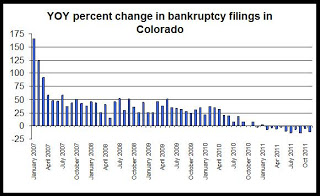

The first graph shows the year-over-year changes in bankruptcy case filings since January 2007:

The appearance of sustained declines in the year-over-year comparisons reinforces the likelihood that consumers are beginning to get a handle on debts now that almost four years have passed since the beginning of the national 2007-2009 recession.

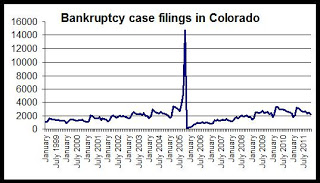

In general, however, bankruptcy filings have grown since 2006 following the implementation of the 2005 Bankruptcy Act (discussed here).

The large spike in 2005 preceded the implementation of the new bankruptcy rules. Filings totals have now returned to the levels experienced just prior to the final run-up in cases in 2005, but are down from 2010, when bankruptcy cases appear to have reached a post-2006 peak.

Recent monthly bankruptcy totals are now on a level similar to what was experienced during several months of 2003 and 2004, during a non-recessionary period. Bankruptcies decreased from October to November, falling 11 percent. This drop appears to be due to seasonal factors.

Note: April tends to be a peak month for bankruptcy filings as people use their tax refunds to pay for bankruptcy attorneys and filing costs.

1 comments:

Filing for bankruptcy is a big step. But, it can be just what you need to do. Or, maybe, it's the last thing you should be considering.

tennessee bankruptcy

Post a Comment