Click here for the full report.

Vacancies in for-rent condos, single-family homes, and other small properties across metro Denver fell year-over-year to 3.8 percent during 2010’s second quarter. According to a report released Tuesday by the Colorado Department of Local Affairs’ Division of Housing, the vacancy rate was 5.2 percent during the second quarter of 2009, and was 3.1 percent during the first quarter of this year. The second quarter’s vacancy rate is the lowest second-quarter rate reported since the report was started in 2004.

The average number of days on the market for single-family rentals and similar properties fell from 54.7 days during the second quarter of 2009 to 47.2 days during the second quarter of 2010. The number of days on the market rose from 2010’s first quarter average of 45.1 days.

The lowest vacancy rates were found in Arapahoe County and Douglas County, both of which reported average rates of 2.9 percent. The highest vacancy rate, likely driven by rental houses left behind by students during the summer break, was 8.6 percent in the Boulder/Broomfield area.

Vacancy rates for all counties surveyed were: Adams, 4.2 percent; Arapahoe, 2.9 percent; Boulder/Broomfield, 8.6 percent; Denver, 3.4 percent; Douglas, 2.9 percent; and Jefferson, 3.3 percent.

Average rents climbed slightly as vacancies tightened.

The average rent for single-family and similar properties rose year-over-year to $1027.78 during 2010’s second quarter, rising from 2009’s second-quarter rate of $1016.35. The second quarter’s average rent was down from this year’s first quarter average rent of $1035.56.

Average rents for all counties were: Adams, $1094.98; Arapahoe, $999.50; Boulder/Broomfield, $1518.43; Denver, $962.91; Douglas, $1415.34; and Jefferson, $975.25.

The Colorado Statewide Vacancy and Rent Study is released each quarter by the Colorado Division of Housing. The Report is available online at the Division of Housing web site: http://dola.colorado.gov/cdh. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type.

Tuesday, August 31, 2010

Friday, August 27, 2010

Alamosa County awarded $281,143

The Department of Local Affairs has announced that $281,143 in CDBG funds has been awarded to Alamosa County for the following project:

Alamosa County, on behalf of the San Luis Valley Housing Coalition, Inc., has received a grant of $281,143 to support their on-going Housing Rehabilitation Program from October 2010 through September 2011. This program will provide and administer twelve (12) housing rehabilitation loans and two (2) replacement homes in Alamosa, Conejos, Costilla, Saguache, Mineral Counties and the Cities of Monte Vista and Del Norte. The SLVHC markets to potential program participants through other community organizations, the local governments and the building departments.

Alamosa County, on behalf of the San Luis Valley Housing Coalition, Inc., has received a grant of $281,143 to support their on-going Housing Rehabilitation Program from October 2010 through September 2011. This program will provide and administer twelve (12) housing rehabilitation loans and two (2) replacement homes in Alamosa, Conejos, Costilla, Saguache, Mineral Counties and the Cities of Monte Vista and Del Norte. The SLVHC markets to potential program participants through other community organizations, the local governments and the building departments.

$250,000 grant in Huerfano County

The Department of Local Affairs has announced that $250,000 in CDBG funds has been awarded to Huerfano County for the following project:

Huerfano County, on behalf of the South Central Council of Governments (SCCOG), has received a grant of $250,000 to continue the funding of their two-county (Huerfano and Las Animas) Single-Family, Owner-Occupied Rehabilitation Program. These grant funds will be used to provide low-interest loans for eighteen (18) rehabilitation projects and eight (8) essential repairs to households at 80% of the Area Median Income in these counties. This rehabilitation program has received funding from the Colorado Division of Housing since 1987 and has completed the rehabilitation of over 412 homes.

Huerfano County, on behalf of the South Central Council of Governments (SCCOG), has received a grant of $250,000 to continue the funding of their two-county (Huerfano and Las Animas) Single-Family, Owner-Occupied Rehabilitation Program. These grant funds will be used to provide low-interest loans for eighteen (18) rehabilitation projects and eight (8) essential repairs to households at 80% of the Area Median Income in these counties. This rehabilitation program has received funding from the Colorado Division of Housing since 1987 and has completed the rehabilitation of over 412 homes.

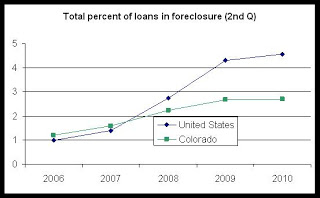

Colorado 34th in foreclosed loans

The percentage of Colorado mortgage loans in foreclosure rose slightly to 2.69 percent during the second quarter of 2010, rising from 2009’s second-quarter rate of 2.67 percent. According to a report released on August 26th by the Mortgage Bankers Association, the proportion of Colorado mortgage loans in foreclosure fell from the first quarter of 2010 to the second quarter of 2010, with the percentage of loans in foreclosure falling from 2.76 percent.

Compared to the proportion of loans in foreclosure for all states, Colorado’s totals are lower than national average. Nationally, 4.57 percent of loans nationwide were in a state of foreclose during the second quarter of 2010. Year-over-year trends are also upward nationally with 2010’s second-quarter percentage being an increase from the second quarter of 2010 when the total percentage of loans in foreclosure was 4.3 percent. Foreclosing loans decreased nationally from the first quarter of 2010 to the second quarter with an fall from the first quarter’s percentage of 4.63 percent.

Thirty-three states reported a smaller percentage than Colorado for the number of mortgage loans in foreclosure. North Dakota reported the smallest percentage of foreclosing mortgages with 1.02 percent. Alaska and Wyoming placed slightly behind North Dakota with 1.40 percent and 1.62 percent of loans in foreclosure, respectively.

States reporting the highest percentages of loans in foreclosure included Nevada and Florida with percentages of 10.33 percent and 14.04 percent, respectively.

Short-term delinquencies dropped slightly in both Colorado and nationwide from the second quarter of last year to the second quarter this year. In Colorado, 30-day delinquencies fell from 2.54 percent to 2.51 percent, year over year, while nationwide, they fell from 3.57 percent to 3.41 percent during the same period.

State of Colorado data has shown declines in new foreclosure filings since the third quarter of 2009, and both new foreclosure filings and completed foreclosures have declined in recent months.

Nationwide, the percentage of loans in foreclosure during the first quarter has outpaced Colorado since 2008. Prior to 2008, Colorado reported a larger percentage of foreclosing loans than was the case nationally, but since 2008, the percentage of foreclosing loans has grown more nationally than in Colorado each year.

Colorado has repeatedly fallen in state-by-state comparisons in recent years. In 2007, for example, Colorado was often found to be in the top 15 states for foreclosures. Colorado has since dropped to 34th.

This has also been the case in 30-day delinquencies and in the total combined percentage of loans that are in foreclosure or are 90-days delinquent.

Prior to 2008, Colorado experienced a large amount of foreclosure and delinquency activity before the rest of the nation making it one of the top states in the nation for foreclosures. Since 2008, other states like Nevada, California and Florida have outpaced Colorado and have moved national percentages above Colorado’s.

