With apartment vacancies down, rents are up

Colorado Springs Gazette - Jan 19, 2011

Finding an empty apartment — and a cheap rent — is getting tougher in the Colorado Springs area, according to a report released Wednesday by the Colorado ...

Denver-area Q4 apartment vacancies hit 10-year low

Denver Business Journal - Jan 25, 2011

Denver-area apartment vacancies in the fourth quarter fell to their lowest level for that three-month period since 2000, and median rents were up, ...

Colorado Springs apartment vacancies at lowest level since 2001 (01/20/2011)Colorado Springs Business Journal

Median rents in Southern Colorado increased over the same period from $700.17 to $711.12.

“From 2005 to 2009, the median rent wasn’t keeping up with inflation in Colorado Springs, so rents were effectively going down,” said the report’s author, Gordon Von Stroh, in a prepared statement. “Over the past couple of years, we’ve started to see some sustained increases in rents, however, and multifamily owners will undoubtedly now need to push rents in hopes of making up for those years of falling rents.”

Wednesday, January 26, 2011

Metro Denver apartment vacancy rate falls to ten-year low

Metro Denver apartment vacancy rate falls to ten-year low

Click here for summary tables.

The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the fourth quarter, dropping to the lowest fourth-quarter vacancy rate recorded since the year 2000. According to a report released Tuesday by the Apartment Association of Metro Denver and the Colorado Division of Housing, apartment vacancy rates fell 28 percent year-over-year from last year’s fourth-quarter rate of 7.7 percent. The vacancy rate rose slightly from 2010’s third-quarter rate of 5.3 percent, although the vacancy rate generally rises from the third quarter the fourth quarter as a result of seasonal factors.

As vacancy rates moved down, the area’s median rent increased. 2010’s fourth-quarter median rent rose to $846.36 from 2009’s fourth-quarter median rent of $811.32. In individual market areas, the median rent rose year-over-year in all County-level regions covered by the survey. The region with the largest year-over-year increase in the median rent was Adams County with an increase of 8.3 percent from $791.26 to $857.16. The smallest year-over-year increase was found in Douglas County where the median rent rose 3.2 percent from $1011.78 during 2009’s fourth quarter to $1043.79 during 2010's fourth quarter.

“From 2001 to 2010, the median rent increased only 7.5 percent and wasn’t keeping up with inflation in the metro area, so rents were effectively going down” said Gordon Von Stroh, professor of Business at the University of Denver, and the report’s author. “As vacancy tightens we’ve started to see a few more increases in rents, however, and multifamily owners will undoubtedly now need to push rents in hopes of making up for those years of falling rents.”

Although market rents increased during 2010, rental losses due to concessions, discounts and delinquencies rose as well. Rental losses rose to 9.8 percent during the fourth quarter of 2010, rising from 8.7 percent during the fourth quarter of 2009.

2010’s first quarter vacancy rates by county were Adams, 5.7 percent; Arapahoe, 6.6 percent; Boulder/Broomfield, 3.6 percent; Denver, 5.2 percent; Douglas, 5.2 percent; Jefferson, 4.5 percent.

Median rents for all counties were: Adams, $857.15; Arapahoe, $829.84; Boulder/Broomfield, $957.92; Denver, $806.79; Douglas, $1043.79; and Jefferson, $823.47.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

Click here for summary tables.

The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the fourth quarter, dropping to the lowest fourth-quarter vacancy rate recorded since the year 2000. According to a report released Tuesday by the Apartment Association of Metro Denver and the Colorado Division of Housing, apartment vacancy rates fell 28 percent year-over-year from last year’s fourth-quarter rate of 7.7 percent. The vacancy rate rose slightly from 2010’s third-quarter rate of 5.3 percent, although the vacancy rate generally rises from the third quarter the fourth quarter as a result of seasonal factors.

