Regional rental market tightens, rents rise

Von Stroh said he would expect "new product" -- such as the Two Nine apartment development near Twenty Ninth Street and the planned multifamily additions at Boulder Junction -- would raise the vacancy rate in Boulder, but would be absorbed relatively quickly.

"There is such great demand," he said. "Boulder is truly in need of more housing. CU, as an institution, has continued to grow, but it's grown much faster than ... the inventory."

First-quarter Denver metro vacancy rate at lowest in 10 years as average rent rises

"If employment improves at all, the vacancy rate will drop below 5 percent by September," Von Stroh said.

Von Stroh and Ryan McMaken, of the Colorado State Division of Housing, said there are a number of factors that have caused the vacancy rate to decline.

Denver apartments get pricier as home ownership declines (Housing Wire)

"Most people who foreclose seem to be mostly moving into single-family rentals, and not into apartments, although some certainly do go back to apartments," said Ryan McMaken, a spokesperson for Colorado's Division of Housing. "The larger factor does seem to be people delaying purchases either because they're in no rush to buy, or because they simply don't have the credit score or the down payment funds necessary."

Area apartment rent prices increasing (Boulder County Business Report)

DENVER - Renters in Boulder and Broomfield counties saw the highest increase in rents during the past year, according to the quarterly apartment vacancy and rent survey released Thursday by the Apartment Association of Metro Denver and the Colorado Division of Housing.

The survey found the median rent for apartments in Boulder and Broomfield counties is $961, a $60 increase compared with the first quarter of 2010. The median rent for the metro Denver area is $858.

Denver apartment-vacancy rate falls (9News)

DENVER - The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the first quarter, dropping to the lowest first-quarter vacancy rate recorded since 2001, according to a report released Thursday by the Apartment Association of Metro Denver and the Colorado Division of Housing.

After recession, a local boom in empty homes

When the recession ended the boom times of the first decade of the 21st Century, it left the lights out in thousands of unoccupied homes across the Roaring Fork and Colorado River valleys.

Results of the 2010 U.S. Census show vacancy rates climbed from Aspen to Parachute, largely as a result of new construction outpacing demand after the housing bubble burst.

Study: Springs housing market could see 'early turnaround'

Colorado Springs is one of 10 cities and metropolitan areas nationwide that are poised for an “early turnaround” in their housing markets, according to a study released this week.

Friday, April 29, 2011

Thursday, April 28, 2011

Request for Proposals: Neighborhood Stabilization Program 3

Reminder: NSP3 applications due May 20, 2011.

COLORADO DEPARTMENT OF LOCAL AFFAIRS

DIVISION OF HOUSING (DOH)

REQUEST FOR PROPOSALS

The Colorado Department of Local Affairs, Division of Housing (DOH) is requesting proposals for Neighborhood Stabilization Program III (NSP3) funding for the purchase and rehabilitation or redevelopment of foreclosed and abandoned homes in the State of Colorado. $6,518,947 in grant funds will be available for program and administrative costs to be expended by March 11, 2014, including up to $1,420,638 for projects in Colorado Springs, and up to $5,098,309 for projects in the balance of the State. Attached is the full text of the RFP.

Application materials will be available online March 21, 2011 at http://dola.colorado.gov/cdh/NSP/NSP3_App.htm. All applications and copies will be due to DOH by Friday, May 20, 2011.

The NSP3 Action Plan (Substantial Amendment) and supporting materials are available online at http://dola.colorado.gov/cdh/NSP3SubstantialAmend.htm. For all questions about the program, applications, guidelines and to be referred to a Housing Development Specialist, please contact Alison O'Kelly at 303-866-3409 or [email protected].

COLORADO DEPARTMENT OF LOCAL AFFAIRS

DIVISION OF HOUSING (DOH)

REQUEST FOR PROPOSALS

The Colorado Department of Local Affairs, Division of Housing (DOH) is requesting proposals for Neighborhood Stabilization Program III (NSP3) funding for the purchase and rehabilitation or redevelopment of foreclosed and abandoned homes in the State of Colorado. $6,518,947 in grant funds will be available for program and administrative costs to be expended by March 11, 2014, including up to $1,420,638 for projects in Colorado Springs, and up to $5,098,309 for projects in the balance of the State. Attached is the full text of the RFP.

Application materials will be available online March 21, 2011 at http://dola.colorado.gov/cdh/NSP/NSP3_App.htm. All applications and copies will be due to DOH by Friday, May 20, 2011.

The NSP3 Action Plan (Substantial Amendment) and supporting materials are available online at http://dola.colorado.gov/cdh/NSP3SubstantialAmend.htm. For all questions about the program, applications, guidelines and to be referred to a Housing Development Specialist, please contact Alison O'Kelly at 303-866-3409 or [email protected].

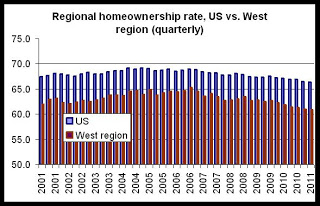

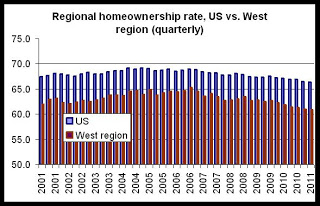

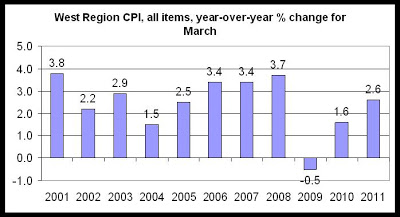

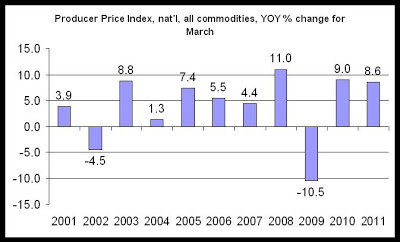

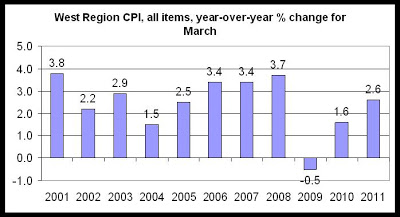

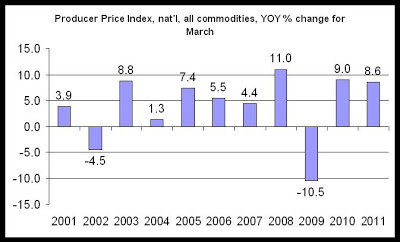

Homeownership in US West slips eight quarters in a row

The census bureau yesterday released its quarterly data on homeownership for the first quarter of 2011. According to the press release:

At 66.4 percent, the national homeownership rate is now down 4 percent from its 2004 peak when the rate reached 69.2 percent during the second quarter.

In the West census region, which includes Colorado, the homeownership rate for 2011's first quarter is down 6.7 percent from its 2006 peak when the rate reached 65.3 percent during the third quarter. The homeownership rate in the west was down 1.6 percent when comparing the first quarter of this year to the same period last year.

Overall, the homeownership rate in the West census region has been below the national homeownership rate, and has had the lowest homeownership rate of all regions.

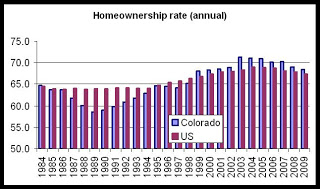

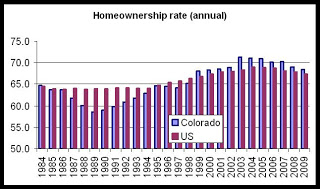

It is likely, however, that the regional homeownership rate itself does not closely reflect Colorado's homeownership rate which has been above the national homeownership rate in recent years. Quarterly homeownership rates at the state level are not available, but in the annual data, Colorado has had a higher homeownership rate than the nation since 1999. The Colorado rate peaked at 71.3 percent in 2003. That same year, the national homeownership rate was 68.3 percent. Since then, the gap has narrowed, and in 2009, the Colorado homeownership rate was 68.4 percent and the national rate was 67.4 percent.

Given the quarterly trends released yesterday, it is likely that the Colorado homeownership rate is still slightly, but not substantially, above the national unemployment rate. Given how the gap between the national and Colorado homeownership rates has narrowed since 2008, it is likely that the Colorado rate is now similar to the national rate.

The homeownership rate of 66.4 percent was 0.7 percentage points (+/-0.4%) lower than the first quarter 2010 rate (67.1 percent) and 0.1 percentage point (+/-0.4%) lower than the rate last quarter (66.5 percent).

At 66.4 percent, the national homeownership rate is now down 4 percent from its 2004 peak when the rate reached 69.2 percent during the second quarter.

In the West census region, which includes Colorado, the homeownership rate for 2011's first quarter is down 6.7 percent from its 2006 peak when the rate reached 65.3 percent during the third quarter. The homeownership rate in the west was down 1.6 percent when comparing the first quarter of this year to the same period last year.

Overall, the homeownership rate in the West census region has been below the national homeownership rate, and has had the lowest homeownership rate of all regions.

