers reported stronger demand for residential real estate loans. Compared to the previous survey, credit standards remained unchanged in all major loan categories. Loan quality was essentially unchanged compared to one year ago. Bankers, however, expected loan quality to improve over the next six months. Deposits, especially for transaction accounts and savings accounts, increased after having been flat since late last year.

Labels:

beige book,

colorado,

division of housing,

economics,

federal reserve

Colorado apartment vacancies fall across Front Range, rents rise

Click here for the full report.

Apartment vacancies fell across Colorado’s Front Range as rents rose during the third quarter of 2010, signaling a continued tightening of the rental market and suggesting future rent increases. According to a report released Thursday by the Colorado Division of Housing, from the third quarter of 2009 to the third quarter of this year, vacancies fell in all Front Range metro areas except Loveland, although vacancies increased in Grand Junction and in several mountain areas including Summit County, Eagle County and Glenwood Springs.

The statewide vacancy rate for 2010’s third quarter was 5.5 percent, falling from a rate of 6.6 percent a year earlier. In Colorado Springs, the vacancy rate fell to the lowest third-quarter rate in nine years, to 6.6 percent. The lowest metro-wide vacancy rate was found in Fort Collins where the rate dropped to 2.8 percent from 5.5 percent, year-over-year. In Fort Collins, vacancies are at the lowest levels reported since 2001 when the first-quarter vacancy rate was 2.6 percent. Vacancies rose from 7.5 percent to 7.9 percent in Grand Junction, year-over-year.

Vacancy rates dropped in many smaller communities such as Alamosa and Montrose, but rates also rose in Eagle County, rising from 3.5 percent to 8.9 percent, year-over-year, for the third quarter, and the rate also rose slightly in Summit county during the same period from 5.0 to 5.2 percent.

The metro Denver apartment vacancy rate, measured in a separate survey released last month, also fell year-over-year, dropping from 7.4 percent to 5.3 percent.

“Generally speaking, rental markets are continuing the trend toward tighter markets that we’ve seen in recent quarters,” said Gordon Von Stroh, a professor of business at the University of Denver and the report’s author. “This isn’t the case in every single market, but given how vacancies are declining significantly in Fort Collins, Greeley, Colorado Springs and other areas as well, it’s clear that empty units are now relatively scarce and that increases in rent levels are likely to follow.”

Median rents rose across the state as vacancies fell. With the exception of Pueblo, where median rents were flat, the median rent rose in all Front Range Metro areas. The median rents in Colorado Springs and in the Fort Collins/Loveland regions rose to new highs of $700.90 and $856.53, respectively.

Among Colorado’s metropolitan areas, only Grand Junction reported a decline in the median rent with a year-over-year drop from $680.37 to $674.08 for the third quarter. Median rents also fell in several Western Slope and mountain regions, although median rents increased in Eagle County and Summit County in spite of increases in vacancy rates.

The metro Denver median rent, measured in a separate survey, was $856.64 for the third quarter.

Apartment vacancies fell across Colorado’s Front Range as rents rose during the third quarter of 2010, signaling a continued tightening of the rental market and suggesting future rent increases. According to a report released Thursday by the Colorado Division of Housing, from the third quarter of 2009 to the third quarter of this year, vacancies fell in all Front Range metro areas except Loveland, although vacancies increased in Grand Junction and in several mountain areas including Summit County, Eagle County and Glenwood Springs.

The statewide vacancy rate for 2010’s third quarter was 5.5 percent, falling from a rate of 6.6 percent a year earlier. In Colorado Springs, the vacancy rate fell to the lowest third-quarter rate in nine years, to 6.6 percent. The lowest metro-wide vacancy rate was found in Fort Collins where the rate dropped to 2.8 percent from 5.5 percent, year-over-year. In Fort Collins, vacancies are at the lowest levels reported since 2001 when the first-quarter vacancy rate was 2.6 percent. Vacancies rose from 7.5 percent to 7.9 percent in Grand Junction, year-over-year.

Vacancy rates dropped in many smaller communities such as Alamosa and Montrose, but rates also rose in Eagle County, rising from 3.5 percent to 8.9 percent, year-over-year, for the third quarter, and the rate also rose slightly in Summit county during the same period from 5.0 to 5.2 percent.

The metro Denver apartment vacancy rate, measured in a separate survey released last month, also fell year-over-year, dropping from 7.4 percent to 5.3 percent.

“Generally speaking, rental markets are continuing the trend toward tighter markets that we’ve seen in recent quarters,” said Gordon Von Stroh, a professor of business at the University of Denver and the report’s author. “This isn’t the case in every single market, but given how vacancies are declining significantly in Fort Collins, Greeley, Colorado Springs and other areas as well, it’s clear that empty units are now relatively scarce and that increases in rent levels are likely to follow.”