Thursday, August 26, 2010

Upcoming releases of housing data

August 31: Single-family rental vacancy rates and rents

September 2: Deed-restricted housing vacancies and rents

September 2: Deed-restricted housing vacancies and rents

Foreclosure filings in Colorado fall again

Click here for the full report.

For the fourth month in s arrow, foreclosure filings in Colorado were down when compared with the same month last year. According to a report released today by the Department of Local Affairs’ Division of Housing, foreclosure filings in Colorado’s metropolitan counties fell 29.5 percent in July as compared to July of last year. Monthly foreclosure filings totals have been down year-over-year every month since April. Foreclosure sales at auction fell 15.4 percent during July as compared to July of last year.

There were 2,718 new foreclosure filings during July compared to 3,855 filings during the same period last year. There were 1,581 foreclosure sales during July, and there were 1,869 foreclosure sales during the same month last year.

From June to July this year, foreclosure filings rose 0.2 percent, and foreclosure sales at auction fell 10.9 percent.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

“We continue to see a generally downward trend in both new filings and foreclosure sales at auction,” said Ryan McMaken, a spokesperson for the Colorado Division of Housing. “The decline in sales at auction can be attributed at least in part to the success of programs like the Foreclosure Hotline. However, since foreclosure activity is so closely tied to wages and employment right now, the trend in filings could change at any time in response to the overall strength of the economy."

Foreclosure activity varied by county. The counties with the largest decreases in foreclosure filings from July 2009 to July 2010 were Weld County and Denver County, where filings decreased by 38.0 percent and 39.0 percent, respectively. Mesa County was the only county surveyed where filings increased. Year-over-year filings in Mesa County increased by 24.6 percent.

Year-over-year, Mesa County was also the only county to report an increase in foreclosure sales at auction. Sales increased 133.3 percent in Mesa County year-over-year. Sales fell most in Larimer County and El Paso County where they decreased by 31.1 percent and 32.4 percent, respectively.

The county with the highest rate of foreclosure sales was Weld County with a rate of 598 households per foreclosure sale. Mesa County came in second with 660 households per foreclosure sale. The lowest rate was found in Boulder County where there were 2,966 households per foreclosure sale. The largest increase in foreclosure rates since 2009 was found in Mesa County where the foreclosure rate increased from 1,540 households per foreclosure to 660 households per foreclosure, year-over-year.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve largest counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

For the fourth month in s arrow, foreclosure filings in Colorado were down when compared with the same month last year. According to a report released today by the Department of Local Affairs’ Division of Housing, foreclosure filings in Colorado’s metropolitan counties fell 29.5 percent in July as compared to July of last year. Monthly foreclosure filings totals have been down year-over-year every month since April. Foreclosure sales at auction fell 15.4 percent during July as compared to July of last year.

There were 2,718 new foreclosure filings during July compared to 3,855 filings during the same period last year. There were 1,581 foreclosure sales during July, and there were 1,869 foreclosure sales during the same month last year.

From June to July this year, foreclosure filings rose 0.2 percent, and foreclosure sales at auction fell 10.9 percent.

Foreclosure filings are the initial filing that begins the foreclosure process, and foreclosure sales totals are the total number of foreclosures that have been sold at auction at the end of the foreclosure process.

“We continue to see a generally downward trend in both new filings and foreclosure sales at auction,” said Ryan McMaken, a spokesperson for the Colorado Division of Housing. “The decline in sales at auction can be attributed at least in part to the success of programs like the Foreclosure Hotline. However, since foreclosure activity is so closely tied to wages and employment right now, the trend in filings could change at any time in response to the overall strength of the economy."

Foreclosure activity varied by county. The counties with the largest decreases in foreclosure filings from July 2009 to July 2010 were Weld County and Denver County, where filings decreased by 38.0 percent and 39.0 percent, respectively. Mesa County was the only county surveyed where filings increased. Year-over-year filings in Mesa County increased by 24.6 percent.

Year-over-year, Mesa County was also the only county to report an increase in foreclosure sales at auction. Sales increased 133.3 percent in Mesa County year-over-year. Sales fell most in Larimer County and El Paso County where they decreased by 31.1 percent and 32.4 percent, respectively.

The county with the highest rate of foreclosure sales was Weld County with a rate of 598 households per foreclosure sale. Mesa County came in second with 660 households per foreclosure sale. The lowest rate was found in Boulder County where there were 2,966 households per foreclosure sale. The largest increase in foreclosure rates since 2009 was found in Mesa County where the foreclosure rate increased from 1,540 households per foreclosure to 660 households per foreclosure, year-over-year.

The Division of Housing’s monthly foreclosure report surveys foreclosure activity in the twelve largest counties of Colorado. The report is a supplement to the Division’s quarterly foreclosure report that includes all counties in Colorado.

Tuesday, August 24, 2010

August Housing Snapshot now available

This month's Housing Snapshot is now online here. In this issue:

Regional CPI

Foreclosure Update

Employment Trends

Statewide Vacancy Rates

Single-Family Building Permits

Regional CPI

Foreclosure Update

Employment Trends

Statewide Vacancy Rates

Single-Family Building Permits

Chart of the Week: Vacancies and Unemployment

We've begun a new feature for this blog called "The Chart of the Week." The goal is to produce a short video presentation, about two to three minutes long, every week that looks at a different piece of the economy to give us a few insights into what is going on with housing. Here is the first installment on Apartment Vacancies and Unemployment:

Labels:

chart of the week,

economics,

unemployment,

vacancy surveys,

videos

Friday, August 20, 2010

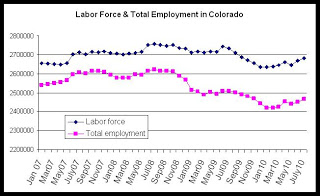

Colorado adds jobs in July, unemployment rate stable

Colorado added 14,882 jobs in July, and the unemployment rate fell slightly to 8.0 from June's rate of 8.2 percent. According to the most recent employment data released by the Colorado Department of Labor and Employment, total employment in July, not seasonally adjusted, rose to 2,465,190 jobs.

More than 11,600 people joined the work force during the month, marking the first time since April 2010 that more jobs were added than there were new workers in the labor force.

From July 2009 to July 2010, total employment fell 1.8 percent, contracting by 45,000 jobs, while the labor force shrank 1.9 percent, shedding more than 52,000 workers. The total labor force in July included 2,680,934 workers during July of this year as compared to 2,733,143,000 during July of last year.

Employment totals are still more than 155,000 below the peak levels experienced during July 2008, when there were 2,621,081 employed workers. Since the peak of the labor market in July 2008, the labor force is still down by more than 75,000.

Among Colorado metropolitan areas, Pueblo showed the highest unemployment rate at 9.8 percent, while the Boulder-Longmont and Fort Collins-Loveland areas showed the lowest rates as 6.4 percent and 6.6 percent, respectively.

