Colorado foreclosure auction sales down 25 percent in 2012 (Denver Post)

New foreclosure auction sales were down

25 percent in Colorado during the first quarter of 2012, compared to the

first quarter of 2011, according to a report released today by the

Colorado Division of Housing.

Following three quarters of

declines, auction sales rose slightly during the first quarter of this

year, but remained well below the totals reported during the first

quarter of last year, according to the report.

Sharp drop in Colorado foreclosures in Q1 (DBJ)

By county, 11 of the state’s 12 metropolitan counties reported year-over-year declines in foreclosure sales in the first quarter. Denver and Douglas counties both had 39 percent drops, while El Paso County fell 24 percent. Only Broomfield County reported an increase, with auction sales rising 36 percent there.

Foreclosure activity down in Larimer County and statewide (Loveland RH)

In Larimer County, lenders filed for foreclosure on 306 properties in the first quarter of this year, a 3.8 decrease from the first quarter of 2011. That number also was a 3.5 percent decline from the previous quarter, the report said.

Statewide in the first quarter, new filings declined 3.7 percent from last year and 8.9 percent from the previous quarter.

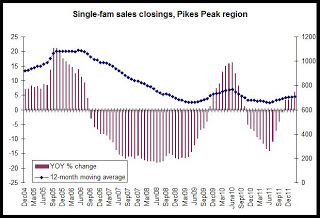

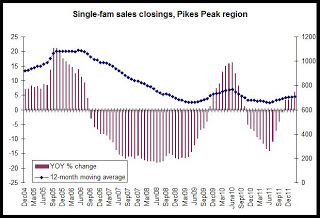

Foreclosure activity slows in Pikes Peak region during 1st quarter (CS Gazette)

The Pikes Peak region was one of several areas in the state that saw a slowdown in foreclosure activity during the first few months of 2012, according to a Colorado Division of Housing report released Thursday.

Foreclosure filings in El Paso County, which includes Colorado Springs, fell 11.3 percent in the first quarter when compared with the same period a year ago. Meanwhile, year-over-year foreclosure sales saw a 24.1 percent reduction.

Weld Foreclosure Sales Down 33.8% in 2012 Compared to 2011 (Greeley Trib)

Foreclosures are continuing their downward spiral in Weld County with a decline of 17.8 percent in filings and 33.8 percent in sales at the end of the first quarter of 2012 compared to last year at the same time.

Boulder County foreclosure sales, filings outpace state average (Longmont Times Call)

The Colorado Division of Housing said Wednesday that Boulder County reported 214 foreclosure filings in the first quarter of 2012, a 7 percent drop from the 231 reported in the first quarter of 2011.

That compares with 7,783 filings statewide during the quarter, down nearly 4 percent from a year ago.

New stats show improving housing market (NCBR)

Foreclosure activity in Larimer and Weld counties is slowing amid new signs of a real estate recovery.

According to state data, new foreclosure filings were down in the first quarter compared with the same period a year earlier, declining by 3.8 percent to 318 filings in Larimer and by 17.8 percent to 412 filings in Weld.

Thursday, April 26, 2012

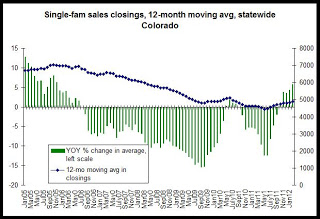

Foreclosure auction sales down 25 percent in 2012

New foreclosure auction sales were down 25 percent in Colorado during the

first quarter of 2012, compared to the first quarter of 2011. Following three

quarters of declines, auction sales rose slightly during the first quarter of

this year, but remained well below totals reported during the first quarter of

last year. According to a report released today by the Colorado Division of

Housing, there were 4,221 foreclosure auction sales, or completed foreclosures,

reported during the first quarter of 2012. There were 5,605 sales reported

during the same period of last year. Sales totals rose four percent from the

fourth quarter of last year to the first quarter of this year, rising from 4,057.

New foreclosure filings also fell during the first quarter. Foreclosure

filing totals for the first quarter of this year were down 3.7 percent, falling

to 7,783 from 2011’s first-quarter total of 8,079. From the fourth quarter of

last year to the first quarter of this year, foreclosure filings fell 8.9

percent.

Foreclosure auction sales during the first quarter fell 40

percent below the 2007’s peak of 7,117 auction sales reported during the third

quarter of that year. Auction sales totals are now near a five-year low. New

foreclosure filings during the first quarter fell 37 percent below 2009’s peak

of 12,468 reported during the third quarter of that year.

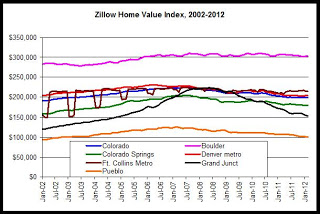

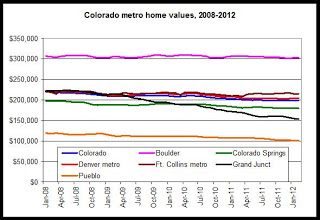

“Foreclosure activity continues to trend downward in Colorado, even when compared

to early 2011 which itself saw a big drop from 2010 totals,” said Ryan McMaken,

spokesman for the Colorado Division of Housing. “Toward the end of 2011, we saw

employment and home prices stabilize while home buying appeared to increase, so

these foreclosure numbers likely reflect those factors.”

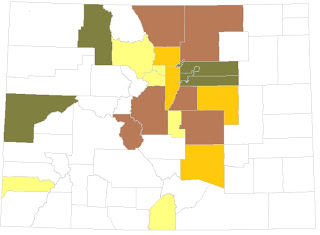

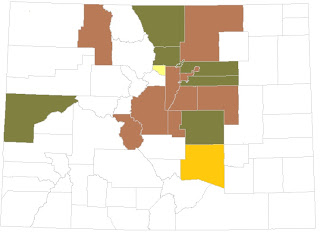

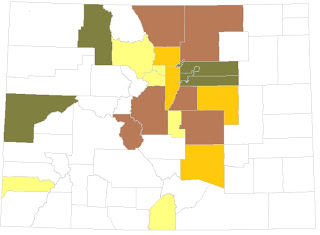

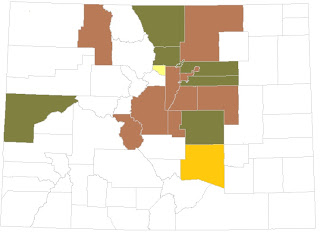

While several regions of Colorado saw improvement during 2011, some areas

continued to experience growth in foreclosures.

Eleven of the state’s twelve metropolitan counties reported

year-over-year declines in the number of foreclosure auction sales occurring

during the first quarter. Sales declined 39 percent in Denver

and Douglas counties from the first quarter of last year to the first quarter

this year, while El Paso

County declined 24

percent during the same period. Only Broomfield

County reported an

increase, with auction sales rising 36 percent.

Those counties that did experience increases were generally

found outside the Front Range. From the first

quarter of 2011 to the first quarter of 2012, 16 of Colorado’s 64 counties reported increases in

foreclosure auction sales. Among those 16, 11 were mountain counties including

Garfield, San Miguel, Ouray and Eagle counties.

The five counties with the highest foreclosure rates during the

first quarter were San Juan, Eagle, Garfield, Las Animas, and

Park. Mesa County

was the only metro county among the counties with the top ten highest

foreclosure rates in the state. Boulder

County, on the other

hand, reported the lowest foreclosure rate of any metropolitan county and also

had one of the lowest foreclosure rates overall.

“Several mountain counties are still dealing with growth in

foreclosure activity, and may not have peaked yet,” McMaken said. “The Front Range, however, which drives the overall statewide

totals, looks like it peaked back in 2010.”

Foreclosure sales are

opened foreclosures that have proceeded through the full foreclosure process to

final sale at public auction. Filings denote the beginning of the foreclosure

process, and once a foreclosure is filed, the borrower has at least 110-120

days to work with the lender to avoid a completed foreclosure. It is during

this period that borrowers work with lenders and housing counselors to work out

loan modifications, short sales, or other ways of withdrawing the foreclosure.

Wednesday, April 25, 2012

Colorado outpaces most states in latest Philly Fed index

The Coincident Index for Colorado rose 0.4 percent from February 2012

to March 2012, which was a larger growth rate than 34 states. March's index, which was released yesterday by

the Philadelphia Federal Reserve Bank, is an index calculated from

nonfarm payroll employment, average hours worked in manufacturing, the

unemployment rate, and wage and salary disbursements deflated by the

consumer price index (U.S. city average).

Colorado's increase of 0.4 percent was above the national index's increase of 0.29.

According to the March 2012 report:

March's month-over-month increase was the 18th increase in a row for Colorado, and was the longest stretch of monthly increases reported since 2007.

