Thursday, March 31, 2011

A new domain for the Division of Housing blog

Please note above that the web address for this site has been simplified to www.divisionofhousing.com.

Employment: Regional Comparisons and Impacts on Housing

Total employment in the state continues to fall, as noted last week. Employment trends in different regions of the state, however, so this entry looks at which regions of the state have the highest unemployment rates, and which regions have recovered the most in their labor markets.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

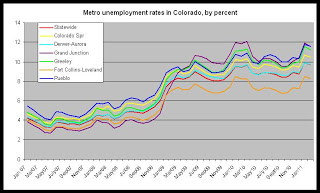

The first graph compares unemployment rates in Colorado's metro areas:

The regional unemployment rates for February 2011 are:

Colorado Springs, 10.5 percent

Denver-Aurora, 9.7 percent

Fort Collins-Loveland, 8.3 percent

Grand Junction, 11.5 percent

Greeley, 11.2 percent

Pueblo, 11.6 percent

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force, so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2011 employment totals:

Colorado Springs MSA, 9.3 percent

Denver-Aurora MSA, 8.4 percent

Fort Collins-Loveland MSA, 7.8 percent

Grand Junction MSA, 14.1 percent

Greeley MSA 10.1 percent

Pueblo MSA, 6.1 percent

Pueblo has only fallen 6.1 percent from peak levels, although Pueblo already had a relatively weak job market during the peak period, which would explain why Pueblo continues to be among the areas with the highest unemployment rates. The Fort Collins Loveland area, on the other hand, is now only 7.8 percent below its peak, and is also the metro area with the lowest unemployment rate.

Impact on Housing

The metro areas with the most job growth should generally also be the areas with the most demand for housing. We do see this reflected to a certain extent in the apartment vacancy data.

The Fort Collins-Loveland area had the lowest vacancy rate of any region during the fourth quarter of 2010, with a rate of 4.1 percent. The metro Denver area had the second-lowest vacancy rate of 5.5 percent. This coincides with the fact that the regional metro unemployment rates are lowest in the Fort Collins Loveland area and in the metro Denver area. Likewise, the areas with the highest unemployment rates, Pueblo and Grand Junction, have the highest metro-wide vacancy rates of 10.2 percent and 7.5 percent, respectively.

By this reasoning, Greeley, which has a relatively high unemployment rate, should also have a high vacancy rate. However, we find that Greeley has a relatively low rate of 5.1 percent.

To explain this, some industry professionals have suggested that rental housing has benefited from the high demand in the Fort Collins-Loveland area. That is, as rents have increased in the Fort Collins-Loveland area, renters have looked to the Greeley area for more affordable rental housing. This may in turn be driving down vacancy rates in spite of a lack of job growth within the Greeley area itself.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

The first graph compares unemployment rates in Colorado's metro areas:

The regional unemployment rates for February 2011 are:

Colorado Springs, 10.5 percent

Denver-Aurora, 9.7 percent

Fort Collins-Loveland, 8.3 percent

Grand Junction, 11.5 percent

Greeley, 11.2 percent

Pueblo, 11.6 percent

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force, so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2011 employment totals:

Colorado Springs MSA, 9.3 percent

Denver-Aurora MSA, 8.4 percent

Fort Collins-Loveland MSA, 7.8 percent

Grand Junction MSA, 14.1 percent

Greeley MSA 10.1 percent

Pueblo MSA, 6.1 percent

Pueblo has only fallen 6.1 percent from peak levels, although Pueblo already had a relatively weak job market during the peak period, which would explain why Pueblo continues to be among the areas with the highest unemployment rates. The Fort Collins Loveland area, on the other hand, is now only 7.8 percent below its peak, and is also the metro area with the lowest unemployment rate.

Impact on Housing

The metro areas with the most job growth should generally also be the areas with the most demand for housing. We do see this reflected to a certain extent in the apartment vacancy data.

The Fort Collins-Loveland area had the lowest vacancy rate of any region during the fourth quarter of 2010, with a rate of 4.1 percent. The metro Denver area had the second-lowest vacancy rate of 5.5 percent. This coincides with the fact that the regional metro unemployment rates are lowest in the Fort Collins Loveland area and in the metro Denver area. Likewise, the areas with the highest unemployment rates, Pueblo and Grand Junction, have the highest metro-wide vacancy rates of 10.2 percent and 7.5 percent, respectively.

By this reasoning, Greeley, which has a relatively high unemployment rate, should also have a high vacancy rate. However, we find that Greeley has a relatively low rate of 5.1 percent.

To explain this, some industry professionals have suggested that rental housing has benefited from the high demand in the Fort Collins-Loveland area. That is, as rents have increased in the Fort Collins-Loveland area, renters have looked to the Greeley area for more affordable rental housing. This may in turn be driving down vacancy rates in spite of a lack of job growth within the Greeley area itself.

Labels:

economics,

employment,

metro areas,

unemployment,

vacancy surveys

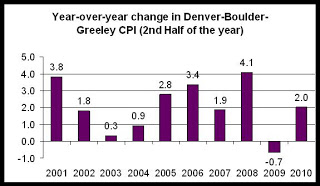

Inflation adjusted rents in Colorado: 2000-2010

In general, market rents across the Colorado have increased consistently over the past decade. As can be seen here in this analysis of median rents and average rents, both median rents and average rents show a sustained increase over the past decade.

When adjusted for inflation, however, average rents in several metro areas of the state have decreased over the past decade.

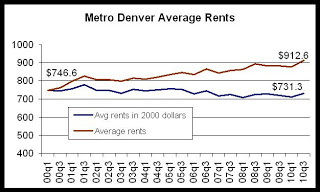

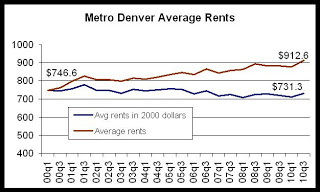

The first chart shows, as an example, the divergence between the average rent, in nominal dollars and in inflation-adjusted dollars, in the Denver metro area over the past decade.

The graph shows us that if the value of the dollar were constant (and all other things being equal), a renter would only need 731 dollars in 2010 to rent an apartment that he or she could have rented in 2000 for 746 dollars.

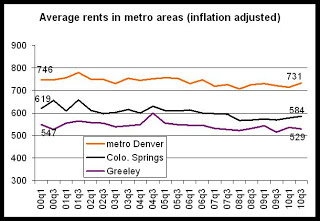

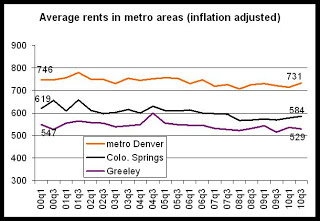

In the second graph, we see the metro areas in the state that have experienced losses in the inflation-adjusted average rent over the past decade. Metro Denver, the Greeley area and the Colorado Springs area had a lower average rent during the third quarter of 2010 than during the first quarter of 2000. In nominal terms, all of these areas have higher average rents now than was the case a decade ago, but inflation brings the change over the past decade, in real dollars, into negative territory.

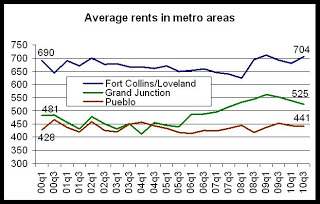

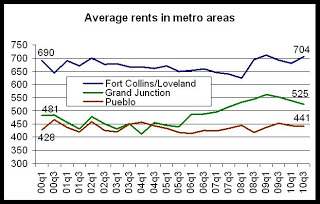

The third graph shows the metro areas that have experienced increases in the average rents even after adjusting for inflation. These areas include the Fort Collins-Loveland area, the Grand Junction Area and the Pueblo area.

The increase in the Fort Collins-Loveland area further reinforces recent conclusions that Larimer County enjoys one of the strongest apartment markets in the state.

The Grand Junction situation is interesting since the average rent has been decreasing in real terms since the first quarter of 2009. The Grand Junction area experienced a substantial increase in rents during the oil and gas boom of the last decade, but has come down in both real and in nominal terms since 2009.

These figures are notable since they provide some additional insight into the profitability of rental housing at the present time. While the multifamily industry expects significant increases in rents over the next several years, many property owners are still in the position to making up for several years of falling rents in inflation-adjusted terms.

Owners have noted in many cases that rents have in fact become more affordable over the past decade. This is indeed true, all things being equal, but as statewide household income data has shown, household incomes have been falling faster than average rents over the past decade.