It is likely, however, that the regional homeownership rate itself does not closely reflect Colorado's homeownership rate which has been above the national homeownership rate in recent years. Quarterly homeownership rates at the state level are not available, but in the annual data, Colorado has had a higher homeownership rate than the nation since 1999. The Colorado rate peaked at 71.3 percent in 2003. That same year, the national homeownership rate was 68.3 percent. Since then, the gap has narrowed, and in 2009, the Colorado homeownership rate was 68.4 percent and the national rate was 67.4 percent.

Given the quarterly trends released yesterday, it is likely that the Colorado homeownership rate is still slightly, but not substantially, above the national unemployment rate. Given how the gap between the national and Colorado homeownership rates has narrowed since 2008, it is likely that the Colorado rate is now similar to the national rate.

Most Colorado metro unemployment rates remain above national average

The BLS released its report yesterday on unemployment in 372 metro areas in the US. The data for Colorado is not different from the statewide report already released by the Colorado Department of Labor and Employment. The chart with local unemployment rates is found here.

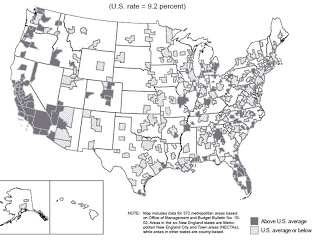

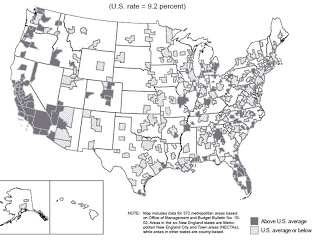

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page shows that most of Colorado's metro areas, with the exceptions of areas in Boulder and Larimer Counties, have unemployment rates above the national unemployment rate of 9.2:

As we noted earlier, the fact that Colorado is now falling behind the nation in the employment situation may pull down the overall demand for real estate in Colorado as workers look elsewhere for employment.

This data also suggests that demand for housing in the Ft Collins-Loveland area and the Boulder area will continue to be relatively strong.

Nevertheless, the report does provide some comparisons with other metro areas in the nation. The map on the last page shows that most of Colorado's metro areas, with the exceptions of areas in Boulder and Larimer Counties, have unemployment rates above the national unemployment rate of 9.2:

As we noted earlier, the fact that Colorado is now falling behind the nation in the employment situation may pull down the overall demand for real estate in Colorado as workers look elsewhere for employment.

This data also suggests that demand for housing in the Ft Collins-Loveland area and the Boulder area will continue to be relatively strong.

Labels:

bls,

employment,

metro areas,

unemployment

First Analysis: Metro Denver Vacancies and Rents

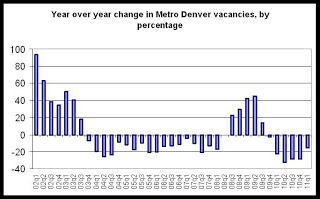

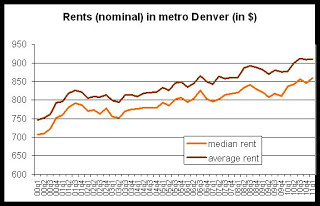

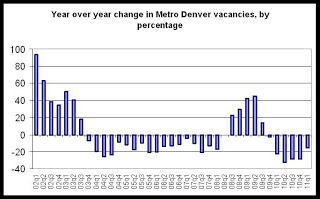

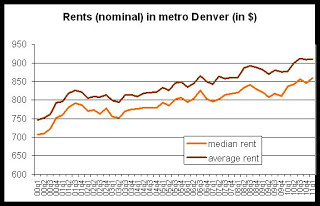

According to new metro Denver vacancy and rent data released today by the Colorado Division of Housing, multifamily rental vacancies fell while median and average rents increased.

The region-wide vacancy rate in metro Denver has fallen every quarter for the past six quarters when compared to the same quarter a year prior. As can be seen in the first graph, the year-over-year change in vacancies has not been positive since the third quarter of 2009, when the vacancy rate rose 13.8 percent over the year prior.

Graph 2 shows the vacancy rate for the metro Denver area for each quarter during the last ten years. 2011's first-quarter vacancy rate, which is unchanged from 2010's fourth quarter, is the lowest first-quarter vacancy rate reported since the first quarter of 2001. Vacancy rates in metro Denver declined following the 2002 recession, but peaked in Metro Denver in 2009 during the most recent recession. In spite of lackluster job growth, the vacancy rate then quickly fell again, and has remained near 5.5 percent for the last three quarters.

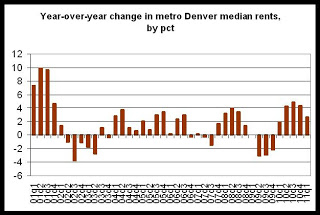

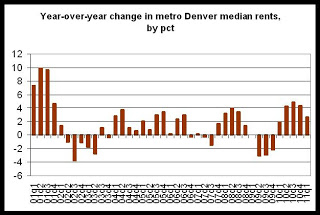

Not unexpectedly, growth in median rents has begun to build in the region as well. Notably, the median rent for the metro Denver area (compared year-over-year) has not decreased since the fourth quarter of 2009. In each quarter since, growth in median rents has either matched or outpaced inflation, suggesting true growth in inflation-adjusted rents.

The region-wide median rent in metro Denver has increased for the past five quarters when compared to the same quarter the previous year. As can be seen in the fourth graph, the past three quarters have shown growth that is among the strongest grwoth trends since 2002, but does not threaten to match growth from the 2000-2001 period at this time. (Related: This rent growth has been more subdued than rent growth in Colorado Springs.)

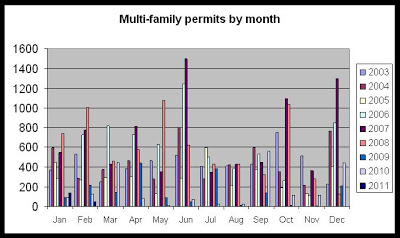

While the recent growth in rents and the declines in vacancy rates does not in itself prove continued demand for multifamily rentals in the region, the relatively small amount of new construction of rentals in the area will contribute to ongoing rent growth and tightness in vacancies.

In addition, the relative unattractiveness or lack of accessibility to for-purchase housing at this time will reinforce this trend.

Note: The average rent information above is not adjusted for inflation. For information on inflation-adjusted rents, see here.

The vacancy and rent report also contains information on average rents. For more information on the differences between median and average rents, see here.

The region-wide vacancy rate in metro Denver has fallen every quarter for the past six quarters when compared to the same quarter a year prior. As can be seen in the first graph, the year-over-year change in vacancies has not been positive since the third quarter of 2009, when the vacancy rate rose 13.8 percent over the year prior.

Graph 2 shows the vacancy rate for the metro Denver area for each quarter during the last ten years. 2011's first-quarter vacancy rate, which is unchanged from 2010's fourth quarter, is the lowest first-quarter vacancy rate reported since the first quarter of 2001. Vacancy rates in metro Denver declined following the 2002 recession, but peaked in Metro Denver in 2009 during the most recent recession. In spite of lackluster job growth, the vacancy rate then quickly fell again, and has remained near 5.5 percent for the last three quarters.

Not unexpectedly, growth in median rents has begun to build in the region as well. Notably, the median rent for the metro Denver area (compared year-over-year) has not decreased since the fourth quarter of 2009. In each quarter since, growth in median rents has either matched or outpaced inflation, suggesting true growth in inflation-adjusted rents.

The region-wide median rent in metro Denver has increased for the past five quarters when compared to the same quarter the previous year. As can be seen in the fourth graph, the past three quarters have shown growth that is among the strongest grwoth trends since 2002, but does not threaten to match growth from the 2000-2001 period at this time. (Related: This rent growth has been more subdued than rent growth in Colorado Springs.)

While the recent growth in rents and the declines in vacancy rates does not in itself prove continued demand for multifamily rentals in the region, the relatively small amount of new construction of rentals in the area will contribute to ongoing rent growth and tightness in vacancies.

In addition, the relative unattractiveness or lack of accessibility to for-purchase housing at this time will reinforce this trend.

Note: The average rent information above is not adjusted for inflation. For information on inflation-adjusted rents, see here.

The vacancy and rent report also contains information on average rents. For more information on the differences between median and average rents, see here.

Metro Denver apartment vacancies fall to ten-year low

Click here for summary tables.

The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the first quarter, dropping to the lowest first-quarter vacancy rate recorded since 2001. According to a report released Thursday by the Apartment Association of Metro Denver and the Colorado Division of Housing, apartment vacancy rates fell 15.5 percent year-over-year from last year’s first-quarter rate of 6.5 percent. The vacancy rate was unchanged from 2010’s fourth-quarter rate of 5.5 percent, although the vacancy rate generally falls from the fourth quarter to the first quarter as a result of seasonal factors.

As vacancy rates moved down, the area’s median rent increased. During the first quarter of 2011, the median rent rose to $858, increasing 2.6 percent from 2010’s first-quarter median rent of $836. In individual market areas, the median rent rose year-over-year in all county-level regions covered by the survey. The region with the largest year-over-year increase in the median rent was the Boulder/Broomfield area with an increase of 6.6 percent from $901 to $961. The smallest increase was found in Denver County where the median rent rose 2.1 percent from $801 during 2010’s first quarter to $818 during this year’s first quarter.