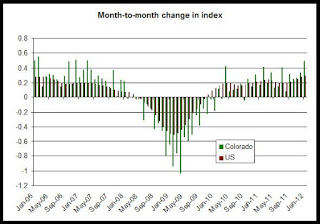

The graph below compares the month-to-month change in both the Colorado Index and the US index. In recent months, the growth rate in Colorado has begun to outpace that of the nation.

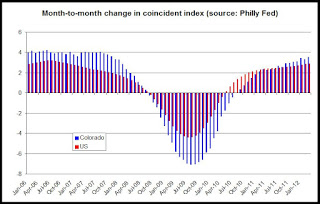

The second graph shows year-over-year changes in the index, and an upward trend is evident here as well:

Overall, this report reinforces earlier data showing ongoing slow and steady increases in real estate demand and employment.

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Colorado's increase of 0.4 percent was above the national index's increase of 0.29.

According to the March 2012 report:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2012. In the past month, the indexes increased in 48 states, decreased in one state (Rhode Island), and remained stable in one state (South Dakota), for a one-month diffusion index of 94. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.3 percent in March and 0.9 percent over the past three months.

March's month-over-month increase was the 18th increase in a row for Colorado, and was the longest stretch of monthly increases reported since 2007.

The graph below compares the month-to-month change in both the Colorado Index and the US index. In recent months, the growth rate in Colorado has begun to outpace that of the nation.

The second graph shows year-over-year changes in the index, and an upward trend is evident here as well:

Overall, this report reinforces earlier data showing ongoing slow and steady increases in real estate demand and employment.

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Labels:

coincident index,

federal reserve,

philly fed

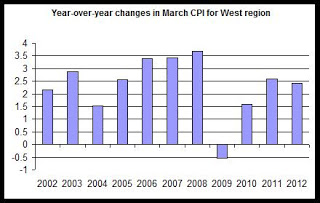

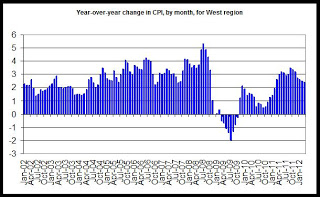

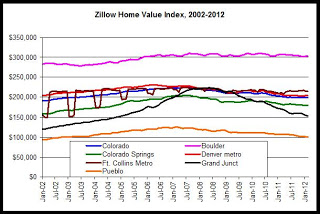

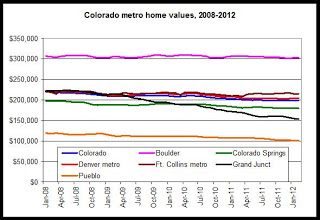

FHFA: Mountain states home prices turn positive in February

House prices in February in the Mountain region, which includes

Colorado, were up, year over year, for the first time in 53 months. During February, the FHFA home price index for the mountain state region increased 1.7 percent over February 2011. Nationally, the house price

index rose slightly for the first time since July 2007, rising 0.4 percent. The new house price index

numbers, released today

by the Federal Housing and Finance Agency, also showed that the

national index is down 20.3 percent from the peak level reached in June

2007, while the Mountain region's index is down 30.7 percent over the

same period.

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac. It is a repeat-sales index similar to the Case-Shiller index, but limited to GSE loans.

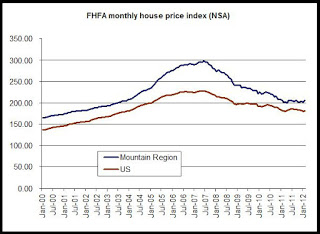

Although it has shown more negative growth than other indices in recent years, the increase in FHFA monthly house prices in the region generally reflects overall trends also found in other home price indices such as the CoreLogic index and the Case-Shiller index. According to FHFA, prices have largely stabilized over the past several months, but remain slightly down from 2009 and 2010 levels. Home prices have shown year-over-year increases since January 2012 in both the Case-Shiller and the CoreLogic indices. The first chart shows the index values for the U.S. and the Mountain region.

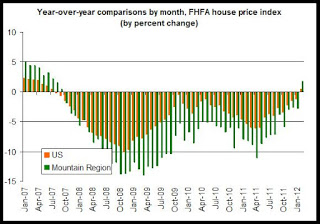

The second chart shows each month's house price index compared to the same month a year earlier:

February 2012 was the end of a period of negative year-over-year comparisons in home prices that lasted 52 months in a row. We can note that until February (in the latest revisions), the Mountain region had tended to perform more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example, shows that local prices did not decline as much as the national composite index following the financial crisis in 2008. Also, the FHFA "expanded-data" index shows Colorado performing better than the national index. Yet during February, the monthly FHFA index shows that mountain region with a larger increase in the price index than the nation overall.

Since we're looking at regional data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Overall, this report signals that home prices began to turn positive in the region during early 2012. This reflects trends reported for Colorado and metro Denver in other home price indices as well.

The FHFA monthly index is calculated using purchase prices of houses purchased with loans that have been sold to or guaranteed by Fannie Mae or Freddie Mac. It is a repeat-sales index similar to the Case-Shiller index, but limited to GSE loans.

Although it has shown more negative growth than other indices in recent years, the increase in FHFA monthly house prices in the region generally reflects overall trends also found in other home price indices such as the CoreLogic index and the Case-Shiller index. According to FHFA, prices have largely stabilized over the past several months, but remain slightly down from 2009 and 2010 levels. Home prices have shown year-over-year increases since January 2012 in both the Case-Shiller and the CoreLogic indices. The first chart shows the index values for the U.S. and the Mountain region.

The second chart shows each month's house price index compared to the same month a year earlier:

February 2012 was the end of a period of negative year-over-year comparisons in home prices that lasted 52 months in a row. We can note that until February (in the latest revisions), the Mountain region had tended to perform more poorly (from a seller's perspective) than the national index. This runs contrary to some local experience and some statistics. The Case-Shiller data for the Denver metro area, for example, shows that local prices did not decline as much as the national composite index following the financial crisis in 2008. Also, the FHFA "expanded-data" index shows Colorado performing better than the national index. Yet during February, the monthly FHFA index shows that mountain region with a larger increase in the price index than the nation overall.

Since we're looking at regional data, however, we have to keep in mind that this data reflects house prices in Arizona and Nevada, and this no doubt will continue to put downward pressure on regional prices for now.

Overall, this report signals that home prices began to turn positive in the region during early 2012. This reflects trends reported for Colorado and metro Denver in other home price indices as well.

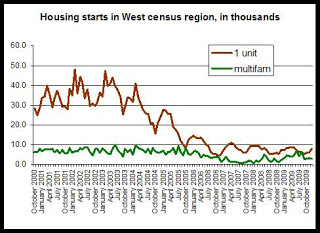

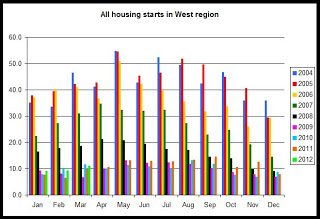

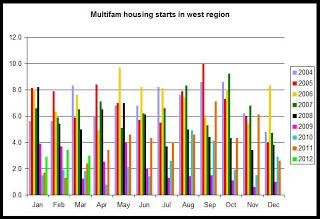

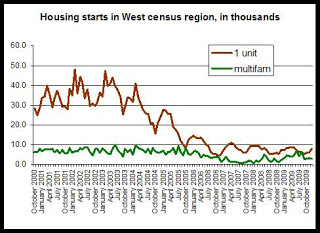

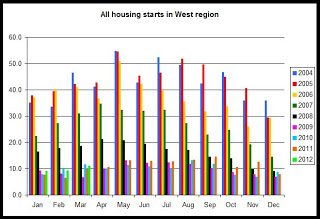

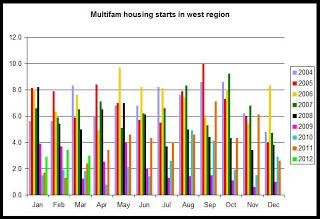

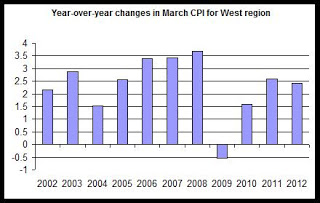

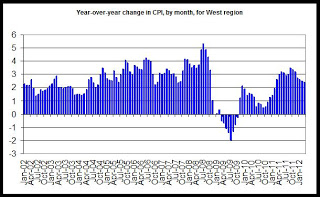

New home sales hit new March low in Western U.S.

New single-family home sales were at the lowest total reported during March in more than ten years in the West region

of the US, which includes Colorado. According to Tuesday's New Home Sales report, released by the Census Bureau,there were six thousand new home sales in the Western U.S. during March 2012.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were down 14 percent during March 2012 from the 7,000 new homes sold in March 2011. Nationwide, sales rose 14 percent, rising from 28,000 to 32,000 during the same period.

At 6,000 new home sales during March, sales are also down from February 2012's total of 8,000, signaling weakness in the regional homebuilding market going into the warmer spring season.