Median rents rose across the state as vacancies fell. With the exception of Pueblo, where median rents were flat, the median rent rose in all Front Range Metro areas. The median rents in Colorado Springs and in the Fort Collins/Loveland regions rose to new highs of $700.90 and $856.53, respectively.

Among Colorado’s metropolitan areas, only Grand Junction reported a decline in the median rent with a year-over-year drop from $680.37 to $674.08 for the third quarter. Median rents also fell in several Western Slope and mountain regions, although median rents increased in Eagle County and Summit County in spite of increases in vacancy rates.

The metro Denver median rent, measured in a separate survey, was $856.64 for the third quarter.

Labels:

economics,

press releases,

rental housing,

vacancy surveys

Wednesday, December 1, 2010

Statewide vacancy surveys coming this Thursday

Be sure to check back with the Housing Blog tomorrow morning. I'll be posting the latest statewide vacancy and rent data for Colorado.

Home sale closings fall across Colorado, median home prices mixed

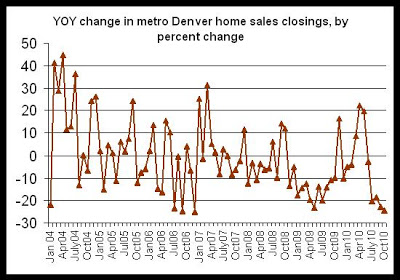

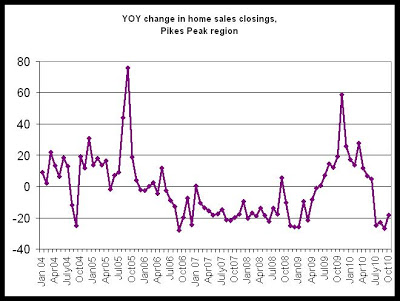

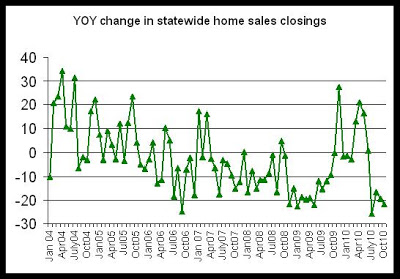

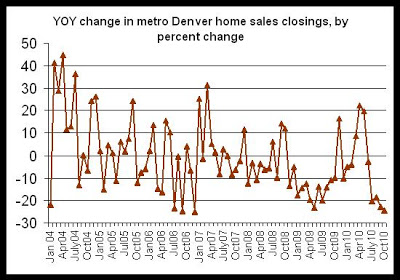

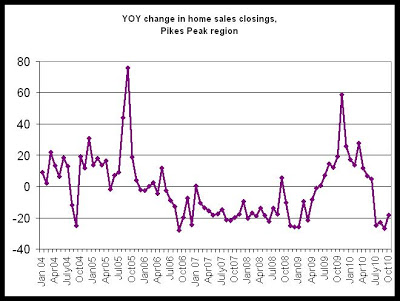

The number of metro Denver home sales closed fell 24.6 percent in October, making October the fifth month in row that home sales have fallen year-over-year. According to new home sales data released by the Colorado Association of REALTORS, the number of closings also fell statewide and in the Pikes Peak region with year-over-year drops of 21.8 percent and 18.4 percent, respectively.

The declines in home sales closings reflects the end of the home buyer tax credits that stimulated home buying during late 2009 and early 2010. The tax credits ended in April 2010, and initially, any home under contract by April 30 needed to close by June 30, but additional legislation extended the closing deadline so that loans closed by September 30 would still be eligible. In spite of the change in legislation, it is clear that sales activity falls off considerably following the June 30 deadline, and year-over-year declines since July has often been as much as 20 percent.

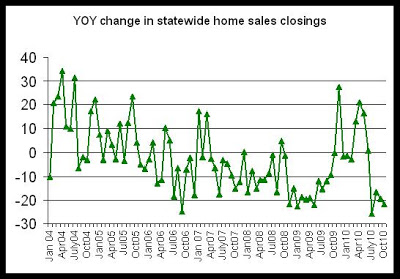

The first graph shows the year-over-year changes in the number of closings in the metro Denver area. The months of June through October have all shown negative movement in closings compared year over year. Similarly, in the second graph, which shows year-over-year changes in closings in the Pikes Peak region, July, August, September and October all show drops in closings as well.

The third graph, which shows closings statewide, shows that a similar trend applies statewide. All large metropolitan areas reported year-over-year drops in transactions, including Fort Collins, Greeley, Pueblo and Grand Junction.

