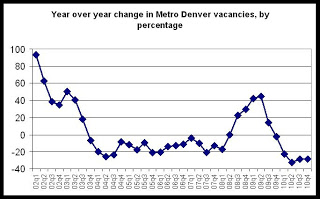

The apartment vacancy rate in the Denver metro area fell to 5.5 percent in the fourth quarter, dropping to the lowest fourth-quarter vacancy rate recorded since the year 2000...Apartment vacancy rates fell 28 percent year-over-year from last year’s fourth-quarter rate of 7.7 percent

...

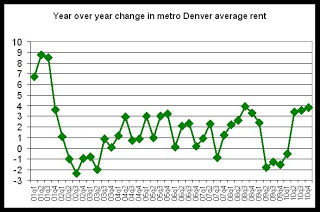

As vacancy rates moved down, the area’s median rent increased. 2010’s fourth-quarter median rent rose to $846.36 from 2009’s fourth-quarter median rent of $811.32. In individual market areas, the median rent rose year-over-year in all County-level regions covered by the survey.

Vacancy rates in the metro Denver are generally now at 10-year lows as the market has tightened in spite of a lack of job growth.

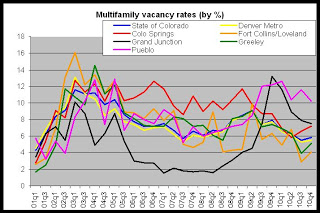

The first graph shows where the Denver area stands in relation to other metro areas in Colorado. Although Greeley's vacancy rate recently fell below metro Denver's rate, over the past several quarters, only the Fort Collins-Loveland area has consistently reported a lower vacancy rate than metro Denver:

The second graph shows the year-over-year percentage changes in the vacancy rate in metro Denver. Note that the last five values are below zero. In other words, for the last five quarters in a row, the vacancy rate in metro Denver has been lower than it was one year earlier. It was apparently not unusual to have a negative year-over-year change in the vacancy rate between 2003 and 2007, it is significant that the year over year changes during the last four quarters have all been down by 20 percent or more. The magnitude of these year-over-year changes in vacancy rates has not been seen on a metro-wide level at any other time during the last ten years.

In the third graph, we see that year-over-year changes in average rent in the Denver metro area have been trending upward. The last three quarters have all shown positive changes of more than three percent each quarter. Again, there isn't anything terribly unique about three quarters in a row of year-over-year increases in average rents, but what is unusual here is the extent to which rents have increased when compared to the previous year. With a change upward of more than three percent each quarter, three quarters in a row, changes in average rents are now beginning to resemble trends not experienced in Colorado since 2001, which in Colorado, was before the 2002 tech bust that followed the 2001 national recession.

Conclusions: Trends in vacancies and in average rents in metro Denver indicate a high demand for multifamily rental housing that has not been seen since prior to the 2002 Colorado recession. If trends continue, especially given the absence of new construction, the metro Denver area will experience additional increases in rent levels as vacancy rates tighten further.

Note: We've covered the Colorado Springs for the 4th Q here: http://divisionofhousing.blogspot.com/2011/01/some-analysis-of-recent-vacancy-and.html