This phenomenon in inflation-adjusted rents is also worth noting because it helps to explain why so little new construction in multifamily rental housing has taken place in recent years: average rents have been falling in inflation-adjusted terms in many areas, thus providing a disincentive for new development.

Note: In the analysis above, I've used average rent data from the Division of Housing's vacancy and rent surveys, and I've adjusted them to the Denver-Boulder-Greeley CPI with a base period of the first half of 2000. Since the Denver-Boulder-Greeley CPI is only issued twice each year, I've adjusted the first quarter's average rent to the CPI for the first half of the year, and I've adjusted the third quarter's average rent to the CPI for the second half of the year.

When adjusted for inflation, however, average rents in several metro areas of the state have decreased over the past decade.

The first chart shows, as an example, the divergence between the average rent, in nominal dollars and in inflation-adjusted dollars, in the Denver metro area over the past decade.

The graph shows us that if the value of the dollar were constant (and all other things being equal), a renter would only need 731 dollars in 2010 to rent an apartment that he or she could have rented in 2000 for 746 dollars.

In the second graph, we see the metro areas in the state that have experienced losses in the inflation-adjusted average rent over the past decade. Metro Denver, the Greeley area and the Colorado Springs area had a lower average rent during the third quarter of 2010 than during the first quarter of 2000. In nominal terms, all of these areas have higher average rents now than was the case a decade ago, but inflation brings the change over the past decade, in real dollars, into negative territory.

The third graph shows the metro areas that have experienced increases in the average rents even after adjusting for inflation. These areas include the Fort Collins-Loveland area, the Grand Junction Area and the Pueblo area.

The increase in the Fort Collins-Loveland area further reinforces recent conclusions that Larimer County enjoys one of the strongest apartment markets in the state.

The Grand Junction situation is interesting since the average rent has been decreasing in real terms since the first quarter of 2009. The Grand Junction area experienced a substantial increase in rents during the oil and gas boom of the last decade, but has come down in both real and in nominal terms since 2009.

These figures are notable since they provide some additional insight into the profitability of rental housing at the present time. While the multifamily industry expects significant increases in rents over the next several years, many property owners are still in the position to making up for several years of falling rents in inflation-adjusted terms.

Owners have noted in many cases that rents have in fact become more affordable over the past decade. This is indeed true, all things being equal, but as statewide household income data has shown, household incomes have been falling faster than average rents over the past decade.

This phenomenon in inflation-adjusted rents is also worth noting because it helps to explain why so little new construction in multifamily rental housing has taken place in recent years: average rents have been falling in inflation-adjusted terms in many areas, thus providing a disincentive for new development.

Note: In the analysis above, I've used average rent data from the Division of Housing's vacancy and rent surveys, and I've adjusted them to the Denver-Boulder-Greeley CPI with a base period of the first half of 2000. Since the Denver-Boulder-Greeley CPI is only issued twice each year, I've adjusted the first quarter's average rent to the CPI for the first half of the year, and I've adjusted the third quarter's average rent to the CPI for the second half of the year.

Labels:

cpi,

economics,

inflation,

metro areas,

rent levels

Construction jobs down 35 percent from peak, hospitality jobs grow

As we showed last week, overall employment in Colorado continues to fall from its 2008 peak. The unemployment rate has now exceeded the national rate, and statewide employment is now down more than 220,000 jobs from the peak.

At the Division of Housing, we keep an eye on industries that are often connected to affordable housing and real estate trends.

Today, we'll look at job creation in the following industries: construction, leisure and hospitality, and retail.

Construction is a key indicator since it is connected to housing production. The construction jobs examined below include non-residential construction.

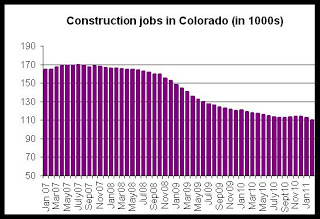

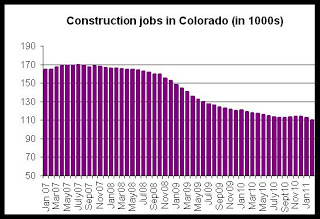

In the first chart, it is clear that, as of February 2011, construction jobs continue to be well below the 2007 peak. Since construction jobs peaked during July 2007, construction jobs have fallen 35 percent, or 60,000 jobs, down to post-recession low of 109,000 jobs. From February 2010 to February 2011, construction jobs have fallen 7.5 percent, or 8,900 jobs.

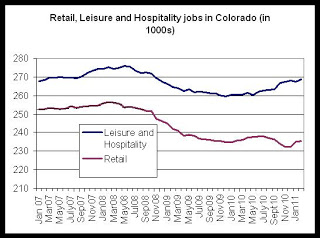

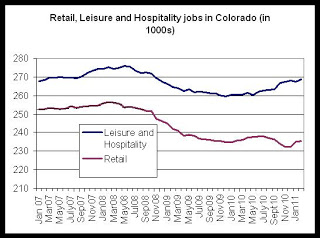

Retail jobs, and jobs in the leisure and hospitality industry are key factors in the rural resort economies, and are also important statewide as sources of income for low-income households. In the chart below, we see that retail jobs have been largely flat since early 2010, while remaining well below the 2008 peak in retail jobs.

Leisure and hospitality jobs, on the other hand, have recovered somewhat since early 2010.

In leisure and hospitality, total jobs are now down 2.5 percent, or about 900 jobs, from the June 2008 peak. From February 2010 to February 2011, total jobs increased 3.1 percent, or about 8,000 jobs.

In retail, however, jobs have been flat since February 2010. From February of last year to February 2011, total employment in retail is down about 400 jobs (is essentially flat). Since the February 2008 peak, retail jobs are down 8.2 percent, or about 19,000 jobs.

At the Division of Housing, we keep an eye on industries that are often connected to affordable housing and real estate trends.

Today, we'll look at job creation in the following industries: construction, leisure and hospitality, and retail.

Construction is a key indicator since it is connected to housing production. The construction jobs examined below include non-residential construction.

In the first chart, it is clear that, as of February 2011, construction jobs continue to be well below the 2007 peak. Since construction jobs peaked during July 2007, construction jobs have fallen 35 percent, or 60,000 jobs, down to post-recession low of 109,000 jobs. From February 2010 to February 2011, construction jobs have fallen 7.5 percent, or 8,900 jobs.

Retail jobs, and jobs in the leisure and hospitality industry are key factors in the rural resort economies, and are also important statewide as sources of income for low-income households. In the chart below, we see that retail jobs have been largely flat since early 2010, while remaining well below the 2008 peak in retail jobs.

Leisure and hospitality jobs, on the other hand, have recovered somewhat since early 2010.

In leisure and hospitality, total jobs are now down 2.5 percent, or about 900 jobs, from the June 2008 peak. From February 2010 to February 2011, total jobs increased 3.1 percent, or about 8,000 jobs.

In retail, however, jobs have been flat since February 2010. From February of last year to February 2011, total employment in retail is down about 400 jobs (is essentially flat). Since the February 2008 peak, retail jobs are down 8.2 percent, or about 19,000 jobs.

Labels:

economics,

employment,

leisure and hospitality,

retail,

unemployment

Housing News Digest, March 31

ECB hiking before Fed would be new in a tightening cycle

FRANKFURT, March 31 (Reuters) - After following the Federal Reserve's lead for over a decade, the European Central Bank is poised to launch a series of interest rate hikes before the U.S. central bank for the first time in the ECB's history.

The change from the traditional pattern reflects the ECB's greater preoccupation with inflation pressures, as well as its higher level of discomfort with the emergency bond-buying programmes run by central banks.

What's the matter with Colorado?

The old frontier isn’t what it used to be. In the year to February, the Mountain West accounted for just 1.8% of national job growth, the worst performance of any Census region. Employment rose over four times as fast in the states along the Pacific coast. Three Rocky Mountain states—Idaho, Colorado, and New Mexico—posted their highest unemployment rates of the recovery in February. Residents are wondering what’s gone wrong.

Shadow Inventory Drops but Supply to Remain High for Extended Period

While the total volume of properties in the shadows dropped, CoreLogic says the amount of time it would currently take to clear this hidden inventory remains the same as a year ago - nine months’ worth of supply. The company says the unchanged supply calculation is due to the slower pace of home sales the industry has experienced in recent months.

Inflation pressures grow on Main Street

Still reeling from the recession, most mom-and-pop shops have held off on raising prices for fear of losing more customers. But business is finally starting to pick up, and after years of being squeezed by cost increases, a growing number of small businesses are hiking their prices.

