The next multi-family weatherization grant solicitation will be in March or April 2010. We encourage potential grantees to sign up for the notices for these grant opportunities at the link below:

http://www.energyoutreachcolorado.org/grants

Friday, November 20, 2009

Thursday, November 19, 2009

Foreclosure filings reach record high in third quarter

Click here for full report.

New foreclosure filings in Colorado again topped 12,000, marking the fourth quarter in a row in which foreclosure filings have increased. The number of completed foreclosures grew for the third quarter in a row, reaching a total of 5,618. According to a report released Thursday by the Colorado Department of Local Affairs’ Division of Housing, new foreclosure filings reached 12,468 during the third quarter for a 9-month total of 35,112. Completed foreclosures reached a 9-month total of 14,971.

During the full year of 2008, there were 39,333 total foreclosure filings and 21,301 total completed foreclosures.

In spite of growth in recent quarters, however, the total number of completed foreclosures fell during the first three quarters of the year when compared to the same period last year. The total number of completed foreclosures, totaling 14,971 during the first 9 months of 2009, fell 8 percent when compared to last year’s 9-month total of 16,265.

“The fact that completed foreclosures have been flat or falling as new foreclosures have risen is certainly a credit to our housing counselors,” said Stephanie Riggi, manager of the Colorado Foreclosure Hotline’s call center. “Plenty of new people are entering the foreclosure process, but fortunately, many of them are finding help with housing counselors and by using strategies such as loan modifications that don’t lead to a full foreclosure.”

Riggi noted that calls to the Hotline (877-601-HOPE) have increased and the Hotline has received more than 3,000 calls each month since August of this year.

New foreclosure filings increased 18 percent from last year’s 9-month total of 29,852 to this year’s total of 35,112.

Changes in foreclosure activity varied by region. Comparing the three quarters of 2009 to the same period last year, the report notes that Adams, Arapahoe, and Denver Counties all experienced significant declines in total numbers of completed foreclosures. Denver’s completed foreclosure totals fell 34 percent while Adams County and Arapahoe County both fell 20 percent.

The largest increases in completed foreclosures were found in counties outside of metro Denver. For the first 9 months of the year, El Paso County reported an increase of 18 percent over the same period last year, while Mesa County reported an increase of 173 percent. Weld County, which has been among counties with the highest foreclosure rates in recent years, appears to have moderated significantly with an increase of only 2 percent. All other metropolitan counties reported decreases.

Some smaller counties have been driving increases as well. According to the report, medium-sized counties like Montrose, Chaffee, Park, La Plata, and Eagle Counties all reported significant increases in new activity in completed foreclosures. La Plata County, for example, reported a 300 percent increase while Eagle County reported an increase of 194 percent.

Foreclosure activity in Colorado has increased in recent quarters following the end of moratoria

Observers noted that an increase in foreclosure activity during recent quarters had been expected. Many lenders and investors had enacted both formal and informal moratoria on foreclosures which slowed down the foreclosure process for many. As these moratoria were phased out, officials expected to see an increase in the number of new foreclosures. As a result, both foreclosure filings and completed foreclosures have grown each quarter since the first quarter of this year.

“Due to the moratoria and the changes in law, foreclosure totals dipped quite a bit at various times during 2008 and early 2009,” said Ryan McMaken, a spokesman for the Division of Housing. “We seem to have worked through much of that now and the trend points toward a situation in which foreclosures are not increasing rapidly, but they’re not going away either.”

In spite of recent decreases in foreclosure totals in Adams, Arapahoe and Denver Counties, high foreclosure rates persist. Adams County reported a rate of 74 households per completed foreclosure, while Arapahoe and Denver Counties reported rates of 104 and 113 respectively. The rate in Boulder County, by contrast, was 329 households per completed foreclosure, while Mesa County reported 283 households per completed foreclosure.

The counties with the lowest foreclosure rates included Garfield and Pitkin Counties where there were 619 and 654 households per completed foreclosure, respectively.