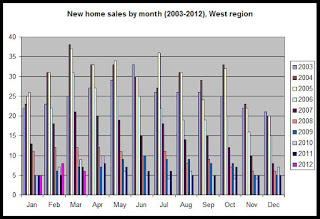

The first graph shows monthly new home sales totals for each month since 2003:

For the West region:

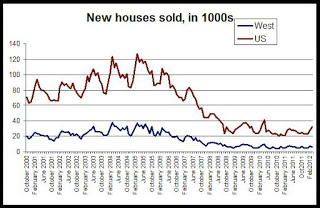

The second graph shows that new home sales continue to fall and have generally followed a downward trend since the middle of the decade.

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 80 percent since the peak of March 2005, and new home sales in the West have fallen 881 percent since sales peaked in the region during March 2004.

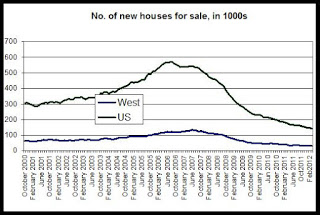

The third graph shows the declines in both US and regional totals in new homes for sale.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 76 percent since the total peaked during June 2007, and the same total has fallen 74 percent in the US since the number of new homes for sale peaked in the US during August 2006.

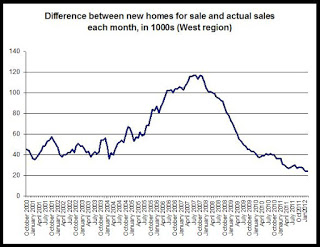

The number of new single-family homes for sale in the West remained near Febuary's ten-year low during March.

As a final note, we can also look to the new home inventory. In this case, we calculate inventory by subtracting the number of new home sales in a given month from the number of new homes for sale at the end of the previous month. In the final graph, we see that the inventory is now at a ten-year low of 24,000 homes. This is good news for owners seeking to sell homes since it suggests that fewer new homes are sitting and waiting to be sold, thus diminishing some of the inventory-driven downward pressure on prices.

Overall, this report shows that new home sales are not recovering quickly, and in spite of some mild rebounding in single-family permit activity (see here), new home activity is largely flat or declining and that totals are still near the same levels they were during the 2008-2009 recession. Inventory of new homes continues to decline which is good news for many people looking to see existing homes.

The report, which monitors sales activity for newly constructed houses, reported that in the West, new home sales were down 14 percent during March 2012 from the 7,000 new homes sold in March 2011. Nationwide, sales rose 14 percent, rising from 28,000 to 32,000 during the same period.

At 6,000 new home sales during March, sales are also down from February 2012's total of 8,000, signaling weakness in the regional homebuilding market going into the warmer spring season.

The first graph shows monthly new home sales totals for each month since 2003:

For the West region:

The second graph shows that new home sales continue to fall and have generally followed a downward trend since the middle of the decade.

New home sales peaked during the spring and summer of 2005 and have trended downward since. The number of new houses sold in the United States is down 80 percent since the peak of March 2005, and new home sales in the West have fallen 881 percent since sales peaked in the region during March 2004.

The third graph shows the declines in both US and regional totals in new homes for sale.

The number of new homes for sale has also fallen off considerably. The number of new houses for sale in the West has fallen 76 percent since the total peaked during June 2007, and the same total has fallen 74 percent in the US since the number of new homes for sale peaked in the US during August 2006.

The number of new single-family homes for sale in the West remained near Febuary's ten-year low during March.

As a final note, we can also look to the new home inventory. In this case, we calculate inventory by subtracting the number of new home sales in a given month from the number of new homes for sale at the end of the previous month. In the final graph, we see that the inventory is now at a ten-year low of 24,000 homes. This is good news for owners seeking to sell homes since it suggests that fewer new homes are sitting and waiting to be sold, thus diminishing some of the inventory-driven downward pressure on prices.

Overall, this report shows that new home sales are not recovering quickly, and in spite of some mild rebounding in single-family permit activity (see here), new home activity is largely flat or declining and that totals are still near the same levels they were during the 2008-2009 recession. Inventory of new homes continues to decline which is good news for many people looking to see existing homes.

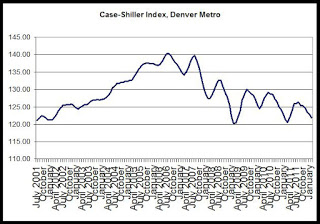

Denver Case-Shiller index up for second month in a row

Case-Shiller released its home price index for February

today. The home price index for the Denver area fell 0.9 percent

percent from January to February, but rose 0.5 percent, year over year,

from February 2011 to February 2012. The year-over-year increase in

February was the second year-over-year increase in a row for Denver, and

was the second increase overall since June 2010. The first graph shows

the index values since 2001:

According to S&P's press release, home prices are still facing headwinds:

In year-over-year comparisons for February, Atlanta showed the largest drop, with a decline of 17.3 percent, while the index in Las Vegas fell 8.5 percent. Year over year, home price indices fell in 15 of the 20 cities included in the study. Only Detroit, Denver, Minneapolis, Miami and Phoenix showed increases.

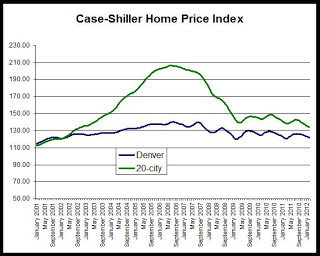

The second chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009.

The 20-city composite is down 35 percent since it peaked in July 2006, but the Denver index is down only 13 percent from its August 2006 peak.

Although the Denver index turned positive in February compared to February of last year, the Denver index during February was at levels comparable to those found during 2002.

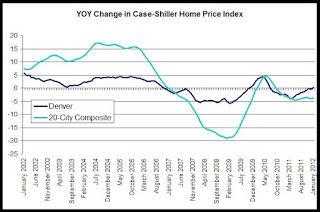

The third chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite, and the rates of decline in Denver have been smaller in recent months. The year-over-year change in the 20-city composite during February was negative with a decrease of 3.5 percent while Denver reported a slight increase for the second month in a row. In the 20-city index, the year-over-year change has been negative for the past 17 months.

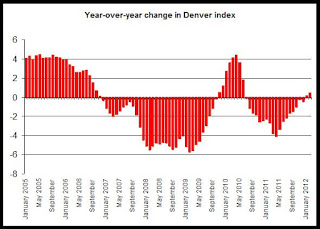

The last chart provides a closer look at year-over-year changes in the Denver index. Note the the change was below zero between June 2010 and December 2011, and likely reflects the end of the homebuyer tax credit’s end which has led to a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010. Since the end of the credit, however, home prices consistently drifted downward until January 2012.

According to S&P's press release, home prices are still facing headwinds:

“While there might be pieces of good news in this report, such as some improvement in many annual rates of return, February 2012 data confirm that, broadly-speaking, home prices continued to decline in the early months of the year,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Nine MSAs -- Atlanta, Charlotte, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa -- and both Composites hit new post-crisis lows. Atlanta continued its downward spiral, posting its lowest annual rate of decline in the 20-year history of the index at -17.3%. The 10-City Composite declined 3.6% and the 20-City was down 3.5% compared to February 2011".

In year-over-year comparisons for February, Atlanta showed the largest drop, with a decline of 17.3 percent, while the index in Las Vegas fell 8.5 percent. Year over year, home price indices fell in 15 of the 20 cities included in the study. Only Detroit, Denver, Minneapolis, Miami and Phoenix showed increases.

The second chart shows trends in the Case-Shiller index for the Denver area and for the 20-city composite index. It is clear that Denver did not experience the kind of price bubble that occurred in many other metropolitan areas, and consequently, the index has not fallen nearly as far in Denver compared to the larger composite. Prices have been largely flat since mid-2009.

The 20-city composite is down 35 percent since it peaked in July 2006, but the Denver index is down only 13 percent from its August 2006 peak.

Although the Denver index turned positive in February compared to February of last year, the Denver index during February was at levels comparable to those found during 2002.

The third chart compares year-over-year changes in the Denver area index and in the 20-city composite. The Denver index did not achieve the rates of growth experienced by the national index, but the Denver index did not experience comparable rates of decline following the onset of the national recession either. Overall, the index has been less volatile in Denver than has been the case for the 20-city composite, and the rates of decline in Denver have been smaller in recent months. The year-over-year change in the 20-city composite during February was negative with a decrease of 3.5 percent while Denver reported a slight increase for the second month in a row. In the 20-city index, the year-over-year change has been negative for the past 17 months.

The last chart provides a closer look at year-over-year changes in the Denver index. Note the the change was below zero between June 2010 and December 2011, and likely reflects the end of the homebuyer tax credit’s end which has led to a fall in demand and a decline in the home price index. The upward trend in the index in response to the tax credit is clear during late 2009 and early 2010. Since the end of the credit, however, home prices consistently drifted downward until January 2012.

