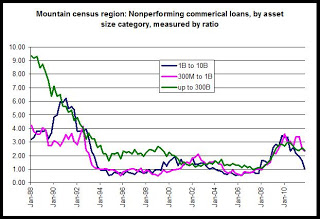

For medium-sized banks, rates of nonperforming commercial loans remain near levels experienced during the late 80s and early 90s during the saving and loan crisis. In all three categories of banks, nonperforming loans have declined since January 2010, although, they have declined the most among the largest banks.

At the end of the fourth quarter, 2011, the ratio/percentage of commercial loans that were non performing was 0.99 among the largest banks, 2.33 among mid-sized banks, and 2.38 percent among the smaller banks.

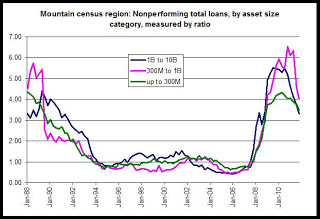

In the mountain census region, the percentage of all bank-held loans that are nonperforming, on the other hand, is well above that of commercial loans only, especially among the largest banks.

While the ratio of nonperforming loans has fallen below prior late-80s peaks in the smallest banks, these levels remain above the 1980s peaks in mid-size and large banks. The second graph below shows that nonperforming loan levels have fallen off from the 2009 highs, but that levels remain well above what was experienced between 1994 and 2008.

At the end of the fourth quarter of 2011, the ratio/percentage of all loans that were non performing was 3.31 among the largest banks, 4.02 among mid-sized banks, and 3.47 percent among the smaller banks.

If we compare the prevalence of nonperforming commercials loans with the same measure of all loans, we find that small banks, which in many cases had relatively low levels of exposure to home mortgage loans, fare more poorly in the commercial loan category. On the other hand, large banks, which were highly impacted by home mortgage loans, fare much worse in the "all loans" category than in the commercial loans category.

Overall, nonperformance rates continue to move slowly downward from 2009 peaks, but among non-commercials loans, considerable time will still be needed to return to more historically normal levels.

Source: Federal Financial Institutions Examination Council, Mountain Census Division

Percentage of nonperforming loans equals total nonperforming loans divided by total loans. Nonperforming loans are those loans that bank managers classify as 90-days or more past due or nonaccrual in the call report.