Lawler: The “Shrill Cry” from Lobbyists on QRM

For ABS backed by QRMs, the DFA provides for an exemption of the risk-retention rule. For folks who don’t remember, the “inclusion” of an exemption for QRMs was in the act because of heavy lobbying by financial institutions and housing-related trade groups, and it put regulators in the uncomfortable position of trying to decide what types of mortgages were so inherently “low risk” that they should/could be excluded from the rule designed to ensure that ABS issuers had “skin in the game.”

FRANKFURT, March 31 (Reuters) - After following the Federal Reserve's lead for over a decade, the European Central Bank is poised to launch a series of interest rate hikes before the U.S. central bank for the first time in the ECB's history.

The change from the traditional pattern reflects the ECB's greater preoccupation with inflation pressures, as well as its higher level of discomfort with the emergency bond-buying programmes run by central banks.

What's the matter with Colorado?

The old frontier isn’t what it used to be. In the year to February, the Mountain West accounted for just 1.8% of national job growth, the worst performance of any Census region. Employment rose over four times as fast in the states along the Pacific coast. Three Rocky Mountain states—Idaho, Colorado, and New Mexico—posted their highest unemployment rates of the recovery in February. Residents are wondering what’s gone wrong.

Shadow Inventory Drops but Supply to Remain High for Extended Period

While the total volume of properties in the shadows dropped, CoreLogic says the amount of time it would currently take to clear this hidden inventory remains the same as a year ago - nine months’ worth of supply. The company says the unchanged supply calculation is due to the slower pace of home sales the industry has experienced in recent months.

Inflation pressures grow on Main Street

Still reeling from the recession, most mom-and-pop shops have held off on raising prices for fear of losing more customers. But business is finally starting to pick up, and after years of being squeezed by cost increases, a growing number of small businesses are hiking their prices.

Lawler: The “Shrill Cry” from Lobbyists on QRM

For ABS backed by QRMs, the DFA provides for an exemption of the risk-retention rule. For folks who don’t remember, the “inclusion” of an exemption for QRMs was in the act because of heavy lobbying by financial institutions and housing-related trade groups, and it put regulators in the uncomfortable position of trying to decide what types of mortgages were so inherently “low risk” that they should/could be excluded from the rule designed to ensure that ABS issuers had “skin in the game.”

Labels:

inflation,

interest rates,

news digest,

shadow inventory

Wednesday, March 30, 2011

Private Activity Bond fees have been updated for 2011

The Private Activity Bond page, found here, has been updated with new PAB fee information for 2011. The new document is here.

Housing News Digest, March 30

Surveys: Colorado banks under more stress

DENVER - Two national surveys on bank health have found that many Colorado banks are under more financial stress banks than other states and they may have a thinner cushion to absorb bad bank loans.

The studies show that at the end of 2010, about one in four Colorado banks met the definition of a "troubled" or "problematic" institution.

Gloomy census and FHFA data weighs on housing market

Seperate reports released yesterday by the US Census Bureau and the Federal Housing Finance Agency do not bode well for the local housing market.

According to this FHFA report, housing prices continued on a downward trend, falling 0.3 percent from December to January. For the 12 months ending in January, prices fell 3.9 percent to roughly the same level as May 2004.

Real Estate: Feds move on home mortgage rules

The Federal Deposit Insurance Corporation and the Federal Reserve now want public comment on the plan, which would require lenders to offer mortgages with at least a 20 percent down payment if they want to repackage the loan to sell to other investors without keeping some of the risk on their books.

House Votes to Terminate Government's Mortgage Modification Program

The U.S. House of Representatives passed legislation Tuesday evening to end the administration’s flagship foreclosure prevention initiative, the Home Affordable Modification Program (HAMP).

CoreLogic: Shadow Inventory Declines Slightly

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

DENVER - Two national surveys on bank health have found that many Colorado banks are under more financial stress banks than other states and they may have a thinner cushion to absorb bad bank loans.

The studies show that at the end of 2010, about one in four Colorado banks met the definition of a "troubled" or "problematic" institution.

Gloomy census and FHFA data weighs on housing market

Seperate reports released yesterday by the US Census Bureau and the Federal Housing Finance Agency do not bode well for the local housing market.

According to this FHFA report, housing prices continued on a downward trend, falling 0.3 percent from December to January. For the 12 months ending in January, prices fell 3.9 percent to roughly the same level as May 2004.

Real Estate: Feds move on home mortgage rules

The Federal Deposit Insurance Corporation and the Federal Reserve now want public comment on the plan, which would require lenders to offer mortgages with at least a 20 percent down payment if they want to repackage the loan to sell to other investors without keeping some of the risk on their books.

House Votes to Terminate Government's Mortgage Modification Program

The U.S. House of Representatives passed legislation Tuesday evening to end the administration’s flagship foreclosure prevention initiative, the Home Affordable Modification Program (HAMP).

CoreLogic: Shadow Inventory Declines Slightly

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

Tuesday, March 29, 2011

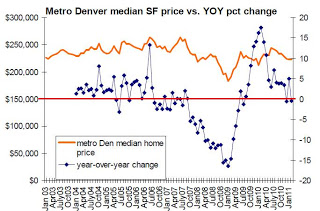

Denver metro home prices down year-over-year for seventh straight month

Case-Shiller’s home price index for the Denver area fell 0.7 percent from November to December, and fell 2.3 percent , year over year from January 2010 to January 2011.

According to the Case-Shiller report, released today by Standard and Poor's, and containing data up through January, 14 of the 20 metro areas measured by the report showed larger declines than the Denver area. The report shows a general decline in home prices across the nation, with only two metropolitan areas, San Diego and Washington, DC, showing increases in home prices over the past year. According to the Case-Shiller press release:

“Keeping with the trends set in late 2010, January brings us weakening home prices with no real hope in sight for the near future” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's. “With this month’s data, we find the same 11 MSAs posting new recent index lows. The 10-City and 20-City Composites continue to decline month-over-month and have posted monthly declines for six consecutive months now.

In year over year comparisons for January, Phoenix showed the largest drop, with a decline of 9.1 percent, while the index in Detroit fell 8.1 percent. The index rose the most in Washington, DC where it increased 3.6 percent, year over year. The index also rose 0.1 percent in San Diego. Home price indices fell in 18 of the 20 cities included in the study.

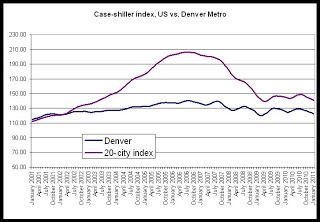

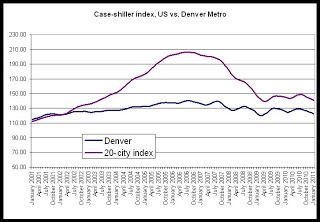

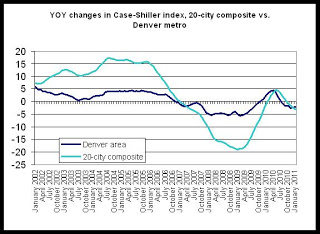

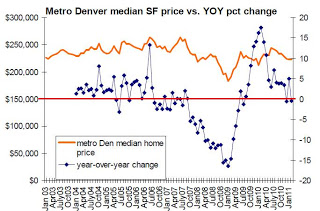

The first chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009, but continue a slow trend downward.

The 20-city composite is down 31.8 percent since it peaked in July 2006, but the Denver index is down only 12.5 percent from its August 2006 peak.

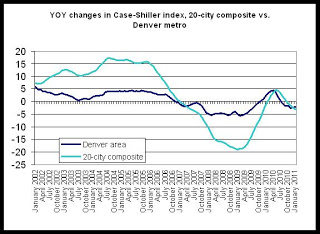

The second chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite. Year-over-year growth in the 20-city composite during January was negative with a decrease of 2.3 percent. The Denver area index’s fall of 2.3 percent is the seventh month in a row in which the growth rate has been negative. In the 20-city index, on the other hand, the year-over-year change has only been negative for the most recent four months.

While Denver’s index has been largely stable, note that for the previous 24 months, only 8 months have shown a positive year-over-year change.