All metropolitan areas in Colorado, except Greeley and the Denver-Aurora area, experienced job declines from June to July, and all metro areas lost jobs from July 2009 to July 2010.

Unemployment rates in all metro areas for July 2010 were Boulder-Longmont, 6.4 percent; Denver-Aurora, 8.1 percent; Greeley, 9.3 percent; Fort Collins-Loveland, 6.6 percent; Grand Junction, 9.5 percent; Pueblo, 9.8 percent.

Earlier this week, the U.S. Department of Labor reported that new jobless claims rose the highest level since November 2009.

The national jobless rate, seasonally adjusted, remains at 9.5 percent.

Thursday, August 19, 2010

Colorado apartment vacancies fall, rents rise

Click here for report.

Apartment vacancies fell across Colorado as rents rose during the second quarter of 2010, signaling a surprising amount of growth in demand for housing in spite of limited wage and job growth. According to a report released Thursday by the Department of Local Affairs’ Division of Housing, from the second quarter of 2009 to the second quarter of this year, vacancies fell in seven of the eight metropolitan areas of the state measured by the survey, including Fort Collins, Loveland, Greeley and Colorado Springs. Only Grand Junction and Pueblo reported a rise in the vacancy rate.

The largest drop in the vacancy rate was found in Colorado Springs where, year-over-year, the rate fell from 9.8 percent to 5.8 percent.

In Grand Junction, vacancies rose year-over-year from 4.5 percent to 8.9 percent, and in Pueblo, they rose from 8.5 percent to 10.4 percent during the same period.

The metro Denver vacancy rate, measured earlier this month in a separate survey, also fell year-over-year from 9.0 percent to 6.1 percent.

Vacancy rates in all metropolitan areas were Colorado Springs, 5.8 percent; Ft. Collins/Loveland, 6.8 percent; Grand Junction, 8.9 percent; Greeley, 6.3 percent; Pueblo, 10.4 percent.

Average rents rose across the state as vacancies fell. Among the state’s metropolitan areas, average rents rose in all areas except Greeley. The largest increase was found in the Fort Collins/Loveland region where the average rent increased from $825.03 to $885.29 from the second quarter of last year to the second quarter of this year. In Greeley, the average rent fell from 629.01 to 618.29, year-over-year.

Average rents in all metropolitan areas measured were Colorado Springs, $719.22, Ft. Collins/Loveland, $885.29; Grand Junction, $634.48; Greeley, $618.29; Pueblo, $541.78.

The metro Denver average rent, measured in a separate survey, was $899.97 for the second quarter.

Apartment vacancies fell across Colorado as rents rose during the second quarter of 2010, signaling a surprising amount of growth in demand for housing in spite of limited wage and job growth. According to a report released Thursday by the Department of Local Affairs’ Division of Housing, from the second quarter of 2009 to the second quarter of this year, vacancies fell in seven of the eight metropolitan areas of the state measured by the survey, including Fort Collins, Loveland, Greeley and Colorado Springs. Only Grand Junction and Pueblo reported a rise in the vacancy rate.

The largest drop in the vacancy rate was found in Colorado Springs where, year-over-year, the rate fell from 9.8 percent to 5.8 percent.

In Grand Junction, vacancies rose year-over-year from 4.5 percent to 8.9 percent, and in Pueblo, they rose from 8.5 percent to 10.4 percent during the same period.

The metro Denver vacancy rate, measured earlier this month in a separate survey, also fell year-over-year from 9.0 percent to 6.1 percent.

Vacancy rates in all metropolitan areas were Colorado Springs, 5.8 percent; Ft. Collins/Loveland, 6.8 percent; Grand Junction, 8.9 percent; Greeley, 6.3 percent; Pueblo, 10.4 percent.

Average rents rose across the state as vacancies fell. Among the state’s metropolitan areas, average rents rose in all areas except Greeley. The largest increase was found in the Fort Collins/Loveland region where the average rent increased from $825.03 to $885.29 from the second quarter of last year to the second quarter of this year. In Greeley, the average rent fell from 629.01 to 618.29, year-over-year.

Average rents in all metropolitan areas measured were Colorado Springs, $719.22, Ft. Collins/Loveland, $885.29; Grand Junction, $634.48; Greeley, $618.29; Pueblo, $541.78.

The metro Denver average rent, measured in a separate survey, was $899.97 for the second quarter.

Wednesday, August 18, 2010

Who regulates HOAs?

We receive many questions about Homeowners Associations at the Division of Housing, although we do not in any way track, register or regulate these associations.

However, since the passage of House Bill 10-1278, homeowners associations must register annually with the Colorado Division of Real Estate. The bill also creates the HOA Information and Resource Center which is housed at the Department of Regulatory Agencies.

Today, The law firm Otten, Johnson (et al) issued an advisory on the new law, which in part reads:

Otten Johnson's interpretation is also that HB 10-1278 "applies not just to what are common called HOA's but also apply to all property owners' associations under the Colorado Common Interest Ownership Act (CCIOA)."

However, since the passage of House Bill 10-1278, homeowners associations must register annually with the Colorado Division of Real Estate. The bill also creates the HOA Information and Resource Center which is housed at the Department of Regulatory Agencies.

Today, The law firm Otten, Johnson (et al) issued an advisory on the new law, which in part reads:

HB 1278 also creates the HOA Information and Resource Center which is to be headed by the "HOA Information Officer" appointed by the Executive Director of the Department of Regulatory Agencies, which appointment is expected to occur in the late fall or early winter of 2010. The HOA Information and Resource Center is to (a) serve as a clearing house for information concerning the basic rights and duties of unit owners, developers, and unit owners' associations under CCIOA, and (b) track and report inquiries and complaints regarding HOAs to the Division of Real Estate.

HB 1278 grants the Director of the Division of Real Estate the power to adopt rules as necessary to implement HB 1278. Because HB 1278 speaks in fairly general terms, the operations and impacts of the HOA Information and Resource Center and the HOA registration requirements will likely be determined by the scope of the adopted rules. Given that this is the Division of Real Estate's first real involvement with HOA operations, it will be interesting to see how far the Division will extend its oversight over the formation and operation of HOAs through future regulations.

Otten Johnson's interpretation is also that HB 10-1278 "applies not just to what are common called HOA's but also apply to all property owners' associations under the Colorado Common Interest Ownership Act (CCIOA)."

Monday, August 16, 2010

Housing prices fall 0.1 percent in West, including Colorado

The overall CPI in the United States fell 0.3 percent from June to July this year, and has increased 1.2 percent over the last 12 months.

For the 12 month period ending in July, consumer prices for gasoline rose 7.4 percent, while energy prices overall rose 5.2 percent.

Prices for shelter increased 0.1 percent from June to July of this year, and have fallen 0.7 percent over the last 12 months.

Year over year, medical care prices increased 3.2 percent.

Overall growth in prices, including shelter, continues to be muted by a lack of job growth and wage growth. Significant increases in deficit spending have substantially increased the money supply in the United States, but these increases have yet to manifest themselves in notable devaluation of the dollar. This is likely due to weak activity in lending, lack of consumer spending due to job fears and banks holding large portions of the recently-produced currency in reserves.

