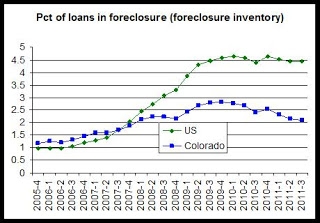

Much of it does have to do with the administrative "slow-down" in the processing of foreclosures that was initiated by the lenders themselves. That is not the only factor, however. As can be seen below, mortgage delinquencies in Colorado were down again during the third quarter.

According to the National Delinquency Survey, released last month by the Mortgage Bankers Association, the percentage of mortgage loans in some state of foreclosure (foreclosure inventory) in Colorado during this year's third quarter fell to 2.1 percent.

The third-quarter foreclosure inventory rate is now down from last year's third-quarter rate of 2.4 percent. The foreclosure inventory has fallen for three quarters in a row following an uptick in the foreclosure inventory during the fourth quarter of 2010.

The national foreclosure inventory rate was 4.43 percent during the third quarter of this year, continuing a trend in which the national foreclosure inventory rate has been above the Colorado rate since the fourth quarter of 2007. The national percentage of loans in foreclosure increased slightly from 4.39 percent during the third quarter of last year to 4.43 percent during the same period this year.

As noted in an earlier post, Colorado was 8th best in the nation for the percentage of loans that are either in foreclosure or are 90 or more days delinquent.

Similarly, only ten states reported higher percentages of loans that are in foreclosure.

The first graph shows the foreclosure inventory rate for each quarter since the fourth quarter of 2005. Colorado is in a generally downward trend that began after the fourth quarter of 2009. It is important to note, of course, that while Colorado is back to the foreclosure inventory rate it experienced in 2009, 2009 was not a good year for real estate and foreclosures, and the foreclosure inventory is still about double what it was in 2005.

Foreclosure inventory rate:

Colorado:

3rd Q 2011: 2.1

2nd Q 2011: 2.14

3rd Q 2010: 2.4

Most recent peak: 2.81, 4th Q 2009

US:

3rd Q 2011: 4.43

2nd Q 2011: 4.43

3rd Q 2010: 4.39

Most recent peak: 4.63, 1st Q 2010, or 4th Q 2010

To supplement the previous post on the inventory plus 90+ day delinquencies, I've included the chart below:

Percentage of loans that are either in foreclosure or are 90 or more days delinquent:

Colorado:

3rd Q 2011: 4.22

2nd Q 2011: 4.24

3rd Q 2010: 5.05

Most recent peak: 5.87, 4th Q 2009

US:

3rd Q 2011: 7.89

2nd Q 2011: 7.85

3rd Q 2010: 8.7

Most recent peak: 9.67, 4th Q 2009

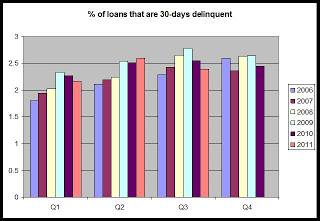

30-day delinquencies

During the third quarter, new 30-day mortgage delinquencies fell year over year to the lowest third-quarter percentage recorded since 2006.

2.39 percent of all mortgage loans surveyed were 30-days delinquent during the third quarter, falling from 2010's third-quarter rate of 2.55.

In the graph below, the 30-day delinquency rate is broken out by year and by quarter. We can see that the 30-day delinquency rate is the lowest it's been during the third quarter since 2006. This suggests that new foreclosure filings in Colorado will continue to gradually decline.

We also can note that the the third third and fourth quarters tend to have the highest delinquency rates when compared to other quarters.