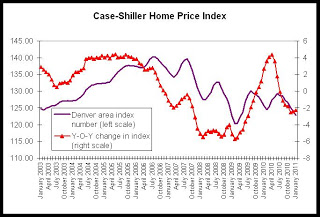

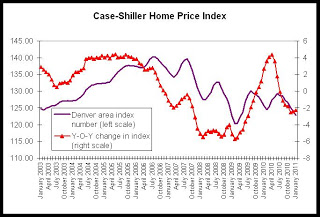

The last chart compares the actual index value for the Denver area with the year-over-year change. Note that for July through December, the change has fallen below zero, and likely reflects the end of the homebuyer tax credit’s end which has translated into a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010. In at least three separate measures of home prices - Case-Shiller, REALTOR, and FHFA data - Colorado and its metro areas have shown continued weakness in the home purchase markets.

The chart shows that from July 2010 through January 2011, the home price index has been below the index for the same period a year earlier (July 2009 through January 2010). Given that 2009 was itself a weak year for home sales, this data does not suggest a speedy rebound for home prices.

According to the Case-Shiller report, released today by Standard and Poor's, and containing data up through January, 14 of the 20 metro areas measured by the report showed larger declines than the Denver area. The report shows a general decline in home prices across the nation, with only two metropolitan areas, San Diego and Washington, DC, showing increases in home prices over the past year. According to the Case-Shiller press release:

“Keeping with the trends set in late 2010, January brings us weakening home prices with no real hope in sight for the near future” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's. “With this month’s data, we find the same 11 MSAs posting new recent index lows. The 10-City and 20-City Composites continue to decline month-over-month and have posted monthly declines for six consecutive months now.

In year over year comparisons for January, Phoenix showed the largest drop, with a decline of 9.1 percent, while the index in Detroit fell 8.1 percent. The index rose the most in Washington, DC where it increased 3.6 percent, year over year. The index also rose 0.1 percent in San Diego. Home price indices fell in 18 of the 20 cities included in the study.

The first chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009, but continue a slow trend downward.

The 20-city composite is down 31.8 percent since it peaked in July 2006, but the Denver index is down only 12.5 percent from its August 2006 peak.

The second chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite. Year-over-year growth in the 20-city composite during January was negative with a decrease of 2.3 percent. The Denver area index’s fall of 2.3 percent is the seventh month in a row in which the growth rate has been negative. In the 20-city index, on the other hand, the year-over-year change has only been negative for the most recent four months.

While Denver’s index has been largely stable, note that for the previous 24 months, only 8 months have shown a positive year-over-year change.

The last chart compares the actual index value for the Denver area with the year-over-year change. Note that for July through December, the change has fallen below zero, and likely reflects the end of the homebuyer tax credit’s end which has translated into a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010. In at least three separate measures of home prices - Case-Shiller, REALTOR, and FHFA data - Colorado and its metro areas have shown continued weakness in the home purchase markets.

The chart shows that from July 2010 through January 2011, the home price index has been below the index for the same period a year earlier (July 2009 through January 2010). Given that 2009 was itself a weak year for home sales, this data does not suggest a speedy rebound for home prices.

Housing News Digest, March 29

House GOP works to end Obama mortgage plan

House Republicans will consider a bill to stop any new funding for the Home Affordable Modification Program (HAMP). The program taps the federal bailout that saved the big banks, providing incentives to mortgage servicers to modify mortgages for borrowers behind on their payments.

US housing prices continue to slump

Today’s release of the S&P;/Case-Shiller (CSI) home price indices for January reported that the non-seasonally adjusted Composite-10 price index declined a notable 0.90% since December indicating that housing is continuing slump into a double-dip.

U.S. Property Taxes Fall by Most Since Housing Market Crash

U.S. state and local property-tax collections dropped in the last three months of 2010 by the most since home prices peaked more than four years ago, slowing the overall growth in government revenue.

Real-estate-tax collections, a main source of income for cities, slid $5.3 billion, or 2.9 percent, from a year earlier to $177.1 billion, the Census Bureau reported today. The drop exceeded a 2.5 percent decline in the first quarter of 2010, the data show.

Servicers to Meet with Officials Wednesday to Discuss Settlement

After reports that the timeline to iron out final details of the robo-signing settlement is “ambitious,” representatives from several major servicers, attorneys general, and some federal regulators are said to have a meeting planned for Wednesday, marking their first face-to-face discussion of terms.

Why house prices will keep falling

Unless Ben Bernanke sets off a big inflation wave, house prices are doomed to keep falling for years.

House Republicans will consider a bill to stop any new funding for the Home Affordable Modification Program (HAMP). The program taps the federal bailout that saved the big banks, providing incentives to mortgage servicers to modify mortgages for borrowers behind on their payments.

US housing prices continue to slump

Today’s release of the S&P;/Case-Shiller (CSI) home price indices for January reported that the non-seasonally adjusted Composite-10 price index declined a notable 0.90% since December indicating that housing is continuing slump into a double-dip.

U.S. Property Taxes Fall by Most Since Housing Market Crash

U.S. state and local property-tax collections dropped in the last three months of 2010 by the most since home prices peaked more than four years ago, slowing the overall growth in government revenue.

Real-estate-tax collections, a main source of income for cities, slid $5.3 billion, or 2.9 percent, from a year earlier to $177.1 billion, the Census Bureau reported today. The drop exceeded a 2.5 percent decline in the first quarter of 2010, the data show.

Servicers to Meet with Officials Wednesday to Discuss Settlement

After reports that the timeline to iron out final details of the robo-signing settlement is “ambitious,” representatives from several major servicers, attorneys general, and some federal regulators are said to have a meeting planned for Wednesday, marking their first face-to-face discussion of terms.

Why house prices will keep falling

Unless Ben Bernanke sets off a big inflation wave, house prices are doomed to keep falling for years.

Monday, March 28, 2011

Housing News Digest, March 28

McWhinney kicking off apartment complex project

Work began on the 252-unit The Greens at Van de Water on Mountain Lion Drive in Loveland last week. Preleasing for the studio, one-, two- and three-bedroom apartments is expected to begin in the fall with move-in slated for the winter.

Vacancy rates in Loveland were at 5.5 percent at the end of the third quarter of 2010 while average rents were among the highest among the lowest in the state's metro regions, according to the state's Multifamily Vacancy and Rent Survey conducted for the Colorado Division of Housing.

Investors eager for metro Denver housing projects

An apartment building boom is on the horizon as increasing demand for a limited supply of apartments pushes rents higher and gives developers and investors an incentive to start building multifamily projects.

Tough economy refills empty nests

It's been almost a year since Charlie Evans graduated from Colorado State University with a degree in engineering, eager to launch a career in the aerospace industry. "I started applying right away," he said. But 200 job applications later, he's landed only two "solid" interviews.

LPS: Overall mortgage delinquencies declined slightly in February

•Delinquency rates resumed their decline after an increase in January and foreclosure inventories remain stable, slightly below historic highs.

• Delinquencies continue to improve as new problem loan rates decline and cure rates increase.

• Foreclosure start declines and foreclosure suspensions are reducing the upward pressure on inventories caused by foreclosure sale moratoria.

• An enormous backlog of foreclosures still exists with overhang at every level

Servicers Asked to Consider a $21,000 "Cash for Keys" Option

According to an article by The Financial Times, the five biggest mortgage servicers in the United States were encouraged to consider a “cash for keys” option for 90-day plus delinquent borrowers that would pay them as much as $21,000 to move out.

Traditionally a cash for keys option offers around $1,000 for a borrower to vacate the property within a defined time frame. The borrower is forgiven of the mortgage debt in exchange for the deed to the property, and the money can help provide for moving expenses.

Work began on the 252-unit The Greens at Van de Water on Mountain Lion Drive in Loveland last week. Preleasing for the studio, one-, two- and three-bedroom apartments is expected to begin in the fall with move-in slated for the winter.

Vacancy rates in Loveland were at 5.5 percent at the end of the third quarter of 2010 while average rents were among the highest among the lowest in the state's metro regions, according to the state's Multifamily Vacancy and Rent Survey conducted for the Colorado Division of Housing.

Investors eager for metro Denver housing projects

An apartment building boom is on the horizon as increasing demand for a limited supply of apartments pushes rents higher and gives developers and investors an incentive to start building multifamily projects.

Tough economy refills empty nests

It's been almost a year since Charlie Evans graduated from Colorado State University with a degree in engineering, eager to launch a career in the aerospace industry. "I started applying right away," he said. But 200 job applications later, he's landed only two "solid" interviews.

LPS: Overall mortgage delinquencies declined slightly in February

•Delinquency rates resumed their decline after an increase in January and foreclosure inventories remain stable, slightly below historic highs.