The the "West" region of the United States, which includes Colorado, consumer prices rose 0.1 percent from June to July, and rose 0.8 percent year over year from July 2009 to July 2010.

According to the Mountain-Plains CPI Blue Card, Housing prices in the West rose 0.1 percent from June to July, and they fell 1.3 percent year over year for July.

The largest year-over-year increases were found in medical care and transportation which increased 3.4 percent and 5.6 percent, respectively.

The largest drops were in housing and apparel, which fell 1.3 percent and 0.1 percent, respectively.

States like California and Arizona, which have been heavily impacted by large numbers of foreclosures, are included in the West, and have impacted overall housing costs as reflected in the regional CPI. Region-wide however, the notable drop of 1.3 percent also reflects generally stable home prices and very stable or falling rent levels, in many areas.

For the 12 month period ending in July, consumer prices for gasoline rose 7.4 percent, while energy prices overall rose 5.2 percent.

Prices for shelter increased 0.1 percent from June to July of this year, and have fallen 0.7 percent over the last 12 months.

Year over year, medical care prices increased 3.2 percent.

Overall growth in prices, including shelter, continues to be muted by a lack of job growth and wage growth. Significant increases in deficit spending have substantially increased the money supply in the United States, but these increases have yet to manifest themselves in notable devaluation of the dollar. This is likely due to weak activity in lending, lack of consumer spending due to job fears and banks holding large portions of the recently-produced currency in reserves.

The the "West" region of the United States, which includes Colorado, consumer prices rose 0.1 percent from June to July, and rose 0.8 percent year over year from July 2009 to July 2010.

According to the Mountain-Plains CPI Blue Card, Housing prices in the West rose 0.1 percent from June to July, and they fell 1.3 percent year over year for July.

The largest year-over-year increases were found in medical care and transportation which increased 3.4 percent and 5.6 percent, respectively.

The largest drops were in housing and apparel, which fell 1.3 percent and 0.1 percent, respectively.

States like California and Arizona, which have been heavily impacted by large numbers of foreclosures, are included in the West, and have impacted overall housing costs as reflected in the regional CPI. Region-wide however, the notable drop of 1.3 percent also reflects generally stable home prices and very stable or falling rent levels, in many areas.

Friday, August 13, 2010

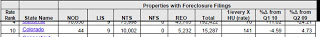

A case study of problematic analysis and data collection in Realtytrac's foreclosure report

In recent wire stories referencing Realtytrac's second quarter foreclosure statistics, it has been noted that "[f]oreclosure filings rose in the second quarter in Idaho, Illinois, Utah, and Colorado compared with a year earlier." [Link]

The reporting in the Bloomberg/BusinessWeek article is based on recently released foreclosure data from Realtytrac, but Realtytrac's data is incorrect. The year-over-year change during the second quarter in Colorado is actually negative, while Realtytrac reports growth. This is an example of incorrect and potentially misleading data coming out of a Realtytrac report.

In this article, I will examine how Realtytrac's reported numbers for the second quarter do not match up with the numbers reported by the public trustees in Colorado, and how Realtytrac's practice of combining foreclosure filings totals with foreclosure sales totals leads to errors in interpreting the data.

The Realtytrac Method

The details of Realtytrac's data collection methods remain a mystery. The press releases note that Realtytrac engages in a kind of sampling: "Data is collected from more than 2,200 counties nationwide, and those counties account for more than 90 percent of the U.S. population."

It is unknown from which Colorado counties Realtytrac samples its data. The quarterly foreclosure reports provided by the Division of Housing, however, collect complete data on foreclosure activity directly from public trustees in all counties in Colorado. The public trustee is the county office responsible for administering foreclosure filings and auctions in Colorado.

In spite of a lack of information about collection methods, we can nevertheless glean some information from the published press releases. Based on the data it does report publicly, the numbers put forward as the statewide number for Colorado is based on the number of "Notices of Trustee Sales" (NTS) added to the number of "Real Estate Owned" (REO) filings.

Here are the numbers as listed on Realtytrac's second quarter report:

Note that the "Totals" column is clearly the total of the NTS and REO numbers added together. In Colorado, what Realtytrac calls NTS is known as the Notice of Election and Demand (NED), and what Realtytrac calls REO is in Colorado commonly referred to as a foreclosure "sale at auction" or "certificate of purchase."

Here we see our first problem with Realtytrac's analysis. By adding together the NED total and the sale number, and then basing foreclosure rates and trends on the combined number, Realtytrac is obscuring essential information that is key to accurate analysis of foreclosure trends in the state.

This is because the NED number and the sale number are two completely independent statistics, and often trend in opposite directions. For example, between April 2009 and April 2010, foreclosure sales at auction showed a generally upward trend, and overall they increased by about 45 percent. During the same period, NEDs showed a generally downward trend and showed an overall decrease during the period of about 16 percent.

NEDs and sales are affected differently by changes in the economic environment and should not be combined. NEDs are a leading indicator of economic pressures that produce foreclosures, while foreclosure sales are a trailing indicator. NEDs represent the beginning of the foreclosure process, while foreclosure sales represent the end.

It is not difficult to see that if NEDs are rising, but foreclosure sales are falling, that, all things being equal, one would expect to see a future rise in foreclosure sales. On the other hand, if NEDs are falling, but sales are rising, we would expect to see a fall in sales activity a few months down the road. If we combine the two numbers before making our analysis, however, these insights into future foreclosure trends become impossible.

Also, foreclosure sales at auction are always sales of loans that were already counted as foreclosures when the NED was filed. So, by combining the two numbers, and then including both in the same category, Realtytrac is reporting a foreclosing loan a second time.

It is probably best to not consider the Realtytrac totals as actual counts of foreclosures at all, but as an index number constructed from two dissimilar statistics. However, as we have seen, this index number can often cause us to miss important information contained in the actual foreclosure totals.

Recent Measurements

The recent wire story noting that year-over-year foreclosure activity is trending upward highlights some of the problems in basing analysis on Realtytrac's combined totals. The State of Colorado's data, which does not sample but relies on full totals collected from all counties, shows that 2010 second-quarter NEDs fell 15.6 percent. Foreclosure sales increased 17.7 percent. Clearly, this shows us that two different trends are at work if we look at sales and NEDs separately.

Realtytrac reports that foreclosure activity increased during this period by 4.73 percent. So, did foreclosures increase or decrease during this period? Realtytrac says they increased, but we see in our own numbers that new properties entering foreclosure actually fell almost 16 percent.

However, to make an honest comparison, we need to add together our own NED and sale totals to re-create the Realtytrac method. After adding together the two totals, we still find that Realtytrac's number is confusing. Adding together the State's NEDs and the sales totals for 2010's second quarter, and then comparing to the second quarter of last year, we find that the combined total is down 5.9 percent, year-over-year. Again, Realtytrac, using the same combined total, shows an increase of 4.73 percent. So, using Realtytrac's own method of analysis for the State's totals, we find that Realtytrac's numbers show an increase when the real change, based on data from all counties direct from public trustees, is a decline of 5.9 percent.