As vacancy rates moved down, the area’s median rent increased. 2010’s fourth-quarter median rent rose to $846.36 from 2009’s fourth-quarter median rent of $811.32. In individual market areas, the median rent rose year-over-year in all County-level regions covered by the survey. The region with the largest year-over-year increase in the median rent was Adams County with an increase of 8.3 percent from $791.26 to $857.16. The smallest year-over-year increase was found in Douglas County where the median rent rose 3.2 percent from $1011.78 during 2009’s fourth quarter to $1043.79 during 2010's fourth quarter.

“From 2001 to 2010, the median rent increased only 7.5 percent and wasn’t keeping up with inflation in the metro area, so rents were effectively going down” said Gordon Von Stroh, professor of Business at the University of Denver, and the report’s author. “As vacancy tightens we’ve started to see a few more increases in rents, however, and multifamily owners will undoubtedly now need to push rents in hopes of making up for those years of falling rents.”

Although market rents increased during 2010, rental losses due to concessions, discounts and delinquencies rose as well. Rental losses rose to 9.8 percent during the fourth quarter of 2010, rising from 8.7 percent during the fourth quarter of 2009.

2010’s first quarter vacancy rates by county were Adams, 5.7 percent; Arapahoe, 6.6 percent; Boulder/Broomfield, 3.6 percent; Denver, 5.2 percent; Douglas, 5.2 percent; Jefferson, 4.5 percent.

Median rents for all counties were: Adams, $857.15; Arapahoe, $829.84; Boulder/Broomfield, $957.92; Denver, $806.79; Douglas, $1043.79; and Jefferson, $823.47.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

Labels:

economics,

press releases,

rental housing,

vacancy surveys

Some recent economic updates

Here are two recent slideshow presentations (including some notes) on rental housing presented by Division of Housing staff.

These two presentation are similar, but have some different areas of emphasis:

Focus on single-family rental houses.

Focus on multi-family (apartment) rentals.

These two presentation are similar, but have some different areas of emphasis:

Focus on single-family rental houses.

Focus on multi-family (apartment) rentals.

Thursday, January 20, 2011

Some analysis of recent vacancy and rent trends in Colorado Springs

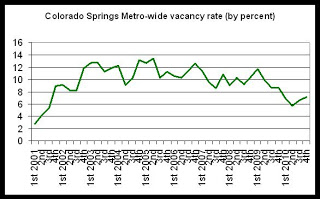

As noted here, apartment vacancies in Colorado fell during the fourth quarter of 2010 as median rents increased. The year-over-year decline during the fourth quarter bring the vacancy rate to a 9-year low in the region. The vacancy rate in the Colorado Springs during the fourth quarter was 7.2 percent.

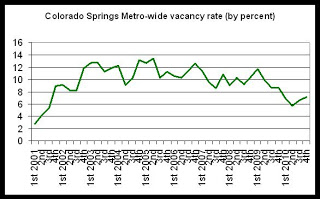

As we can see in the first graph, the Colorado Springs metro vacancy rate is now well below the rates experienced between 2002 and 2010 when the vacancy rate rarely fell below 9 percent, and was frequently above 10 percent. The high vacancy rates during this period were often driven by the absence of a large number of military personnel who had been serving in Iraq and Afghanistan during this period. As the number of troops in Iraq has been reduced, military personnel in Colorado Springs have increased, and vacancies have fallen.

Graph 1

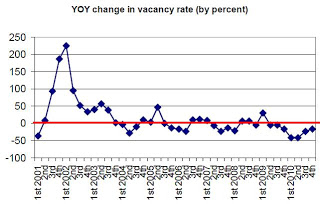

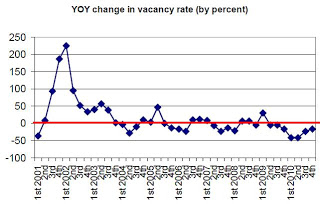

In graph 2, looking to year-over-year percentage changes in the vacancy rate, we find that the fourth quarter of 2010 was the seventh quarter in a row during which the vacancy rate has fallen compared to the same period the previous year. This is the longest string of annual drops in the vacancy rate in over ten years.