As market rents generally increased over the past year, rental losses due to concessions, discounts and delinquencies fell slightly. Rental losses fell to 9.5 percent during the first quarter of 2010, dropping from 2010’s first-quarter rate of 9.7 percent.

2011’s first quarter vacancy rates by county were Adams, 5.6 percent; Arapahoe, 6.4 percent; Boulder/Broomfield, 4.9 percent; Denver, 4.8 percent; Douglas, 5.3 percent; Jefferson, 4.7 percent.

Median rents for all counties were: Adams, $871; Arapahoe, $825; Boulder/Broomfield, $961; Denver, $818; Douglas, $1061; and Jefferson, $828.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the first quarter, dropping to the lowest first-quarter vacancy rate recorded since 2001. According to a report released Thursday by the Apartment Association of Metro Denver and the Colorado Division of Housing, apartment vacancy rates fell 15.5 percent year-over-year from last year’s first-quarter rate of 6.5 percent. The vacancy rate was unchanged from 2010’s fourth-quarter rate of 5.5 percent, although the vacancy rate generally falls from the fourth quarter to the first quarter as a result of seasonal factors.

As vacancy rates moved down, the area’s median rent increased. During the first quarter of 2011, the median rent rose to $858, increasing 2.6 percent from 2010’s first-quarter median rent of $836. In individual market areas, the median rent rose year-over-year in all county-level regions covered by the survey. The region with the largest year-over-year increase in the median rent was the Boulder/Broomfield area with an increase of 6.6 percent from $901 to $961. The smallest increase was found in Denver County where the median rent rose 2.1 percent from $801 during 2010’s first quarter to $818 during this year’s first quarter.

As market rents generally increased over the past year, rental losses due to concessions, discounts and delinquencies fell slightly. Rental losses fell to 9.5 percent during the first quarter of 2010, dropping from 2010’s first-quarter rate of 9.7 percent.

2011’s first quarter vacancy rates by county were Adams, 5.6 percent; Arapahoe, 6.4 percent; Boulder/Broomfield, 4.9 percent; Denver, 4.8 percent; Douglas, 5.3 percent; Jefferson, 4.7 percent.

Median rents for all counties were: Adams, $871; Arapahoe, $825; Boulder/Broomfield, $961; Denver, $818; Douglas, $1061; and Jefferson, $828.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

Housing News Digest, April 28

New housing plan addresses concerns

The North Carolina-based developer Campus Crest, which is proposing a 27-acre 612-bed student-housing project known as The Grove at Fort Collins, held an open house Wednesday evening to showcase and garner public input on its new sustainable design.

Pinnacle Real Estate Advisors LLC announced the sale of Boulevard Park, a 103-unit apartment community at 2443 S. Colorado Blvd., for $6.6 million.

Former Fort Collins real estate broker indicted in land scheme

Matthew Sysum, 41, was arrested following a two-year investigation by the Weld County District Attorney's Office. He is accused of conspiring with an appraiser to overvalue the price of properties he was offering for sale, and also selling land that he did not yet own, with the help of a title company.

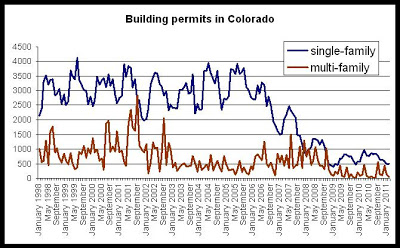

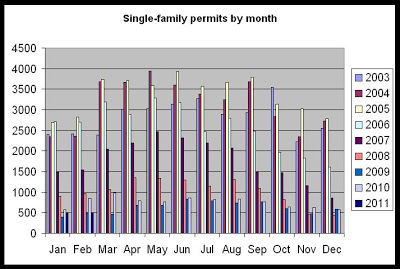

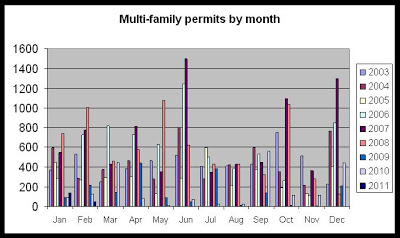

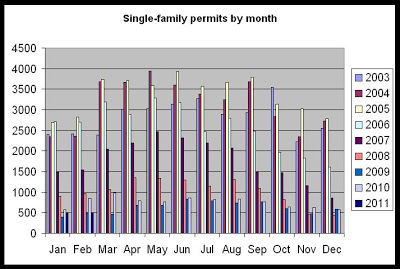

Building activity drops

Developers and builders pulled 1,116 building permits for homes, condos/town homes and apartment units in the first quarter, compared with 1,375 permits during the first quarter of 2010, according to the report by the Home Builders Association of Metro Denver. The report includes the counties of Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, and Jefferson, as well as 22 municipalities. Permits signal future construction, as builders pull them before they start construction.

Case-Shiller: Denver No. 5

The Denver-area housing market showed a 2.6 percent decline in value in February from February 2010, but that was still good enough for fifth place out of the 20 metropolitan statistical areas tracked by the closely watched S&P;/Case-Shiller Home Price Indices released today.

See CDOH analysis here - http://www.divisionofhousing.com/2011/04/case-shiller-denver-home-prices-down.html

The North Carolina-based developer Campus Crest, which is proposing a 27-acre 612-bed student-housing project known as The Grove at Fort Collins, held an open house Wednesday evening to showcase and garner public input on its new sustainable design.

Pinnacle Real Estate Advisors LLC announced the sale of Boulevard Park, a 103-unit apartment community at 2443 S. Colorado Blvd., for $6.6 million.

Former Fort Collins real estate broker indicted in land scheme

Matthew Sysum, 41, was arrested following a two-year investigation by the Weld County District Attorney's Office. He is accused of conspiring with an appraiser to overvalue the price of properties he was offering for sale, and also selling land that he did not yet own, with the help of a title company.

Building activity drops

Developers and builders pulled 1,116 building permits for homes, condos/town homes and apartment units in the first quarter, compared with 1,375 permits during the first quarter of 2010, according to the report by the Home Builders Association of Metro Denver. The report includes the counties of Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, and Jefferson, as well as 22 municipalities. Permits signal future construction, as builders pull them before they start construction.

Case-Shiller: Denver No. 5

The Denver-area housing market showed a 2.6 percent decline in value in February from February 2010, but that was still good enough for fifth place out of the 20 metropolitan statistical areas tracked by the closely watched S&P;/Case-Shiller Home Price Indices released today.

See CDOH analysis here - http://www.divisionofhousing.com/2011/04/case-shiller-denver-home-prices-down.html

Labels:

case-shiller,

john rebchook,

news digest

Wednesday, April 27, 2011

Case-Shiller: Denver home prices down for eighth month

Case-Shiller’s home price index for the Denver area fell 1.2 percent from January to February, and fell 2.6 percent ,year over year from February 2010 to February 2011.

According to the Case-Shiller report, released today by Standard and Poor's, and containing data up through February, 14 of the 20 metro areas measured by the report showed larger declines than the Denver area. The report shows a general decline in home prices across the nation, with only one metropolitan area, Washington, DC, showing and increase in home prices over the past year. According to the Case-Shiller press release:

In year over year comparisons for February, Phoenix showed the largest drop, with a decline of 8.4 percent, while the index in Minneapolis fell 8.3 percent. The index rose the most in Washington, DC where it increased 2.7 percent, year over year. Home price indices fell in 19 of the 20 cities included in the study.

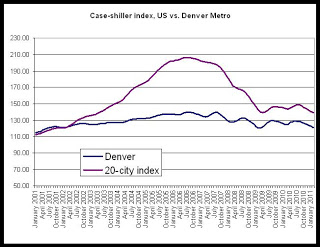

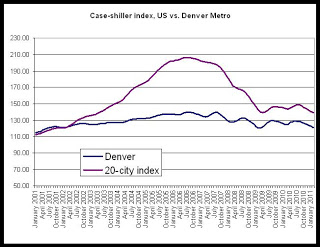

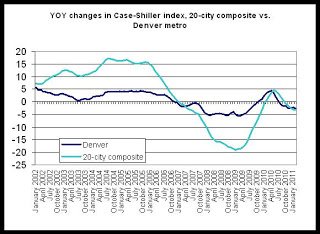

The first chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009, but continue a slow trend downward.

The 20-city composite is down 33 percent since it peaked in July 2006, but the Denver index is down only 13.5 percent from its August 2006 peak.

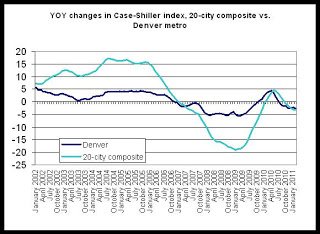

The second chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite. Year-over-year growth in the 20-city composite during February was negative with a decrease of 2.6 percent. The Denver area index’s fall of 2.6 percent is the eighth month in a row in which the growth rate has been negative. In the 20-city index, the year-over-year change has only been negative for the most recent five months, although the index has now dropped further in the 20-city index, year-over-year, than in the Denver index for the second month.