New foreclosure filings in Colorado again topped 12,000, marking the fourth quarter in a row in which foreclosure filings have increased. The number of completed foreclosures grew for the third quarter in a row, reaching a total of 5,618. According to a report released Thursday by the Colorado Department of Local Affairs’ Division of Housing, new foreclosure filings reached 12,468 during the third quarter for a 9-month total of 35,112. Completed foreclosures reached a 9-month total of 14,971.

During the full year of 2008, there were 39,333 total foreclosure filings and 21,301 total completed foreclosures.

In spite of growth in recent quarters, however, the total number of completed foreclosures fell during the first three quarters of the year when compared to the same period last year. The total number of completed foreclosures, totaling 14,971 during the first 9 months of 2009, fell 8 percent when compared to last year’s 9-month total of 16,265.

“The fact that completed foreclosures have been flat or falling as new foreclosures have risen is certainly a credit to our housing counselors,” said Stephanie Riggi, manager of the Colorado Foreclosure Hotline’s call center. “Plenty of new people are entering the foreclosure process, but fortunately, many of them are finding help with housing counselors and by using strategies such as loan modifications that don’t lead to a full foreclosure.”

Riggi noted that calls to the Hotline (877-601-HOPE) have increased and the Hotline has received more than 3,000 calls each month since August of this year.

New foreclosure filings increased 18 percent from last year’s 9-month total of 29,852 to this year’s total of 35,112.

Changes in foreclosure activity varied by region. Comparing the three quarters of 2009 to the same period last year, the report notes that Adams, Arapahoe, and Denver Counties all experienced significant declines in total numbers of completed foreclosures. Denver’s completed foreclosure totals fell 34 percent while Adams County and Arapahoe County both fell 20 percent.

The largest increases in completed foreclosures were found in counties outside of metro Denver. For the first 9 months of the year, El Paso County reported an increase of 18 percent over the same period last year, while Mesa County reported an increase of 173 percent. Weld County, which has been among counties with the highest foreclosure rates in recent years, appears to have moderated significantly with an increase of only 2 percent. All other metropolitan counties reported decreases.

Some smaller counties have been driving increases as well. According to the report, medium-sized counties like Montrose, Chaffee, Park, La Plata, and Eagle Counties all reported significant increases in new activity in completed foreclosures. La Plata County, for example, reported a 300 percent increase while Eagle County reported an increase of 194 percent.

Foreclosure activity in Colorado has increased in recent quarters following the end of moratoria

Observers noted that an increase in foreclosure activity during recent quarters had been expected. Many lenders and investors had enacted both formal and informal moratoria on foreclosures which slowed down the foreclosure process for many. As these moratoria were phased out, officials expected to see an increase in the number of new foreclosures. As a result, both foreclosure filings and completed foreclosures have grown each quarter since the first quarter of this year.

“Due to the moratoria and the changes in law, foreclosure totals dipped quite a bit at various times during 2008 and early 2009,” said Ryan McMaken, a spokesman for the Division of Housing. “We seem to have worked through much of that now and the trend points toward a situation in which foreclosures are not increasing rapidly, but they’re not going away either.”

In spite of recent decreases in foreclosure totals in Adams, Arapahoe and Denver Counties, high foreclosure rates persist. Adams County reported a rate of 74 households per completed foreclosure, while Arapahoe and Denver Counties reported rates of 104 and 113 respectively. The rate in Boulder County, by contrast, was 329 households per completed foreclosure, while Mesa County reported 283 households per completed foreclosure.

The counties with the lowest foreclosure rates included Garfield and Pitkin Counties where there were 619 and 654 households per completed foreclosure, respectively.

October 2009 foreclosures down from October 2008

Click here for full report.

The Division of Housing now releases monthly data on foreclosure filings and foreclosure sales in metropolitan counties in Colorado. These reports are a supplement to the Division’s quarterly statewide foreclosure reports available at the Division’s web site: http://dola.colorado.gov/cdh/

Findings:

Comparing year-over-year, foreclosure filings in October increased 6.9 percent overall with totals rising from 3,024 to 3,234.