• Delinquencies continue to improve as new problem loan rates decline and cure rates increase.

• Foreclosure start declines and foreclosure suspensions are reducing the upward pressure on inventories caused by foreclosure sale moratoria.

• An enormous backlog of foreclosures still exists with overhang at every level

Servicers Asked to Consider a $21,000 "Cash for Keys" Option

According to an article by The Financial Times, the five biggest mortgage servicers in the United States were encouraged to consider a “cash for keys” option for 90-day plus delinquent borrowers that would pay them as much as $21,000 to move out.

Traditionally a cash for keys option offers around $1,000 for a borrower to vacate the property within a defined time frame. The borrower is forgiven of the mortgage debt in exchange for the deed to the property, and the money can help provide for moving expenses.

Friday, March 25, 2011

February 2011 employment summary: job losses continue

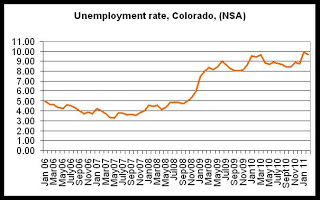

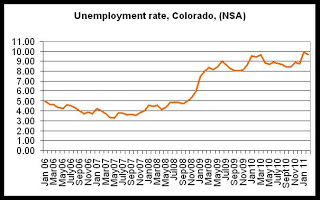

Colorado lost 20,500 jobs in February, compared to February of last year, and the non-seasonally-adjusted unemployment rate rose slightly to 9.7 from February 2010's rate of 9.4 percent. According to the most recent employment data released by the Colorado Department of Labor and Employment, total employment in February, not seasonally adjusted, fell to 2.41 million jobs. There were 14,500 fewer people in the work force during February, compared to February 2010, which mitigated the rise in the unemployment rate.

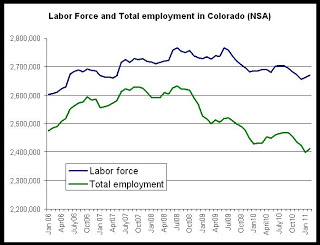

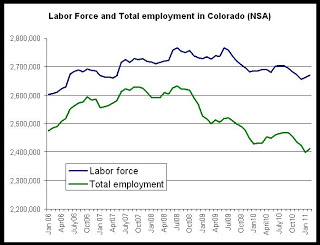

From February 2010 to February 2011, total employment fell 0.8 percennt, while the labor force shrank 0.5 percent. The total labor force in February included 2.67 million workers.

As can be seen in the second graph, both total employment and total workforce size have fallen off in recent months, and both remain well below the July 2008 peak.

Employment totals are still more than 221,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Since the labor force peaked in July 2008, it has fallen by more than 96,000 workers.

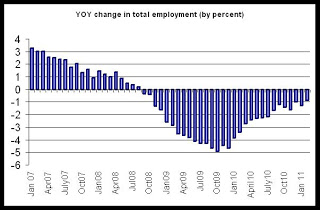

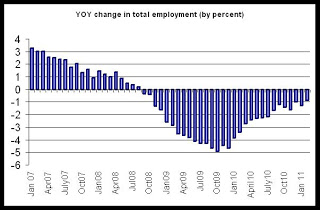

In the third graph is shown the year-over-year comparisons for total employment. Not since August 2008 has Colorado posted a positive change in total employment when compared to a year earlier. Although overall total employment has increased since January 2010, employment totals remain below 2009 totals in each year-over-year comparison.

This is the second month in a row in which Colorado's unemployment rate has exceeded the national rate (discussed here.) Recent personal income data (discussed here) from the BLS also showed Colorado lagging the nation and the region, with Colorado placing in the bottom quintile for all states for personal income during the fourth quarter of 2010.

Also of interest: Comparing national unemployment with state unemployment.

From February 2010 to February 2011, total employment fell 0.8 percennt, while the labor force shrank 0.5 percent. The total labor force in February included 2.67 million workers.

As can be seen in the second graph, both total employment and total workforce size have fallen off in recent months, and both remain well below the July 2008 peak.

Employment totals are still more than 221,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Since the labor force peaked in July 2008, it has fallen by more than 96,000 workers.

In the third graph is shown the year-over-year comparisons for total employment. Not since August 2008 has Colorado posted a positive change in total employment when compared to a year earlier. Although overall total employment has increased since January 2010, employment totals remain below 2009 totals in each year-over-year comparison.

This is the second month in a row in which Colorado's unemployment rate has exceeded the national rate (discussed here.) Recent personal income data (discussed here) from the BLS also showed Colorado lagging the nation and the region, with Colorado placing in the bottom quintile for all states for personal income during the fourth quarter of 2010.

Also of interest: Comparing national unemployment with state unemployment.

Colorado unemployment rate remains above national rate, could affect rental vacancies

New employment data was released today by the BLS for all states. For the second month in a row, Colorado's unemployment rate has exceeded the national unemployment rate. The Colorado unemployment had been below the national rate from 2006 until December 2010, but as Colorado has lagged the national economy in job creation and income growth, the national rate has fallen while the Colorado rate has risen.

(All unemployment rates quoted in this article are seasonally adjusted.)

In December, the national rate was at 9.4 percent while Colorado's rate was 8.9 percent. In January, however, Colorado's rate rose to 9.1 percent while the national rate fell to 9.0 percent. February widened the gap with Colorado's unemployment rate rising to 9.3 percent while the national rate fell to 8.9 percent.

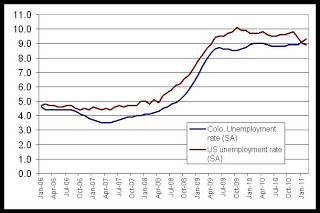

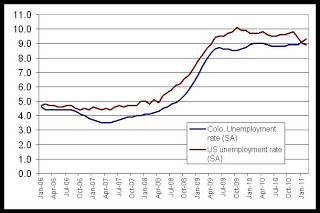

The first graph shows the relationship between the national unemployment rate and the Colorado unemployment rate in recent years.

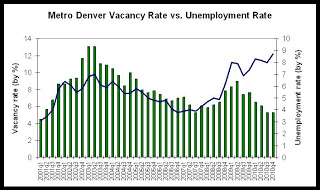

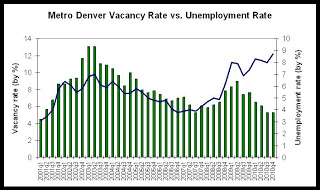

This reversal could have an effect on the demand for housing. As we've discussed here before, the vacancy rate had tended to move with the unemployment rate in recent years. Prior to the 2007-2009 recession, as unemployment increased, the vacancy rate increased as well. This was due to the connection between employment, household formation and the demand for rental housing.

The second graph shows this relationship:

Over the past 18 months, though, the vacancy rate has fallen in spite of a heightened unemployment rate. This change was unexpected, although it could at least be partially explained by the lack of new development in rental housing, and by the decline in the attractiveness of for-sale housing.

Another large factor has been the fact that household formation has continued at a strong pace in spite of stagnant economic and job growth in the area. This was no doubt helped along by the fact that Colorado was experiencing a lower unemployment rate than the nation in general. This encouraged workers to relocate to Colorado, and made Colorado a relatively attractive place for entry-level workers who, in many cases, are rental housing's target market.

With the reversal of this trend, the demand for rental housing may be impacted if it leads to a significant number of workers and households seeking employment outside the state. Vacancy data from the first and second quarters of this year will be helpful in determining if this change in unemployment rates will have much of an effect on the multifamily industry.

Also of interest: Feb 2011 employment summary

(All unemployment rates quoted in this article are seasonally adjusted.)

In December, the national rate was at 9.4 percent while Colorado's rate was 8.9 percent. In January, however, Colorado's rate rose to 9.1 percent while the national rate fell to 9.0 percent. February widened the gap with Colorado's unemployment rate rising to 9.3 percent while the national rate fell to 8.9 percent.

The first graph shows the relationship between the national unemployment rate and the Colorado unemployment rate in recent years.

This reversal could have an effect on the demand for housing. As we've discussed here before, the vacancy rate had tended to move with the unemployment rate in recent years. Prior to the 2007-2009 recession, as unemployment increased, the vacancy rate increased as well. This was due to the connection between employment, household formation and the demand for rental housing.

The second graph shows this relationship:

Over the past 18 months, though, the vacancy rate has fallen in spite of a heightened unemployment rate. This change was unexpected, although it could at least be partially explained by the lack of new development in rental housing, and by the decline in the attractiveness of for-sale housing.

