Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

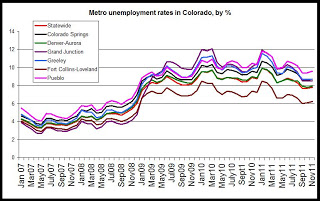

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for November 2011 are:

Colorado Springs, 8.7%

Denver-Aurora, 7.9%

Fort Collins-Loveland, 6.2%

Grand Junction, 8.5%

Greeley, 8.7%

Pueblo, 9.6%

Statewide, 7.8%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates.

Year over year, the unemployment rate decreased in all metro areas. In Pueblo, where the highest metro unemployment rate was found, the rate decreased from 10.5 percent to 9.6 percent, year over year. In the Fort Collins-Loveland area, where the rates were lowest, the unemployment rate fell from 7.3 percent to 6.2 percent during the same period.

The unemployment rate is a reflection of both the total number of employed persons and the total size of the labor force (as reflected in the Household Survey), so the unemployment rate can decrease even in times of falling total employment if the size of the labor force decreases as well.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the October 2011 employment totals:

Colorado Springs MSA, 6.5%

Denver-Aurora MSA, 4.4%

Fort Collins-Loveland MSA, 2.6%

Grand Junction MSA, 11.8%

Greeley MSA 5.4%

Pueblo MSA, 2.8%

Statewide, 4.4%

All things being equal, the areas further below the peak have recovered the least from initial job losses.

By far, Grand Junction remains the furthest below peak levels.

The Pueblo area and the Fort Collins-Loveland area, are nearest to peak levels, although Pueblo still reports a relatively high unemployment rate. The fort Collins-Loveland area, on the other hand, reports the lowest unemployment rate of the metro areas.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In November 2011, the rate in the Boulder-Longmont area was 5.9%.)

Impact on Housing

The metro areas with the most job growth should generally also be the areas with the most demand for housing. We do see this reflected to a certain extent in the apartment vacancy data and in job growth.

We expect the demand for housing to continue to be strongest in the Fort Collins-Loveland area and in metro Denver.