Labels:

case-shiller,

home prices,

metro denver

Comment period for new application instructions for grants and loans

The draft revised application instructions for grant

and loan applications to the Colorado Division of Housing have been posted. Due to the number of

formatting changes, the document is not blacklined to show changes from the 2010

version. The proposed revisions have been developed over the last several months

and do not take into account the proposed Colorado Housing Investment Fund

(CHIF). Some revisions will be necessary to account for DOH's administration of

the CHIF and will be made when the structure of the CHIF is finalized.

This document will be posted through May 11, 2012 for public

comment. Please send comments by email to [email protected]. In

particular, please note the following changes:

- Adjustments to cost ranges by project type;

- Clarification for determining to fund a loan verses a grant;

- Single Family Owner Occupied (SFOO) rehabilitation program applications due July 1st;

- Community Housing Development Organization (CHDO) operating grants due September 1st;

- Downpayment Assistance Program (DPA) applications due November 1st; and

- Clarification regarding legal residency requirements.

Tuesday, April 24, 2012

Housing News Digest, April 24

In Colorado, Grand Junction Fares Better than Most for Affordable Housing

GRAND JUNCTION, Colo.- New census figures reveal low-income households outnumber affordable rental units in Colorado. However, Grand Junction fares better than most cities.

Report: Low-income Coloradans Priced Out of Rentals People with the lowest incomes in Colorado are being priced out of rental properties, according to a report issued Monday by the Colorado Division of Housing. "Rental housing in general since 2009 has become more scarce for many households as vacancies fall and rents rise," said Ryan McMaken, a spokesman for the Division of Housing. The report said that among households with the lowest incomes, there are twice as many households as there are affordable rental units in Colorado.

Report: Fort Collins-Loveland residents spend more of incomes on housing "It seems like the grocery stores are getting more expensive, rents are going up ... it's getting to be a whirlwind and a downward spiral." What the numbers say Colorado officials say census data collected from 2006 to 2010 show the number of low-income households outnumbered the affordable rental units in the state.

Boulder County toughest rental market BOULDER - Boulder County is the toughest market in Colorado for low-income families in need of affordable rental units, and it has the highest percentage of "rent-burdened" households in the state, according to a report released Monday by the Colorado Division of Housing. The study, which relies on U.S. Census Bureau data collected from 2006 to 2010, is a comprehensive overview of the availability and affordability of rental units in Colorado. The division conducts the survey in order to determine the state of the market and where it should allocate its resources, spokesman Ryan McMaken said.

Real estate development: a mixed bag A recent report from Beacon Hill Institute ranks Colorado as the third-most economically competitive state. We continue to see decreasing unemployment, positive job growth, and a new sense of optimism from business owners and consumers - all pointing to an improving regional economy. The Governor’s Office of State Planning and Budgeting in March announced that the state general fund revenue is projected to be $164.5 million higher in the next fiscal year than was originally forecasted, due to continued improvement in the job market and increased confidence among households and businesses.

Maybe no housing rebound for a generation: Shiller The Housing market is likely to remain weak and may take a generation or more to rebound, Yale economics professor Robert Shiller told Reuters Insider on Tuesday. Shiller, the co-creator of the Standard & Poor's/Case-Shiller home price index, said a weak labor market, high gas prices and a general sense of unease among consumers was outweighing low mortgage rates and would likely keep a lid on prices for the foreseeable future

Report: Low-income Coloradans Priced Out of Rentals People with the lowest incomes in Colorado are being priced out of rental properties, according to a report issued Monday by the Colorado Division of Housing. "Rental housing in general since 2009 has become more scarce for many households as vacancies fall and rents rise," said Ryan McMaken, a spokesman for the Division of Housing. The report said that among households with the lowest incomes, there are twice as many households as there are affordable rental units in Colorado.

Report: Fort Collins-Loveland residents spend more of incomes on housing "It seems like the grocery stores are getting more expensive, rents are going up ... it's getting to be a whirlwind and a downward spiral." What the numbers say Colorado officials say census data collected from 2006 to 2010 show the number of low-income households outnumbered the affordable rental units in the state.

Boulder County toughest rental market BOULDER - Boulder County is the toughest market in Colorado for low-income families in need of affordable rental units, and it has the highest percentage of "rent-burdened" households in the state, according to a report released Monday by the Colorado Division of Housing. The study, which relies on U.S. Census Bureau data collected from 2006 to 2010, is a comprehensive overview of the availability and affordability of rental units in Colorado. The division conducts the survey in order to determine the state of the market and where it should allocate its resources, spokesman Ryan McMaken said.

Real estate development: a mixed bag A recent report from Beacon Hill Institute ranks Colorado as the third-most economically competitive state. We continue to see decreasing unemployment, positive job growth, and a new sense of optimism from business owners and consumers - all pointing to an improving regional economy. The Governor’s Office of State Planning and Budgeting in March announced that the state general fund revenue is projected to be $164.5 million higher in the next fiscal year than was originally forecasted, due to continued improvement in the job market and increased confidence among households and businesses.

Maybe no housing rebound for a generation: Shiller The Housing market is likely to remain weak and may take a generation or more to rebound, Yale economics professor Robert Shiller told Reuters Insider on Tuesday. Shiller, the co-creator of the Standard & Poor's/Case-Shiller home price index, said a weak labor market, high gas prices and a general sense of unease among consumers was outweighing low mortgage rates and would likely keep a lid on prices for the foreseeable future

Monday, April 23, 2012

Housing News Digest, April 23

Report: Low-income Coloradans priced out of rentals (Denver Post)

The report said that among households with the lowest incomes, there are twice as many households as there are affordable rentals units in Colorado. The report said there are 50 rental units affordable to every 100 renter households that earn less than $20,000 . The report assumes that households earning $20,000 can afford a monthly rent payment of $500 , or 30 percent of monthly income.

Low-income households outnumber affordable housing units (NCBR)

Twice as many low-income households exist in Colorado as there are affordable rental units, according to data released Monday by the Colorado Division of Housing. There are 50 affordable units available for every 100 renter households earning less than $20,000 per year. This annual income suggests that the renter would be able to afford a monthly rent payment of $500, or 30 percent of monthly income.

Colorado low-income families outnumber affordable rentals 2-1 (DBJ)

The shortage is even more acute in the Denver area, where there are 39 units affordable for each 100 households earning $20,000 or less, the Division of Housing report says. The statewide shortage also increases for families earning less than $15,000 a year.

Effect of camping bans debated as Denver considers ordinance

Denver has spent nearly $60 million in the past seven years to end homelessness. Yet even with that massive effort, there are increasing numbers of people on the street. That dynamic is what led city officials to consider joining the ranks of many cities across the United States that have banned camping — and ignited the vigorous debate over whether such a move "criminalizes" homelessness.

Rent burdened households rise (Inside Real Estate News) There are twice as many extremely low-income households in Colorado as there are affordable rental units for them, according to the report released by the Colorado Division of Housing.

There are 100 renter households for every 50 affordable rental units for households that earn less than $20,000, according to the report. The report assumes that households earning $20,000 can afford a monthly rent payment of $500, or 30 percent of monthly income.

The report said that among households with the lowest incomes, there are twice as many households as there are affordable rentals units in Colorado. The report said there are 50 rental units affordable to every 100 renter households that earn less than $20,000 . The report assumes that households earning $20,000 can afford a monthly rent payment of $500 , or 30 percent of monthly income.

Low-income households outnumber affordable housing units (NCBR)

Twice as many low-income households exist in Colorado as there are affordable rental units, according to data released Monday by the Colorado Division of Housing. There are 50 affordable units available for every 100 renter households earning less than $20,000 per year. This annual income suggests that the renter would be able to afford a monthly rent payment of $500, or 30 percent of monthly income.

Colorado low-income families outnumber affordable rentals 2-1 (DBJ)

The shortage is even more acute in the Denver area, where there are 39 units affordable for each 100 households earning $20,000 or less, the Division of Housing report says. The statewide shortage also increases for families earning less than $15,000 a year.

Effect of camping bans debated as Denver considers ordinance

Denver has spent nearly $60 million in the past seven years to end homelessness. Yet even with that massive effort, there are increasing numbers of people on the street. That dynamic is what led city officials to consider joining the ranks of many cities across the United States that have banned camping — and ignited the vigorous debate over whether such a move "criminalizes" homelessness.

Rent burdened households rise (Inside Real Estate News) There are twice as many extremely low-income households in Colorado as there are affordable rental units for them, according to the report released by the Colorado Division of Housing.

There are 100 renter households for every 50 affordable rental units for households that earn less than $20,000, according to the report. The report assumes that households earning $20,000 can afford a monthly rent payment of $500, or 30 percent of monthly income.