Another large factor has been the fact that household formation has continued at a strong pace in spite of stagnant economic and job growth in the area. This was no doubt helped along by the fact that Colorado was experiencing a lower unemployment rate than the nation in general. This encouraged workers to relocate to Colorado, and made Colorado a relatively attractive place for entry-level workers who, in many cases, are rental housing's target market.

With the reversal of this trend, the demand for rental housing may be impacted if it leads to a significant number of workers and households seeking employment outside the state. Vacancy data from the first and second quarters of this year will be helpful in determining if this change in unemployment rates will have much of an effect on the multifamily industry.

Also of interest: Feb 2011 employment summary

Labels:

economics,

employment,

unemployment,

vacancy surveys

Housing News Digest, March 25

Morgan Stanley’s Deep Secret Now Is Revealed: Jonathan Weil

Here’s a little secret the Federal Reserve Board doesn’t want you to know. On Sept. 24, 2008, while financial markets were collapsing, Morgan Stanley borrowed $3.5 billion through the Fed’s oldest lending program, the 98-year- old discount window.

The Fed has long claimed that releasing this type of data could trigger bank runs, public hysteria, death spirals at financial institutions large and small, and other horrible outcomes. Yet I’ve got a hunch Morgan Stanley somehow will survive this revelation. Mass panic will not ensue. The world will not end.

State by State Estimate of Shadow Inventory

Differences in the levels of foreclosure and seriously delinquent inventory, as well as the saturation of distressed sales in total existing sales are naturally causing varying levels of shadow inventory across states. State by state estimate of shadow inventory presented here is based on the same method as described in the March 2010 shadow inventory article(PDF).

Northern Colorado housing presentation a mixed bag

On a more serious note, Laposa briefed the 130 audience members, including the not-so-happy lenders, on the results of a 2011 residential survey during the two-hour “Housing Colorado’s Future” presentation.

The survey combined the results of three separate surveys of the Colorado Association of Realtors, the Colorado Association of Home Builders and the Colorado Mortgage Lenders Association.

Survey says tough market ahead

Highlights of the report include higher expectations for jobs than interest rates this year compared to last.

All three organizations indicated employment growth would be stagnant, while interest rates were likely to rise.

Slow start for new homes

New home building activity in the Denver area was down 43.2 percent in February from February 2010, according to the latest report released by the Home Builders Association of Metro Denver.

There were only 267 building permits pulled in the Denver area in February, compared with 462 in February 2010, shows the report, which tracks apartments, single-family attached and single-family detached homes in 28 counties and municipalities from Erie to Parker. It includes the counties of Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, and Jefferson. Building permits track future construction activity.

Here’s a little secret the Federal Reserve Board doesn’t want you to know. On Sept. 24, 2008, while financial markets were collapsing, Morgan Stanley borrowed $3.5 billion through the Fed’s oldest lending program, the 98-year- old discount window.

The Fed has long claimed that releasing this type of data could trigger bank runs, public hysteria, death spirals at financial institutions large and small, and other horrible outcomes. Yet I’ve got a hunch Morgan Stanley somehow will survive this revelation. Mass panic will not ensue. The world will not end.

State by State Estimate of Shadow Inventory

Differences in the levels of foreclosure and seriously delinquent inventory, as well as the saturation of distressed sales in total existing sales are naturally causing varying levels of shadow inventory across states. State by state estimate of shadow inventory presented here is based on the same method as described in the March 2010 shadow inventory article(PDF).

Northern Colorado housing presentation a mixed bag

On a more serious note, Laposa briefed the 130 audience members, including the not-so-happy lenders, on the results of a 2011 residential survey during the two-hour “Housing Colorado’s Future” presentation.

The survey combined the results of three separate surveys of the Colorado Association of Realtors, the Colorado Association of Home Builders and the Colorado Mortgage Lenders Association.

Survey says tough market ahead

Highlights of the report include higher expectations for jobs than interest rates this year compared to last.

All three organizations indicated employment growth would be stagnant, while interest rates were likely to rise.

Slow start for new homes

New home building activity in the Denver area was down 43.2 percent in February from February 2010, according to the latest report released by the Home Builders Association of Metro Denver.

There were only 267 building permits pulled in the Denver area in February, compared with 462 in February 2010, shows the report, which tracks apartments, single-family attached and single-family detached homes in 28 counties and municipalities from Erie to Parker. It includes the counties of Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, and Jefferson. Building permits track future construction activity.

Thursday, March 24, 2011

Developer's Toolkit Workshop: May 11 & 12 in Brighton

Developer's Toolkit Workshop

Join the DOLA/Colorado Division of Housing for an exciting two-day

workshop designed to enlighten participants about the art and science of

affordable housing development. Through role-playing, participants will

attempt to solve the housing challenge facing a typical Colorado

community. Hands-on exercises will provide a working knowledge of the

critical steps necessary to develop an affordable rental housing

community.

DOLA/CDOH will be presenting the Developer's Toolkit on May 11 & 12 in Brighton, at the Adams County Government Center, Platte River B Conference Room, 4430 S. Adams County Parkway, Brighton.

The brochure/registration form is here. Registrations are due on April 27th.

This class often fills up quickly, so register soon! Mail your check and registration form to Antoinette Johns at DOLA/CDOH. Unfortunately, we cannot accept payment by credit card.

Please contact Denise Selders (303-866-4650) or [email protected] with any questions.

Join the DOLA/Colorado Division of Housing for an exciting two-day

workshop designed to enlighten participants about the art and science of

affordable housing development. Through role-playing, participants will

attempt to solve the housing challenge facing a typical Colorado

community. Hands-on exercises will provide a working knowledge of the

critical steps necessary to develop an affordable rental housing

community.

DOLA/CDOH will be presenting the Developer's Toolkit on May 11 & 12 in Brighton, at the Adams County Government Center, Platte River B Conference Room, 4430 S. Adams County Parkway, Brighton.

The brochure/registration form is here. Registrations are due on April 27th.

This class often fills up quickly, so register soon! Mail your check and registration form to Antoinette Johns at DOLA/CDOH. Unfortunately, we cannot accept payment by credit card.

Please contact Denise Selders (303-866-4650) or [email protected] with any questions.

March 2011 Housing Snapshot now available

At four pages, the Housing Snapshot is a very concise summary of recent housing trends. It's published 6 times a year to provide a quick snapshot of housing trends in Colorado for the non-expert.

Click here for the latest issue.

Housing News Digest, March 24

Cash Is King in Today's Distressed Marketplace

For many homebuyers, mortgage financing is hard to come by these days. Lenders have tightened up credit requirements in an about-face from the lax lending of pre-crisis days that put people into mortgages they couldn’t afford and fueled record-high delinquencies.

Evidence of constricted mortgage credit was highlighted in the latest HousingPulse report from Campbell Surveys and Inside Mortgage Finance as cash transactions set a new record, accounting for 33.7 percent of home purchases in February.

US Finances Rank Near Worst in the World: Study

In the Sovereign Fiscal Responsibility Index, the Comeback America Initiative ranked 34 countries according to their ability to meet their financial challenges, and the US finished 28th, said David Walker, head of the organization and former US comptroller general.

"We think it is important for the American people to understand where the United States is as compared to other countries with regard to fiscal responsibility and sustainability," Walker said in a CNBC interview. "Americans are used to rankings and they're used to ranking very high, but frankly in this area we rank very low."

Why Housing Is Going Through a Double Dip

AP

The sales pace of newly built homes is now at the lowest on record.

Sales dropped nearly 17 percent in February after a big drop in January. Put that on top of the nearly 10 percent February drop in existing home sales reported earlier this week and the incredibly low level of mortgage purchase applications, and you get a clear case for a double dip in housing.

Study: Colorado added few jobs in last decade even as labor force grew

Colorado's Western Slope and central-northern mountains created a net 12,200 jobs during the past decade while the rest of the state stagnated, a new study finds.

For many homebuyers, mortgage financing is hard to come by these days. Lenders have tightened up credit requirements in an about-face from the lax lending of pre-crisis days that put people into mortgages they couldn’t afford and fueled record-high delinquencies.

Evidence of constricted mortgage credit was highlighted in the latest HousingPulse report from Campbell Surveys and Inside Mortgage Finance as cash transactions set a new record, accounting for 33.7 percent of home purchases in February.