Movement in new foreclosure filings was mixed. While Arapahoe, Boulder, Larimer and Mesa Counties all reported sizable increases year over year, Adams, Denver, Douglas, El Paso, and Weld Counties reported decreases in foreclosure filing activity over the same period.

Decreases were more widespread with foreclosure sales. Sales totals dropped in all counties except Boulder and Mesa Counties. Adams, Arapahoe, and Denver reported year over year decreases of over 30 percent.

Overall, foreclosure sales fell 30 percent, year over year.

Overall activity fell from September to October in 2009.

Foreclosure filings fell 7.1 percent from September to October and foreclosure sales fell 9.8 percent.

The Division of Housing now releases monthly data on foreclosure filings and foreclosure sales in metropolitan counties in Colorado. These reports are a supplement to the Division’s quarterly statewide foreclosure reports available at the Division’s web site: http://dola.colorado.gov/cdh/

Findings:

Comparing year-over-year, foreclosure filings in October increased 6.9 percent overall with totals rising from 3,024 to 3,234.

Movement in new foreclosure filings was mixed. While Arapahoe, Boulder, Larimer and Mesa Counties all reported sizable increases year over year, Adams, Denver, Douglas, El Paso, and Weld Counties reported decreases in foreclosure filing activity over the same period.

Decreases were more widespread with foreclosure sales. Sales totals dropped in all counties except Boulder and Mesa Counties. Adams, Arapahoe, and Denver reported year over year decreases of over 30 percent.

Overall, foreclosure sales fell 30 percent, year over year.

Overall activity fell from September to October in 2009.

Foreclosure filings fell 7.1 percent from September to October and foreclosure sales fell 9.8 percent.

Wednesday, November 18, 2009

New affordable housing made possible by NSP

Neighborhood Stabilization Program dollars were part of recent acquisitions for new affordable housing in Colorado Springs. Here is some of the local media coverage:

Stimulus money to put families in low-income housing

COLORADO SPRINGS, COLO. -- Twenty-four Colorado Springs families will have new homes Saturday thanks in part to a large sum of federal stimulus money.

Greccio Housing, a local nonprofit organization that serves low income families, recently purchased an apartment complex with $2 million in grant money from the Federal Neighborhood Stabilization Program.

Foreclosed Property Turned Into Affordable Housing

See the video.

Thursday, November 12, 2009

Apartment vacancies rise across Colorado

Click here for full report.

Apartment vacancies rise across Colorado

Colorado Springs and Sterling the only areas with falling rates

The Colorado statewide apartment vacancy rate for 2009’s third quarter increased to 7.4 percent, rising from 2008’s third quarter rate of 6.6 percent. According to a report released Thursday by the Department of Local Affairs’ Division of Housing, only Colorado Springs and Sterling, out of 22 cities and towns surveyed, reported fewer vacancies during the third quarter of this year than during the same period last year.

Among large metropolitan areas, Fort Collins and Loveland reported the lowest vacancy rates at 5.9 percent and 4.3 percent respectively. All other metro areas measured in the survey reported vacancy rates above 7 percent. Pueblo and Grand Junction reported the largest increases from the third quarter of last year to the third quarter of this year. In Pueblo, rates rose from 6.8 percent to 12 percent year over year, while they rose from 2.4 percent to 7.5 percent in Grand Junction during the same period.

Third quarter vacancies in the metro Denver area, measured in a separate survey last week, were at 7.4 percent.

“Although unemployment in Colorado fell in recent months, unemployment is still up when compared to last year,” said Gordon Von Stroh, professor of business at the University of Denver, and the report’s author. “In Grand Junction, where vacancies are up quite a bit, the unemployment rate rose from 3.7 percent to 8.2 percent over the last year.”

In general, a vacancy rate of 5 percent is considered to be the “equilibrium rate.”

Colorado Springs was the only metropolitan area where vacancies fell. Experts note this is likely due to recent troop arrivals in the region which has led to an increased demand for housing in the area.

Average rents were flat or falling in many areas of the state from the third quarter of 2008 to the same period this year. Rents fell in Colorado Springs, Greeley and the Fort Collins/Loveland area. In spite of increases in the vacancy rate, however, some areas reported rental increases. Average rents increased from $514.17 to $554.58 year over year in Pueblo, and they rose from $670.24 to $674.31 in Grand Junction during the same period.