Low-income households outnumber affordable rental units in Colorado

Among households with the lowest incomes, there are twice as many households as there are affordable rental units in Colorado. According to a report released today by the Colorado Division of Housing, there are 50 rental units affordable to every 100 renter households that earn less than $20,000. The report assumes that households earning $20,000 can afford a monthly rent payment of $500, or 30 percent of monthly income.

The report, which is based on Census Bureau data collected from 2006 to 2010, stated that there are 45 affordable rental units for every 100 households earning less than $15,000 per year, and 55 units for every 100 households at an income level below $10,000. For households at the $35,000 income level, there are 107 rental units affordable to every 100 households.

In the report, units are deemed affordable if the household pays no more than 30 percent of monthly income to rent. Households that pay more than 30 percent of income for housing are described as “rent burdened.”

“Rental housing in general since 2009 has become more scarce for many households as vacancies fall and rents rise,” said Ryan McMaken a spokesman for the Colorado Division of Housing. “But when one is at the lowest income levels, the impact of growing demand for rentals can be especially severe as once-affordable units are priced out of range.”

At all income levels, there were approximately 298,200 rent burdened households in Colorado, which is equal to 48 percent of all renter households. 50 percent of all rent burdened households are at income levels below $20,000 per year.

The report also noted that in Colorado there are “243,000 households (39 percent of all renter households) paying 35 percent or more of income toward housing. Approximately 150,000 households (24 percent of all renter households) pay 50 percent or more of income toward housing.”

The availability of affordable rental units varied across the state. In the metro Denver area, there were 43 units affordable to every 100 households earning less than $10,000, and 39 units affordable for each 100 households earning less than $20,000. Affordable rentals were more accessible in the Grand Junction area where there were 77 units affordable to every 100 households earning less than $10,000, and 61 units affordable to every 100 households earning less than $20,000.

For households earning $35,000 in all areas except the Boulder area, there were at least 100 units affordable to every 100 households. In the Boulder area there were 78 units for households earning $35,000.

The areas with the largest percentages of rent burdened households were the Boulder area and the Fort Collins-Loveland area where 56 percent and 54 percent of households were rent burdened, respectively. The areas with the smallest percentages of rent burdened households were the Colorado Springs and Grand Junction areas where the proportion of households that were rent burdened was 47 percent and 43 percent, respectively.

Monday’s report is an update of 2011’s housing need report released by the Division of Housing last summer.

“Comparing this year’s report to last year’s we can see that the need increased somewhat during that time” McMaken said. “That’s not surprising because in recent years we’ve seen the homeownership rate drop and rents increase. That squeezes the renters at the lowest income levels.”

The report, which is based on Census Bureau data collected from 2006 to 2010, stated that there are 45 affordable rental units for every 100 households earning less than $15,000 per year, and 55 units for every 100 households at an income level below $10,000. For households at the $35,000 income level, there are 107 rental units affordable to every 100 households.

In the report, units are deemed affordable if the household pays no more than 30 percent of monthly income to rent. Households that pay more than 30 percent of income for housing are described as “rent burdened.”

“Rental housing in general since 2009 has become more scarce for many households as vacancies fall and rents rise,” said Ryan McMaken a spokesman for the Colorado Division of Housing. “But when one is at the lowest income levels, the impact of growing demand for rentals can be especially severe as once-affordable units are priced out of range.”

At all income levels, there were approximately 298,200 rent burdened households in Colorado, which is equal to 48 percent of all renter households. 50 percent of all rent burdened households are at income levels below $20,000 per year.

The report also noted that in Colorado there are “243,000 households (39 percent of all renter households) paying 35 percent or more of income toward housing. Approximately 150,000 households (24 percent of all renter households) pay 50 percent or more of income toward housing.”

The availability of affordable rental units varied across the state. In the metro Denver area, there were 43 units affordable to every 100 households earning less than $10,000, and 39 units affordable for each 100 households earning less than $20,000. Affordable rentals were more accessible in the Grand Junction area where there were 77 units affordable to every 100 households earning less than $10,000, and 61 units affordable to every 100 households earning less than $20,000.

For households earning $35,000 in all areas except the Boulder area, there were at least 100 units affordable to every 100 households. In the Boulder area there were 78 units for households earning $35,000.

The areas with the largest percentages of rent burdened households were the Boulder area and the Fort Collins-Loveland area where 56 percent and 54 percent of households were rent burdened, respectively. The areas with the smallest percentages of rent burdened households were the Colorado Springs and Grand Junction areas where the proportion of households that were rent burdened was 47 percent and 43 percent, respectively.

Monday’s report is an update of 2011’s housing need report released by the Division of Housing last summer.

“Comparing this year’s report to last year’s we can see that the need increased somewhat during that time” McMaken said. “That’s not surprising because in recent years we’ve seen the homeownership rate drop and rents increase. That squeezes the renters at the lowest income levels.”

Friday, April 20, 2012

Take the survey on the State's contracting process

As a part of Governor Hickenlooper's LEANing government effort, the Department of Local Affairs (DOLA) is seeking input on our contracting process.

Please help DOLA, Division of Housing understand our customers' perspectives by completing the online survey below. We want to improve our contracting process with your input, and we greatly appreciate your time in responding to this survey.

Customer Survey

http://www.zoomerang.com/Survey/WEB22FENK6FPKP

Please help DOLA, Division of Housing understand our customers' perspectives by completing the online survey below. We want to improve our contracting process with your input, and we greatly appreciate your time in responding to this survey.

Customer Survey

http://www.zoomerang.com/Survey/WEB22FENK6FPKP

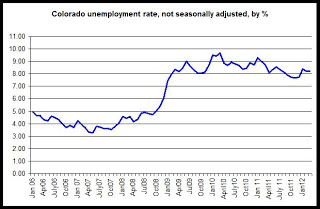

Colorado 31st in nation for unemployment during March

The Bureau of Labor Statistics last week released employment information on all states for March 2012.

According to the BLS press release:

Colorado was not among the 18 states that reported statistically significant decreases in the unemployment rate, year over year. 19 states reported unemployment rates that were higher than Colorado's, including California, Nevada, Florida and Michigan.

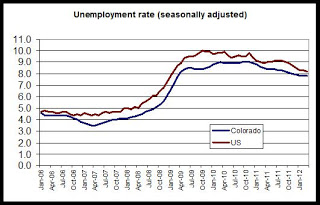

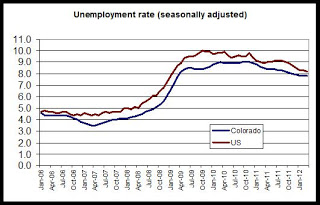

Colorado's unemployment rate remains below that of the nation overall, continuing a trend that has been in place since 2005. Earlier comparisons of Colorado and national unemployment rates had shown Colorado above the national rate during early 2011, but data revised in early 2012 shows that Colorado has not edged above the national rate in almost seven years.

The graph shows a comparison between the two rates since 2006:

The unemployment rate in Colorado, seasonally adjusted, has been flat at 7.8 percent since January. The national rate fell to 8.2 percent.

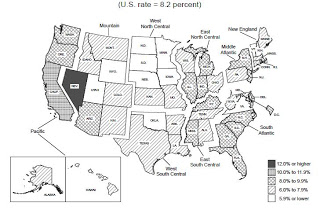

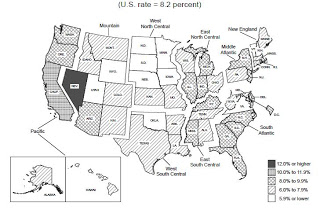

The BLS map below shows state-by-state comparisons.

Within the Rocky Mountain region, Colorado has the third highest unemployment rate:

Arizona, 8.6%

Colorado, 7.8%

Idaho, 7.9%

Montana, 6.2%

New Mexico, 7.2%

Utah, 5.8%

Wyoming, 5.3%

Colorado remains in the middle of the pack when it comes to statewide unemployment rates, but has seen its rate rise above more states in recent months. At the regional level, however, Colorado contains some metro areas that have unemployment rate well below the national rate, such as the Boulder area and the Fort Collins area.

According to the BLS press release:

Regional and state unemployment rates were little changed in March. Thirty states recorded unemployment rate decreases, 8 states posted rate increases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while New York experienced an increase. The national jobless rate was little changed from February at 8.2 percent but was 0.7 percentage point lower than in March 2011.

Colorado was not among the 18 states that reported statistically significant decreases in the unemployment rate, year over year. 19 states reported unemployment rates that were higher than Colorado's, including California, Nevada, Florida and Michigan.

Colorado's unemployment rate remains below that of the nation overall, continuing a trend that has been in place since 2005. Earlier comparisons of Colorado and national unemployment rates had shown Colorado above the national rate during early 2011, but data revised in early 2012 shows that Colorado has not edged above the national rate in almost seven years.

The graph shows a comparison between the two rates since 2006:

The unemployment rate in Colorado, seasonally adjusted, has been flat at 7.8 percent since January. The national rate fell to 8.2 percent.

The BLS map below shows state-by-state comparisons.