Since using Realtytrac's method of analysis still yields a discrepancy between the state numbers and the Realtytrac numbers, we must therefore conclude that Realtytrac's method of data collection is faulty.

Data Collection

Let's now look at the actual totals reported by Realtytrac and compare them to our own numbers.

First Realtytrac's numbers:

For the second quarter of 2010, Realtytrac reports an NED total of 10,002 and a sale number of 5,232. The combined total is 15,287. Realtytrac does not provide historical stats in its reports, but if we look up the old 2nd Q 2009 report, we find that Realtytrac's totals for that period were 10,938 NEDs and 3,618 sales. The combined total is 14,579. The change from 14,579 to 15,287 is an increase of 4.7 percent, which is reported in the 2nd Q 2010 Realtytrac report.

The State of Colorado numbers:

For the second quarter of 2010, the state's public trustees reported an NED total of 10,233 and a sale number of 5,885. The combined total is 16,118. For the second quarter of 2009, the state's public trustees reported 12,135 NEDs and 4,999 sales. The combined total is 17,134. The change from 17,134 to 16,118 is a decrease of 5.9 percent, although this statistic was not published in the State's 2nd Q report since we believe it is not useful and is misleading to combine the NED total and the Sale total.

Looking at these totals, we find that Realtytrac undercounted considerably during the second quarter of 2009, and that this incorrectly low number, when compared with the 2nd Q 2010 total, showed a net positive increase in foreclosure activity between the second quarter of 2009 and the same period this year. It is likely that the change over this period was, in fact, negative.

Also, the fact that NEDs declined over this period while sales increased is key information that is left out of the Realtytrac analysis as packaged for the media.

Conclusion

Since it is unknown from which counties Realtytrac samples in Colorado, it is difficult to determine the reasons for Realtytrac's significantly large undercounting during the second quarter of 2009. However, the fact that small and medium-size counties in Colorado have driven much of the growth in Colorado foreclosures in recent quarters may be important if Realtytrac is not collecting data from these counties.

The Division of Colorado continues to provide the most accurate information on foreclosure trends in Colorado. The state's data is taken not from samples, but from complete counts of foreclosure events as provided by the public trustee in each county.

A case study of the 2009 and 2010 second-quarter data is produced above as an example of some of the problematic elements in the Realtytrac data. At this time it is unknown as to what other quarterly or monthly analyses might be affected by similar problems in data collection or analysis.

We believe it is important that media reports of foreclosure trends in Colorado reflect the most accurate data available.

The reporting in the Bloomberg/BusinessWeek article is based on recently released foreclosure data from Realtytrac, but Realtytrac's data is incorrect. The year-over-year change during the second quarter in Colorado is actually negative, while Realtytrac reports growth. This is an example of incorrect and potentially misleading data coming out of a Realtytrac report.

In this article, I will examine how Realtytrac's reported numbers for the second quarter do not match up with the numbers reported by the public trustees in Colorado, and how Realtytrac's practice of combining foreclosure filings totals with foreclosure sales totals leads to errors in interpreting the data.

The Realtytrac Method

The details of Realtytrac's data collection methods remain a mystery. The press releases note that Realtytrac engages in a kind of sampling: "Data is collected from more than 2,200 counties nationwide, and those counties account for more than 90 percent of the U.S. population."

It is unknown from which Colorado counties Realtytrac samples its data. The quarterly foreclosure reports provided by the Division of Housing, however, collect complete data on foreclosure activity directly from public trustees in all counties in Colorado. The public trustee is the county office responsible for administering foreclosure filings and auctions in Colorado.

In spite of a lack of information about collection methods, we can nevertheless glean some information from the published press releases. Based on the data it does report publicly, the numbers put forward as the statewide number for Colorado is based on the number of "Notices of Trustee Sales" (NTS) added to the number of "Real Estate Owned" (REO) filings.

Here are the numbers as listed on Realtytrac's second quarter report:

Note that the "Totals" column is clearly the total of the NTS and REO numbers added together. In Colorado, what Realtytrac calls NTS is known as the Notice of Election and Demand (NED), and what Realtytrac calls REO is in Colorado commonly referred to as a foreclosure "sale at auction" or "certificate of purchase."

Here we see our first problem with Realtytrac's analysis. By adding together the NED total and the sale number, and then basing foreclosure rates and trends on the combined number, Realtytrac is obscuring essential information that is key to accurate analysis of foreclosure trends in the state.

This is because the NED number and the sale number are two completely independent statistics, and often trend in opposite directions. For example, between April 2009 and April 2010, foreclosure sales at auction showed a generally upward trend, and overall they increased by about 45 percent. During the same period, NEDs showed a generally downward trend and showed an overall decrease during the period of about 16 percent.

NEDs and sales are affected differently by changes in the economic environment and should not be combined. NEDs are a leading indicator of economic pressures that produce foreclosures, while foreclosure sales are a trailing indicator. NEDs represent the beginning of the foreclosure process, while foreclosure sales represent the end.

It is not difficult to see that if NEDs are rising, but foreclosure sales are falling, that, all things being equal, one would expect to see a future rise in foreclosure sales. On the other hand, if NEDs are falling, but sales are rising, we would expect to see a fall in sales activity a few months down the road. If we combine the two numbers before making our analysis, however, these insights into future foreclosure trends become impossible.

Also, foreclosure sales at auction are always sales of loans that were already counted as foreclosures when the NED was filed. So, by combining the two numbers, and then including both in the same category, Realtytrac is reporting a foreclosing loan a second time.

It is probably best to not consider the Realtytrac totals as actual counts of foreclosures at all, but as an index number constructed from two dissimilar statistics. However, as we have seen, this index number can often cause us to miss important information contained in the actual foreclosure totals.

Recent Measurements

The recent wire story noting that year-over-year foreclosure activity is trending upward highlights some of the problems in basing analysis on Realtytrac's combined totals. The State of Colorado's data, which does not sample but relies on full totals collected from all counties, shows that 2010 second-quarter NEDs fell 15.6 percent. Foreclosure sales increased 17.7 percent. Clearly, this shows us that two different trends are at work if we look at sales and NEDs separately.

Realtytrac reports that foreclosure activity increased during this period by 4.73 percent. So, did foreclosures increase or decrease during this period? Realtytrac says they increased, but we see in our own numbers that new properties entering foreclosure actually fell almost 16 percent.

However, to make an honest comparison, we need to add together our own NED and sale totals to re-create the Realtytrac method. After adding together the two totals, we still find that Realtytrac's number is confusing. Adding together the State's NEDs and the sales totals for 2010's second quarter, and then comparing to the second quarter of last year, we find that the combined total is down 5.9 percent, year-over-year. Again, Realtytrac, using the same combined total, shows an increase of 4.73 percent. So, using Realtytrac's own method of analysis for the State's totals, we find that Realtytrac's numbers show an increase when the real change, based on data from all counties direct from public trustees, is a decline of 5.9 percent.