Graph 2

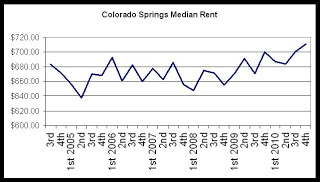

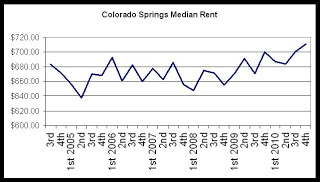

Median rents in the Colorado Springs area have been moving upward, as would be expected in a period of declining vacancies. As can be seen in graph 3, median rents are now at record highs in the region, rising to $711.12 during 2010's fourth quarter from $700.17 a year earlier. Note that median rents from 2004 to 2008 were often declining, driving overall drops in revenue for many apartment owners.

Graph 3

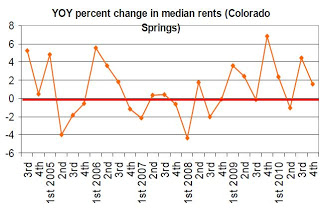

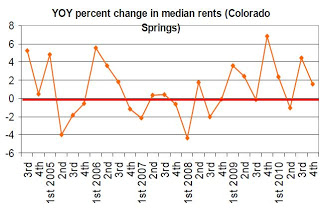

Since early 2009, however, median rent growth has been sustained with only 1 quarter of the past 8 showing a year-over-year drop in median rents. Graph 4 shows how for most quarters since the first quarter of 2009 have shown year-over-year increases of 2 percent or more. Clearly, the trend is now toward considerably more rent growth since 2009 than was the case during 2007 and 2008.

Graph 4

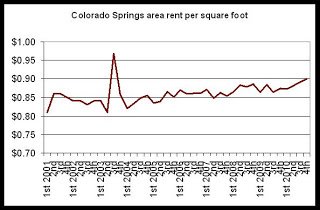

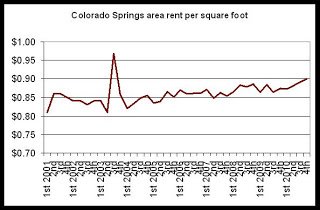

Finally, graph 5 shows movement in rent per square foot, and as can be seen here, rent per square foot saw sustained growth during 2010 in contrast to years of very limited growth between 2002 and 2008.

Graph 5

All of this points to tighter markets for renters as well as sustained rent growth in the short and medium term. Owners will be looking to make up for several years of declining rents (in inflation-adjusted dollars) during the past decade.

As we can see in the first graph, the Colorado Springs metro vacancy rate is now well below the rates experienced between 2002 and 2010 when the vacancy rate rarely fell below 9 percent, and was frequently above 10 percent. The high vacancy rates during this period were often driven by the absence of a large number of military personnel who had been serving in Iraq and Afghanistan during this period. As the number of troops in Iraq has been reduced, military personnel in Colorado Springs have increased, and vacancies have fallen.

Graph 1

In graph 2, looking to year-over-year percentage changes in the vacancy rate, we find that the fourth quarter of 2010 was the seventh quarter in a row during which the vacancy rate has fallen compared to the same period the previous year. This is the longest string of annual drops in the vacancy rate in over ten years.

Graph 2

Median rents in the Colorado Springs area have been moving upward, as would be expected in a period of declining vacancies. As can be seen in graph 3, median rents are now at record highs in the region, rising to $711.12 during 2010's fourth quarter from $700.17 a year earlier. Note that median rents from 2004 to 2008 were often declining, driving overall drops in revenue for many apartment owners.

Graph 3

Since early 2009, however, median rent growth has been sustained with only 1 quarter of the past 8 showing a year-over-year drop in median rents. Graph 4 shows how for most quarters since the first quarter of 2009 have shown year-over-year increases of 2 percent or more. Clearly, the trend is now toward considerably more rent growth since 2009 than was the case during 2007 and 2008.