Within the Rocky Mountain region, Colorado has the third highest unemployment rate:

Arizona, 8.6%

Colorado, 7.8%

Idaho, 7.9%

Montana, 6.2%

New Mexico, 7.2%

Utah, 5.8%

Wyoming, 5.3%

Colorado remains in the middle of the pack when it comes to statewide unemployment rates, but has seen its rate rise above more states in recent months. At the regional level, however, Colorado contains some metro areas that have unemployment rate well below the national rate, such as the Boulder area and the Fort Collins area.

Unemployment increases year over year in Colo. Springs, Grand Junct., and Pueblo

Total employment growth in Colorado in February continued to show growth statewide in the year-over-year comparisons. In March, total employment in Colorado was down 139,000 from the July 2008 peak. Employment trends in various regions of the state differ, however, so this article looks at which regions of the state have the highest unemployment rates, and which regions have recovered the most in their labor markets.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

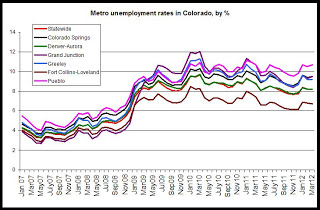

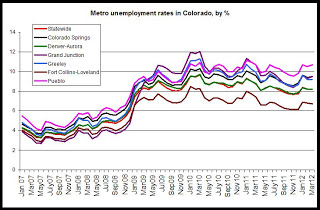

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for March 2012 are:

Colorado Springs, 9.5%

Denver-Aurora, 8.2%

Fort Collins-Loveland, 6.7%

Grand Junction, 9.5%

Greeley, 9.2%

Pueblo, 10.7%

Statewide, 8.2%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates. during recent months,however, the unemployment rate in Grand Junction has fallen to the point where Greeley, Grand Junction, and Colorado Springs now all have similar unemployment rates near 9.5 percent.

Year over year, the unemployment rate increased in Colorado Springs, Grand Junction and Pueblo. Total employment declined year over year in both Colorado Springs and Grand Junction, pushin gup the unemployment rate while it was an increase in teh labor force size that pushed up the unemployment rate in Pueblo. The unemployment rate was flat, year over year, in Denver-Aurora, Greeley, and Ft. Collins-Loveland.

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force (as reflected in the Household Survey), so the unemployment rate can increase even in times of rising total employment if the size of the labor force increases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2012 employment totals:

Colorado Springs MSA, 8.3%

Denver-Aurora MSA, 5.1%

Fort Collins-Loveland MSA, 4.7%

Grand Junction MSA, 11.7%

Greeley MSA 4.5%

Pueblo MSA, 3.6%

Statewide, 5.1%

All things being equal, the areas further below the peak have recovered the least from initial job losses.

By far, Grand Junction remains the furthest below peak levels.

The Pueblo area, the Greeley area, and the Ft. Collins-Loveland areas are nearest to peak levels, although both Pueblo and Greeley still report unemployment rates above 9 percent.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In March 2012, the rate in the Boulder-Longmont area was 6.1%, and was down year over year.)

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for March 2012 are:

Colorado Springs, 9.5%

Denver-Aurora, 8.2%

Fort Collins-Loveland, 6.7%

Grand Junction, 9.5%

Greeley, 9.2%

Pueblo, 10.7%

Statewide, 8.2%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates. during recent months,however, the unemployment rate in Grand Junction has fallen to the point where Greeley, Grand Junction, and Colorado Springs now all have similar unemployment rates near 9.5 percent.

Year over year, the unemployment rate increased in Colorado Springs, Grand Junction and Pueblo. Total employment declined year over year in both Colorado Springs and Grand Junction, pushin gup the unemployment rate while it was an increase in teh labor force size that pushed up the unemployment rate in Pueblo. The unemployment rate was flat, year over year, in Denver-Aurora, Greeley, and Ft. Collins-Loveland.

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force (as reflected in the Household Survey), so the unemployment rate can increase even in times of rising total employment if the size of the labor force increases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the February 2012 employment totals:

Colorado Springs MSA, 8.3%

Denver-Aurora MSA, 5.1%

Fort Collins-Loveland MSA, 4.7%

Grand Junction MSA, 11.7%

Greeley MSA 4.5%

Pueblo MSA, 3.6%

Statewide, 5.1%

All things being equal, the areas further below the peak have recovered the least from initial job losses.

By far, Grand Junction remains the furthest below peak levels.

The Pueblo area, the Greeley area, and the Ft. Collins-Loveland areas are nearest to peak levels, although both Pueblo and Greeley still report unemployment rates above 9 percent.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In March 2012, the rate in the Boulder-Longmont area was 6.1%, and was down year over year.)

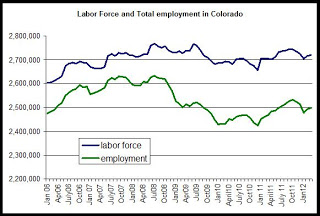

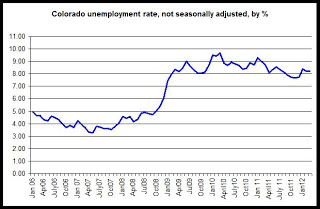

Colorado adds more jobs in March

Colorado gained 29,882 jobs in March 2012 compared to March of 2011, and the non-seasonally-adjusted unemployment rate fell year-over-year from 8.7 percent to 8.2 percent. According to the most recent employment data, collected through the Household Survey and released today by the Colorado Department of Labor and Employment and the BLS, total employment in March, not seasonally adjusted, rose to 2.49 million jobs. The labor force also increased from March 2011 to March 2012.

In month-to-month comparisons, the unemployment rate was flat at 8.2 percent from February to March. 4,000 jobs were added month-over-month while 4,500 people entered the work force.

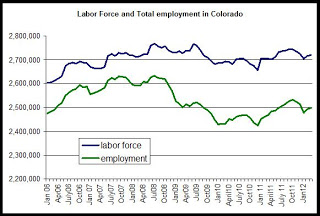

From March 2011 to March 2012, total employment rose 1.2 percent while the labor force rose 0.6 percent. The total labor force in March included 2.72 million workers.

As can be seen in the second graph, total employment and total workforce size have risen slightly, month-over-month, for the past two months after falling for the previous three months. Year over year, employment rose and the labor force rose. However, both remain well below July 2008 peaks.

The employment total is now 135,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Compared to the labor force peak in July 2008, the labor force is now down by almost 47,000 workers.

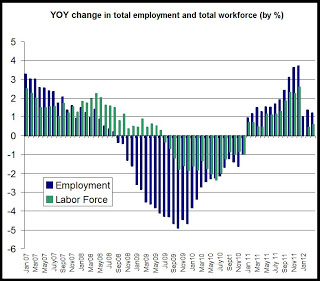

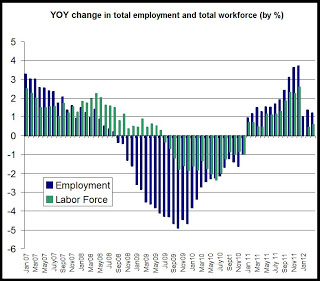

In the third graph is shown the year-over-year comparisons, by percent, for total employment. March 2012 was the 15th month in a row showing a positive year-over-year change in total employment. The 15 months of increases followed 28 months in a row of negative job growth in year-over-year comparisons.

The graph also shows the year-over-change in the labor force. Total labor force size rose slightly from March 2011 to March 2012 for the second month in a row, and follows a slight decrease that occurred from January 2011 to January 2012. The labor force size had shrunk, year over year, for 18 months in a row from July 2009 to December 2010.

These numbers come from the Household Survey employment data, so the size of the workforce is dependent on the number of people stating that they are actively looking for work if not employed. Discouraged workers who have stopped looking for work are excluded. On the other hand, the Household Survey picks up on small business and start-up employment that may be missed by the Establishment Survey, the other commonly-used measure of employment.

Note: This analysis reflects newly revised data released in January. In most cases, total employment was revised upward for the months of 2011.

In month-to-month comparisons, the unemployment rate was flat at 8.2 percent from February to March. 4,000 jobs were added month-over-month while 4,500 people entered the work force.

From March 2011 to March 2012, total employment rose 1.2 percent while the labor force rose 0.6 percent. The total labor force in March included 2.72 million workers.

As can be seen in the second graph, total employment and total workforce size have risen slightly, month-over-month, for the past two months after falling for the previous three months. Year over year, employment rose and the labor force rose. However, both remain well below July 2008 peaks.

The employment total is now 135,000 jobs below the peak levels experienced during July 2008 when there were 2.63 million employed workers. Compared to the labor force peak in July 2008, the labor force is now down by almost 47,000 workers.

In the third graph is shown the year-over-year comparisons, by percent, for total employment. March 2012 was the 15th month in a row showing a positive year-over-year change in total employment. The 15 months of increases followed 28 months in a row of negative job growth in year-over-year comparisons.