In non-metropolitan areas of the state, average rents rose in Alamosa, Buena Vista, Durango, Ft Morgan/Brush, Glenwood Springs, Montrose, Sterling, Summit County, and “Southeastern Colorado.” Rents were flat or falling in Aspen, Cañon City, Eagle County, Gunnison, Lake County, Salida and Steamboat Springs.

“It’s difficult to raise rents in the current economic environment, and we’ve seen rents fall in several metro areas including the Denver metro area, which is certainly good news for renters” said Ryan McMaken, a spokesperson with the Division of Housing. “Many owners who are trying to cover the increasing costs of apartment ownership will continue to raise rents where they can. But this carries the risk of increasing costly turnover, so it’s a balancing act.”

Apartment vacancies rise across Colorado

Colorado Springs and Sterling the only areas with falling rates

The Colorado statewide apartment vacancy rate for 2009’s third quarter increased to 7.4 percent, rising from 2008’s third quarter rate of 6.6 percent. According to a report released Thursday by the Department of Local Affairs’ Division of Housing, only Colorado Springs and Sterling, out of 22 cities and towns surveyed, reported fewer vacancies during the third quarter of this year than during the same period last year.

Among large metropolitan areas, Fort Collins and Loveland reported the lowest vacancy rates at 5.9 percent and 4.3 percent respectively. All other metro areas measured in the survey reported vacancy rates above 7 percent. Pueblo and Grand Junction reported the largest increases from the third quarter of last year to the third quarter of this year. In Pueblo, rates rose from 6.8 percent to 12 percent year over year, while they rose from 2.4 percent to 7.5 percent in Grand Junction during the same period.

Third quarter vacancies in the metro Denver area, measured in a separate survey last week, were at 7.4 percent.

“Although unemployment in Colorado fell in recent months, unemployment is still up when compared to last year,” said Gordon Von Stroh, professor of business at the University of Denver, and the report’s author. “In Grand Junction, where vacancies are up quite a bit, the unemployment rate rose from 3.7 percent to 8.2 percent over the last year.”

In general, a vacancy rate of 5 percent is considered to be the “equilibrium rate.”

Colorado Springs was the only metropolitan area where vacancies fell. Experts note this is likely due to recent troop arrivals in the region which has led to an increased demand for housing in the area.

Average rents were flat or falling in many areas of the state from the third quarter of 2008 to the same period this year. Rents fell in Colorado Springs, Greeley and the Fort Collins/Loveland area. In spite of increases in the vacancy rate, however, some areas reported rental increases. Average rents increased from $514.17 to $554.58 year over year in Pueblo, and they rose from $670.24 to $674.31 in Grand Junction during the same period.

In non-metropolitan areas of the state, average rents rose in Alamosa, Buena Vista, Durango, Ft Morgan/Brush, Glenwood Springs, Montrose, Sterling, Summit County, and “Southeastern Colorado.” Rents were flat or falling in Aspen, Cañon City, Eagle County, Gunnison, Lake County, Salida and Steamboat Springs.

“It’s difficult to raise rents in the current economic environment, and we’ve seen rents fall in several metro areas including the Denver metro area, which is certainly good news for renters” said Ryan McMaken, a spokesperson with the Division of Housing. “Many owners who are trying to cover the increasing costs of apartment ownership will continue to raise rents where they can. But this carries the risk of increasing costly turnover, so it’s a balancing act.”

Monday, November 9, 2009

Private Activity Bond Advisory Committee Meeting

The Private Activity Bond Advisory Committee will meet on November 17:

PRIVATE ACTIVITY BOND ADVISORY COMMITTEE MEETING

November 17, 2009

Centennial Building

1313 Sherman Street, Room 318

2:00 PM

Click here for the full agenda.

PRIVATE ACTIVITY BOND ADVISORY COMMITTEE MEETING

November 17, 2009

Centennial Building

1313 Sherman Street, Room 318

2:00 PM

Click here for the full agenda.