Graph 4

Finally, graph 5 shows movement in rent per square foot, and as can be seen here, rent per square foot saw sustained growth during 2010 in contrast to years of very limited growth between 2002 and 2008.

Graph 5

All of this points to tighter markets for renters as well as sustained rent growth in the short and medium term. Owners will be looking to make up for several years of declining rents (in inflation-adjusted dollars) during the past decade.

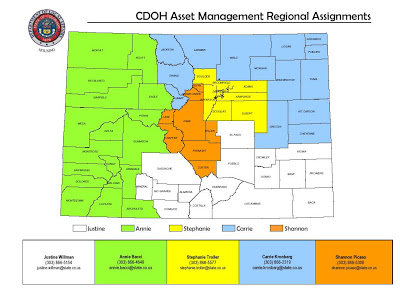

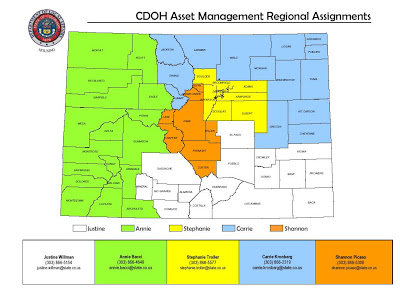

New asset managers at the Division of Housing

Annie Bacci recently joined the team as the Asset Manager for counties on the Western Slope, including: Routt, Eagle, Pitkin, Gunnison, Hinsdale, Archuleta, La Plata, San Juan, Ouray, Montrose, Delta, Mesa, Garfield, Rio Blanco, Moffat, San Miguel, Delores, and Montezuma county.

Annie worked in housing for over six years prior to becoming an Asset Manager with the Division of Housing. She began working with Volunteers of America as a case manager for homeless youth in 2003, and in 2006 became a program manager for transitional and permanent housing programs for youth and families. Much of Annie's work with Volunteers of America was focused on permanent housing initiatives.

After completing her undergraduate degree in Social Work at the University of Iowa, Annie moved to Colorado in 2003. Currently pursuing a M.B.A degree from the University of Colorado, Denver, she plans to continue her work in the affordable housing field.

Carrie Kronberg and Cheryl Moore (link here) have also recently joined the Asset Management team.

A map of regional assignments is here:

Annie worked in housing for over six years prior to becoming an Asset Manager with the Division of Housing. She began working with Volunteers of America as a case manager for homeless youth in 2003, and in 2006 became a program manager for transitional and permanent housing programs for youth and families. Much of Annie's work with Volunteers of America was focused on permanent housing initiatives.

After completing her undergraduate degree in Social Work at the University of Iowa, Annie moved to Colorado in 2003. Currently pursuing a M.B.A degree from the University of Colorado, Denver, she plans to continue her work in the affordable housing field.

Carrie Kronberg and Cheryl Moore (link here) have also recently joined the Asset Management team.

A map of regional assignments is here:

Wednesday, January 19, 2011

Colorado Springs apartment vacancies fall to lowest level since 2001

Click here for full report.

The apartment vacancy rate in the Colorado Springs metro area fell to 7.2 percent during the fourth quarter of 2010, falling to the lowest fourth-quarter rate reported since 2001. According to a report released today by the Apartment Association of Southern Colorado and the Colorado Division of Housing, the vacancy rate in the Colorado Springs area fell 17 percent year-over-year from 2009’s fourth-quarter rate of 8.7 percent. Compared to the third quarter of 2010, however, rates rose from 6.6 percent as expected. Seasonal factors generally lead to a rising vacancy rate during the fourth quarter of the year.

The fourth quarter’s drop in the vacancy rate is the seventh quarter in a row in which the vacancy rate has fallen, year-over-year, signaling strengthening demand for multifamily rentals in the region.

