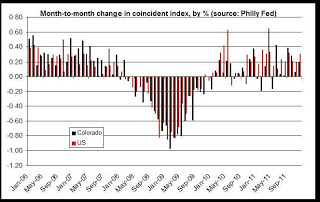

Colorado's increase of 0.2 percent was below the national index's increase of 0.3.

According to the December 2011 report:

In the past month, the indexes increased in 39 states, decreased in seven, and remained unchanged in four (Arizona, Nebraska, New York, and Wyoming) for a one-month diffusion index of 64. Over the past three months, the indexes increased in 42 states, decreased in six, and remained unchanged in two (Maine and New Mexico) for a three-month diffusion index of 72.

December's month-over-month increase was the seventh increase in a row for Colorado, and was the longest stretch of monthly increases reported since 2007.

The graph below compares the month-to-month change in both the Colorado Index and the US index. The US index has been more consistently positive than the Colorado Index over the past 12 months.

The gap between the two indices suggests that the employment situation in Colorado, at least according to this measure, is not showing as much strength as in 30 other states, or as the nation taken as a whole.

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.