The Latest 'Housing Snapshot' is now available

The Division of Housing will now be publishing a monthly update of housing and economic statistics that is designed to help the public and our partners better understand recent trends in the housing economy.

October's issue, now available online, contains some of the most recently released data on the work force, on housing prices and on homeownership levels. We'll be sending out the November issue when it becomes available later this month.

Click here for the full report.

October's issue, now available online, contains some of the most recently released data on the work force, on housing prices and on homeownership levels. We'll be sending out the November issue when it becomes available later this month.

Click here for the full report.

Labels:

home prices,

housing snapshot,

reports,

unemployment

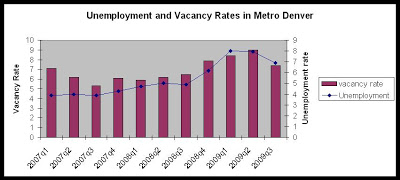

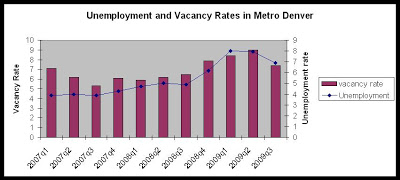

Unemployment rates and vacancies

With the release of the latest Metro Denver vacancy and rent data, it was pointed out that the vacancy rate tracks fairly closely with the unemployment rate. This is true at both the statewide level and at the Metro Denver level. In the graph below, you'll find a correlation between the Denver-Aurora-Boulder unemployment rate and the Metro Denver vacancy rate.

In the future, we plan to provide more analysis and visual aids of this type.

In the future, we plan to provide more analysis and visual aids of this type.

Labels:

unemployment,

vacancy surveys,

work force

3rd Quarter Metro Denver Vacancy and Rent Data released

Last week, the 3rd Q vacancy and rent survey for Metro Denver was made available. Due to our only partial ownership of the data, the new data will be made available in about 60 days. 2nd Q and historical data is available now. Until then, it can be purchased through the Apartment Association of Metro Denver. The release is below.

Metro Denver apartment vacancies fall

Falling for the first time in 21 months, apartment vacancy rates fell in the Denver Metro to 7.4 percent during the third quarter of 2009. According to a report released Thursday by the Apartment Association of Metro Denver and the Department of Local Affairs - Division of Housing, vacancy rates hit 9 percent during the second quarter of this year after six quarters of rising vacancies.

Falling over one-and-a-half percent during the third quarter, vacancy rates are now at the lowest rate since the third quarter of last year. Nevertheless, year-over-year comparisons show increases. The vacancy rate during the third quarter of last year was almost a point lower at 6.5 percent.

The recent declines in the unemployment rate may be having an effect on vacancies in the region.

“We know that vacancy rates tend to be sensitive to unemployment rates in Colorado,” said Gordon Von Stroh, professor of business at the University of Denver. “Unemployment peaked at 7.8 percent at the end of the second quarter, and slowly fell to 6.7 percent over the third quarter. The vacancy rate reflects this trend.”

Observers also noted that continued population increases have also buoyed the demand for housing.

“There’s still demand for rental housing because the population continues to grow in Colorado,” said Ryan McMaken, a spokesperson with the Division of Housing. “Over 30,000 new households were formed in Colorado during 2008, and even when job growth is not robust, new households translates into a demand for housing.”

Arapahoe County and Denver County tied for the highest county-wide vacancy rates at 8.5 percent, and Douglas County reported the lowest rate at 4.3 percent. From the third quarter of last year, to the third quarter of this year, vacancies increased in Arapahoe County, Denver County, and the Boulder/Broomfield area. During the same period, vacancies fell in Adams, Douglas, and Jefferson Counties. Vacancy rates for all counties surveyed were: Adams, 6.7 percent; Arapahoe, 8.5 percent; Boulder/Broomfield, 5.5 percent; Denver, 8.5 percent; Douglas, 4.3 percent; and Jefferson, 6.3 percent.

In general, a vacancy rate of 5 percent is considered the “equilibrium” rate. Rates below 5 percent indicate tight markets.

