Related Post: New 30-day mortgage delinquencies rise in Colorado

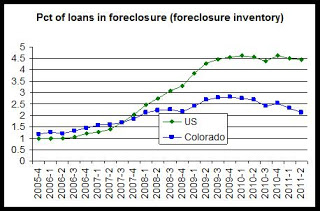

The second-quarter foreclosure inventory rate is now down from last year's second-quarter rate of 2.69 percent. The foreclosure inventory has fallen for two quarters in a row following an uptick in the foreclosure inventory during the fourth quarter of 2010.

The national foreclosure inventory rate was 4.43 percent during the second quarter of this year, continuing a trend in which the national foreclosure inventory rate has been above the Colorado rate since the fourth quarter of 2007.

During the second quarter, 38 states reported higher foreclosure inventory rates than Colorado, with Nevada and Florida reporting the highest rates of 8.15 percent and 14.39 percent, respectively. Among the 11 states with lower foreclosure inventory rates than Colorado, Alaska and North Dakota had the lowest rates of 0.98 and 1.11, respectively.

The first graph shows the foreclosure inventory rate for each quarter since the fourth quarter of 2005. Colorado is in a generally downward trend that began after the fourth quarter of 2009. It is important to note, of course, that while Colorado is back to the foreclosure inventory rate it experienced in 2009, 2009 was not a good year for real estate and foreclosures, and the foreclosure inventory is still about double what it was in 2005.

Foreclosure inventory rate:

Colorado:

2nd Q 2011: 2.14

1st Q 2011: 2.33

2nd Q 2010: 2.69

Most recent peak: 2.81, 4th Q 2009

US:

2nd Q 2011: 4.43

1st Q 2011: 4.52

2nd Q 2010: 4.57

Most recent peak: 4.63, 1st Q 2010, or 4th Q 2010

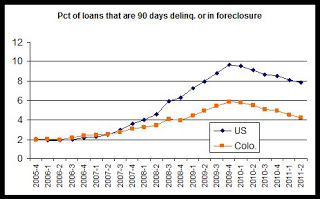

The Delinquency Survey also provides a very broad measure that surveys the percentage of loans that are either 90-days delinquent or in foreclosure. The percentage of Colorado loans found in this category has declined every quarter since the fourth quarter of 2009 and is now at the lowest rate reported since the second quarter of 2009.

The percentage of Colorado mortgage loans that were 90-days delinquent or in foreclosure fell to 4.24 percent during the second quarter, falling from 2010's second-quarter rate of 5.48. The rate peaked at 5.87 during the fourth quarter of 2009.

Nationwide, the percentage of mortgage loans that were either 90-days delinquent or in foreclosure was 7.85 percent during this year's second quarter, falling from last year's second quarter rate of 9.11 percent.

As can be seen in the second graph, in this measure, as with the foreclosure inventory and the 30-day delinquency rate, Colorado's rate is below the national rate and in this case has been below the national rate since the third quarter of 2007.

Compared to Colorado, only seven states had a lower percentage of loans that were 90-days delinquent or in foreclosure. The highest rates were found in Nevada and Florida with rates of 14.34 and 18.68, respectively. The lowest rates were found in North Dakota and Alaska with rate of 1.76 and 2.24, respectively.

This new information, combined with the 30-day delinquency information (discussed here), further suggests that Colorado enjoys lower foreclosure rates than most states, and that Colorado, with the nation as a whole, is seeing a continued slow and steady decline in foreclosure inventory. However, as was shown in this post, the number of new delinquencies increased during the second quarter, and if these new delinquencies become foreclosures, the foreclosure inventory will likely increase again.

Overall, however, foreclosure inventories and 90-day delinquencies remain well above historical norms.

90-day + in foreclosure inventory:

Colorado:

2nd Q 2011: 4.24

1st Q 2011: 4.52

2nd Q 2010: 5.48

Most recent peak: 5.87, 4th Q 2009

US:

2nd Q 2011: 7.85

1st Q 2011: 8.1

2nd Q 2010: 9.11

Most recent peak: 9.67, 4th Q 2009

0 comments:

Post a Comment