While Denver’s index has been largely stable, note that for the previous 24 months, only 8 months have shown a positive year-over-year change.

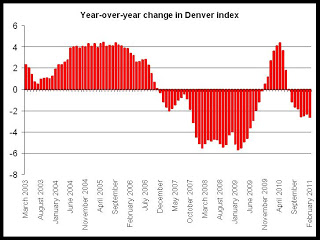

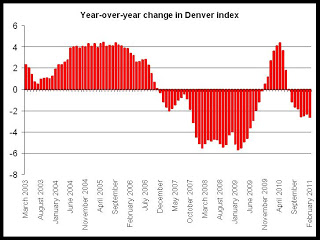

The last chart provides a closer look at year-over-year changes in the Denver index. Note that for July through February, the change has fallen below zero, and likely reflects the end of the homebuyer tax credit’s end which has led to a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010.

The chart shows that from July 2010 through February 2011, the home price index has been below the index for the same period a year earlier (July 2009 through January 2010). Given that 2009 was itself a weak year for home sales, this data does not suggest a speedy rebound for home prices.

According to the Case-Shiller report, released today by Standard and Poor's, and containing data up through February, 14 of the 20 metro areas measured by the report showed larger declines than the Denver area. The report shows a general decline in home prices across the nation, with only one metropolitan area, Washington, DC, showing and increase in home prices over the past year. According to the Case-Shiller press release:

'There is very little, if any, good news about housing. Prices continue to weaken, trends in sales and construction are disappointing.' says David M. Blitzer, Chairman of the Index Committee at S&P; Indices. 'Ten of the 11 MSAs that recorded index lows in January fell further in February. The one exception, Detroit, is 30% below its 2000 price level. The 20-City Composite is within a hair’s breadth of a double dip. Fourteen MSAs and both Composites have continued to decline month-over-month for more than six consecutive months as of February.'

In year over year comparisons for February, Phoenix showed the largest drop, with a decline of 8.4 percent, while the index in Minneapolis fell 8.3 percent. The index rose the most in Washington, DC where it increased 2.7 percent, year over year. Home price indices fell in 19 of the 20 cities included in the study.

The first chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009, but continue a slow trend downward.

The 20-city composite is down 33 percent since it peaked in July 2006, but the Denver index is down only 13.5 percent from its August 2006 peak.

The second chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite. Year-over-year growth in the 20-city composite during February was negative with a decrease of 2.6 percent. The Denver area index’s fall of 2.6 percent is the eighth month in a row in which the growth rate has been negative. In the 20-city index, the year-over-year change has only been negative for the most recent five months, although the index has now dropped further in the 20-city index, year-over-year, than in the Denver index for the second month.

While Denver’s index has been largely stable, note that for the previous 24 months, only 8 months have shown a positive year-over-year change.

The last chart provides a closer look at year-over-year changes in the Denver index. Note that for July through February, the change has fallen below zero, and likely reflects the end of the homebuyer tax credit’s end which has led to a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010.

The chart shows that from July 2010 through February 2011, the home price index has been below the index for the same period a year earlier (July 2009 through January 2010). Given that 2009 was itself a weak year for home sales, this data does not suggest a speedy rebound for home prices.

Labels:

case-shiller,

denver metro,

home prices

Thursday, April 21, 2011

Housing News Digest, April 22

Springs apartments getting tough to find

Local apartments are getting tougher to find and rents are on the rise as a result, two reports show.

The local apartment vacancy rate dropped to 5.8 percent during January, February and March, down from 7.2 percent in the fourth quarter of last year, according to a Colorado Division of Housing and the Apartment Association of Southern Colorado survey of the market released this week.

(Colo Springs Gazette)

Apartment vacancies drop to lowest levels in a decade

It’s getting harder to find an apartment in Colorado Springs.

Vacancy rates for the metro area fell to 5.8 percent during the first quarter, the lowest since 2001, and a 15.7 percent drop from the same time period in 2010.

(Colo Springs Business Journal)

2 Colorado lenders join HUD home energy-upgrade program

The U.S. Department of Housing and Urban Development has approved two Colorado lenders in a new pilot program that grants low-cost loans to homeowners wanting to make energy-saving improvements, HUD announced Thursday.

Colorado Brightwater Club Golf Development Files Bankruptcy

April 20 (Bloomberg) -- Clearwater Development Inc., operator of the Brightwater Club, a gated community in Colorado, filed for bankruptcy protection from creditors with debt exceeding $100 million.

The company said its debt included secured claims of $69.5 million and unsecured claims of $32.8 million. Assets, mostly real estate, were $8.29 million, according to an April 18 filing in U.S. Bankruptcy Court in Denver.

$1 million judgment against broker

A Denver District Court judge has barred a Centennial mortgage broker from issuing loans in Colorado and fined him and his companies almost $1 million in civil penalties.

Local apartments are getting tougher to find and rents are on the rise as a result, two reports show.

The local apartment vacancy rate dropped to 5.8 percent during January, February and March, down from 7.2 percent in the fourth quarter of last year, according to a Colorado Division of Housing and the Apartment Association of Southern Colorado survey of the market released this week.

(Colo Springs Gazette)

Apartment vacancies drop to lowest levels in a decade

It’s getting harder to find an apartment in Colorado Springs.

Vacancy rates for the metro area fell to 5.8 percent during the first quarter, the lowest since 2001, and a 15.7 percent drop from the same time period in 2010.

(Colo Springs Business Journal)

2 Colorado lenders join HUD home energy-upgrade program

The U.S. Department of Housing and Urban Development has approved two Colorado lenders in a new pilot program that grants low-cost loans to homeowners wanting to make energy-saving improvements, HUD announced Thursday.

Colorado Brightwater Club Golf Development Files Bankruptcy

April 20 (Bloomberg) -- Clearwater Development Inc., operator of the Brightwater Club, a gated community in Colorado, filed for bankruptcy protection from creditors with debt exceeding $100 million.

The company said its debt included secured claims of $69.5 million and unsecured claims of $32.8 million. Assets, mostly real estate, were $8.29 million, according to an April 18 filing in U.S. Bankruptcy Court in Denver.

$1 million judgment against broker

A Denver District Court judge has barred a Centennial mortgage broker from issuing loans in Colorado and fined him and his companies almost $1 million in civil penalties.

Job opening at the Division of Housing: Housing Developer

The official notice was posted April 13th and will run through April 25th at http://dola.colorado.gov/employment.html. Qualified applicants must submit a State of Colorado application and resume during the announcement period. The Job Description is a follows:

PRIMARY PHYSICAL WORK ADDRESS: Pueblo, CO Office

SALARY RANGE: $3,895.00 - $5,617.00 Monthly

DUTIES: The Housing Developer position is responsible for providing technical assistance on the planning and development of affordable housing to private developers, non-profit developers, and local governments; underwriting and review of grant and loan requests submitted to the Colorado Division of Housing including complex analysis of financial information and market conditions, evaluation of projects in reference to State and Federal housing regulations, and project funding recommendations to the State Housing Board; working closely with other project funding sources including private sector financing sources, HUD, Rural Development, and the Colorado Housing and Finance Authority (CHFA) to develop cost-effective and successful affordable housing projects; and assisting communities in developing strategies to meet local housing needs.

MINIMUM QUALIFICATIONS: Qualified applicants must have a bachelor’s degree from an accredited college or university and two years professional experience in federal housing programs (HOME, CDBG, Rural Development), multifamily housing finance, real estate development, or architecture/construction management.

SUBSTITUTION: Professional work experience in federal housing programs (HOME, CDBG, Rural Development), multifamily housing finance, real estate development, or architecture/construction management which provided the same kind, amount and level of knowledge acquired in the required education, may be substituted on a year-for-year basis for the bachelor's degree.

PRIMARY PHYSICAL WORK ADDRESS: Pueblo, CO Office

SALARY RANGE: $3,895.00 - $5,617.00 Monthly

DUTIES: The Housing Developer position is responsible for providing technical assistance on the planning and development of affordable housing to private developers, non-profit developers, and local governments; underwriting and review of grant and loan requests submitted to the Colorado Division of Housing including complex analysis of financial information and market conditions, evaluation of projects in reference to State and Federal housing regulations, and project funding recommendations to the State Housing Board; working closely with other project funding sources including private sector financing sources, HUD, Rural Development, and the Colorado Housing and Finance Authority (CHFA) to develop cost-effective and successful affordable housing projects; and assisting communities in developing strategies to meet local housing needs.

MINIMUM QUALIFICATIONS: Qualified applicants must have a bachelor’s degree from an accredited college or university and two years professional experience in federal housing programs (HOME, CDBG, Rural Development), multifamily housing finance, real estate development, or architecture/construction management.

SUBSTITUTION: Professional work experience in federal housing programs (HOME, CDBG, Rural Development), multifamily housing finance, real estate development, or architecture/construction management which provided the same kind, amount and level of knowledge acquired in the required education, may be substituted on a year-for-year basis for the bachelor's degree.