During the second quarter of 2009, average rents fell to $880.99 when compared to $892.22 from the third quarter of last year. The average rent during the second quarter of this year was $870.37.

In spite of falling vacancy rates, rent growth was limited. When compared to the third quarter of 2008, Only Arapahoe County and Douglas County reported increases in overall average rents. Adams, Boulder/Broomfield, Denver, and Jefferson counties all reported decreases in overall average rents.

The highest average rent was reported in Douglas County at $1058.13, and the lowest was reported in Jefferson County at $818.18. Average rents for all counties were: Adams, $848.22; Arapahoe, $862.16; Boulder/Broomfield, $951.11; Denver, $888.07; Douglas, $1058.13; and Jefferson, $818018.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

Metro Denver apartment vacancies fall

Falling for the first time in 21 months, apartment vacancy rates fell in the Denver Metro to 7.4 percent during the third quarter of 2009. According to a report released Thursday by the Apartment Association of Metro Denver and the Department of Local Affairs - Division of Housing, vacancy rates hit 9 percent during the second quarter of this year after six quarters of rising vacancies.

Falling over one-and-a-half percent during the third quarter, vacancy rates are now at the lowest rate since the third quarter of last year. Nevertheless, year-over-year comparisons show increases. The vacancy rate during the third quarter of last year was almost a point lower at 6.5 percent.

The recent declines in the unemployment rate may be having an effect on vacancies in the region.

“We know that vacancy rates tend to be sensitive to unemployment rates in Colorado,” said Gordon Von Stroh, professor of business at the University of Denver. “Unemployment peaked at 7.8 percent at the end of the second quarter, and slowly fell to 6.7 percent over the third quarter. The vacancy rate reflects this trend.”

Observers also noted that continued population increases have also buoyed the demand for housing.

“There’s still demand for rental housing because the population continues to grow in Colorado,” said Ryan McMaken, a spokesperson with the Division of Housing. “Over 30,000 new households were formed in Colorado during 2008, and even when job growth is not robust, new households translates into a demand for housing.”

Arapahoe County and Denver County tied for the highest county-wide vacancy rates at 8.5 percent, and Douglas County reported the lowest rate at 4.3 percent. From the third quarter of last year, to the third quarter of this year, vacancies increased in Arapahoe County, Denver County, and the Boulder/Broomfield area. During the same period, vacancies fell in Adams, Douglas, and Jefferson Counties. Vacancy rates for all counties surveyed were: Adams, 6.7 percent; Arapahoe, 8.5 percent; Boulder/Broomfield, 5.5 percent; Denver, 8.5 percent; Douglas, 4.3 percent; and Jefferson, 6.3 percent.

In general, a vacancy rate of 5 percent is considered the “equilibrium” rate. Rates below 5 percent indicate tight markets.

During the second quarter of 2009, average rents fell to $880.99 when compared to $892.22 from the third quarter of last year. The average rent during the second quarter of this year was $870.37.

In spite of falling vacancy rates, rent growth was limited. When compared to the third quarter of 2008, Only Arapahoe County and Douglas County reported increases in overall average rents. Adams, Boulder/Broomfield, Denver, and Jefferson counties all reported decreases in overall average rents.

The highest average rent was reported in Douglas County at $1058.13, and the lowest was reported in Jefferson County at $818.18. Average rents for all counties were: Adams, $848.22; Arapahoe, $862.16; Boulder/Broomfield, $951.11; Denver, $888.07; Douglas, $1058.13; and Jefferson, $818018.

The Vacancy and Rent Surveys are a service provided by the Apartment Association of Metro Denver and the Colorado Department of Local Affairs’ Division of Housing to renters and the multi-family housing industry on a quarterly basis. The Colorado Vacancy and Rent Survey reports averages and, as a result, there are often differences in rental and vacancy rates by size, location, age of building, and apartment type. The full Report is available through the Apartment Association of Metro Denver at www.aamdhq.org; and limited information is available online at the Division of Housing web site: http://dola.colorado.gov/cdh/

Subscribe to:

Posts (Atom)