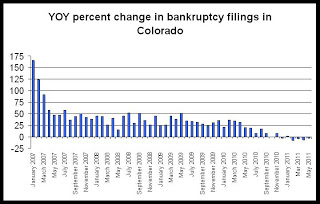

The first graph shows the year-over-year changes in bankruptcy case filings since January 2007:

The appearance of sustained declines in the year-over-year comparisons reinforces the likelihood that consumers are beginning to get a handle on debts now that more than three years have passed since the beginning of the national 2007-2009 recession.

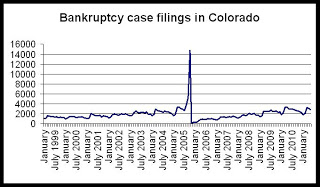

In general, however, bankruptcy filings have grown since 2006 following the implementation of the 2005 Bankruptcy Act (discussed here).

The large spike in 2005 preceded the implementation of the new bankruptcy rules. Filings totals have now returned to the levels experienced just prior to the final run-up in cases in 2005.

Recent monthly bankruptcy totals are now on a level similar to what was experienced during May 2004 and 2005, during a non-recessionary period. The decline in bankruptcy filings from April to May was expected. April tends to be a peak month for bankruptcy filings as people use their tax refunds to pay for bankruptcy attorneys and filing costs.

0 comments:

Post a Comment