Labels:

colorado division of housing,

job posting,

pueblo

Housing News Digest, April 21

Report: Apartment Vacancy Rates Lowest In A Decade

Colorado Springs boasts its lowest apartment vacancy rate in a decade, according to new statistics released by the Colorado Division of Housing.

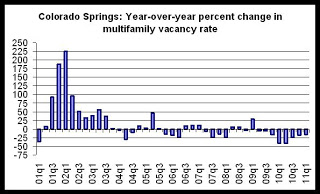

The vacancy rate fell to 5.8 percent for the first quarter of 2011, the lowest first-quarter vacancy report since 2011 and 15.7 percent lower than the reported first-quarter rate in 2010. The DOH says that this is also the eighth quarter in a row for the vacancy rate to be lower than the same quarter a year earlier.

Springs apartment vacancy rate at 10-year low

The apartment vacancy rate in the Colorado Springs metro area fell to 5.8 percent during the first quarter of 2011, falling to the lowest first-quarter vacancy rate reported since 2001, shows a report released today.

HOAs compared to Mafia

Alex Walter and Jim Burneson have a lot in common. They’re about the same age, they have long histories in real estate, they lived in the same Aurora community - Dam East - for years, and they have been friends for decades.

And they both despise homeowner associations.

Colorado job market is looking better

KUSA - Colorado's unemployment rate is at 9.3 percent, which is higher than the national rate of 8.8 percent. Despite these disappointing figures, things may be looking up in the Colorado job market.

HOA registration law

In case you didn’t think HOAs are a big deal, think again. Some 7,652 HOAs in Colorado have registered with the state of Colorado, a requirement of a law passed by legislators last year that went into effect in 2011

The HOAs registered with the Department of Regulatory Agencies, or DORA, as required by House Bill 1278, represent 817,675 units. Observers believe that means well over one million people live in HOA communities.

Colorado Springs boasts its lowest apartment vacancy rate in a decade, according to new statistics released by the Colorado Division of Housing.

The vacancy rate fell to 5.8 percent for the first quarter of 2011, the lowest first-quarter vacancy report since 2011 and 15.7 percent lower than the reported first-quarter rate in 2010. The DOH says that this is also the eighth quarter in a row for the vacancy rate to be lower than the same quarter a year earlier.

Springs apartment vacancy rate at 10-year low

The apartment vacancy rate in the Colorado Springs metro area fell to 5.8 percent during the first quarter of 2011, falling to the lowest first-quarter vacancy rate reported since 2001, shows a report released today.

HOAs compared to Mafia

Alex Walter and Jim Burneson have a lot in common. They’re about the same age, they have long histories in real estate, they lived in the same Aurora community - Dam East - for years, and they have been friends for decades.

And they both despise homeowner associations.

Colorado job market is looking better

KUSA - Colorado's unemployment rate is at 9.3 percent, which is higher than the national rate of 8.8 percent. Despite these disappointing figures, things may be looking up in the Colorado job market.

HOA registration law

In case you didn’t think HOAs are a big deal, think again. Some 7,652 HOAs in Colorado have registered with the state of Colorado, a requirement of a law passed by legislators last year that went into effect in 2011

The HOAs registered with the Department of Regulatory Agencies, or DORA, as required by House Bill 1278, represent 817,675 units. Observers believe that means well over one million people live in HOA communities.

Labels:

colorado springs,

HOA,

john rebchook,

news digest,

vacancy surveys

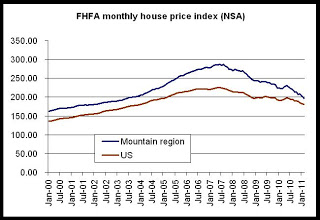

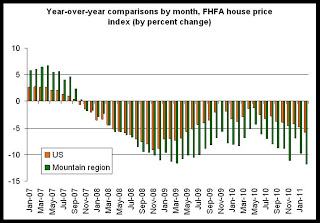

House prices in mountain region down 11.7 percent in February

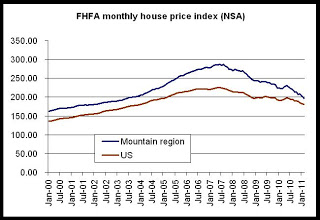

House prices in February in the Mountain region, which includes Colorado, fell 11.7 percent, year-over-year. Nationally, the house price index fell 5.8 percent. The new house price index numbers, released today by the Federal Housing and Finance Agency, also showed that the national index is down 19.9 percent from the peak level reached in June 2007, while the Mountain region's index is down 31.5 percent over the same period.

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

The decline in house prices, both regionally and nationally, continues the trend that began in mid-2007 as prices as fallen almost constantly since the peak.

Notably, the FHFA index does not show a "double dip" as can be seen in the Case-Shiller data (discussed here) in which prices begin to recover in 2009, but then fall again after mid-2010. The FHFA monthly data shows nothing but losses following mid-2007.

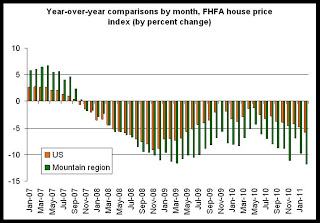

The second chart shows each month's house price index compared to the same month a year earlier:

In the second chart, we can also note that the Mountain region has performed more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example shows that local prices did not decline as much as the national composite index following the financial panic in 2008.

Since we're looking at regional, data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Since the Case-Shiller data is specific to the Denver area, this contrast between the two studies might also suggest that while the Denver area has recovered somewhat, many areas of the state are doing less well. Home prices in Grand Junction, for example, are down considerably from peak levels experienced in 2008. (According to FHFA quarterly data)

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac.

The decline in house prices, both regionally and nationally, continues the trend that began in mid-2007 as prices as fallen almost constantly since the peak.

Notably, the FHFA index does not show a "double dip" as can be seen in the Case-Shiller data (discussed here) in which prices begin to recover in 2009, but then fall again after mid-2010. The FHFA monthly data shows nothing but losses following mid-2007.

The second chart shows each month's house price index compared to the same month a year earlier:

In the second chart, we can also note that the Mountain region has performed more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example shows that local prices did not decline as much as the national composite index following the financial panic in 2008.

Since we're looking at regional, data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Since the Case-Shiller data is specific to the Denver area, this contrast between the two studies might also suggest that while the Denver area has recovered somewhat, many areas of the state are doing less well. Home prices in Grand Junction, for example, are down considerably from peak levels experienced in 2008. (According to FHFA quarterly data)

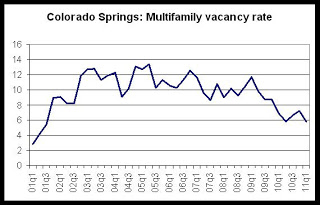

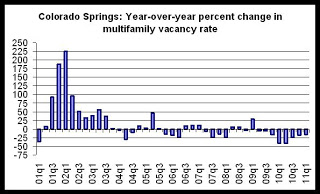

Analysis: 1st Q 2011 Vacancies and Rents in Colorado Springs metro area

According to new Colorado Springs vacancy and rent data released today by the Colorado Division of Housing, multifamily rental vacancies fell while average rents increased.

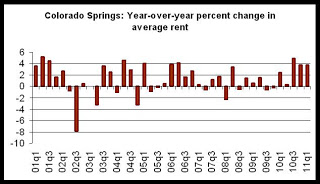

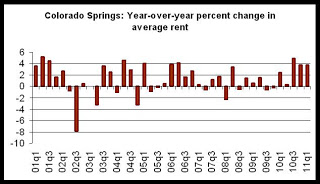

The region-wide vacancy rate in Colorado Springs has fallen every quarter for the past eight quarters when compared to the same quarter a year prior. As can be seen in the first graph, the year-over-year change in vacancies has not been positive since the first quarter of 2009, when the vacancy rate rose 30 percent over the year prior.

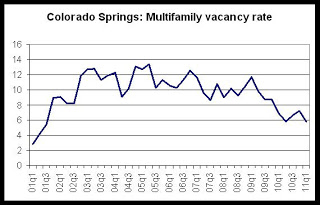

Graph 2 shows the vacancy rate for the Colorado Springs area for each quarter during the last ten years. 2011's first-quarter vacancy rate, which is tied with the second quarter of 2010 at 5.8 percent, is the lowest vacancy rate reported since the third quarter of 2001. Colorado Springs is just now recovering from ten years of high vacancy rates and stagnant rents. This period was touched off by the mobilization of large numbers of troops stationed in Colorado Springs, and was further reinforced by a decade of aggressive home buying which cut the demand for rental housing. The Colorado Springs area also endured several mass layoffs during the last decade.

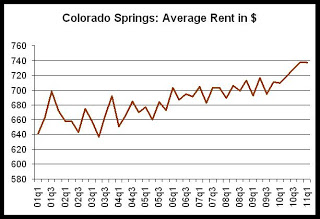

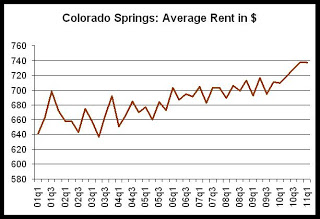

Not unexpectedly, growth in average rents has begun to build in the region as well. Notably, the average rent for the Colorado Springs area has not decreased since the third quarter of 2009. In each quarter since, the average rent has been flat or has increased from each quarter to the next, creating the longest period of sustained rental increases in ten years.

