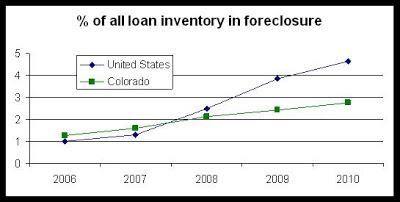

Compared to the proportion of loans in foreclosure for all states, Colorado’s totals are lower than national numbers with 4.63 percent of loans nationwide being in a state of foreclose during the first quarter of 2010. Year-over-year trends are also upward nationally with 2010’s first-quarter percentage being an increase from the first quarter of 2009 when the total percentage of loans in foreclosure was 3.85 percent. Foreclosing loans also increased nationally from the fourth quarter of 2009 to the first quarter of this year with an increase from the fourth quarter’s percentage of 4.58 percent.

Eighteen states reported a smaller percentage than Colorado for the number of mortgage loans in foreclosure. North Dakota reported the smallest percentage of foreclosing mortgages with 1.18 percent. Alaska and Wyoming placed slightly behind North Dakota with 1.34 percent and 1.66 percent of loans in foreclosure, respectively.

States reporting the highest percentages of loans in foreclosure included Nevada and Florida with percentages of 10.40 percent and 13.97 percent, respectively.

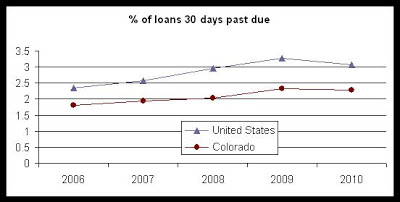

Short-term delinquencies dropped slightly in both Colorado and nationwide from the first quarter of last year to the first quarter this year. In Colorado, 30-day delinquencies fell from 2.33 percent to 2.27 percent, year over year, while nationwide, they fell from 3.27 percent to 3.07 percent during the same period.

In a written statement, the Mortgage Bankers Association’s chief economist Jay Brinkmann noted that “the economy has begun to generate jobs and layoffs have declined, although new claims for unemployment insurance remained higher in the first quarter than we expected. The percent of loans behind one payment had been declining as first-time claims for unemployment began falling in March 2009. Those new claims stopped falling during the first quarter of this year, which likely halted the decline in the underlying 30-day delinquency rate.”

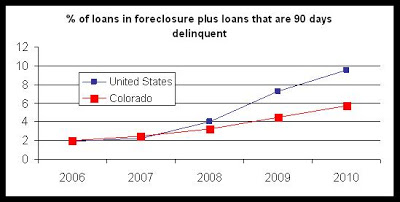

Nationwide, the percentage of loans in foreclosure during the first quarter has outpaced Colorado since 2008. Prior to 2008, Colorado reported a larger percentage of foreclosing loans than was the case nationally, but since 2008, the percentage of foreclosing loans has grown more nationally than in Colorado each year.

This has also been the case in 30-day delinquencies and in the total combined percentage of loans that are in foreclosure or are 90-days delinquent.

Prior to 2008, Colorado experienced a large amount of foreclosure and delinquency activity before the rest of the nation making it one of the top states in the nation for foreclosures. Since 2008, other states like Nevada, California and Florida have outpaced Colorado and have moved national percentages above Colorado’s.

-R. McMaken

Source: Mortgage Bankers Association