Since using Realtytrac's method of analysis still yields a discrepancy between the state numbers and the Realtytrac numbers, we must therefore conclude that Realtytrac's method of data collection is faulty.

Data Collection

Let's now look at the actual totals reported by Realtytrac and compare them to our own numbers.

First Realtytrac's numbers:

For the second quarter of 2010, Realtytrac reports an NED total of 10,002 and a sale number of 5,232. The combined total is 15,287. Realtytrac does not provide historical stats in its reports, but if we look up the old 2nd Q 2009 report, we find that Realtytrac's totals for that period were 10,938 NEDs and 3,618 sales. The combined total is 14,579. The change from 14,579 to 15,287 is an increase of 4.7 percent, which is reported in the 2nd Q 2010 Realtytrac report.

The State of Colorado numbers:

For the second quarter of 2010, the state's public trustees reported an NED total of 10,233 and a sale number of 5,885. The combined total is 16,118. For the second quarter of 2009, the state's public trustees reported 12,135 NEDs and 4,999 sales. The combined total is 17,134. The change from 17,134 to 16,118 is a decrease of 5.9 percent, although this statistic was not published in the State's 2nd Q report since we believe it is not useful and is misleading to combine the NED total and the Sale total.

Looking at these totals, we find that Realtytrac undercounted considerably during the second quarter of 2009, and that this incorrectly low number, when compared with the 2nd Q 2010 total, showed a net positive increase in foreclosure activity between the second quarter of 2009 and the same period this year. It is likely that the change over this period was, in fact, negative.

Also, the fact that NEDs declined over this period while sales increased is key information that is left out of the Realtytrac analysis as packaged for the media.

Conclusion

Since it is unknown from which counties Realtytrac samples in Colorado, it is difficult to determine the reasons for Realtytrac's significantly large undercounting during the second quarter of 2009. However, the fact that small and medium-size counties in Colorado have driven much of the growth in Colorado foreclosures in recent quarters may be important if Realtytrac is not collecting data from these counties.

The Division of Colorado continues to provide the most accurate information on foreclosure trends in Colorado. The state's data is taken not from samples, but from complete counts of foreclosure events as provided by the public trustee in each county.

A case study of the 2009 and 2010 second-quarter data is produced above as an example of some of the problematic elements in the Realtytrac data. At this time it is unknown as to what other quarterly or monthly analyses might be affected by similar problems in data collection or analysis.

We believe it is important that media reports of foreclosure trends in Colorado reflect the most accurate data available.

Friday, August 6, 2010

Montezuma County Benefits from Recovery Act

for immediate release

FRIDAY, AUG. 6, 2010

contact:

Jerilynn Martinez, 303.297.7427

[email protected]

Montezuma County Benefits from Recovery Act

$6.4 million will help build 48 affordable housing units

(Cortez, Colo.) - The Housing Authority of the County of Montezuma has been awarded $6.4 million from the American Recovery and Reinvestment Act (ARRA) to build Brubaker Place, a 48 unit affordable housing community in Cortez, Colorado.

“We currently have more than 280 low to moderate income qualified applicants waiting for housing,” said Terri Wheeler, executive director of the Housing Authority of the County of Montezuma. “Brubaker Place will provide affordable, workforce housing for Montezuma County’s service population, which civic and business leaders agree is vital to the success of our community.”

Upon its completion, Brubaker Place will consist of six, two-story apartment buildings and a one-story community center. One, two, and three bedroom units will be available for rent to households earning 60 percent Area Median Income and below, or less than $30,480 annually for a family of four. Overall, the $8.6 million project is estimated to generate over $18 million in economic investment within the surrounding community and support 136 jobs.

Congressman John Salazar said, “I’m glad that stimulus funding can help to create jobs in Colorado and affordable housing opportunities for those who need them. This funding will help create 48 units of affordable housing while putting money into the Cortez economy. I’m proud to have supported stimulus funding for this project and I will continue to support projects that create jobs and develop our communities.”

The ARRA funding awarded to Brubaker Place is part of the Tax Credit Exchange Program (TCEP) created by Congress to support the development and preservation of affordable housing and stimulate jobs. To date, Colorado has received $32.8 million in TCEP funds to eight affordable housing developments consisting of 410 rental units across the state. The TCEP program is administered by the Colorado Housing and Finance Authority (CHFA).

“Several affordable housing developments across Colorado were at risk of not moving forward as a result of the national economic decline,” said Cris White, CHFA executive director and CEO. “The TCEP program, created by Congress in ARRA, has been key to ensuring that many of these developments are able to proceed.”

In addition in TCEP funding, Brubaker Place is receiving $1.1 million from Funding Partners’ Mammel Affordable Housing Loan Program, and $950,000 in Community Development Block Grant (CDBG) funds awarded by the Colorado Department of Local Affairs, Division of Housing.

Darcy McClure, president of the Funding Partners Board of Trustees said, “Brubaker Place is a marvelous example of how the public and private sectors have joined forces to respond to market disruptions and meet rural Colorado’s needs, an area that too often falls from our collective radar. Although complex, the community benefits and long-term impacts of this financing structure are well worth the effort.”

Brubaker Place will be constructed with double paned windows, brick and stone exterior detail, attractive steel balcony and stair railings, and water efficient landscaping. The units will feature tile entries, large windows, nine foot ceilings, brushed nickel hardware throughout the kitchens and baths, modern energy efficient appliances, washer/dryer hook-ups, and a patio or balcony.

For more information about Brubaker Place, or to apply for rental housing assistance from the Housing of Montezuma Housing Authority, please contact Terri Wheeler, executive director at 970.565.3831 or visit the Main Office located at 37 N. Madison, Cortez, Colorado 81321.

FRIDAY, AUG. 6, 2010

contact:

Jerilynn Martinez, 303.297.7427

[email protected]

Montezuma County Benefits from Recovery Act

$6.4 million will help build 48 affordable housing units

(Cortez, Colo.) - The Housing Authority of the County of Montezuma has been awarded $6.4 million from the American Recovery and Reinvestment Act (ARRA) to build Brubaker Place, a 48 unit affordable housing community in Cortez, Colorado.

“We currently have more than 280 low to moderate income qualified applicants waiting for housing,” said Terri Wheeler, executive director of the Housing Authority of the County of Montezuma. “Brubaker Place will provide affordable, workforce housing for Montezuma County’s service population, which civic and business leaders agree is vital to the success of our community.”

Upon its completion, Brubaker Place will consist of six, two-story apartment buildings and a one-story community center. One, two, and three bedroom units will be available for rent to households earning 60 percent Area Median Income and below, or less than $30,480 annually for a family of four. Overall, the $8.6 million project is estimated to generate over $18 million in economic investment within the surrounding community and support 136 jobs.