The graph also shows the year-over-change in the labor force. Total labor force size rose slightly from March 2011 to March 2012 for the second month in a row, and follows a slight decrease that occurred from January 2011 to January 2012. The labor force size had shrunk, year over year, for 18 months in a row from July 2009 to December 2010.

These numbers come from the Household Survey employment data, so the size of the workforce is dependent on the number of people stating that they are actively looking for work if not employed. Discouraged workers who have stopped looking for work are excluded. On the other hand, the Household Survey picks up on small business and start-up employment that may be missed by the Establishment Survey, the other commonly-used measure of employment.

Note: This analysis reflects newly revised data released in January. In most cases, total employment was revised upward for the months of 2011.

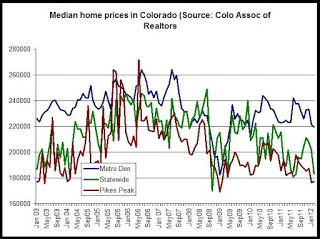

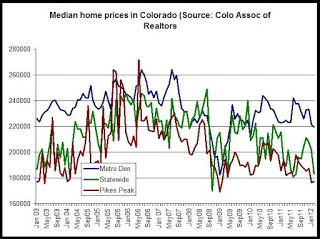

Colo. Realtors: Median home prices down in February

Median home prices for single-family homes during February 2012 fell in Colorado and in the Pikes Peak region and in the metro Denver area. According to median home price data for February, released by the Colorado Association of Realtors, the median home price for single-family homes in the Denver area was $219,760 during February, which is an decrease of 1 percent from February of 2011. Statewide, the median home price was $183,333 during February, a drop of 5 percent from the same month last year. The median price in the Pikes Peak region fell 9 percent, year over year, falling to $177,234 during February.

The first graph shows the median single-family home price for the state and for the metro Denver and Pikes Peak regions. Median home prices fell dramatically in all three measures following the financial crisis of late 2008, but moved back up quickly by mid-2009. Since mid-2009, however, median home prices have been largely flat in metro Denver. In the Pikes Peak region, on the other hand, the median price remains well below peak levels and was lower during most months of 2011 when compared to 2010. Statewide, as is typical, the median price has been more volatile, but has not recovered as much as the metro Denver median. Statewide, declining prices in western Colorado are a factor in statewide price declines.

The metro Denver area, where the median price is 17 percent below its June 2007 peak levels, has recovered the most. Metro Denver prices appear to have stabilized since 2009 and the median price generally moves between 220K and 240K. The statewide median price is now 25 percent below its June 2006 peak. The Pikes Peak median price fell in January to 23 percent below its July 07 peak, falling below 180K. The Pikes Peak area's median price ranged between 181K and 197K during 2011.

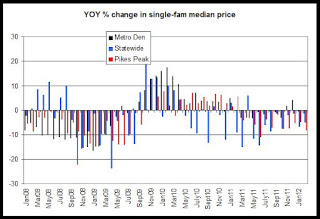

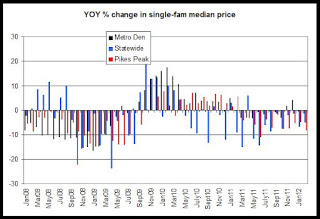

The second graph shows that the year-over-year changes in all three areas have been generally negative each month for the past six months, and all three areas were down during both January and February 2012 when compared to the same month a year earlier.

While the overall trend over the past six months has been downward in the year-to-year comparisons, January did begin to show some small price increases in both the Case-Shiller metro Denver report while the CoreLogic February report for Colorado showed an increase in the price index as well. See here for more.

The home price data provided by the Colorado Association of Realtors is based on home sales transactions that are listed in the MLS systems for each area and do not include for-sale-by-owner transactions or new homes sold directly by home builders.

The first graph shows the median single-family home price for the state and for the metro Denver and Pikes Peak regions. Median home prices fell dramatically in all three measures following the financial crisis of late 2008, but moved back up quickly by mid-2009. Since mid-2009, however, median home prices have been largely flat in metro Denver. In the Pikes Peak region, on the other hand, the median price remains well below peak levels and was lower during most months of 2011 when compared to 2010. Statewide, as is typical, the median price has been more volatile, but has not recovered as much as the metro Denver median. Statewide, declining prices in western Colorado are a factor in statewide price declines.

The metro Denver area, where the median price is 17 percent below its June 2007 peak levels, has recovered the most. Metro Denver prices appear to have stabilized since 2009 and the median price generally moves between 220K and 240K. The statewide median price is now 25 percent below its June 2006 peak. The Pikes Peak median price fell in January to 23 percent below its July 07 peak, falling below 180K. The Pikes Peak area's median price ranged between 181K and 197K during 2011.

The second graph shows that the year-over-year changes in all three areas have been generally negative each month for the past six months, and all three areas were down during both January and February 2012 when compared to the same month a year earlier.

While the overall trend over the past six months has been downward in the year-to-year comparisons, January did begin to show some small price increases in both the Case-Shiller metro Denver report while the CoreLogic February report for Colorado showed an increase in the price index as well. See here for more.

The home price data provided by the Colorado Association of Realtors is based on home sales transactions that are listed in the MLS systems for each area and do not include for-sale-by-owner transactions or new homes sold directly by home builders.

Labels:

CAR,

colorado,

denver metro,

home prices,

pikes peak

Thursday, April 19, 2012

After four quarters of declining mortgage rates, releases surge

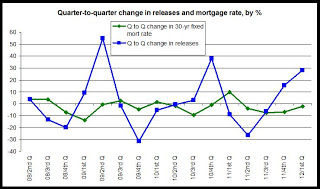

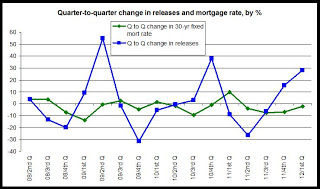

Today, the Division of Housing released its first-quarter 2012 report on releases of deeds of trust. Since release activity reflects trends in home purchase and refinance activity they can help us identify some trends in demand for home loans.

The report notes that, in general, release activity responds to movements in the mortgage rate in ways very similar to that seen in mortgage refinance activity.

The first graph shows the quarter-to-quarter changes in the 30-yr fixed mortgage rate and in the number of releases. The quarterly data goes back to 2008. Release activity tends to move in the opposite direction of trends in the mortgage rate. In general, the blue line will move above zero following a period in which the green line is below zero. So, after growth in the mortgage rate turned negative during the 4th q of 2008, release activity moved above zero, topping out at a growth rate of more than 50 percent. In other words, a dip in the mortgage rate produced a surge in release activity. A similar phenomenon can then be seen again following the third quarter of 2010, and then again following the third quarter of 2011. Note, however, that the increase in release activity gets smaller after each period of declining mortgage rates. The effect of pushing down the mortgage rate appears to be diminishing when it comes to release activity.

During the first quarter of 2012, however, following four quarters in a row of declining mortgage rates, we get a substantial increase in the number of releases - a 28 percent increase form the fourth quarter of 2011.

See here for analysis of releases and mortgage rates going back to the year 2000.

Although the relationship between mortgage rates and releases has weakened in recent years due to tightening of credit and a lack of consumer confidence, the relationship does appear to still be holding.

The report notes that, in general, release activity responds to movements in the mortgage rate in ways very similar to that seen in mortgage refinance activity.

The first graph shows the quarter-to-quarter changes in the 30-yr fixed mortgage rate and in the number of releases. The quarterly data goes back to 2008. Release activity tends to move in the opposite direction of trends in the mortgage rate. In general, the blue line will move above zero following a period in which the green line is below zero. So, after growth in the mortgage rate turned negative during the 4th q of 2008, release activity moved above zero, topping out at a growth rate of more than 50 percent. In other words, a dip in the mortgage rate produced a surge in release activity. A similar phenomenon can then be seen again following the third quarter of 2010, and then again following the third quarter of 2011. Note, however, that the increase in release activity gets smaller after each period of declining mortgage rates. The effect of pushing down the mortgage rate appears to be diminishing when it comes to release activity.

During the first quarter of 2012, however, following four quarters in a row of declining mortgage rates, we get a substantial increase in the number of releases - a 28 percent increase form the fourth quarter of 2011.

See here for analysis of releases and mortgage rates going back to the year 2000.

Although the relationship between mortgage rates and releases has weakened in recent years due to tightening of credit and a lack of consumer confidence, the relationship does appear to still be holding.