US Finances Rank Near Worst in the World: Study

In the Sovereign Fiscal Responsibility Index, the Comeback America Initiative ranked 34 countries according to their ability to meet their financial challenges, and the US finished 28th, said David Walker, head of the organization and former US comptroller general.

"We think it is important for the American people to understand where the United States is as compared to other countries with regard to fiscal responsibility and sustainability," Walker said in a CNBC interview. "Americans are used to rankings and they're used to ranking very high, but frankly in this area we rank very low."

Why Housing Is Going Through a Double Dip

AP

The sales pace of newly built homes is now at the lowest on record.

Sales dropped nearly 17 percent in February after a big drop in January. Put that on top of the nearly 10 percent February drop in existing home sales reported earlier this week and the incredibly low level of mortgage purchase applications, and you get a clear case for a double dip in housing.

Study: Colorado added few jobs in last decade even as labor force grew

Colorado's Western Slope and central-northern mountains created a net 12,200 jobs during the past decade while the rest of the state stagnated, a new study finds.

Wednesday, March 23, 2011

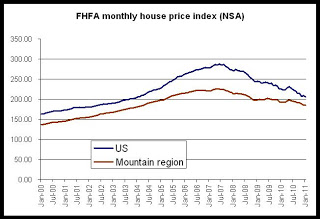

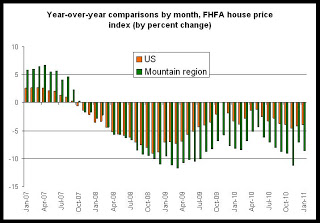

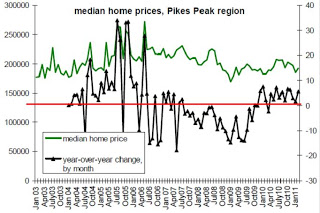

Mountain region house prices fall 8.6 percent in January

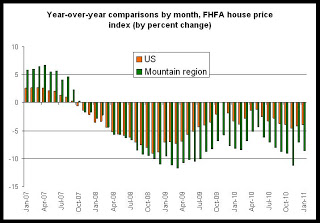

House prices in January in the Mountain region, which includes Colorado, fell 8.6 percent, year-over-year. Nationally, the house price index fell 3.8 percent. The new house price index numbers, released today by the Federal Housing and Finance Agency, also showed that the national index is down 18.3 percent from the peak level reached in June 2007, while the Mountain region's index is down 28.6 percent over the same period.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

The decline in house prices, both regionally and nationally, continues the trend that began in mid-2007 as prices as fallen almost constantly since the peak.

Notably, the FHFA index dows not show a "double dip" as can be seen in the Case-shiller data (discussed here) in which prices begin to recover in 2009, but then fall again after mid-2010. The FHFA monthly data shows nothing but losses following mid-2007. The second chart shows each month's house price index compared to the same month a year earlier:

In the second chart, we can also note that the Mountain region has performed more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example shows that local prices did not decline as much as the national composite index following the financial panic in 2008.

Since we're looking at regional, data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Data specific to Colorado and its metro areas can be found in the FHFA quarterly data, which we discussed here.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

The decline in house prices, both regionally and nationally, continues the trend that began in mid-2007 as prices as fallen almost constantly since the peak.

Notably, the FHFA index dows not show a "double dip" as can be seen in the Case-shiller data (discussed here) in which prices begin to recover in 2009, but then fall again after mid-2010. The FHFA monthly data shows nothing but losses following mid-2007. The second chart shows each month's house price index compared to the same month a year earlier:

In the second chart, we can also note that the Mountain region has performed more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example shows that local prices did not decline as much as the national composite index following the financial panic in 2008.

Since we're looking at regional, data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Data specific to Colorado and its metro areas can be found in the FHFA quarterly data, which we discussed here.

February new home sales fall to new lows

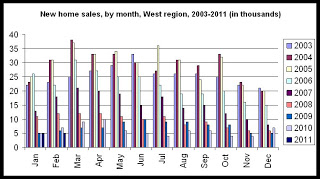

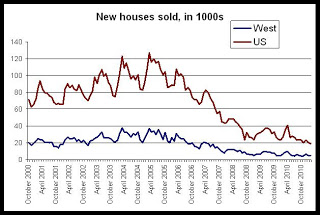

New single-family home sales fell again in the US, and in the West region, which includes Colorado, new home sales fell to the lowest February total recorded in at least ten years.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were down, year over year, falling to 5,000 in February 2011 from 7,000 new homes sold in February 2010. Nationwide, sales dropped off 219.6 percent, falling from 27,000 to 19,000 during the same period.

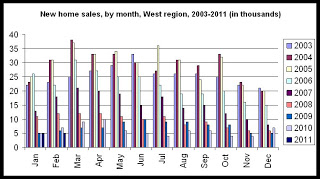

In February, new home sales were at the lowest point for the lowest volume in at least a decade. The first chart shows monthly new home sales totals for each month since 2003. February’s total of 5,000 new homes sold is below totals for both February 2010 and February 2009, and is near 4,000, the lowest monthly total recorded in any month during the last decade.

For the West region:

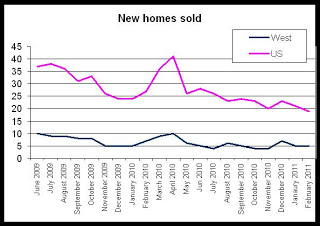

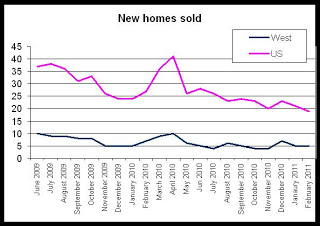

The drop off in home sales is likely tied to the end of the new home buyer tax credit which expired in April. The second chart shows that in both the West and in the US, new home sales were pushed up by the tax credit, and then fell quickly after April 2010. Note, however, that sales totals are largely flat in the West region while nationally, they continue to decline.

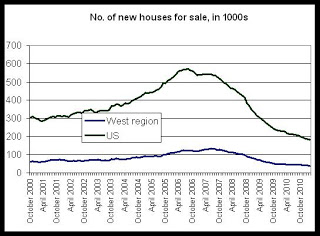

New home sales and new home inventory continue to fall and have generally followed a downward trend since the middle of the decade.

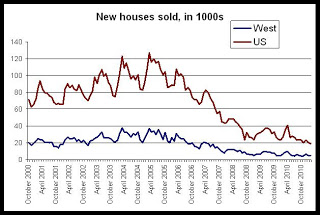

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 85 percent since the peak of March 2005, and new home sales in the West have fallen 86 percent since sales peaked in the region during March 2004.

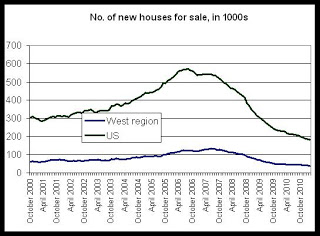

The third chart shows the declines in both US and regional new home sales.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 69 percent since the total peaked during June 2007, and the same total has fallen 68 percent in the US since the number of new homes for sale peaked in the US during August 2006.

The number of homes for sale grew more quickly in the West than in the US, with growth in the West topping 119.6 percent from January 2001 to June 2007, and the total grew 92.2 percent from January 2001 to August 2006. The fourth chart shows the rise of new homes for sale.

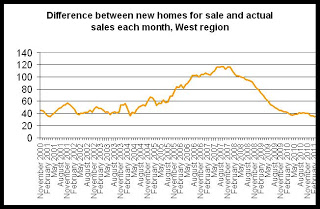

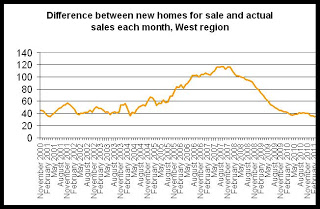

The fifth chart shows the difference between the number of homes in the West region for sale at the beginning of a month vs. the number of homes sold during that month. Interestingly, the build up in inventory can be seen as it grows from 2004 to 2007. Historically, it appears that the a “normal” difference between new homes for sale and new homes sold is somewhere between 40,000 and 50,000 homes in the region. This total reaches almost 120,000 homes during the peak months, and has now fallen to below 40,000 homes, where the total has remained for the past several months. The build-up in inventory clearly shows a situation in which the construction of new homes was exceeding the purchase of new homes. The difference between new homes for sale and new homes sold has declined considerably in recent year, although this is due primarily to a large decline in new construction, and not to significant increases in demand for new homes.