The region-wide average rent in Colorado Springs has increased for the past five quarters when compared to the same quarter the previous year. As can be seen in the fourth graph, the past three quarters have shown growth rates near or above 4 percent which suggests the sort of growth in average rents seen in Colorado Springs before the 2002 recession hit Colorado.

While the recent growth in rents and the declines in vacancy rates does not in itself prove continued demand for multifamily rentals in the region, the absence of any substantial amount of new construction of rentals in the area will contribute to ongoing rent growth and tightness in vacancies. Barring a large mobilization of troops out of the area, there will be sufficient population to sustain continued demand for rentals.

In addition, the relative unattractiveness or lack of accessibility to for-purchase housing at this time will reinforce this trend.

Note: The average rent information above is not adjusted for inflation. For information on inflation-adjusted rents, see here.

The vacancy and rent report also contains information on median rents. For more information on the differences between median and average rents, see here.

The region-wide vacancy rate in Colorado Springs has fallen every quarter for the past eight quarters when compared to the same quarter a year prior. As can be seen in the first graph, the year-over-year change in vacancies has not been positive since the first quarter of 2009, when the vacancy rate rose 30 percent over the year prior.

Graph 2 shows the vacancy rate for the Colorado Springs area for each quarter during the last ten years. 2011's first-quarter vacancy rate, which is tied with the second quarter of 2010 at 5.8 percent, is the lowest vacancy rate reported since the third quarter of 2001. Colorado Springs is just now recovering from ten years of high vacancy rates and stagnant rents. This period was touched off by the mobilization of large numbers of troops stationed in Colorado Springs, and was further reinforced by a decade of aggressive home buying which cut the demand for rental housing. The Colorado Springs area also endured several mass layoffs during the last decade.

Not unexpectedly, growth in average rents has begun to build in the region as well. Notably, the average rent for the Colorado Springs area has not decreased since the third quarter of 2009. In each quarter since, the average rent has been flat or has increased from each quarter to the next, creating the longest period of sustained rental increases in ten years.

The region-wide average rent in Colorado Springs has increased for the past five quarters when compared to the same quarter the previous year. As can be seen in the fourth graph, the past three quarters have shown growth rates near or above 4 percent which suggests the sort of growth in average rents seen in Colorado Springs before the 2002 recession hit Colorado.

While the recent growth in rents and the declines in vacancy rates does not in itself prove continued demand for multifamily rentals in the region, the absence of any substantial amount of new construction of rentals in the area will contribute to ongoing rent growth and tightness in vacancies. Barring a large mobilization of troops out of the area, there will be sufficient population to sustain continued demand for rentals.

In addition, the relative unattractiveness or lack of accessibility to for-purchase housing at this time will reinforce this trend.

Note: The average rent information above is not adjusted for inflation. For information on inflation-adjusted rents, see here.

The vacancy and rent report also contains information on median rents. For more information on the differences between median and average rents, see here.

Colorado Springs apartment vacancies fall to ten-year low

Click here for full report.

The apartment vacancy rate in the Colorado Springs metro area fell to 5.8 percent during the first quarter of 2011, falling to the lowest first-quarter vacancy rate reported since 2001. According to a report released today by the Apartment Association of Southern Colorado and the Colorado Division of Housing, the vacancy rate in the Colorado Springs area fell 15.7 percent year over year from 2010’s first-quarter rate of 6.9 percent. The vacancy rate also dropped from 2010’s fourth quarter rate of 7.2 percent, as expected. Seasonal factors generally lead to a falling vacancy rate from the fourth quarter to first quarter.

The first quarter’s drop in the vacancy rate is the eighth quarter in a row in which the vacancy rate has fallen when compared to the same period a year earlier.

Year over year, vacancy rates fell the most in the “Southwest” market area of Colorado Springs where vacancy rates fell 35 percent from 5.1 percent to 3.3 percent. Vacancy rates were lowest in the Northwest and Southwest market areas with rates of 3.6 percent and 3.3 percent, respectively.

Vacancy rates for all market areas were: Northwest, 3.6 percent; Northeast, 6.5 percent; Far Northeast, 5.5 percent, Southeast, 7.0 percent; Security/Widefield/Fountain, 16.2 percent; Southwest, 3.3 percent; Central, 6.3 percent.

As vacancy rates moved down, the area’s average rent increased. 2011’s first-quarter average rent rose 3.7 percent to $737.00 from 2010’s first-quarter average rent of $710.07. In individual market areas, the average rent rose year over year in all areas except the Southeast and the Security/Wifefield/Fountain areas. The area with the largest year-over-year increase in the average rent was the Central region with an increase of 10.6 percent from $649.88 to $719.37. The average rent dropped the most in the Security/Widefield/Fountain area where the average rent fell 5.7 percent from $603.58 during 2010’s first quarter to $568.86 during the first quarter of this year.

Average rents for all market areas were: Northwest, $839.62; Northeast, $721.48; Far Northeast, $832.69, Southeast, $598.42; Security/Widefield/Fountain, $668.86; Southwest, $765.09; Central, $719.37.

The apartment vacancy rate in the Colorado Springs metro area fell to 5.8 percent during the first quarter of 2011, falling to the lowest first-quarter vacancy rate reported since 2001. According to a report released today by the Apartment Association of Southern Colorado and the Colorado Division of Housing, the vacancy rate in the Colorado Springs area fell 15.7 percent year over year from 2010’s first-quarter rate of 6.9 percent. The vacancy rate also dropped from 2010’s fourth quarter rate of 7.2 percent, as expected. Seasonal factors generally lead to a falling vacancy rate from the fourth quarter to first quarter.

The first quarter’s drop in the vacancy rate is the eighth quarter in a row in which the vacancy rate has fallen when compared to the same period a year earlier.

Year over year, vacancy rates fell the most in the “Southwest” market area of Colorado Springs where vacancy rates fell 35 percent from 5.1 percent to 3.3 percent. Vacancy rates were lowest in the Northwest and Southwest market areas with rates of 3.6 percent and 3.3 percent, respectively.

Vacancy rates for all market areas were: Northwest, 3.6 percent; Northeast, 6.5 percent; Far Northeast, 5.5 percent, Southeast, 7.0 percent; Security/Widefield/Fountain, 16.2 percent; Southwest, 3.3 percent; Central, 6.3 percent.

As vacancy rates moved down, the area’s average rent increased. 2011’s first-quarter average rent rose 3.7 percent to $737.00 from 2010’s first-quarter average rent of $710.07. In individual market areas, the average rent rose year over year in all areas except the Southeast and the Security/Wifefield/Fountain areas. The area with the largest year-over-year increase in the average rent was the Central region with an increase of 10.6 percent from $649.88 to $719.37. The average rent dropped the most in the Security/Widefield/Fountain area where the average rent fell 5.7 percent from $603.58 during 2010’s first quarter to $568.86 during the first quarter of this year.

Average rents for all market areas were: Northwest, $839.62; Northeast, $721.48; Far Northeast, $832.69, Southeast, $598.42; Security/Widefield/Fountain, $668.86; Southwest, $765.09; Central, $719.37.

Wednesday, April 20, 2011

NAR: Western US only region with drop in home sales

The National Association of Realtors released its monthly home sales data today.

Nationally:

At the regional level, the West showed the weakest numbers:

Home sales and price statistics in the West continue to be pulled down by weak markets in California, Nevada and in the Phoenix area. Nevertheless, according to the most recent data from the Colorado Association of Realtors, Case-Shiller and FHFA, home sales and prices have tended to be down or flat in recent year-over-year comparisons.

This NAR report further confirms the view that home sales activity in the West, including Colorado, is flat to slightly negative.

Nationally:

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010. Sales were at elevated levels from March through June of 2010 in response to the home buyer tax credit.

At the regional level, the West showed the weakest numbers:

Regionally, existing-home sales in the Northeast rose 3.9 percent to an annual level of 800,000 in March but are 12.1 percent below March 2010. The median price in the Northeast was $232,900, down 3.0 percent from a year ago.

Existing-home sales in the Midwest increased 1.0 percent in March to a pace of 1.06 million but are 13.1 percent lower than a year ago. The median price in the Midwest was $126,100, which is 7.1 percent below March 2010.

In the South, existing-home sales rose 8.2 percent to an annual level of 1.99 million in March but are 1.0 percent below March 2010. The median price in the South was $138,200, down 6.6 percent from a year ago.

Existing-home sales in the West slipped 0.8 percent to an annual pace of 1.25 million in March and are 3.1 percent below a year ago. The median price in the West was $192,100, which is 11.2 percent lower than March 2010.

Home sales and price statistics in the West continue to be pulled down by weak markets in California, Nevada and in the Phoenix area. Nevertheless, according to the most recent data from the Colorado Association of Realtors, Case-Shiller and FHFA, home sales and prices have tended to be down or flat in recent year-over-year comparisons.

This NAR report further confirms the view that home sales activity in the West, including Colorado, is flat to slightly negative.