Year-over-year, vacancy rates fell the most in the “Southeast” market area of Colorado Springs where vacancy rates fell 32 percent from 14.6 percent to 9.9 percent. Vacancy rates were lowest in the Far Northeast and Southwest market areas with vacancy rates of 6.0 percent and 5.4 percent, respectively.

Vacancy rates for all market areas were: Northwest, 6.3 percent; Northeast, 6.0 percent; Far Northeast, 6.9 percent, Southeast, 9.9 percent; Security/Widefield/Fountain, 19.3 percent; Southwest, 5.4 percent; Central, 6.8 percent.

As vacancy rates moved down, the area’s median rent increased. 2010’s fourth-quarter median rent rose to $711.12 from 2009’s fourth-quarter median rent of $700.17. In individual market areas, the median rent rose year-over-year in all areas except the Northwest and the Far Northeast. By far, the area with the largest year-over-year increase in the median rent was the Central region with an increase of 25 percent from $524.86 to $658.30. All other areas reported year-over-year increases in median rent ranging from one percent to four percent.

“From 2005 to 2009, the median rent wasn’t keeping up with inflation in Colorado Springs, so rents were effectively going down” said Gordon Von Stroh, professor of Business at the University of Denver, and the report’s author. “Over the past couple of years, we’ve started to see some sustained increases in rents, however, and multifamily owners will undoubtedly now need to push rents in hopes of making up for those years of falling rents.”

Median rents for all market areas were: Northwest, $831.87; Northeast, $722.50; Far Northeast, $791.46, Southeast, $614.15; Security/Widefield/Fountain, $627.45; Southwest, $722.66; Central, $658.30.

Labels:

colorado springs,

press releases,

vacancy surveys

Monday, January 17, 2011

Preview of 2010 year-end foreclosure totals

The statewide foreclosure report for the fourth quarter will be available in early February. Below are some estimates for 2010's year-end based on metropolitan foreclosure data.

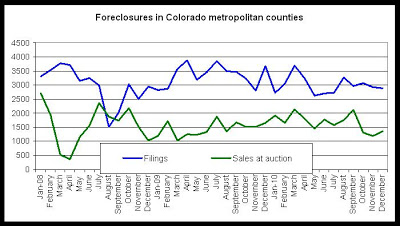

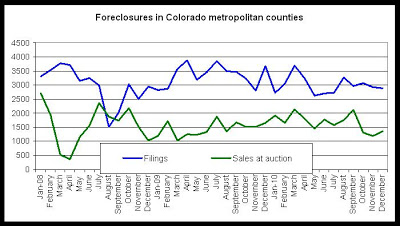

Below are two graphs based on totals in foreclosure filings and foreclosure sales at auction in Colorado's metropolitan counties. These counties generally account for about 85 percent of all foreclosure activity in the state. This information can give us some insights into how the 2010 statewide year-end foreclosure totals will look.

In the chart below, we can see that in the monthly data, the total number of new foreclosure filings fell for the second month in a row in December. Compared to December 2009, December 2010's total was down about 21 percent. Foreclosure filings have been generally falling since the third quarter of 2009. The large number of foreclosure filings in 2009 that can be seen in the graph were likely driven by the large increases in job losses that began to occur in Colorado in late 2008 and through much of 2009.

Looking at the full year, 2010 foreclosure filings in metro counties were down about 11 percent compared to 2009.

Foreclosure sales rose from November 2010 to December 2010, but compared year-over-year, December sales were down about 19 percent. This decline was likely driven by the effects of the "slowdown" put in place in October by Bank of America and other servicers in response to the "robo-signing" controversy. Although the slowdown was phased out in early November, it appears that the processing of foreclosures has been slowly returning to former levels and that foreclosure sales totals did not bounce back quickly from the slowdown.

Looking at 2010 as a whole, however, the number of foreclosure sales at auction was up about 11 percent as the new foreclosure inventory (which was made considerably larger by the number of new filings in 2009) had to work its way through the system.

Nevertheless, if new filings continue to decline in a similar fashion as was the case during 2010, foreclosure sales will inevitably begin to decline as well.

