See here for recent entries about building permits.

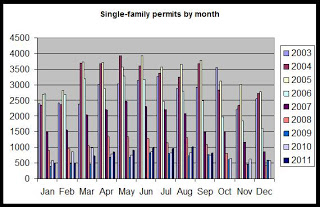

New single-family permits from Jan-Sept

El Paso 1190

Douglas 717

Larimer 563

Denver 529

Arapahoe 482

Also:

Adams 420

Broomfield 82

Chaffee 59

Clear Creek 7

Grand 25

Jefferson 416

Mesa 64

Park 57

Teller 23

Weld 479

(Note: All permits discussed in this article are single-family permits.)

However, when permit totals are adjusted to the number of existing housing units in each county, the counties with the larges amounts of permit activity were Chaffee, Park, Douglas, El Paso and Weld.

The first map shows the relative amount of single-family permit activity adjusted for the existing size of the housing stock in each county. The counties are then broken out in quartiles reflecting the amount of single-family activity compared to other counties. The top quartile has the largest amount of new permitting compared to the number of existing units. The bottom quartile has the smallest amount.

Top Q: Brown

2nd Q: Green

3rd Q: Orange

Bottom Q: Yellow

No data: White

In absolute terms, and as expected, the counties with the largest populations have the most permit activity. But when adjusted to the number of existing housing units (as shown in the map), the hot spots for single-family permits right now are Douglas, Park and Chaffee, Weld and El Paso counties. Larimer, Grand, Mesa and Broomfield counties land in the second quartile.

During the first nine months of 2011, the areas with relatively few new single-family permits relative to the size of the existing stock are Pueblo, Jefferson, Denver, Arapahoe, Elbert and Boulder counties.

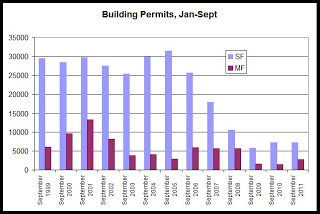

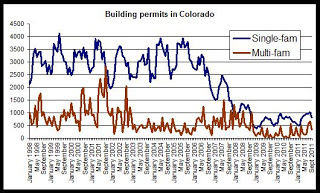

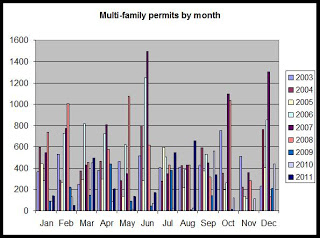

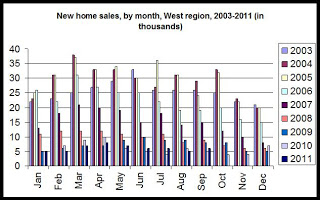

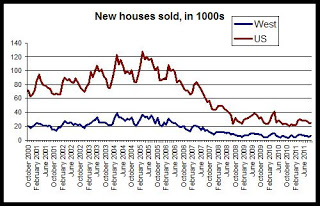

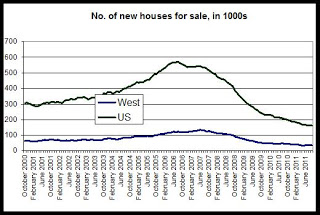

In the larger context, single-family permits remain well below totals experienced prior to 2007. From 2006 to 2008, single-family permits in the state decreased 60 percent from 31,000 to 12,000. Permit activity appears to have bottomed out in 2009. When disussing permit activity from 2008 to the present time, we're looking at permit totals that are near 20-year lows.

See here for a discussion on historical permit data by county.

It is also helpful to see which counties have shown the largest increases and decreases in permit activity. In the map below, we see that comparing the first nine months of this year to the same period last year, Larimer and Teller counties were among the counties with the largest increases in single-family permit activity. Boulder, Jefferson, Denver and Douglas counties also showed increases. On the other hand, permits decreased in Mesa, Weld, Adams, Arapahoe, El Paso and Pueblo counties.

Brown: Increase of 25 percent or more

Green: Increase of 1 to 24.9 percent

Orange: Decrease of 1 to 24.9 percent

Yellow: Decrease of 25 percent or more

White: No data or no change

Largest increases among metro counties:

Larimer 56 percent

Teller 43 percent

Douglas 12 percent

Denver 4 percent

Jefferson 3.5 percent

With relatively large numbers of new permit activity in 2011, and with a year-over-year increase in each county, both Larimer County and Douglas County show solid demand for new permitting at this time. In spite of year-over-year declines in totals, El Paso County continues to report a significant share of the state's overall permitting activity while Weld county reports a surprisingly large number of new single-family permits in the wake of very high foreclosure totals. Much of the new permit activity in Weld county is coming from expanding communities in southern Weld County.