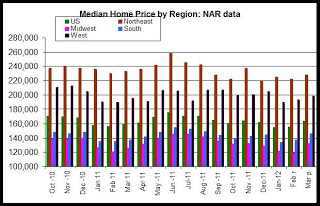

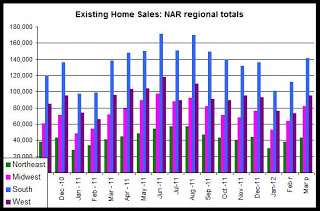

NAR: Home sales down in U.S. West, but prices up

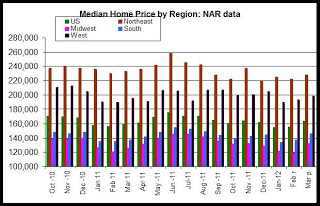

The median home price in the West region of the U.S., which includes Colorado, rose 1.6 percent from March 2011 to March 2012. According to new existing home sales data, released today by the National Association of Realtors, the median home price rose nationally and in all regions except the Northeast region where the median price fell 1.9 percent.

The first graph shows median home prices for all regions plus the U.S. The median home price in the West rose to $198,300. Nationally, the median home price rose to $163,800. In the West, and nationally, median home prices remains well below the prices reached during 2010 when the homebuyer tax credits were in place. The most recent peak for the median home price in the West was $224,100 reached during July of 2010.

Nationally, home prices rose 2.5 percent, year over year.

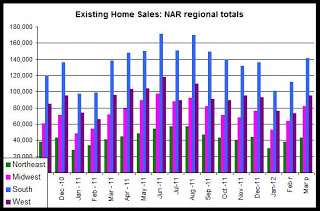

According to today's report, home sales transactions (closings) fell 1.0 percent, from March 2011 to March 2012, in the West region while nationally, sales rose 4.0 percent during the same period. All regions reported year-over-year increases in sales activity except the West region. The largest increase was reported in the Northeast where sales rose 13.9 percent.

The second graph shows closings by region. All regions showed a month-over-month increase from February to March, which is common due to seasonality. Sales rose nationally 25.8 percent from February to March, while sales in the West fell 1.0 percent.

Overall, March's sales activity was higher than was the case during March of last year.

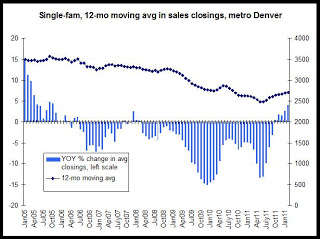

In short, home sales have increased in most of the country when compared year over year, and median home prices have begun to move up. Although the region-wide data from NAR showed a small decline in home sales transactions,Colorado data shows growth in home sales activity in recent months. Recent data on releases of deeds of trust also suggests more sales and refinance activity. More transactions are taking place, and the most recent home price data from sources other than the Realtors, such as FHFA and Case-Shiller, also suggest some mild increases in home prices during the first quarter of 2012.

The first graph shows median home prices for all regions plus the U.S. The median home price in the West rose to $198,300. Nationally, the median home price rose to $163,800. In the West, and nationally, median home prices remains well below the prices reached during 2010 when the homebuyer tax credits were in place. The most recent peak for the median home price in the West was $224,100 reached during July of 2010.

Nationally, home prices rose 2.5 percent, year over year.

According to today's report, home sales transactions (closings) fell 1.0 percent, from March 2011 to March 2012, in the West region while nationally, sales rose 4.0 percent during the same period. All regions reported year-over-year increases in sales activity except the West region. The largest increase was reported in the Northeast where sales rose 13.9 percent.

The second graph shows closings by region. All regions showed a month-over-month increase from February to March, which is common due to seasonality. Sales rose nationally 25.8 percent from February to March, while sales in the West fell 1.0 percent.

Overall, March's sales activity was higher than was the case during March of last year.

In short, home sales have increased in most of the country when compared year over year, and median home prices have begun to move up. Although the region-wide data from NAR showed a small decline in home sales transactions,Colorado data shows growth in home sales activity in recent months. Recent data on releases of deeds of trust also suggests more sales and refinance activity. More transactions are taking place, and the most recent home price data from sources other than the Realtors, such as FHFA and Case-Shiller, also suggest some mild increases in home prices during the first quarter of 2012.

Labels:

existing home sales,

home prices,

home sales

Housing News Digest, April 19

Colorado home purchase and refinance activity up as rates fall

The number of mortgage loans paid off in Colorado was up 2.4 percent during 2012's first quarter compared to the same period of last year, and they rose 28.2 percent from the fourth quarter of last year to the first quarter of this year, the Colorado Division of Housing said today.

According to the report, public trustees in Colorado released a total of 74,808 deeds of trust during the first quarter of 2012, indicating a sizable increase in the amount of home purchase and refinance activity since late 2011.

Colorado sees 'sizable increase' in homebuying, refis in Q1

Colorado saw a "sizable increase" in home purchases and refinacing in the first quarter following months of sinking mortgage rates, according to a report Thursday from the Colorado Division of Housing.

The quarterly report tracks releases of deeds of trust as an indicator of financed home purchase and refinance activity in the state. Deeds of trust usually are released when a home is refinanced or sold or when a home loan is paid off.

Denver housing market second in nation for quick sales

New advice from the trenches on buying a home: Look early. Think fast. Hone your quick-draw skills with the checkbook.

Metro Denver's real estate market, not long ago a buyer's domain, suddenly has shifted to a seller's paradise, at least in some neighborhoods and price ranges.

U.S. home sales fall in March after earlier gains

WASHINGTON — Americans bought fewer previously owned homes in March, a reminder that the housing market remains weak.

The National Association of Realtors said Thursday that home sales fell 2.6 percent last month to a seasonally adjusted annual rate of 4.48 million. That followed a revised 4.6 million sold in February.

Releases of deeds of trust up statewide, regionally

Releases of deeds of trust in Colorado increased 2.4 percent year-over-year in the first quarter from 73,025 to 74,808, indicating economic improvement.

Releases were also up year-over-year in both Larimer and Weld Counties, according to the most recent data provided by the Colorado Division of Housing.

The Largest Ranch Near Aspen Just Hit The Market For $41 Million

In the posh Colorado resort area of Aspen, one-upmanship is the name of the game when it comes to luxury real estate. Now Christie’s International Real Estate affiliate Joshua & Co. has listed the largest ranch currently available for sale in the region for $41 million.

The property, known as the Child Capitol Creek Ranch, features 1,321 acres of stunning land set against the dramatic backdrop of Haystack Mountain adjacent to chic Snowmass

The number of mortgage loans paid off in Colorado was up 2.4 percent during 2012's first quarter compared to the same period of last year, and they rose 28.2 percent from the fourth quarter of last year to the first quarter of this year, the Colorado Division of Housing said today.

According to the report, public trustees in Colorado released a total of 74,808 deeds of trust during the first quarter of 2012, indicating a sizable increase in the amount of home purchase and refinance activity since late 2011.

Colorado sees 'sizable increase' in homebuying, refis in Q1

Colorado saw a "sizable increase" in home purchases and refinacing in the first quarter following months of sinking mortgage rates, according to a report Thursday from the Colorado Division of Housing.

The quarterly report tracks releases of deeds of trust as an indicator of financed home purchase and refinance activity in the state. Deeds of trust usually are released when a home is refinanced or sold or when a home loan is paid off.

Denver housing market second in nation for quick sales

New advice from the trenches on buying a home: Look early. Think fast. Hone your quick-draw skills with the checkbook.

Metro Denver's real estate market, not long ago a buyer's domain, suddenly has shifted to a seller's paradise, at least in some neighborhoods and price ranges.

U.S. home sales fall in March after earlier gains

WASHINGTON — Americans bought fewer previously owned homes in March, a reminder that the housing market remains weak.

The National Association of Realtors said Thursday that home sales fell 2.6 percent last month to a seasonally adjusted annual rate of 4.48 million. That followed a revised 4.6 million sold in February.

Releases of deeds of trust up statewide, regionally

Releases of deeds of trust in Colorado increased 2.4 percent year-over-year in the first quarter from 73,025 to 74,808, indicating economic improvement.

Releases were also up year-over-year in both Larimer and Weld Counties, according to the most recent data provided by the Colorado Division of Housing.

The Largest Ranch Near Aspen Just Hit The Market For $41 Million

In the posh Colorado resort area of Aspen, one-upmanship is the name of the game when it comes to luxury real estate. Now Christie’s International Real Estate affiliate Joshua & Co. has listed the largest ranch currently available for sale in the region for $41 million.

The property, known as the Child Capitol Creek Ranch, features 1,321 acres of stunning land set against the dramatic backdrop of Haystack Mountain adjacent to chic Snowmass

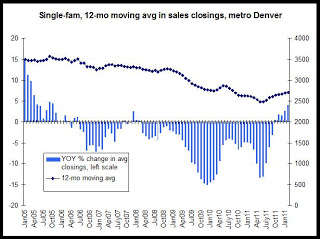

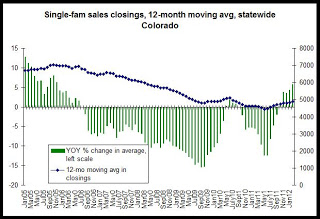

Releases of deeds of trust up 28 percent during the first quarter