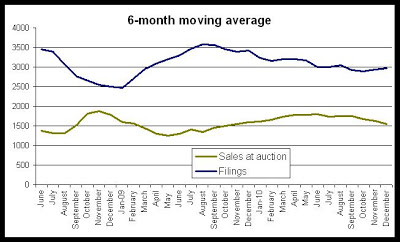

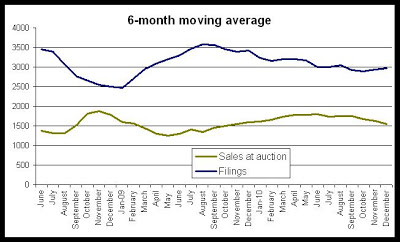

Since the monthly foreclosure totals can be relatively volatile, I've smoothed out the totals by graphing a 6-month moving average of totals. As can be seen below, the number of filings clearly peaked in mid-2009 as job losses mounted, and foreclosure sales at auction then began to grow significantly about nine months later. The moving average in foreclosure sales has been declining since June 2010.

Below are two graphs based on totals in foreclosure filings and foreclosure sales at auction in Colorado's metropolitan counties. These counties generally account for about 85 percent of all foreclosure activity in the state. This information can give us some insights into how the 2010 statewide year-end foreclosure totals will look.

In the chart below, we can see that in the monthly data, the total number of new foreclosure filings fell for the second month in a row in December. Compared to December 2009, December 2010's total was down about 21 percent. Foreclosure filings have been generally falling since the third quarter of 2009. The large number of foreclosure filings in 2009 that can be seen in the graph were likely driven by the large increases in job losses that began to occur in Colorado in late 2008 and through much of 2009.

Looking at the full year, 2010 foreclosure filings in metro counties were down about 11 percent compared to 2009.

Foreclosure sales rose from November 2010 to December 2010, but compared year-over-year, December sales were down about 19 percent. This decline was likely driven by the effects of the "slowdown" put in place in October by Bank of America and other servicers in response to the "robo-signing" controversy. Although the slowdown was phased out in early November, it appears that the processing of foreclosures has been slowly returning to former levels and that foreclosure sales totals did not bounce back quickly from the slowdown.

Looking at 2010 as a whole, however, the number of foreclosure sales at auction was up about 11 percent as the new foreclosure inventory (which was made considerably larger by the number of new filings in 2009) had to work its way through the system.

Nevertheless, if new filings continue to decline in a similar fashion as was the case during 2010, foreclosure sales will inevitably begin to decline as well.

Since the monthly foreclosure totals can be relatively volatile, I've smoothed out the totals by graphing a 6-month moving average of totals. As can be seen below, the number of filings clearly peaked in mid-2009 as job losses mounted, and foreclosure sales at auction then began to grow significantly about nine months later. The moving average in foreclosure sales has been declining since June 2010.

MULTI-FAMILY WEATHERIZATION PROGRAM GRANT ANNOUNCEMENT and INVITATION TO APPLY

Energy Outreach Colorado is excited to invite ALL low-income multifamily housing providers to apply for weatherization funding for the 2011-2012 Multifamily Weatherization grant cycle. Applications will be accepted between Monday, January 17 and closing at 11:59 p.m. on February 11, 2011.

Funding options for the 2011-2012 multifamily weatherization program has changed significantly from last year. Please read the following information to understand the new eligibility requirements for your application.

What is NEW about the Multifamily Weatherization Program:

Energy Outreach Colorado will be administering weatherization grants on behalf of a number of organizations including the Colorado Governor’s Energy Office, energy utility programs, and specific service districts. Applications will be evaluated against all funding sources, and selected projects will be funded by ONE primary funding source only.

EOC will be accepting applications for ALL 5+ unit multifamily building types regardless of how the building is heated. EOC will accept applications from centrally heated and individually heated buildings.