Summary: Nationally, new home sales and new home construction are very weak, and continue to move downward. In the West region, the trend in new home sales appears to have stabilized in recent months, with new sales totals consistently coming in between 4,000 and 7,000 sales since May 2010. However, the number of houses for sale did reach a new low in February with only 39,000 new houses available for sale.

Note: The Census Bureau only provides new home data at a regional level. Extrapolating to the Colorado is problematic with this data since the West region includes California, Arizona and Nevada, all of which experienced large housing bubbles. Nevertheless, regional banks, builders and housing providers will gain insights into how Colorado fits into the larger Western region.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were down, year over year, falling to 5,000 in February 2011 from 7,000 new homes sold in February 2010. Nationwide, sales dropped off 219.6 percent, falling from 27,000 to 19,000 during the same period.

In February, new home sales were at the lowest point for the lowest volume in at least a decade. The first chart shows monthly new home sales totals for each month since 2003. February’s total of 5,000 new homes sold is below totals for both February 2010 and February 2009, and is near 4,000, the lowest monthly total recorded in any month during the last decade.

For the West region:

The drop off in home sales is likely tied to the end of the new home buyer tax credit which expired in April. The second chart shows that in both the West and in the US, new home sales were pushed up by the tax credit, and then fell quickly after April 2010. Note, however, that sales totals are largely flat in the West region while nationally, they continue to decline.

New home sales and new home inventory continue to fall and have generally followed a downward trend since the middle of the decade.

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 85 percent since the peak of March 2005, and new home sales in the West have fallen 86 percent since sales peaked in the region during March 2004.

The third chart shows the declines in both US and regional new home sales.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 69 percent since the total peaked during June 2007, and the same total has fallen 68 percent in the US since the number of new homes for sale peaked in the US during August 2006.

The number of homes for sale grew more quickly in the West than in the US, with growth in the West topping 119.6 percent from January 2001 to June 2007, and the total grew 92.2 percent from January 2001 to August 2006. The fourth chart shows the rise of new homes for sale.

The fifth chart shows the difference between the number of homes in the West region for sale at the beginning of a month vs. the number of homes sold during that month. Interestingly, the build up in inventory can be seen as it grows from 2004 to 2007. Historically, it appears that the a “normal” difference between new homes for sale and new homes sold is somewhere between 40,000 and 50,000 homes in the region. This total reaches almost 120,000 homes during the peak months, and has now fallen to below 40,000 homes, where the total has remained for the past several months. The build-up in inventory clearly shows a situation in which the construction of new homes was exceeding the purchase of new homes. The difference between new homes for sale and new homes sold has declined considerably in recent year, although this is due primarily to a large decline in new construction, and not to significant increases in demand for new homes.

Summary: Nationally, new home sales and new home construction are very weak, and continue to move downward. In the West region, the trend in new home sales appears to have stabilized in recent months, with new sales totals consistently coming in between 4,000 and 7,000 sales since May 2010. However, the number of houses for sale did reach a new low in February with only 39,000 new houses available for sale.

Note: The Census Bureau only provides new home data at a regional level. Extrapolating to the Colorado is problematic with this data since the West region includes California, Arizona and Nevada, all of which experienced large housing bubbles. Nevertheless, regional banks, builders and housing providers will gain insights into how Colorado fits into the larger Western region.

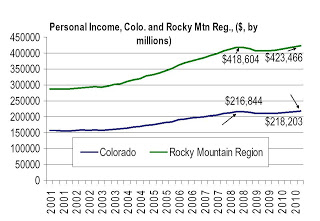

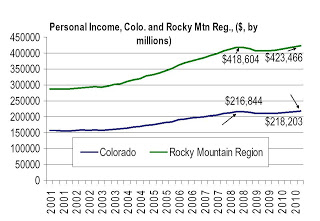

4thQ 2010 personal income rises above pre-recession levels

New personal income data for Colorado was released today by the BLS. See their regional site here.

Colorado has now exceeded the personal income levels reached prior to the financial panic of 2008.

At $218.2 billion, personal income in Colorado has now exceeded the peak levels reached during the third quarter of 2008, when personal income reached $216.8 billion. Personal income is now up by 0.6 percent from previous levels.

During the third quarter of 2010, the rocky Mountain Region and the US as a whole had exceed pre-recession levels while Colorado lagged.

Colorado still lags the US and region. As of the 4th quarter of 2010, The Rocky Mountain region is 1.1 percent above peak levels and the US is 2.0 percent above its own previous peak which occurred during the second quarter of 2008.

Over ten years from the 4th quarter of 2001 to the fourth quarter of 2010, US personal income iuncreased 42.8 percent, and in Colorado it increased 40.0 percent. In the Rocky Mountain region, the increase for the same period was 47.3 percent.

This is just one measure in which Colorado underperformed compared to the nation during the last decade. Overall job growth and income growth was also more sluggish in Colorado during this period as compared to many regions in the United States. The most recent report also shows Colorado in the lowest quintile of all states for personal income growth.

As has been noted by some regional economists, Colorado has recovered more slowly since the most recent recession than have other states in the Rocky Mountain region.

However, over the past year, Colorado has nearly matched regional growth. From the 4th quarter of 2009 to the 4th quarter of 2010, personal income increased 3.8 percent nationwide, while it increased 3.4 percent in Colorado. Income increased 3.5 percent in the Rocky Mountain region during the same period.

Overall, Colorado's real estate markets and labor markets have not suffered as much as many markets, but in a variety of ways, including personal income, Colorado is recovering more slowly than the nation. January 2011 employment data also showed Colorado's unemployment rate moving above the nationwide unemployment rate for the first time since the most recent recession began in late 2007.

Generally speaking, personal income has been flat in Colorado since 2008 reflecting a sluggish job market and wage growth. An increase of 0.6 percent over the previous peak, being an estimate, is effectively a sideways movement in income.

Note: Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Total personal income will rise as population rises, even if household incomes are declining. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wage and salary disbursements, supplements to wages and salaries, and proprietors' income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for inflation).

Colorado has now exceeded the personal income levels reached prior to the financial panic of 2008.

At $218.2 billion, personal income in Colorado has now exceeded the peak levels reached during the third quarter of 2008, when personal income reached $216.8 billion. Personal income is now up by 0.6 percent from previous levels.

During the third quarter of 2010, the rocky Mountain Region and the US as a whole had exceed pre-recession levels while Colorado lagged.

Colorado still lags the US and region. As of the 4th quarter of 2010, The Rocky Mountain region is 1.1 percent above peak levels and the US is 2.0 percent above its own previous peak which occurred during the second quarter of 2008.

Over ten years from the 4th quarter of 2001 to the fourth quarter of 2010, US personal income iuncreased 42.8 percent, and in Colorado it increased 40.0 percent. In the Rocky Mountain region, the increase for the same period was 47.3 percent.

This is just one measure in which Colorado underperformed compared to the nation during the last decade. Overall job growth and income growth was also more sluggish in Colorado during this period as compared to many regions in the United States. The most recent report also shows Colorado in the lowest quintile of all states for personal income growth.

As has been noted by some regional economists, Colorado has recovered more slowly since the most recent recession than have other states in the Rocky Mountain region.

However, over the past year, Colorado has nearly matched regional growth. From the 4th quarter of 2009 to the 4th quarter of 2010, personal income increased 3.8 percent nationwide, while it increased 3.4 percent in Colorado. Income increased 3.5 percent in the Rocky Mountain region during the same period.

Overall, Colorado's real estate markets and labor markets have not suffered as much as many markets, but in a variety of ways, including personal income, Colorado is recovering more slowly than the nation. January 2011 employment data also showed Colorado's unemployment rate moving above the nationwide unemployment rate for the first time since the most recent recession began in late 2007.

Generally speaking, personal income has been flat in Colorado since 2008 reflecting a sluggish job market and wage growth. An increase of 0.6 percent over the previous peak, being an estimate, is effectively a sideways movement in income.

Note: Personal income is the income received by all persons from all sources. Personal income is the sum of net earnings by place of residence, property income, and personal current transfer receipts. Total personal income will rise as population rises, even if household incomes are declining. Property income is rental income of persons, personal dividend income, and personal interest income. Net earnings is earnings by place of work (the sum of wage and salary disbursements, supplements to wages and salaries, and proprietors' income) less contributions for government social insurance, plus an adjustment to convert earnings by place of work to a place-of-residence basis. Personal income is measured before the deduction of personal income taxes and other personal taxes and is reported in current dollars (no adjustment is made for inflation).

Housing News Digest, March 23