Congressman John Salazar said, “I’m glad that stimulus funding can help to create jobs in Colorado and affordable housing opportunities for those who need them. This funding will help create 48 units of affordable housing while putting money into the Cortez economy. I’m proud to have supported stimulus funding for this project and I will continue to support projects that create jobs and develop our communities.”

The ARRA funding awarded to Brubaker Place is part of the Tax Credit Exchange Program (TCEP) created by Congress to support the development and preservation of affordable housing and stimulate jobs. To date, Colorado has received $32.8 million in TCEP funds to eight affordable housing developments consisting of 410 rental units across the state. The TCEP program is administered by the Colorado Housing and Finance Authority (CHFA).

“Several affordable housing developments across Colorado were at risk of not moving forward as a result of the national economic decline,” said Cris White, CHFA executive director and CEO. “The TCEP program, created by Congress in ARRA, has been key to ensuring that many of these developments are able to proceed.”

In addition in TCEP funding, Brubaker Place is receiving $1.1 million from Funding Partners’ Mammel Affordable Housing Loan Program, and $950,000 in Community Development Block Grant (CDBG) funds awarded by the Colorado Department of Local Affairs, Division of Housing.

Darcy McClure, president of the Funding Partners Board of Trustees said, “Brubaker Place is a marvelous example of how the public and private sectors have joined forces to respond to market disruptions and meet rural Colorado’s needs, an area that too often falls from our collective radar. Although complex, the community benefits and long-term impacts of this financing structure are well worth the effort.”

Brubaker Place will be constructed with double paned windows, brick and stone exterior detail, attractive steel balcony and stair railings, and water efficient landscaping. The units will feature tile entries, large windows, nine foot ceilings, brushed nickel hardware throughout the kitchens and baths, modern energy efficient appliances, washer/dryer hook-ups, and a patio or balcony.

For more information about Brubaker Place, or to apply for rental housing assistance from the Housing of Montezuma Housing Authority, please contact Terri Wheeler, executive director at 970.565.3831 or visit the Main Office located at 37 N. Madison, Cortez, Colorado 81321.

Thursday, August 5, 2010

New foreclosures filings drop 16 percent in Colorado

Full report is available here.

New foreclosure filings fell to 10,233 in Colorado during 2010’s second quarter, falling 15.7 percent from 2009’s second-quarter total of 12,135. According to a report released Thursday by the Colorado Department of Local Affairs’ Division of Housing, 2010’s second quarter filings were also down 8.1 percent from 2010’s first-quarter total of 11,136.

Foreclosure filings fell for the third quarter in a row with foreclosure filings now down 18 percent from the recent peak in filings activity experienced during the third quarter of 2009 when total filings hit 12,468.

“With foreclosure filings at their lowest point in five quarters, we think this constitutes a future downward trend” said Pat Coyle, director of the Division of Housing. “It’s becoming increasingly clear that in Colorado at least, new foreclosure filings are inching down in spite of a steady unemployment rate.”

During the first half of 2010, foreclosure filings fell 5.6 percent as compared to the first half of 2009, while foreclosure sales at auction rose 34.4 percent during the same period.

Foreclosure sales at auction, the event that completes the foreclosure process, increased 17.7 percent from the second quarter of 2009 to the same period this year, rising from 4,999 to 5,885. However, foreclosure sales fell 12.0 percent from the first quarter’s total of 6,686 to the second quarter of this year.

Although year-over-year comparisons show marked increases in foreclosure sales totals from 2009 to 2010, foreclosure sales totals for 2010 remain in line with totals experienced during most quarters since 2006. Foreclosure sales during the first half of 2009 had been significantly affected by moratoria put on the processing of foreclosures by several major investors and servicers of mortgages. These moratoria drove foreclosure sales numbers to unusually low totals while quarterly totals in 2010 returned to more typical levels.

“5,000 to 6,000 foreclosure sales each quarter has been the norm since 2006, but what’s notable is that in spite of the job losses in 2008 and 2009, the foreclosure sales numbers haven’t moved above those levels.” Coyle said. “This is where we’ve really seen the impact of the Foreclosure Hotline and the housing counseling agencies in Colorado. They’ve really helped put a limit on how many homes end up on the auction block.”

All Front Range counties reported year-over-year drops in foreclosure filings. Comparing the second quarter of 2009 to the same period this year, foreclosure filings in Denver County fell 30.4 percent, while filings fell 26.1 percent in Adams County and 23.4 percent in Weld County. Filings fell by 20 percent and 12.8 percent in Pueblo County and El Paso County, respectively.

The counties that did report increases in foreclosure filings were all found outside the metro Denver area and Colorado’s Front Range. Foreclosure filings in Mesa County increased 40.2 percent from the second quarter of last year to the same period this year. In Delta County, Montezuma County and Summit County, for example, foreclosure filings increased 46.3 percent, 12.5 percent and 23.4 percent, respectively.

Foreclosure sales are opened foreclosures that have proceeded through the full foreclosure process to final sale at public auction. Filings denote the beginning of the foreclosure process, and once a foreclosure is filed, the borrower has approximately four months to work with the lender to avoid a completed foreclosure. It is during this period that borrowers work with lenders and housing counselors to work out loan modifications, short sales, or other ways of withdrawing the foreclosure.

New foreclosure filings fell to 10,233 in Colorado during 2010’s second quarter, falling 15.7 percent from 2009’s second-quarter total of 12,135. According to a report released Thursday by the Colorado Department of Local Affairs’ Division of Housing, 2010’s second quarter filings were also down 8.1 percent from 2010’s first-quarter total of 11,136.

Foreclosure filings fell for the third quarter in a row with foreclosure filings now down 18 percent from the recent peak in filings activity experienced during the third quarter of 2009 when total filings hit 12,468.

“With foreclosure filings at their lowest point in five quarters, we think this constitutes a future downward trend” said Pat Coyle, director of the Division of Housing. “It’s becoming increasingly clear that in Colorado at least, new foreclosure filings are inching down in spite of a steady unemployment rate.”

During the first half of 2010, foreclosure filings fell 5.6 percent as compared to the first half of 2009, while foreclosure sales at auction rose 34.4 percent during the same period.

Foreclosure sales at auction, the event that completes the foreclosure process, increased 17.7 percent from the second quarter of 2009 to the same period this year, rising from 4,999 to 5,885. However, foreclosure sales fell 12.0 percent from the first quarter’s total of 6,686 to the second quarter of this year.

Although year-over-year comparisons show marked increases in foreclosure sales totals from 2009 to 2010, foreclosure sales totals for 2010 remain in line with totals experienced during most quarters since 2006. Foreclosure sales during the first half of 2009 had been significantly affected by moratoria put on the processing of foreclosures by several major investors and servicers of mortgages. These moratoria drove foreclosure sales numbers to unusually low totals while quarterly totals in 2010 returned to more typical levels.

“5,000 to 6,000 foreclosure sales each quarter has been the norm since 2006, but what’s notable is that in spite of the job losses in 2008 and 2009, the foreclosure sales numbers haven’t moved above those levels.” Coyle said. “This is where we’ve really seen the impact of the Foreclosure Hotline and the housing counseling agencies in Colorado. They’ve really helped put a limit on how many homes end up on the auction block.”