Housing News Digest, April 20

Builders offer green tract homes with nearly zero utility bills

On Earth Day Friday, Meritage Homes will begin offering a “net-zero” home that’s designed to produce as much energy as it uses annually. Such homes, starting at $140,000 in Tucson and $160,000 in Las Vegas, will be available in parts of Arizona, California, Colorado, Nevada and central Texas, where a nine-panel rooftop solar array is already a standard feature. For a $10,000 upgrade, consumers can get 24 more solar panels that could reduce utility bills to zero.

MBA: Mortgage Purchase Application activity increases

The Refinance Index increased 2.7 percent from the previous week. The seasonally adjusted Purchase Index increased 10.0 percent to its highest level since December 3, 2010, driven largely by a 17.6 percent increase in Government purchase applications.

Aspen's high-end hotels all close

The Aspen Times reports it's the first time in memory all three have been closed at once, although each has a different reason. The Jerome will be undergoing general maintenance and The Little Nell will see some minor renovations that will shutter both until near the middle of May. A bigger, $30 million renovation project will keep the St. Regis closed until mid-June.

Distressed Properties Claim 40% of Existing-Home Sales

Distressed homes - typically REOs and short sales - accounted for 40 percent of the existing homes sold in March, the National Association of Realtors (NAR) reported Wednesday.

The trade group notes that these properties generally sell at discounts in the vicinity of 20 percent. Their large market share served to dampen the median existing-home price. For all housing types, it came in at $159,600 last month, down 5.9 percent from March 2010.

'Uneven' housing recovery continues

Also see here.

NEW YORK (CNNMoney) -- Sales of existing homes increased in March, "continuing an uneven recovery" in real estate, an industry group said Monday.

Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.

On Earth Day Friday, Meritage Homes will begin offering a “net-zero” home that’s designed to produce as much energy as it uses annually. Such homes, starting at $140,000 in Tucson and $160,000 in Las Vegas, will be available in parts of Arizona, California, Colorado, Nevada and central Texas, where a nine-panel rooftop solar array is already a standard feature. For a $10,000 upgrade, consumers can get 24 more solar panels that could reduce utility bills to zero.

MBA: Mortgage Purchase Application activity increases

The Refinance Index increased 2.7 percent from the previous week. The seasonally adjusted Purchase Index increased 10.0 percent to its highest level since December 3, 2010, driven largely by a 17.6 percent increase in Government purchase applications.

Aspen's high-end hotels all close

The Aspen Times reports it's the first time in memory all three have been closed at once, although each has a different reason. The Jerome will be undergoing general maintenance and The Little Nell will see some minor renovations that will shutter both until near the middle of May. A bigger, $30 million renovation project will keep the St. Regis closed until mid-June.

Distressed Properties Claim 40% of Existing-Home Sales

Distressed homes - typically REOs and short sales - accounted for 40 percent of the existing homes sold in March, the National Association of Realtors (NAR) reported Wednesday.

The trade group notes that these properties generally sell at discounts in the vicinity of 20 percent. Their large market share served to dampen the median existing-home price. For all housing types, it came in at $159,600 last month, down 5.9 percent from March 2010.

'Uneven' housing recovery continues

Also see here.

NEW YORK (CNNMoney) -- Sales of existing homes increased in March, "continuing an uneven recovery" in real estate, an industry group said Monday.

Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.

Tuesday, April 19, 2011

Housing News Digest, April 19

Americans Shun Cheapest Homes in 40 Years as Ownership Fades

April 19 (Bloomberg) -- Victoria Pauli signed a one-year lease last week to stay in her rental home in Fair Oaks, California. She had considered buying in the area, where property prices have slumped 57 percent since a 2005 peak.

Luxury home market flat

Luxury home sales and the median sale price in the Denver Metro Area were flat last month compared to year-ago levels, although sales were up from February, according to Coldwell Banker Residential Brokerage.

Waters Introduces Bill Calling for Mandatory Loss Mitigation

Mortgage servicing practices have taken center stage on Capitol Hill, with a flurry of bills being penned to make servicing reforms the law of the land.

Rep. Maxine Waters (D-California) has revised a bill she’s brought to the table several times before that would compel lenders to engage in what she says are “reasonable loss mitigation activities” for all delinquent homeowners.

Verdigris Group Advances Carbon Neutral Operational Policy to Include Watershed Restoration and Reforestation to Their Suite of Initiatives

Verdigris Group’s three primary operating divisions include their development division, Verdigris Properties, which concentrates on developing green / LEED Certified commercial and residential properties. They are currently in the due diligence phase of land acquisition for a planned multi-family project in Breckenridge, Colorado that is slated to achieve LEED Gold Certification under the U.S Building Council's Leadership in Energy & Environmental Design green building rating system. “This project will be the first of its kind in this market-place, setting a new bar in residential real estate development in Summit County and across the high-country, and serving as a beacon of what sustainable development can achieve,”

Breckenridge Colorado Resort Real Estate Market Analysis - Q1 2011

The Breckenridge real estate market is continuing to make a comeback from the market lows of 2009 and this comeback is being lead by Breckenridge investment property sales. The number of first quarter single family home sales are also up for the second year in a row. Vacant land continues to be the weakest segment of the Breckenridge real estate market. But even vacant lot sales have seen an increase during the first quarter of 2011 over those of Q1 2009.

April 19 (Bloomberg) -- Victoria Pauli signed a one-year lease last week to stay in her rental home in Fair Oaks, California. She had considered buying in the area, where property prices have slumped 57 percent since a 2005 peak.

Luxury home market flat

Luxury home sales and the median sale price in the Denver Metro Area were flat last month compared to year-ago levels, although sales were up from February, according to Coldwell Banker Residential Brokerage.

Waters Introduces Bill Calling for Mandatory Loss Mitigation

Mortgage servicing practices have taken center stage on Capitol Hill, with a flurry of bills being penned to make servicing reforms the law of the land.

Rep. Maxine Waters (D-California) has revised a bill she’s brought to the table several times before that would compel lenders to engage in what she says are “reasonable loss mitigation activities” for all delinquent homeowners.

Verdigris Group Advances Carbon Neutral Operational Policy to Include Watershed Restoration and Reforestation to Their Suite of Initiatives

Verdigris Group’s three primary operating divisions include their development division, Verdigris Properties, which concentrates on developing green / LEED Certified commercial and residential properties. They are currently in the due diligence phase of land acquisition for a planned multi-family project in Breckenridge, Colorado that is slated to achieve LEED Gold Certification under the U.S Building Council's Leadership in Energy & Environmental Design green building rating system. “This project will be the first of its kind in this market-place, setting a new bar in residential real estate development in Summit County and across the high-country, and serving as a beacon of what sustainable development can achieve,”

Breckenridge Colorado Resort Real Estate Market Analysis - Q1 2011

The Breckenridge real estate market is continuing to make a comeback from the market lows of 2009 and this comeback is being lead by Breckenridge investment property sales. The number of first quarter single family home sales are also up for the second year in a row. Vacant land continues to be the weakest segment of the Breckenridge real estate market. But even vacant lot sales have seen an increase during the first quarter of 2011 over those of Q1 2009.

Labels:

breckenridge,

LEED,

new development,

news digest

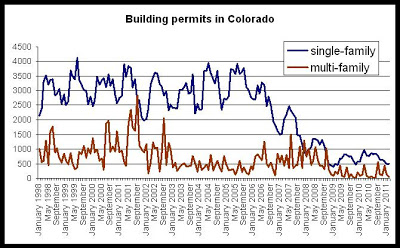

Housing starts in western US fall 19 percent

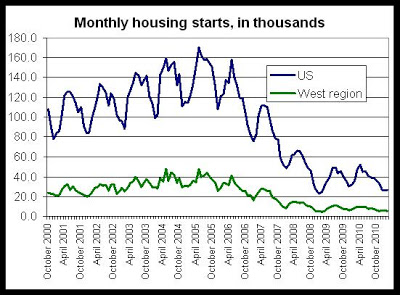

Housing starts in the West census region of the US, which includes Colorado, fell 19 percent from March 2010 to March 2011. According to new housing construction and housing starts data released today by the US Census Bureau, there were approximately 9,300 housing units started in the West during March 2011. Of the new units started, 7,300 were single-family structures and 2,000 were structures containing more than one housing unit.

Nationally, housing starts fell 16 percent during the same period, with total housing starts falling to a total of 45,900.

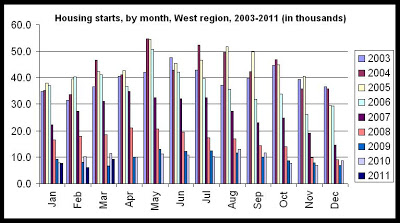

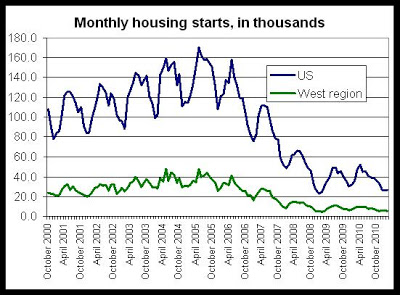

The first graph shows the overall trend of housing starts nationally and in the West census region. Total housing starts remain near ten year lows in both measures.