Please visit http://www.energyoutreachcolorado.org/overview_mfwg and log in with your existing password. Your application(s) from last year will be available for updates with the option to resubmit. A “request login information” button will be available in case you have forgotten your login information.

Applicants new to this Process:

Please visit http://www.energyoutreachcolorado.org/overview_mfwg and follow the instructions to create a login and password.

Once you create a login, you will be guided through a brief program overview. We strongly encourage you to “save your work” frequently as you complete the applications so no data is lost.

Funding options for the 2011-2012 multifamily weatherization program has changed significantly from last year. Please read the following information to understand the new eligibility requirements for your application.

What is NEW about the Multifamily Weatherization Program:

Energy Outreach Colorado will be administering weatherization grants on behalf of a number of organizations including the Colorado Governor’s Energy Office, energy utility programs, and specific service districts. Applications will be evaluated against all funding sources, and selected projects will be funded by ONE primary funding source only.

EOC will be accepting applications for ALL 5+ unit multifamily building types regardless of how the building is heated. EOC will accept applications from centrally heated and individually heated buildings.

Please visit http://www.energyoutreachcolorado.org/overview_mfwg and log in with your existing password. Your application(s) from last year will be available for updates with the option to resubmit. A “request login information” button will be available in case you have forgotten your login information.

Applicants new to this Process:

Please visit http://www.energyoutreachcolorado.org/overview_mfwg and follow the instructions to create a login and password.

Once you create a login, you will be guided through a brief program overview. We strongly encourage you to “save your work” frequently as you complete the applications so no data is lost.

Labels:

announcements,

grant announcements,

grants

Thursday, January 13, 2011

Upcoming releases of housing data

New housing reports to be released by the Division of Housing in the next several weeks:

Colorado Springs vacancy and rent survey: January 19

Metro Denver vacancy and rent survey: January 25

Estimated release of 4th 2010 foreclosure report: February 8

Colorado Springs vacancy and rent survey: January 19

Metro Denver vacancy and rent survey: January 25

Estimated release of 4th 2010 foreclosure report: February 8

Labels:

economics,

foreclosure,

vacancy surveys

Two new asset managers join Division staff

Two asset managers have recently joined Division of Housing staff:

Carrie Kronberg is now the Division's asset manager for the following counties: Summit, Grand, Jackson, Larimer, Weld, Morgan, Logan, Sedgwick, Phillips, Washington, Yuma, Lincoln, Kit Carson and Cheyenne.

Carrie hails from Santa Rosa, California, where she worked in affordable housing before relocating to Colorado. Most recently, she spent three years at the Sonoma County Community Development Commission working with HOME, CDBG, and local affordable housing programs.

The pursuit of advanced education brought Carrie to Colorado, and she now holds a Master of Architecture and a Master of Urban Design from the University of Colorado, Denver. Much of her graduate coursework focused on affordable housing, civic projects, and sustainable development. She also has a Bachelor of Arts in Urban Studies and Planning from the University of California, San Diego.

Cheryl Moore has joined the Division as a Section 8/Housing Choice Voucher asset manager covering the following counties:

Moffat, Rio Blanco, Garfield, Routt, Eagle, Pitkin, Jackson, Grand, Summit, Park, Larimer, Boulder, Gilpin, Clear Creek, Jefferson, Denver, Broomfield, Weld, Adams, Morgan, Logan, Washington, Sedgwick, Phillips, Yuma.

UPDATE 1/13/11, 4:49pm: The counties previously listed for Cheryl Moore's region were incorrect. The updated counties are correct.

Prior to joining the Division of Housing, Cheryl owned and operated Comprehensive Real Estate Services; a corporation that served primarily low-income, first-time home buyers and pre-foreclosure clients. She created the Real Estate Company as part of her tenure as Real Estate Specialist for Community Resources and Housing Development Corporation, overseeing the Real Estate Division of the corporation. Cheryl began her career in the nonprofit sector in 1995. In the last fifteen years she has served in many capacities of asset management within the affordable housing realm.