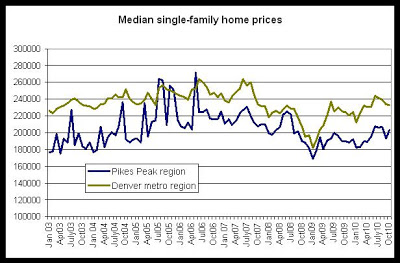

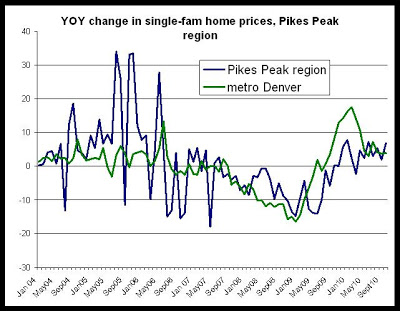

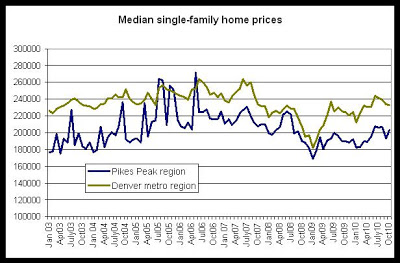

Median home prices showed gains, however. The fourth graph shows that in both the Pikes Peak region and in the metro Denver area, median home prices were up in October compared to both October of 2008 and October of 2009.

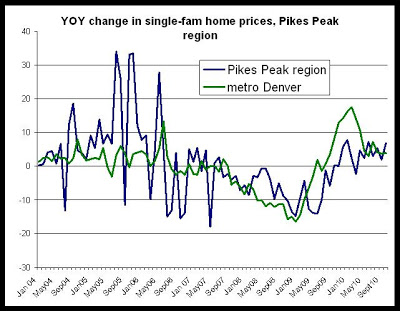

In the fifth graph, we see that year-over-year changes in median home prices have been positive since July 2009 in metro Denver, and have also been positive since April 2010 in the Pikes Peak region. No downward trend has been forming in either metro Denver or in the Pikes Peak region. With fewer buyers, however, the recent declines in closings are likely to put downward pressure on prices.

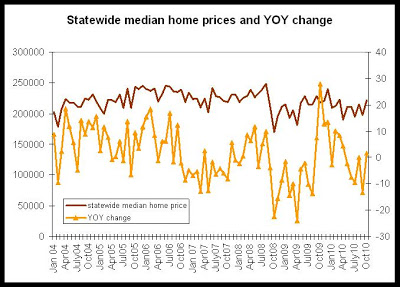

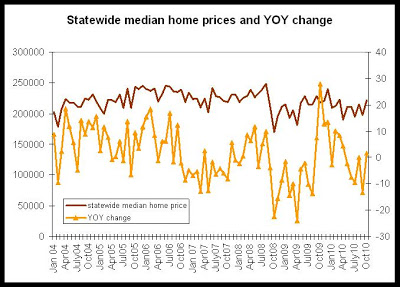

In the final graph, we see that statewide, growth in median home prices has been less strong. Outside of metro Denver and the Pikes Peak region, growth has been considerably smaller, with Fort Collins, Greeley, Grand Junction and Pueblo all showing year-over-year drops in prices.

The declines in home sales closings reflects the end of the home buyer tax credits that stimulated home buying during late 2009 and early 2010. The tax credits ended in April 2010, and initially, any home under contract by April 30 needed to close by June 30, but additional legislation extended the closing deadline so that loans closed by September 30 would still be eligible. In spite of the change in legislation, it is clear that sales activity falls off considerably following the June 30 deadline, and year-over-year declines since July has often been as much as 20 percent.

The first graph shows the year-over-year changes in the number of closings in the metro Denver area. The months of June through October have all shown negative movement in closings compared year over year. Similarly, in the second graph, which shows year-over-year changes in closings in the Pikes Peak region, July, August, September and October all show drops in closings as well.

The third graph, which shows closings statewide, shows that a similar trend applies statewide. All large metropolitan areas reported year-over-year drops in transactions, including Fort Collins, Greeley, Pueblo and Grand Junction.

Median home prices showed gains, however. The fourth graph shows that in both the Pikes Peak region and in the metro Denver area, median home prices were up in October compared to both October of 2008 and October of 2009.

In the fifth graph, we see that year-over-year changes in median home prices have been positive since July 2009 in metro Denver, and have also been positive since April 2010 in the Pikes Peak region. No downward trend has been forming in either metro Denver or in the Pikes Peak region. With fewer buyers, however, the recent declines in closings are likely to put downward pressure on prices.

In the final graph, we see that statewide, growth in median home prices has been less strong. Outside of metro Denver and the Pikes Peak region, growth has been considerably smaller, with Fort Collins, Greeley, Grand Junction and Pueblo all showing year-over-year drops in prices.

Labels:

CAR,

closings,

colorado springs,

denver metro,

economics,

home prices,

pikes peak

Subscribe to:

Posts (Atom)