The West census region includes California, so given the size of the West census region, the fact that total housing starts are below 10,000 indicates that new home construction continues to be very light throughout the region.

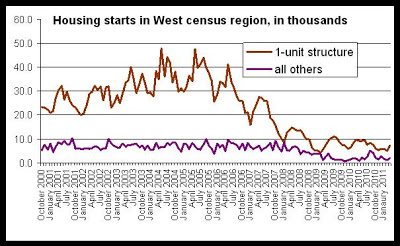

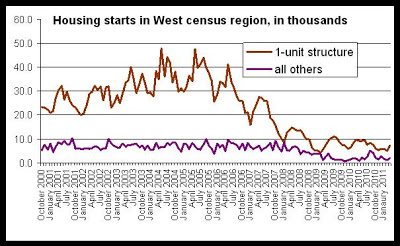

The second graph shows the difference between single-family starts and starts for structures with more than one housing unit. Both remain near ten-year lows, and single-family starts fell 24 percent from March 2010 to March 2011. However, starts for structures with more than one unit increased by 11 percent during the same period. Given recent data showing strength in the demand for rental-housing, the housing starts data may suggest that developers of rental housing are beginning to move forward with construction of new multifamily structures.

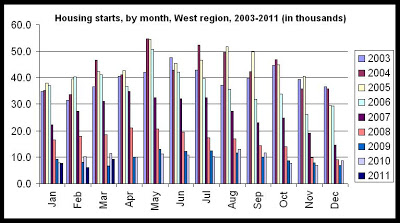

The third graph shows month-by-month comparisons in housing starts for each year. March's housing starts total was the second lowest total for the month in at least ten years. Only 2009 showed fewer housing starts for March. March produced the largest number of housing starts in six months, but much of this is due to seasonal factors.

Nationally, housing starts fell 16 percent during the same period, with total housing starts falling to a total of 45,900.

The first graph shows the overall trend of housing starts nationally and in the West census region. Total housing starts remain near ten year lows in both measures.

The West census region includes California, so given the size of the West census region, the fact that total housing starts are below 10,000 indicates that new home construction continues to be very light throughout the region.

The second graph shows the difference between single-family starts and starts for structures with more than one housing unit. Both remain near ten-year lows, and single-family starts fell 24 percent from March 2010 to March 2011. However, starts for structures with more than one unit increased by 11 percent during the same period. Given recent data showing strength in the demand for rental-housing, the housing starts data may suggest that developers of rental housing are beginning to move forward with construction of new multifamily structures.

The third graph shows month-by-month comparisons in housing starts for each year. March's housing starts total was the second lowest total for the month in at least ten years. Only 2009 showed fewer housing starts for March. March produced the largest number of housing starts in six months, but much of this is due to seasonal factors.

Labels:

census data,

colorado,

construction,

housing starts,

new construction,

west region

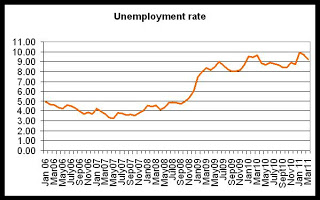

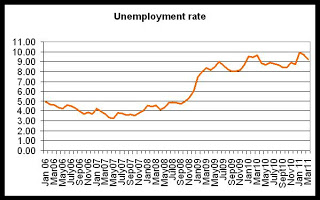

Colorado March employment down 6,000 jobs from March 2010

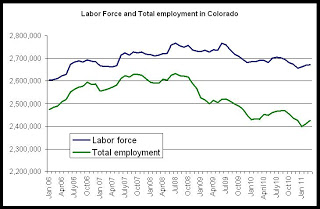

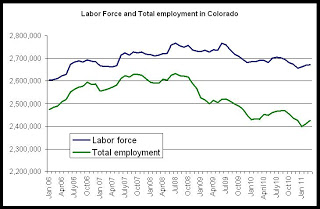

Colorado lost 6,300 jobs in March compared to March of last year, but the non-seasonally-adjusted unemployment rate fell to 9.2 from March 2010's rate of 9.7 percent. According to the most recent employment data released by the Colorado Department of Labor and Employment, total employment in March, not seasonally adjusted, fell to 2.42 million jobs. There were 19,000 fewer people in the work force during March, compared to March 2010, which contributed to the decline in the unemployment rate.

From March 2010 to March 2011, total employment fell 0.2 percennt, while the labor force shrank 0.7 percent. The total labor force in March included 2.67 million workers.

As can be seen in the second graph, total employment and total workforce size have increased month-over-month, but both remain down in year-over-year comparisons, and both remain well below the July 2008 peak.

Employment totals are still more than 207,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Since the labor force peaked in July 2008, it has fallen by more than 95,000 workers.

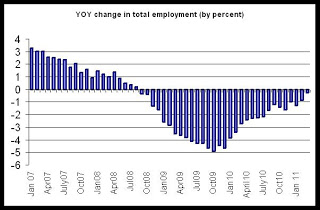

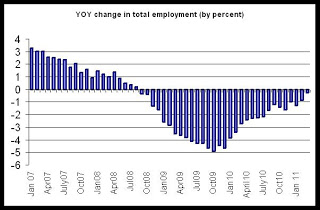

In the third graph is shown the year-over-year comparisons, by percent, for total employment. Not since August 2008 has Colorado posted a positive change in total employment when compared to a year earlier. Although overall total employment has increased since January 2010, employment totals remain below 2009 totals in each year-over-year comparison. The annual declines, however, have grown smaller in recent months. March's year-over-year drop of 0.2 percent was the smallest annual drop since September 2008 when total employment fell 0.3 percent from the previous September.

This is the third month in a row in which Colorado's unemployment rate has exceeded the national rate (discussed here.)

From March 2010 to March 2011, total employment fell 0.2 percennt, while the labor force shrank 0.7 percent. The total labor force in March included 2.67 million workers.

As can be seen in the second graph, total employment and total workforce size have increased month-over-month, but both remain down in year-over-year comparisons, and both remain well below the July 2008 peak.

Employment totals are still more than 207,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Since the labor force peaked in July 2008, it has fallen by more than 95,000 workers.

In the third graph is shown the year-over-year comparisons, by percent, for total employment. Not since August 2008 has Colorado posted a positive change in total employment when compared to a year earlier. Although overall total employment has increased since January 2010, employment totals remain below 2009 totals in each year-over-year comparison. The annual declines, however, have grown smaller in recent months. March's year-over-year drop of 0.2 percent was the smallest annual drop since September 2008 when total employment fell 0.3 percent from the previous September.

This is the third month in a row in which Colorado's unemployment rate has exceeded the national rate (discussed here.)

Labels:

colorado,

economics,

employment,

unemployment

March 2010 employment: regional comparisons

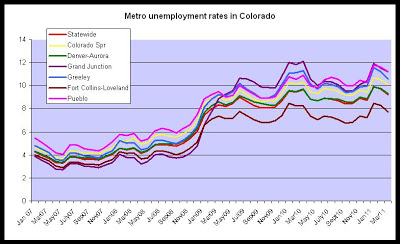

Total employment in the state continues to fall, as we noted this morning. Employment trends in different regions of the state differ, however, so this article looks at which regions of the state have the highest unemployment rates, and which regions have recovered the most in their labor markets.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

The first graph compares unemployment rates in Colorado's metro areas:

The regional unemployment rates for March 2011 are:

Colorado Springs, 10.1%

Denver-Aurora, 9.3%

Fort Collins-Loveland, 7.7%

Grand Junction, 11.2%

Greeley, 10.6%

Pueblo, 11.2%

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force, so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the March 2011 employment totals:

Colorado Springs MSA, 9.2%

Denver-Aurora MSA, 7.6%

Fort Collins-Loveland MSA, 6.7%

Grand Junction MSA, 14.7%

Greeley MSA 9.1%

Pueblo MSA, 5.4%

Pueblo has only fallen 5.4 percent from peak levels, although Pueblo already had a relatively weak job market during the peak period, which would explain why Pueblo continues to be among the areas with the highest unemployment rates. The Fort Collins Loveland area, on the other hand, is now only 6.7 percent below its peak, and is also the metro area with the lowest unemployment rate.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In March 2011, the rate in the Boulder-Longmont area was 6.9%.)

Among metro areas shown here, the March unemployment rate fell in every area except Pueblo, year-over-year.

Impact on Housing

The metro areas with the most job growth should generally also be the areas with the most demand for housing. We do see this reflected to a certain extent in the apartment vacancy data.

New vacancy and rent reports will be released over the next three weeks which will provide vacancy numbers for March 2011, and will allow for additional comparisons and analysis.

We expect the demand for housing to continue to be strongest in the Fort Collins-Loveland area and in metro Denver.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

The first graph compares unemployment rates in Colorado's metro areas:

The regional unemployment rates for March 2011 are:

Colorado Springs, 10.1%

Denver-Aurora, 9.3%

Fort Collins-Loveland, 7.7%

Grand Junction, 11.2%

Greeley, 10.6%

Pueblo, 11.2%

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force, so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the March 2011 employment totals:

Colorado Springs MSA, 9.2%

Denver-Aurora MSA, 7.6%

Fort Collins-Loveland MSA, 6.7%