A Colorado native she received her B.S. in Business Administration, with a minor in Political Science from Colorado University, Denver in 1995 and obtained a Real Estate License in 2004. In addition, she holds several housing related designations and is committed to the sustainability of affordable housing.

[Note: Section 8/Housing Choice Voucher asset manager Lisa Stearns will cover the balance of the state:

Mesa, Delta, Montrose, San Miguel, Dolores, Montezuma, Ouray, San Juan, La Plata, Gunnison, Hinsdale, Archuleta, Mineral, Lake, Chaffee, Saguache, Rio Grande, Conejos, Fremont, Custer, Huerfano, Costilla, Douglas, Teller, Arapahoe, Elbert, El Paso Pueblo, Las Animas, Lincoln, Crowley, Otero, Kit Carson, Cheyenne, Kiowa, Bent, Prowers and Baca.]

Carrie Kronberg is now the Division's asset manager for the following counties: Summit, Grand, Jackson, Larimer, Weld, Morgan, Logan, Sedgwick, Phillips, Washington, Yuma, Lincoln, Kit Carson and Cheyenne.

Carrie hails from Santa Rosa, California, where she worked in affordable housing before relocating to Colorado. Most recently, she spent three years at the Sonoma County Community Development Commission working with HOME, CDBG, and local affordable housing programs.

The pursuit of advanced education brought Carrie to Colorado, and she now holds a Master of Architecture and a Master of Urban Design from the University of Colorado, Denver. Much of her graduate coursework focused on affordable housing, civic projects, and sustainable development. She also has a Bachelor of Arts in Urban Studies and Planning from the University of California, San Diego.

Cheryl Moore has joined the Division as a Section 8/Housing Choice Voucher asset manager covering the following counties:

Moffat, Rio Blanco, Garfield, Routt, Eagle, Pitkin, Jackson, Grand, Summit, Park, Larimer, Boulder, Gilpin, Clear Creek, Jefferson, Denver, Broomfield, Weld, Adams, Morgan, Logan, Washington, Sedgwick, Phillips, Yuma.

UPDATE 1/13/11, 4:49pm: The counties previously listed for Cheryl Moore's region were incorrect. The updated counties are correct.

Prior to joining the Division of Housing, Cheryl owned and operated Comprehensive Real Estate Services; a corporation that served primarily low-income, first-time home buyers and pre-foreclosure clients. She created the Real Estate Company as part of her tenure as Real Estate Specialist for Community Resources and Housing Development Corporation, overseeing the Real Estate Division of the corporation. Cheryl began her career in the nonprofit sector in 1995. In the last fifteen years she has served in many capacities of asset management within the affordable housing realm.

A Colorado native she received her B.S. in Business Administration, with a minor in Political Science from Colorado University, Denver in 1995 and obtained a Real Estate License in 2004. In addition, she holds several housing related designations and is committed to the sustainability of affordable housing.

[Note: Section 8/Housing Choice Voucher asset manager Lisa Stearns will cover the balance of the state:

Mesa, Delta, Montrose, San Miguel, Dolores, Montezuma, Ouray, San Juan, La Plata, Gunnison, Hinsdale, Archuleta, Mineral, Lake, Chaffee, Saguache, Rio Grande, Conejos, Fremont, Custer, Huerfano, Costilla, Douglas, Teller, Arapahoe, Elbert, El Paso Pueblo, Las Animas, Lincoln, Crowley, Otero, Kit Carson, Cheyenne, Kiowa, Bent, Prowers and Baca.]

Foreclosure reports web site updated

All foreclosure reports for Colorado through November 2010 are now available at the main page: http://dola.colorado.gov/cdh/researchers/index.htm#foreclosure

The 4th Quarter Statewide Foreclosure Report and the December Metro-Area foreclosure report will be likely available the second week of February.

The 4th Quarter Statewide Foreclosure Report and the December Metro-Area foreclosure report will be likely available the second week of February.

Subscribe to:

Posts (Atom)