All Front Range counties reported year-over-year drops in foreclosure filings. Comparing the second quarter of 2009 to the same period this year, foreclosure filings in Denver County fell 30.4 percent, while filings fell 26.1 percent in Adams County and 23.4 percent in Weld County. Filings fell by 20 percent and 12.8 percent in Pueblo County and El Paso County, respectively.

The counties that did report increases in foreclosure filings were all found outside the metro Denver area and Colorado’s Front Range. Foreclosure filings in Mesa County increased 40.2 percent from the second quarter of last year to the same period this year. In Delta County, Montezuma County and Summit County, for example, foreclosure filings increased 46.3 percent, 12.5 percent and 23.4 percent, respectively.

Foreclosure sales are opened foreclosures that have proceeded through the full foreclosure process to final sale at public auction. Filings denote the beginning of the foreclosure process, and once a foreclosure is filed, the borrower has approximately four months to work with the lender to avoid a completed foreclosure. It is during this period that borrowers work with lenders and housing counselors to work out loan modifications, short sales, or other ways of withdrawing the foreclosure.

Wednesday, August 4, 2010

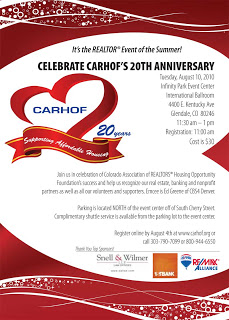

CARHOF's 20th Anniversary Luncheon coming next Tuesday

Tuesday, August 10, 2010

Infinity Park Event Center

International Ballroom

4400 E. Kentucky Ave

Glendale, CO 80246

11:30 am - 1 pm

Check-in: 11:00 am

Cost is $30

Join us for a celebration of Colorado Association of REALTORS® Housing Opportunity Foundation’s success and help us recognize of our real estate, banking and nonprofit partners as well as all our volunteers and supporters.

Parking is located North of the event center off of South Cherry Street.

FREE Shuttle service is available from the parking lot to the event center.

Register here: http://coloradorealtors.com/car_events_main.asp?EventID=2010CARHOF

Tuesday, August 3, 2010

Metro Denver apartment vacancies fall to 6.1 percent

See here for report summaries.

Apartment vacancies in the Denver metro area fell again in the second quarter, dropping to 6.1 percent. According to a report released Tuesday by the Apartment Association of Metro Denver and the Department of Local Affairs’ Division of Housing, apartment vacancy rates fell to the lowest rate reported for the second-quarter since 2001, falling from 2010’s first-quarter rate of 6.5 percent. The vacancy rate also fell from last year’s second-quarter rate of 9.0 percent.

In recent years, vacancy rates have tracked closely with the unemployment rate, illustrating a close connection between job growth and demand for apartments. In recent quarters, however, vacancy rates have remained low in spite of job losses and slow job creation.

“Vacancy rates continue to tighten in spite of meager job growth,” said Gordon Von Stroh, professor of business at the University of Denver, and the report’s author. “There has been little new apartment development in recent years, so the tight supply we do have will become even tighter once we start to see some large-scale job creation.”

Vacancy rates had initially increased following the rapid increase in the unemployment rate in late 2008 and early 2009, rising to 9.0 percent. But the vacancy rate quickly fell below eight percent by the end of 2009, and is now at a two-year low.

For 2010’s second quarter, the highest vacancy rates were found in Denver County where rates fell year-over-year from 9.8 percent to 7.4 percent. Rates were lowest in Douglas County where vacancies fell year-over-year from 5.8 percent to 3.9 percent. Vacancy rates fell in all metro Denver counties form the second quarter of 2009 to the same period this year.

2010’s first quarter vacancy rates by county were Adams, 5.2; Arapahoe, 6.4; Boulder/Broomfield, 4.9; Denver, 7.4; Douglas, 3.9; Jefferson, 5.4.

Rent growth was unusually strong. The metro-wide average rent increased year over year from $870.37 to $899.97 during the second quarter. For the first time in more than a year, all counties reported year-over-year increases in county-wide average rents.

“We’re starting to see signs of more significant increases in rents,” said Ryan McMaken, a spokesperson for the Division of Housing. “Rent growth, which hasn’t been adjusted for inflation in this survey, has been very moderate for several years now. But we’re likely to see more growth in the short- and medium-term as population grows and supply remains stable.”

Average rents for all counties were: Adams, $892.48; Arapahoe, $856.54; Boulder/Broomfield, $995.07; Denver, $909.46; Douglas, $1085.79; and Jefferson, $845.38.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

# # #

Apartment vacancies in the Denver metro area fell again in the second quarter, dropping to 6.1 percent. According to a report released Tuesday by the Apartment Association of Metro Denver and the Department of Local Affairs’ Division of Housing, apartment vacancy rates fell to the lowest rate reported for the second-quarter since 2001, falling from 2010’s first-quarter rate of 6.5 percent. The vacancy rate also fell from last year’s second-quarter rate of 9.0 percent.

In recent years, vacancy rates have tracked closely with the unemployment rate, illustrating a close connection between job growth and demand for apartments. In recent quarters, however, vacancy rates have remained low in spite of job losses and slow job creation.

“Vacancy rates continue to tighten in spite of meager job growth,” said Gordon Von Stroh, professor of business at the University of Denver, and the report’s author. “There has been little new apartment development in recent years, so the tight supply we do have will become even tighter once we start to see some large-scale job creation.”

Vacancy rates had initially increased following the rapid increase in the unemployment rate in late 2008 and early 2009, rising to 9.0 percent. But the vacancy rate quickly fell below eight percent by the end of 2009, and is now at a two-year low.

For 2010’s second quarter, the highest vacancy rates were found in Denver County where rates fell year-over-year from 9.8 percent to 7.4 percent. Rates were lowest in Douglas County where vacancies fell year-over-year from 5.8 percent to 3.9 percent. Vacancy rates fell in all metro Denver counties form the second quarter of 2009 to the same period this year.

2010’s first quarter vacancy rates by county were Adams, 5.2; Arapahoe, 6.4; Boulder/Broomfield, 4.9; Denver, 7.4; Douglas, 3.9; Jefferson, 5.4.

Rent growth was unusually strong. The metro-wide average rent increased year over year from $870.37 to $899.97 during the second quarter. For the first time in more than a year, all counties reported year-over-year increases in county-wide average rents.

“We’re starting to see signs of more significant increases in rents,” said Ryan McMaken, a spokesperson for the Division of Housing. “Rent growth, which hasn’t been adjusted for inflation in this survey, has been very moderate for several years now. But we’re likely to see more growth in the short- and medium-term as population grows and supply remains stable.”

Average rents for all counties were: Adams, $892.48; Arapahoe, $856.54; Boulder/Broomfield, $995.07; Denver, $909.46; Douglas, $1085.79; and Jefferson, $845.38.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

# # #

Subscribe to:

Posts (Atom)